I know you have heard it many times before. Net of fees, most professional stock pickers can’t beat the market. As Brian Portnoy stated in The Geometry of Wealth:

Decades’ worth of data validate that demonstrating persistent skill is very hard. According to Standard and Poor’s, more than four-fifths of professional stock pickers have not been able to beat their market (big caps, small caps, international, etc.) over 5-year or 10-year periods.

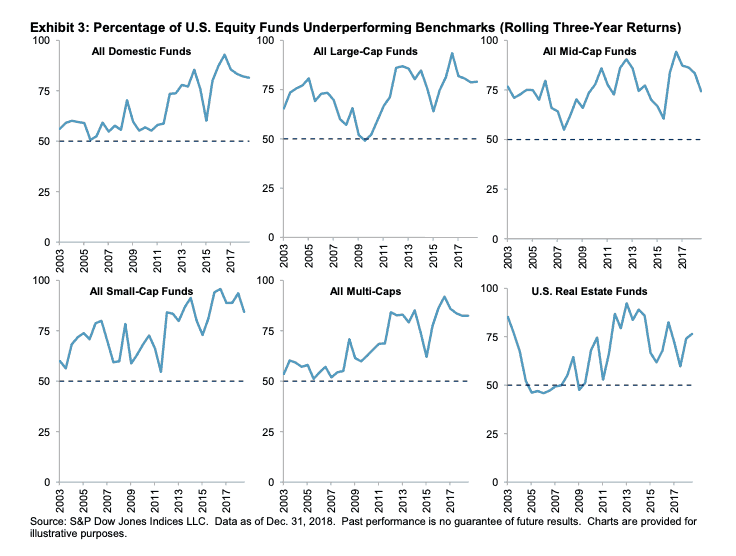

His reference data is SPIVA (S&P Indices Versus Active) or the “the de facto scorekeeper of the active versus passive debate.” The SPIVA reports vary over time, but they all tell roughly the same story—the majority of active managers in U.S. equity funds have underperformed their benchmarks (net of fees) over 3-year periods and longer:

With statistics like this, being a passive investor seems like a no-brainer. In fact, this is why most of my money is invested passively.

However, I want to take the other side of this argument. If 80% of stock pickers won’t beat their benchmark net of fees, this implies that 20% of them will beat their benchmarks.

Now think about this from a stock picker’s perspective. They are likely intelligent, well-educated, and have competed their way to the top of the academic hierarchy throughout their lives. For example, of the 2.6 million students expected to enroll in college in 2020, less than 1% will attend the Ivy League. Imagine trying to convince one of these people that they couldn’t be in the top 20% when they are used to being in the top 1% (or better).

Of course, being in the top 20% of professional stock pickers (and their algorithms) is much tougher than being in the top 20% of incoming college freshman, but the logic is the same. It’s easy to seduce yourself into thinking that you are above average. People do it all the time. As Jason Zweig wrote in Your Money and Your Brain:

If you ask a group of 100 people, “Compared with the other 99 people here, who’s above average at x?” roughly 75 will stick up their hands, regardless of whether x is driving a car, playing basketball, telling jokes, or scoring well on an intelligence test—and despite the fact that, by definition, half the people must be below average within the group.

If this tendency occurs in people with no good reason to believe that they are funnier or a better driver than the average person, imagine what it must be like for someone who knows that they are an outlier? One of these individuals can easily start making evidence-based arguments as to why they could succeed at an ultra-competitive endeavor like stock picking.

Take me for example. Throughout my life I have been told that I am smart and hard-working, and I have received evidence affirming these notions. I got voted “Most Likely to Succeed” in high school, attended a top university, and have worked in intellectually-demanding jobs throughout my career. I can list reason after reason as to why I am well-equipped to be a great active manager.

And deep inside I believe it to some extent. I tell myself that if I just had the interest and if I worked hard enough, I could learn to beat the market. But, this is where the seduction occurs. I start deluding myself into thinking that I am special. I start to assume that because I am intelligent I will be good at all intellectually-based activities such as stock picking.

But, being smart doesn’t imply that you will be a good stock picker, but it does imply that you could be susceptible to believing so. While there is some evidence that more intelligent people are better investors, this is not because they are superior at picking stocks. Despite this, people still convince themselves that they can beat the market. They convince themselves because it is easy to do so.

Is there any way to combat this kind of thinking? Yes. You have to recognize that the competition will be orders of magnitude harder as you go further up the ladder. You are now playing against the cream of the cream of the crop. It’s like a college football player that enters the NFL. The game might be the same, but the players have changed.

But don’t just take my word for it. When Michael Steinhardt, the famous hedge fund manager, was asked what he could teach the average investor he replied:

I’m their competition.

The Only Way to Be Above Average

The only way to be above average as an investor is to invest differently from the masses. That’s it. Whether that means forgoing a market capitalization weighted index for individual stocks, or diversifying into assets that others shun, you cannot invest like the crowd and expect better-than-crowd performance. To re-imagine a famous Jerry Rice quote:

Today I will invest like others won’t, so tomorrow I can earn what others can’t.

Of course, I don’t recommend this approach. I would rather do nothing (as an indexer) and still beat 80% of investors. It just seems more logical to me to focus your time and energy on an endeavor where you know with certainty that you can add value.

Thankfully, some of you won’t listen to me. Some of you will try your luck at beating the market. Some of you will fail, but some of you will succeed. And I don’t need to convince you of anything. Because for better or for worse, you have already seduced yourself.

Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 137. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data