[Updated 07/01/24]

If you’ve ever wondered, “Where do millionaires keep their money?” then you’re not alone. Many people are curious about the financial habits of the wealthy, and for good reason. Having a better understanding of how millionaires manage their money can help us learn from their successes and potentially improve our own financial well-being as well.

In this blog post, I’ll explore the various options available to millionaires for storing and growing their wealth. From traditional asset classes to more exotic investments, we’ll take a closer look at the strategies millionaires employ to protect and grow their fortunes. Whether you’re a millionaire looking for new ways to manage your money or just someone who wants to learn from the best, this post has something for you.

1. Stocks

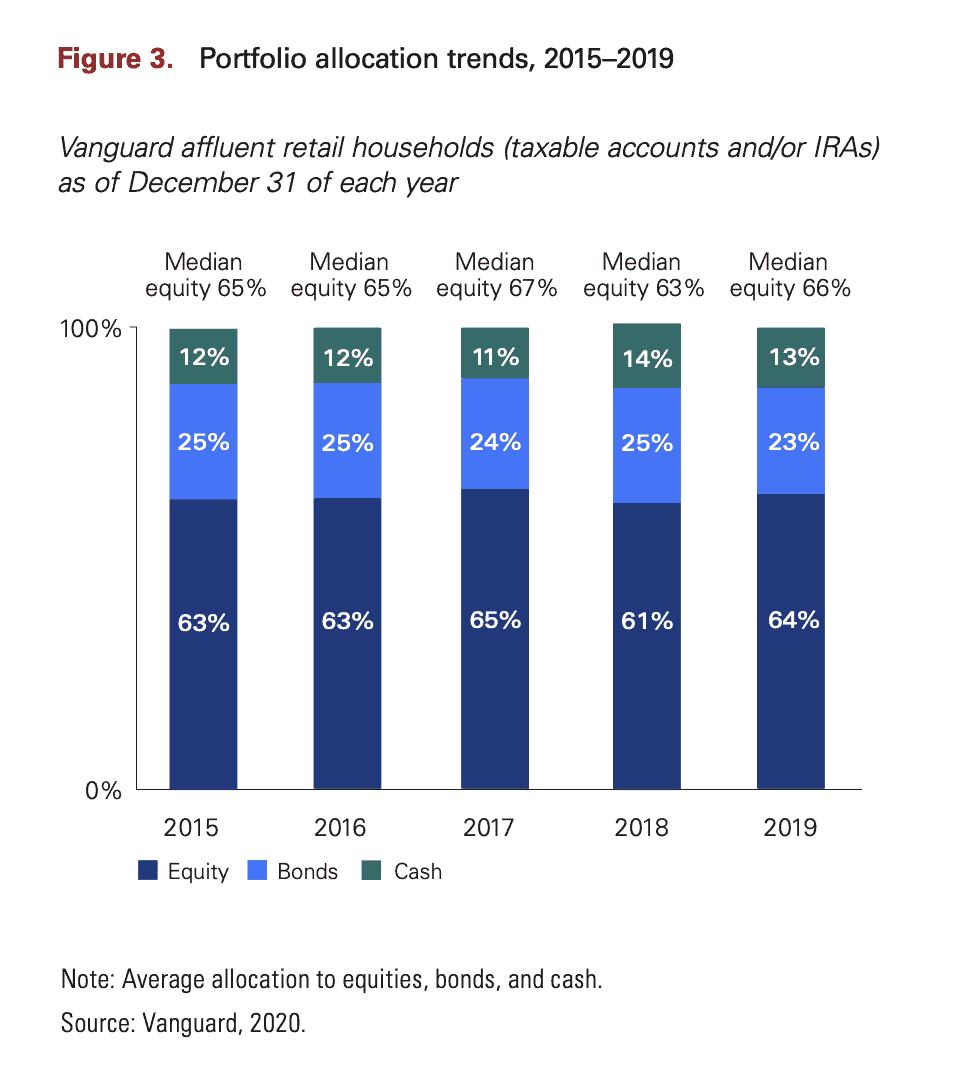

Despite what you might believe, stocks are the most popular asset class among millionaire households. According to Vanguard, the asset allocation of the typical millionaire is:

- 65% Stocks (Equity)

- 25% Bonds (Fixed income)

- 10% Cash

More importantly, this allocation has been relatively stable over time:

This gives us a good idea of how millionaires tend to invest their money within their investment accounts on average. However, it doesn’t tell us anything about how those allocations change over time within households. Since the chart above is the aggregate allocation across all households, we don’t get to see any age-related allocation changes.

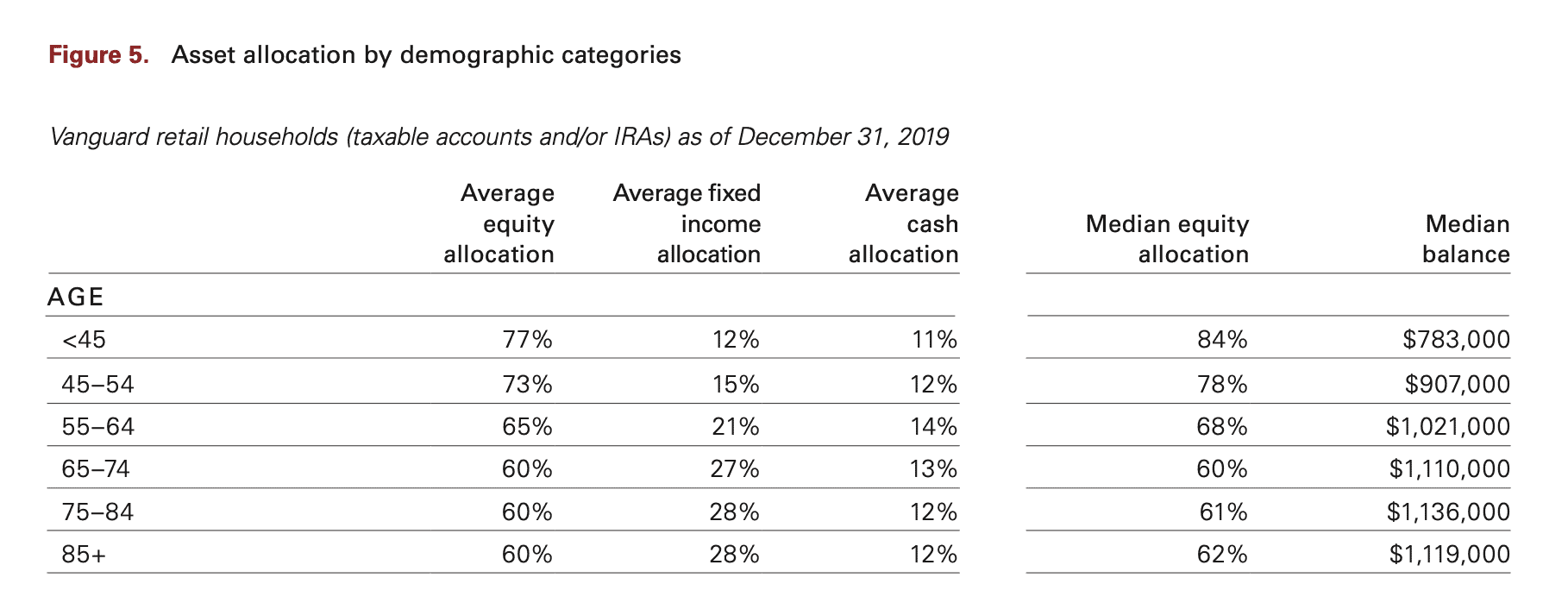

Fortunately, Vanguard provides a breakdown of allocation by household age in their study as well. We can see this in the table below which shows that households under 45 tend to allocate around 75% of their portfolios to equities, while households older than 65 allocate around 60% to equities:

What happens to the money that comes out of equities as these affluent households age? It goes into fixed income/bonds.

From the table above, we can see that the fixed income allocation of affluent households nearly doubles from age 50 to age 80. In other words, affluent households tend to go from 15% bonds in their 40s to 30% bonds during retirement.

While this data is useful, it only reflects what millionaires hold inside their traditional investment accounts. But this isn’t everything they own. When we include those assets outside of these accounts, we get a better picture of where millionaires keep their money.

2. Their Primary Residence

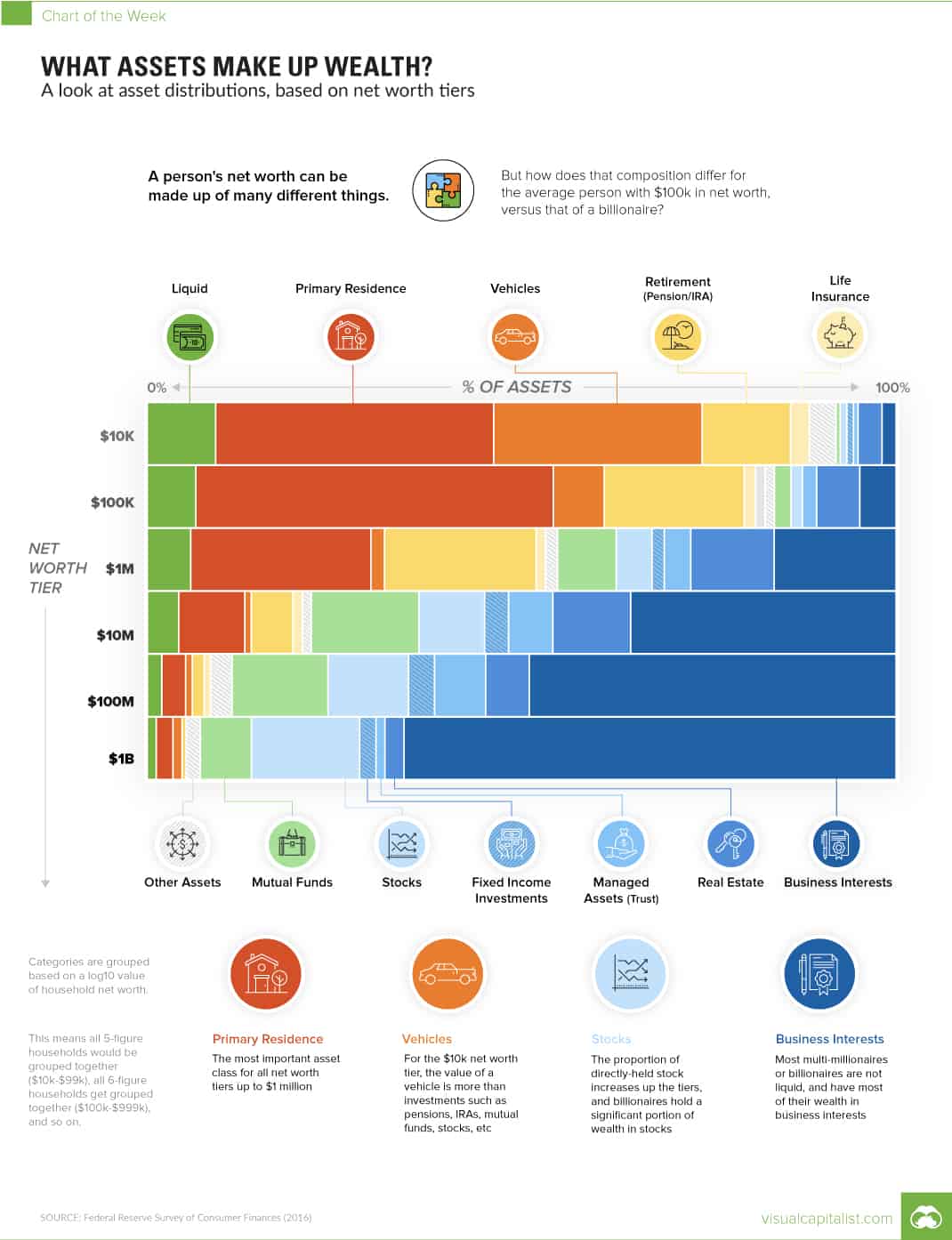

Despite the sophistication of millionaires, those with $1M–$10M still have a considerable amount of their wealth in their home. We can see this more clearly if we look at the chart below (from VisualCapitalist), which highlights how household net worth is broken out across different wealth tiers. In it we can see the percentage allocated to a primary residence, vehicles, business interests, and much more:

As you can see, millionaire households have about 25% of their wealth in their primary residence. This leaves the remaining three quarters of their wealth for investable assets, which are mostly held in stocks and in retirement accounts.

3. Their Own Business

Outside of traditional asset classes and real estate, millionaires tend to hold nearly 15% of their wealth in their own businesses. You can see this under “Business Interests” in the Visual Capital chart from the prior section. This allocation to business interests is similar to what Thomas J. Stanley and William D. Danko found in their groundbreaking book, The Millionaire Next Door. As they stated about the typical millionaire household:

On average, 21 percent of [millionaire] wealth is in private business.

After including ownership of private businesses and a primary residence, the typical millionaire household’s allocation to traditional asset classes (e.g. stocks, bonds, cash) is a bit lower that what has been shown above. In fact, the typical millionaire only has about 60% of their wealth in a combination of stocks, bonds, cash, and other real estate.

More importantly, as millionaire households get wealthier, we tend to see a decline in the amount they allocate to these traditional asset classes. As you can see in the Visual Capital chart from the prior section, once you become a decamillionaire ($10M-$100M) or centimillionaire ($100M), business interests began to dominate most of your wealth.

But, outside of traditional asset classes, millionaires also tend to invest in alternatives. However, it’s probably not as much as you think.

4. Alternatives (Hedge Funds, etc.)

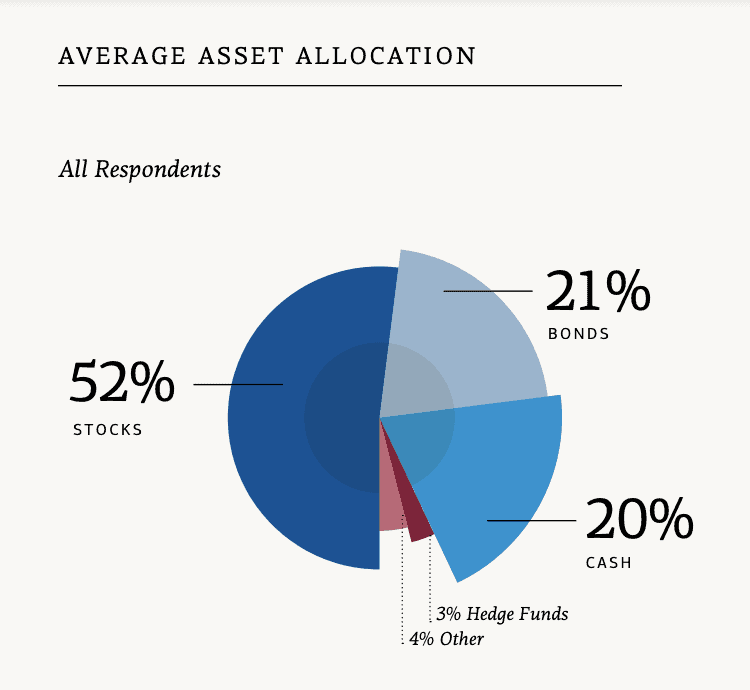

Do millionaires invest a lot of money outside of stocks, bonds, and cash? According to the 2017 U.S. Trust Insights on Wealth and Worth, the answer is “Not really.”

As their study shows, high net worth households (those with over $3 million in investable assets) had the vast majority of their wealth in stocks, bonds, and cash, with less than 7% of their investable assets in alternatives such as hedge funds and other asset classes:

This suggests that what we see in the Vanguard’s How America Invests study is representative of how the typical millionaire household allocates their money. They own typical asset classes and not all these exotic investments like the financial media might have us believe.

Nevertheless, all of our conclusions thus far are based on households that are right above the million dollar threshold. But, what about households that have more than just a few million dollars to their name? Do they invest differently than the typical millionaire household? Let’s turn to that now.

Do Wealthier Millionaires Invest Differently?

There’s a big difference between having $3 million to invest and having $30 million to invest. But does that lead to different investment decisions? The evidence suggests so.

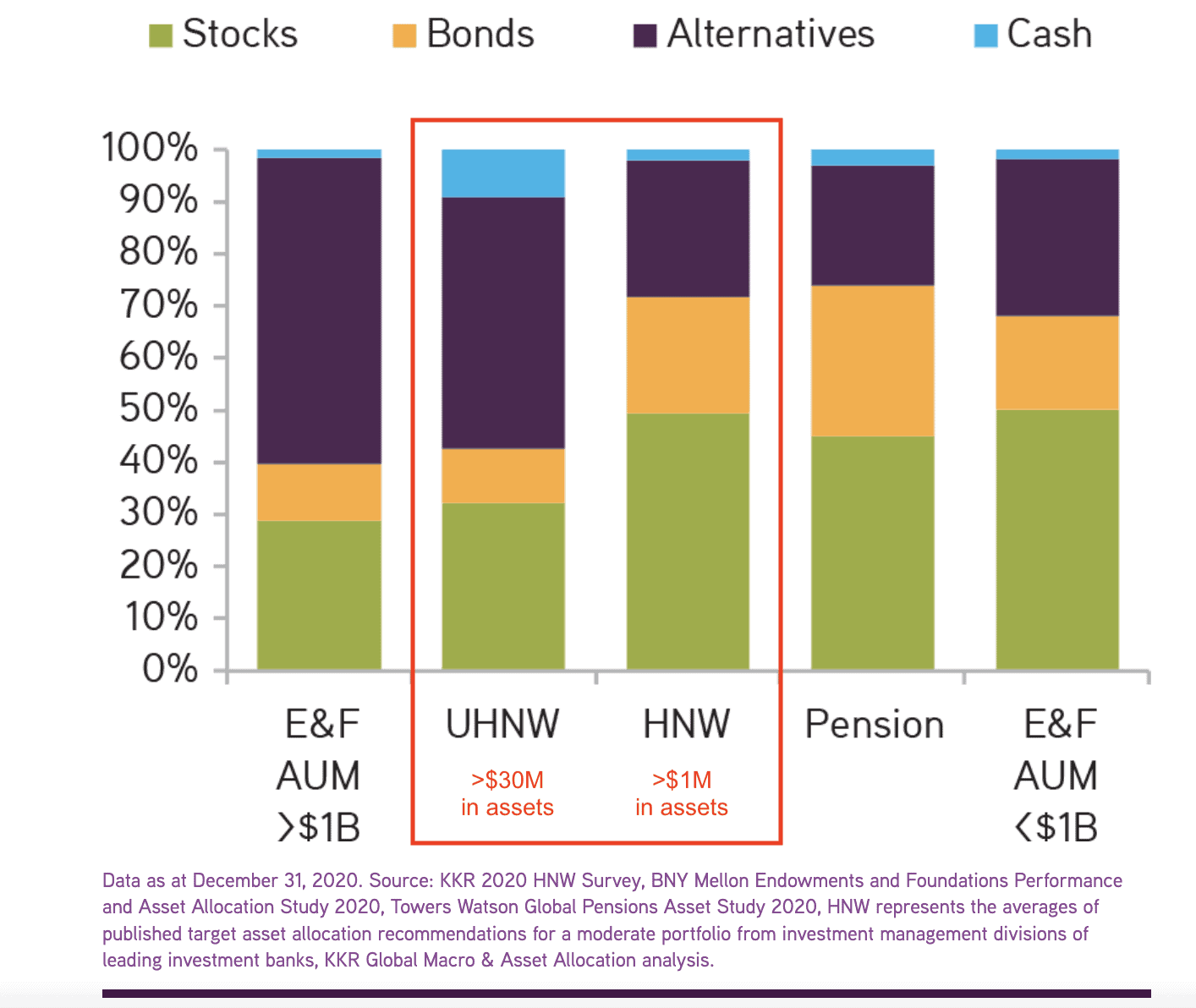

This report from KKR demonstrates that ultra-high net worth investors (those with >$30 million in assets) invest more money into alternatives (i.e. private equity, hedge funds, etc.) and cash than high net worth investors (those with >$1 million in assets).

As you can see in the chart below, ultra-high net worth (UHNW) investors allocated:

- 50% to alternatives

- 30% to stocks

- 10% to bonds

- 10% to cash

This is quite different from the millionaire households we have examined thus far:

I can’t necessarily explain why UHNW investors have more money in alternatives, but I have a few theories. One of them is that, as wealth increases, households tend to invest based more on status than returns. Alternative investments like private equity and hedge funds offer a sense of exclusivity that you can’t get with a Vanguard index fund.

Another possibility is that wealthier households invest in alternatives because they are the only ones that can access them anyway. While anyone with a few thousand dollars (sometimes less) can buy an index fund, you need to have serious capital to get into many of these alternatives.

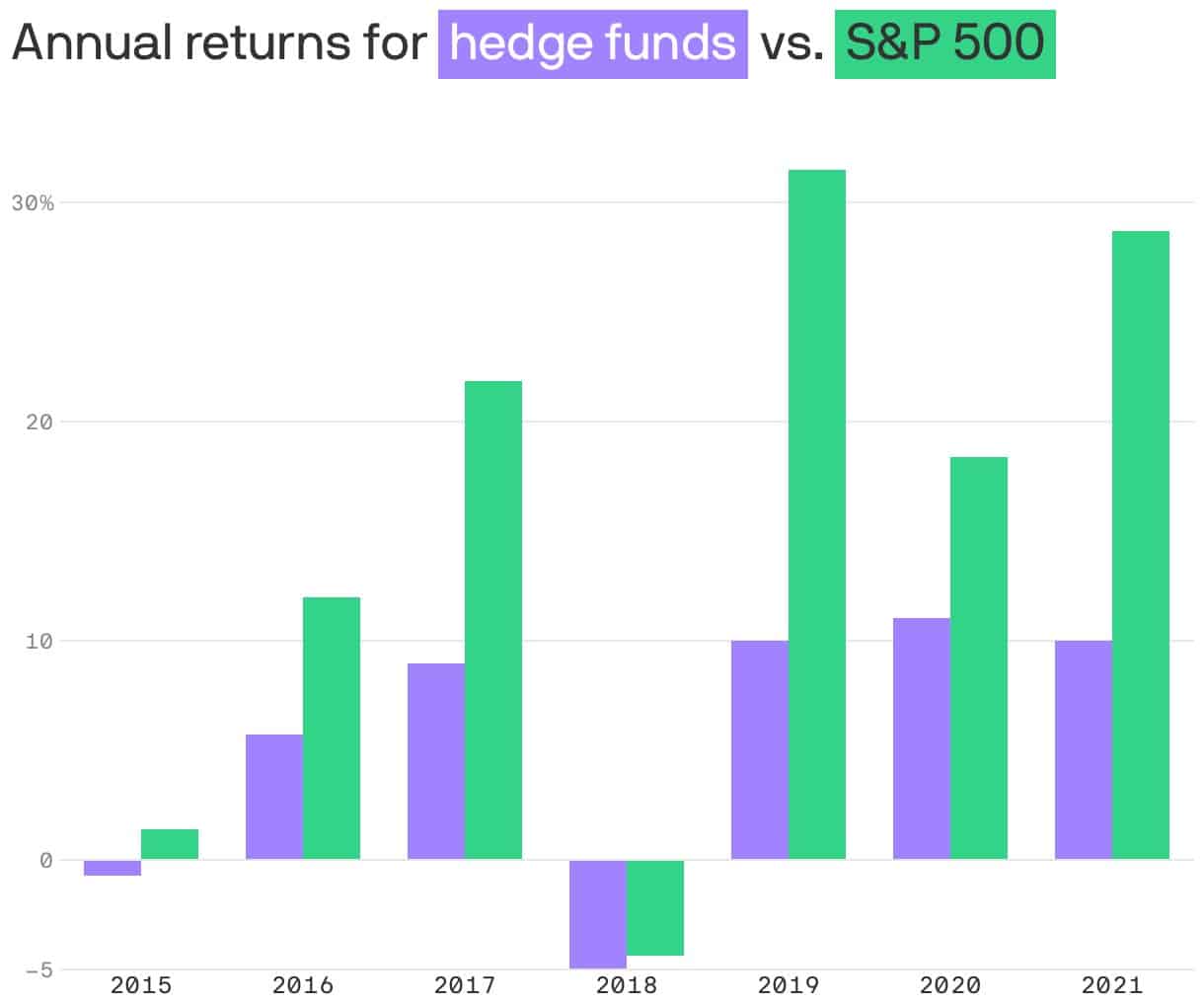

Fortunately, retail investors (i.e. you and I) don’t need alternatives to successfully build wealth. In fact, there’s a decent amount of evidence showing that public investment strategies tend to outperform private strategies, especially after fees are taken into account. For example, the chart below shows the returns generated by hedge funds and the S&P 500 from 2015 to 2021:

As you can see, the S&P 500 outperformed a basket of hedge funds in every year from 2015-2021. This is even true in 2018, the only down year during this time period! For all those hedge fund defenders that like to say, “But hedge funds will outperform in a down market!” please explain 2018.

Either way, my point stands. There is no evidence that the typical retail investor needs alternatives to build wealth. While investing in alternatives can be nice to brag about at dinner parties, I’m not in the business of bragging. I’m in the business of trying to make you richer.

With that being said, let’s conclude by discussing why investing like a millionaire won’t necessarily make you into one.

Why Investing Like a Millionaire Won’t Make You into a Millionaire

Throughout this article we have assumed that by emulating how millionaires invest their money, you too will one day become a millionaire. But this isn’t always the case.

Why? Because most millionaires don’t become millionaires solely based on their investment decisions. They also tend to have a high income, a high savings rate, or both. And the further you go up the wealth spectrum, the more apparent this becomes.

If you want to become a typical millionaire, like the affluent households in Vanguard’s 2020 How America Invests study, buying a diverse set of income-producing assets and earning 7% a year will work just fine.

However, if you want wealth that is orders of magnitude higher, the S&P 500 isn’t gonna cut it. To obtain extreme levels of wealth you need:

- A very high income (i.e. famous musician/actor/athlete, successful business owner, C-Suite executive, etc.), or

- A huge liquidity event (i.e. sell your business, startup equity IPO, etc.)

Possibly a bit of both. Of course, I don’t know which path will be right for you. But, I do know that investing like a millionaire doesn’t always make you into one. With that being said, happy investing and thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 334. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data