This week the SEC filed suit against eight financial influencers from Atlas Trading, an online stock picking community, for manipulating their social media followers into buying and selling stocks for their own personal gain. The suit explains how their scheme worked:

They identify stocks ripe for manipulation, acquire substantial positions in these securities, and then recommend those stocks as good investments to their followers on Twitter, in online stock-trading forums they run, and on podcasts.

They encourage their followers to purchase the selected stocks, often claiming that they likewise have bought or intend to buy these stocks for themselves and hold them. Instead, the defendants sell their shares into the demand that their deceptive promotions generate.

Since January 2020 the influencers earned approximately $100 million from their illicit trading activities, making it one of the largest pump and dump schemes in American history. Alex Good wrote an incredible thread providing details on exactly what these influencers did and why you should avoid these kinds of behaviors. He concluded:

A] Do not use followers as exit liquidity

B] Do not collude or provide ‘early’ signals to friends

C] Do not discuss the materiality of your statements to price action privately or publicly

D] Do not flex, or entice others to do your trades

E] Do not lie

If I could, I’d add “Do not get cocky” to the list as well. Because, in light of the lawsuit, every brash thing these guys ever said is coming back to haunt them.

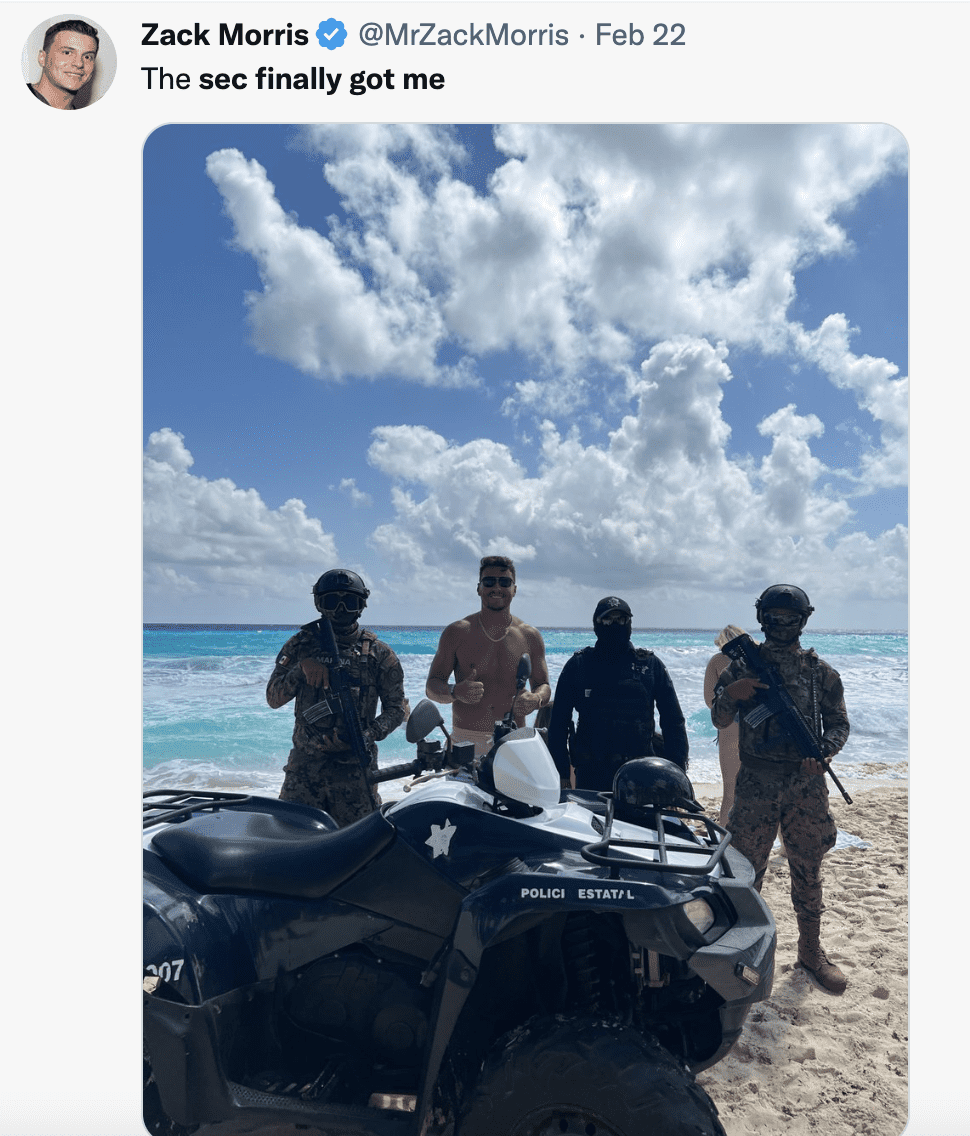

In particular, “Zack Morris” (the ringleader at Atlas Trading) had quite a few tweets that make him look very bad in retrospect. Morris once tweeted “sec deez nutz” after someone told him that his actions could get him investigated by the agency. He frequently joked about getting caught by the SEC:

And he even tweeted “the movie will be sweet” in reference to the lawsuit filed against him:

Morris has since deleted the tweet. I’m guessing he didn’t like the ending to the movie.

Jokes aside, this behavior doesn’t really surprise me. Because the kind of people that make tens of millions of dollars by lying to their followers are the same kind of people that think they can outwit the SEC. It’s almost true by definition. Think about it. If you’re making millions of dollars in such a short period through trading, you are either: (1) insanely lucky or (2) willing to take extreme actions (i.e. break the law, borrow heavily, etc.) to get there.

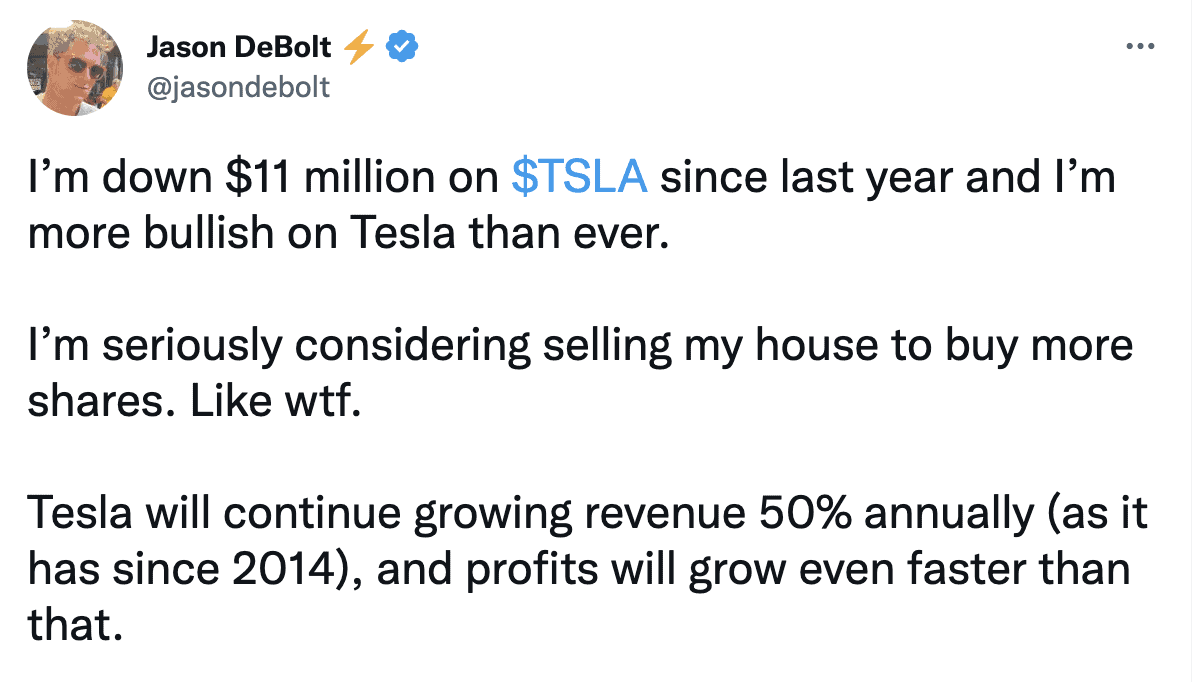

I could apply the same logic to Jason DeBolt, everyone’s favorite “all in” Tesla investor (100% of his portfolio is in Tesla stock). Of course what Jason is doing isn’t illegal, but it’s similarly extreme. Last week, Debolt tweeted that he was down $11 million on his Tesla position and was considering selling his house to buy more Tesla shares:

Well, guess what? This week he announced that he’s following through. Debolt will soon be without a home, but will have many more Tesla shares as a result.

If you recall, I wrote about Debolt back in January 2021 when I pleaded with him to sell some of his Tesla shares and take some money off the table. Of course, he didn’t and Tesla has since fallen 44%. I don’t say this to highlight my market timing ability (I have none), but to emphasize the risk associated with his “all in” strategy.

But for people like Debolt, risk is the point. It comes with the territory. That’s how you get the opportunity to lose $11 million on a single stock in the first place—you have to take risk.

This is why it’s such a fallacy to look at some asset and think, “If I had only bought back then…” Because if you had bought “back then” you probably would have sold “back then” too! If you had bought Bitcoin at $1,000, you probably would have sold it at $15,000 or $30,000 or $52,000. You wouldn’t have gotten anywhere near the $68,000 high.

Why? Because most people can’t stomach that much risk. They aren’t that far along the risk-taking spectrum. But, those that are, are the ones that can experience such returns.

This is how risk works. The more risk you take, the more likely you are to see an extreme outcome (to the upside or the downside). Jason Debolt and Atlas Trading are perfect examples of this. Debolt took lots of risk (legally) and made tens of millions of dollars. Atlas Trading took even more risk (illegally) and ended up with $100 million. Unfortunately for Atlas, that $100 million is a lot closer to $0 today thanks to the SEC. As some like to say, “Risk happens fast.”

But this isn’t the only thing that we can learn from this ordeal. There’s also a deeper lesson about how people make money in this business. As Jason Zweig’s father once told him:

There are three ways to get paid:

1) Lie to people who want to be lied to, and you’ll get rich.

2) Tell the truth to those who want the truth, and you’ll make a living.

3) Tell the truth to those who want to be lied to, and you’ll go broke.

While Atlas Trading was happy to sell their lies to their followers to make a temporary fortune, there are far more people in our industry that are just trying to make a living. You’ll find them in far greater numbers on FinTwit. You’ll find them in wealth management firms across the country. But, where you won’t find them is in the news. Their stories are never trending on Twitter. Yet, they make their living just the same.

At times it can look like the entire financial industry is filled with charlatans and frauds. However, we forget that the honest people don’t make the headlines. These are the people that understand that managing peoples’ money is a serious affair. They aren’t messing around. They aren’t playing trading games like so many others are.

Because they understand something that the members of Atlas never could:

In the game of trading, the only winning move is not to play.

Happy investing and thank you for reading.

Note: I will be on vacation next week so there will be no post next Tuesday (12/20/22). Wishing you all safe travels and happy holidays!

If you liked this post, consider signing up for my newsletter.

This is post 327. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data