Harry Markowitz. The man who popularized diversification with the creation of modern portfolio theory. In 1990, he shared the Nobel Prize in Economics with William Sharpe (the creator of the Sharpe ratio) and Merton Miller (of the Modigliani–Miller theorem) for “pioneering work in the theory of financial economics.” Markowitz’s pioneering work was illustrating that, by combining different asset classes, one could create a portfolio that had the highest return per unit risk (based on historical data).

You would think that the man who popularized such a precise theory would use it to invest his own money, but you would be wrong. As Nassim Taleb is known for saying, “Don’t tell me what you think, show me your portfolio.”

When Jason Zweig asked Markowitz what was in his portfolio and whether he used modern portfolio theory, Markowitz replied (emphasis mine):

I visualized my grief if the stock market went way up and I wasn’t in it — or if it went way down and I was completely in it. My intention was to minimize my future regret…So I split my contributions 50/50 between bonds and equities.

As Zweig correctly points out, many investing experts urge “do as I say, not as I do.” The funny part about this is that Markowitz didn’t run a mean-variance analysis to find his optimal portfolio. Instead, he made a portfolio based on his expected reaction to various market events. Behavior trumps math.

But, that’s not even the punchline. In a 2017 interview, Markowitz stated, “Well, that was in 1952. But, that’s not what I would do today.” So how does Markowitz invest today?

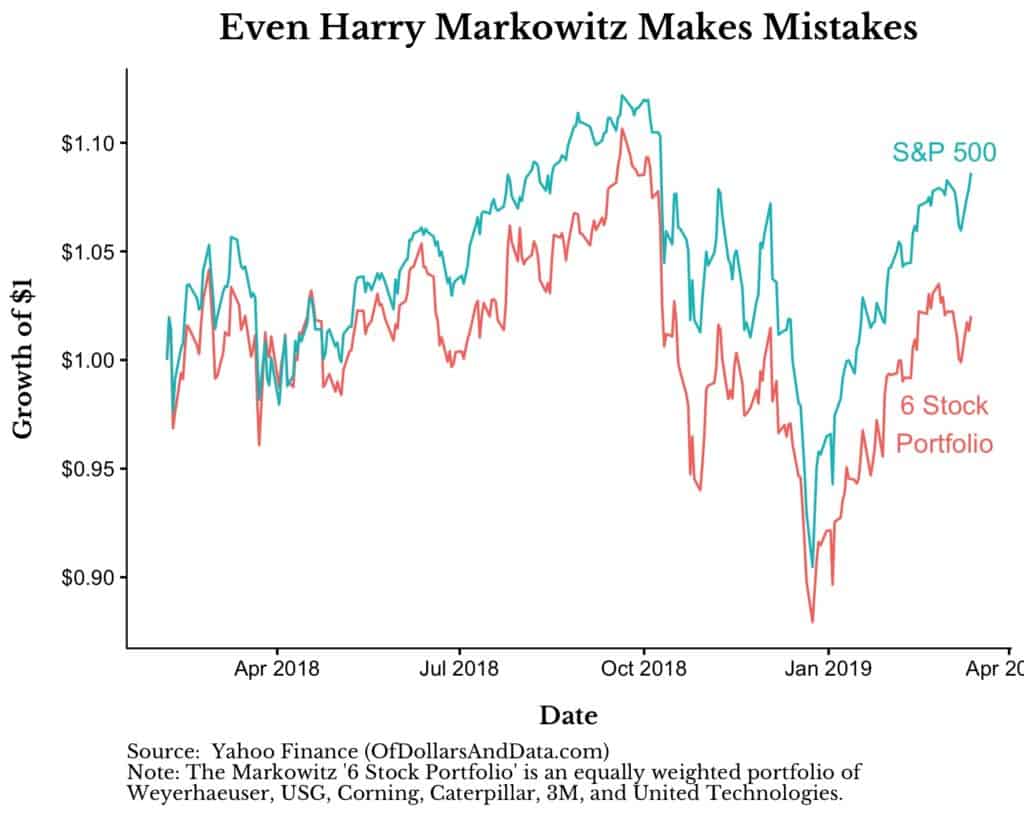

According to a Barron’s article in February 2018, Markowitz had 100% of his liquid assets in equities with 1/3 in a small cap index fund, 1/3 in an emerging markets index fund, and 1/3 in just 6 stocks. Yes, 6 stocks. Which ones? Weyerhaeuser, USG, Corning, Caterpillar, 3M, and United Technologies. Notice a pattern? They are all construction related.

So what caused the global champion of diversification to make a bet on construction stocks? In his own words (from Barron’s):

It’s for the long run, but not the indefinite long run. My thought process is this: They are someday going to rebuild Houston. It will take a while, but they’ll rebuild Houston. They’re going to rebuild Florida….And they’re going to rebuild Puerto Rico.

Yes, Harry Markowitz wagered 1/3 of his portfolio on infrastructure rebuilding after a series of hurricanes struck the Gulf states and Puerto Rico in 2017. How has that bet turned out? You guessed it. Markowitz has underperformed the S&P 500 by about 6% since the article’s publication:

My point with this isn’t to dunk on Harry Markowitz. Markowitz has done more for the investment world than just about anyone and likely belongs on the Mt. Rushmore of Finance.

My point is to illustrate that we all make mistakes. Yes, Markowitz’s “mistake” is trivial and will likely have no impact on his long run financial goals. However, it does illustrate a deep truth about the difficulty with investing. If one of the most brilliant minds in finance can error, why should you be any different?

This question was masterfully addressed by my colleague Michael Batnick last year in his book Big Mistakes. Batnick demonstrates how some of the greatest investors in history (i.e. Buffett, Bogle, Druckenmiller, etc.) all made huge blunders during their investment careers. But, it wasn’t Warren Buffett’s stock acquisition of Dexter Shoe or Bill Ackman’s failed short against Herbalife that were the most memorable, it was the chapter Batnick wrote about his own struggles in investing.

This chapter was so good because self-reflection and admitting failure are exceedingly rare. Few people will acknowledge their mistakes. Few people will confess when they acted foolishly.

My biggest investment blunder so far is buying 1 Bitcoin at $7,500. I still own it despite its price being cut nearly in half. I don’t know if this is a mistake yet, but time will tell. I have been fortunate that I haven’t made many other investing mistakes. I bought a few individual stocks over the years, but I got lucky and didn’t lose money (just lost on a relative basis compared to the S&P 500).

Most of my mistakes have come outside of the realm of investing. Though now I am very extroverted, I should have been more social in college. I should have minored in computer science. I should have started weight lifting earlier in life. I should have cared more about my health/nutrition. I should have been a better brother, a better son. I should have understood myself a decade ago, but I didn’t. There are lots of things that I should have done, but maybe that is a part of the process.

The Value of Mistakes

Sometimes I wonder, how would my life be if I had only made optimal decisions throughout it? What if I had start lifting weights earlier? What if I had been more social in college? What if? What if? What if?

It’s easy to play these mind games and imagine what our lives would be like in an alternate timeline, but this is pure fantasy. The problem with such a thought experiment is that you can’t see how your life would be had you made the other choice. For example, if I had started lifting weights earlier in my life maybe this would have been beneficial. Or maybe it would have made me overconfident. That overconfidence could have led to a host of other problems that I don’t face in my current life.

You cannot know whether any one decision will make you better or worse off. The chaos engine of life doesn’t allow for it. There is no single solution, only a web of possibilities.

This is why mistakes are so valuable. They teach you things that you don’t have to learn later in life. A mistake is a dividend of knowledge that will pay you until the day you die. So, cherish your mistakes. Learn from them. Value them.

I pity those people that haven’t made many mistakes in life. They are likely to make mistakes later in life when they have less time to recover from them. Just like in investing, it is far better to lose 30% when you are young and have little money, then to lose 30% when you are old and on the verge of retirement.

We all make mistakes. The trick is to make them when they matter the least. Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 116. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data