One of the most expensive dining experiences you can have in New York City is at Masa. An upscale sushi restaurant located in Midtown Manhattan, Masa offers an omakase tasting that starts at $750 per person, not including drinks or tax. If you decide to upgrade your tasting so that you are served at Masa’s sushi counter by one of their highly skilled chefs, the price rises to $950 a person.

So, assuming you brought your own bottle of wine and paid the $200 corkage fee to save money, a dinner for two at Masa would cost you around $2,300, including tax and gratuity [($950 * 2 + $200) * 1.08875 ~ $2,300].

I’ve been thinking about this hypothetical dinner at Masa a lot lately. Not because I would ever pay this amount of money for a meal, but because I recently lost $500 more than the price of this meal after buying some altcoins that collapsed in price earlier this year. I know. It’s embarrassing. After all, how could I, a die-hard index investor, lose $2,800 on random internet money? One word—greed.

Late last year a friend of mine who had made 10x in crypto in 2021 tweeted about what coins he was recommending for 2022. Having no exposure to the space, I saw his tweet and thought it was about time for me to get involved. So, I took less than 1% of my net worth and let it ride on a few of these coins. After all, what’s the worst that could happen? Well…I found out.

Almost immediately after I bought the altcoins in early January, the market started to unravel. Within a few weeks my altcoin portfolio was cut in half and there seemed to be no end in sight. Down another 5%. Then another 10%. Then another 5%. It was getting ridiculous. To stop the bleeding, I exited my positions in late February. When all was said and done, I had lost 70% in less than 6 weeks.

But the ironic part of my altcoin experiment was that I knew it was a bad idea, yet I did it anyways. In fact, I had written about why the crypto market was overhyped back in November 2021. I had written about how things had gotten a little too far ahead of themselves. I had written about why this was so similar to the DotCom bubble.

In retrospect, my call was pretty accurate. One week after I published that post, Bitcoin peaked at $68,000 and it hasn’t been near there since. Nevertheless, I quickly forgot my own advice. I forgot why I don’t buy individual securities like altcoins. I forgot why I became an indexer in the first place.

Looking back now it seems so obvious that valuations of speculative cryptocurrencies and high growth tech stocks would collapse. The prices made no sense and we all knew they made no sense. But, in the moment, it’s hard to imagine how everything could come undone. It’s hard to imagine when everyone would wake up. But, they always do.

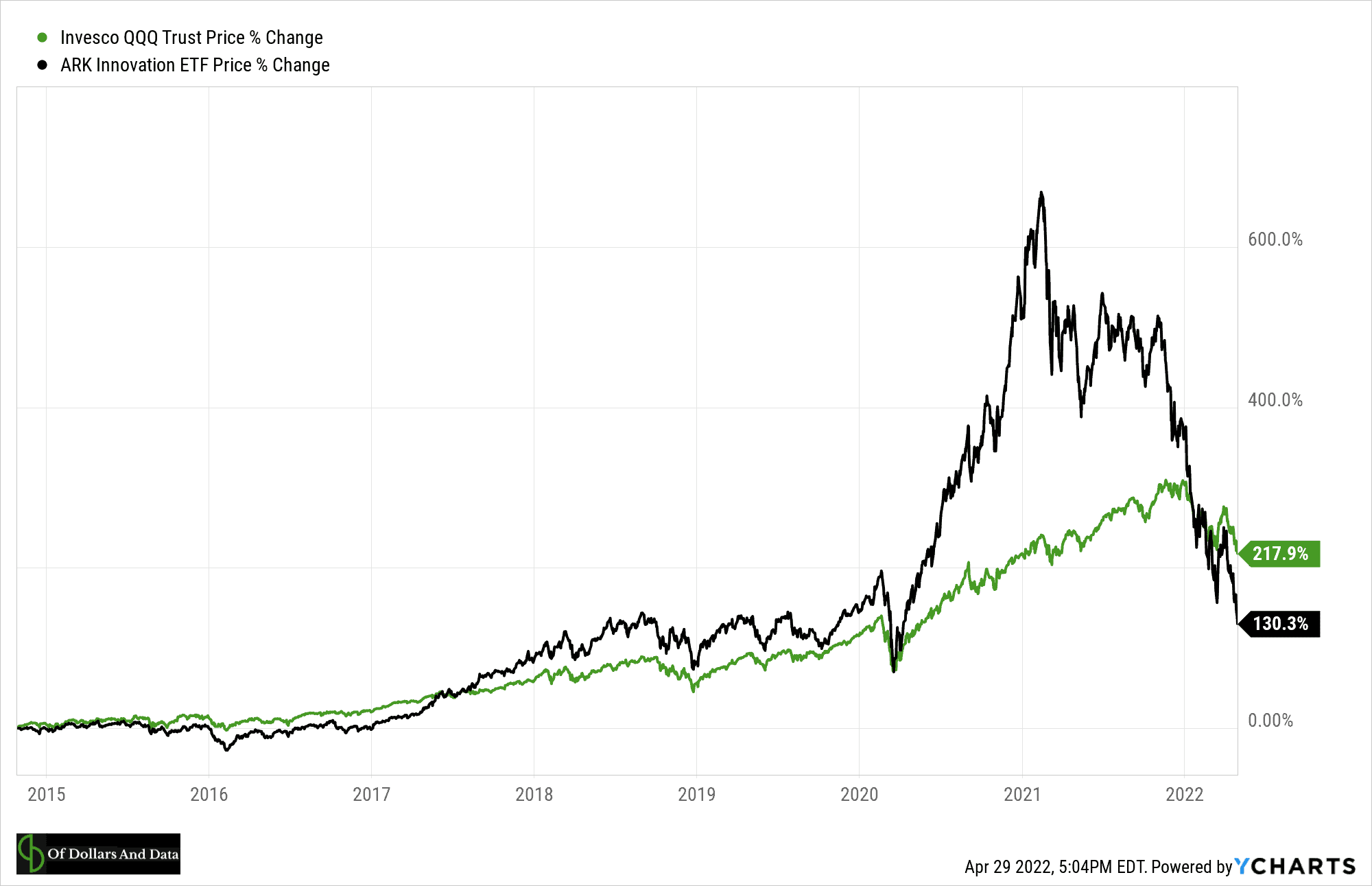

Consider what happened to ARKK over the past year. The high flying fund of the tech world has now underperformed the NASDAQ-100 since inception:

With rising interest rates and skittish investors, the “disruptive innovators” of the future aren’t looking so disruptive. More importantly, the fund’s underperformance has been disastrous to those in the fund. As Jeffrey Ptak recently tweeted:

But this is what makes $ARKK a unicorn: Assets *poured* in during the run-up and, remarkably, have largely stayed put since then, despite the brutal selloff. Take the two together, and it is maybe the biggest, fastest destruction of shareholder capital in fund history.

Yes, this is an unfortunate result for ARKK investors, but is it really that surprising? After all, I’ve been hearing FinTwit call out Cathie Wood and ARKK for a while now. Drew Dickson wrote a scathing critique of the fund in February 2021, just a few weeks after ARKK’s peak, that says it all:

Eventually, everyone figured out that Galileo was right. Eventually, everyone will figure out that Cathie Wood isn’t. And it won’t take as long either.

Drew’s intuition was spot on. Within a year people had figured it out.

But ARKK is just the tip of the “we all knew this would happen” iceberg. If we expand our investment universe to include crypto and NFTs, it’s much easier to find examples of obvious froth. For example, consider Jack Dorsey’s first ever tweet, which originally sold as an NFT for $2.9 million, but now can’t fetch bids anywhere near that price.

Is this outcome shocking to you? I’m not surprised in the slightest. We will see more of this before we see less. As Josh Brown recently wrote:

They’re going to stop treating their savings like a video game. Survival and bill-paying tends to take precedence over buying and displaying digital trinkets for the approval of strangers

Why do people do these crazy things even when they know better?

I’ve been asking myself that question ever since I sold my dreaded altcoins a few months ago. And I don’t have a great answer. Maybe it’s greed. Maybe it’s the thrill of the game. Maybe it’s a drive toward self-destruction. I don’t know.

But what I do know is that many of us will probably keep doing it, even when we try to stop ourselves. It reminds me of that infamous quote from Stanley Druckenmiller after he lost $3 billion during the DotCom bubble:

You asked me what I learned. I didn’t learn anything. I already knew that I wasn’t supposed to do that.

But what about me? Did I learn anything from my altcoin experiment?

Yes. The next time I want to do something speculative with my money, I’ll just go to Masa instead.

Thank you for reading.

If you liked this post, consider signing up for my newsletter.

This is post 293. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data