Last week, Michael Lewis’s new book Going Infinite, detailing the rise and fall of Sam Bankman-Fried (“SBF”) and his cryptocurrency exchange FTX, was released to a wave of outrage. It all started when 60 Minutes published an interview with Lewis where he stated:

This isn’t a Ponzi scheme. Like when you think of a Ponzi scheme, idk, Bernie Madoff. The problem is there’s no real business there. The dollar coming in is being used to pay the dollar going out.

And, in this case, they actually had a great real business. If no one had cast aspersions on the business. If there hadn’t been a run on customer deposits, they’d still be sitting there making tons of money.

As soon as the interview came out, Crypto Twitter and Financial Twitter started dragging Lewis through the mud. One of the most scathing tweets came from Nassim Taleb:

The tragedy of the good writer. Michael Lewis never had any idea how finance worked, yet managed for ~34 years to fool nonfinance people into believing that he knew what he was talking about. The good news is that one gets caught eventually, but 34 years is far too long!

As more people started to pile onto Lewis, I started to wonder whether his 60 Minutes interview was merely a marketing ploy to help sell his book. After all, maybe Lewis does believe that SBF is a fraud (and says so in his book), but he is downplaying it in interviews to stir up controversy and generate more buzz. As the saying goes, “There’s no such thing as bad publicity.”

Unfortunately, after reading Going Infinite last week, I realized that this wasn’t the case. While many critiques of the book have argued that Lewis defended SBF (see here, here, and here), that wasn’t my takeaway. Lewis doesn’t defend SBF or his actions, but he doesn’t throw any punches either.

Instead, Lewis’s thesis seems to be that SBF was a careless/reckless kid who got in over his head. After reading Going Infinite I can see how you could make this case. Based on every anecdote I’ve seen of SBF, he is easily the most careless business executive in history.

He doesn’t care about how he dresses. He doesn’t care about his prior commitments (and would regularly bail on people). He doesn’t care about compliance or accounting or any of that. His company had no CFO, no board of directors, and no HR. For Christ’s sake, he would play video games while being interviewed on national television. It’s insane how far SBF got while not giving a shit about anything.

John Ray, the lawyer appointed to recover customer funds following FTX’s collapse, summarized SBF’s carelessness best:

Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here.

And this is the guy who cleaned up Enron!

So when SBF was asked why Alameda Research (SBF’s cryptocurrency trading firm) had access to FTX customer deposits, he claimed that FTX couldn’t get a bank account (at the time), so they just used Alameda Research’s bank account instead. He found a temporary solution and didn’t bother to fix it.

According to SBF, it was only later when crypto prices were crashing in late 2021 that he realized that Alameda was utilizing FTX customer funds for its trading. By then it was too late to fix the problem.

But here’s the part that irked me—Lewis presents this story with very little pushback, stating:

His story, implausible as it sounded, remained irritatingly difficult to disprove.

Now with most of SBF’s inner circle admitting criminal guilt with regards to the intentional co-mingling of FTX customer funds with Alameda Research assets, it seems like Lewis didn’t dig deep enough.

But, to defend Lewis for a second, it’s likely that he couldn’t get access to the information he needed because the people who had it wouldn’t talk to him. After all, many former FTX employees took plea deals with the government and were probably advised not to speak to anyone (including Lewis) about the case.

When Barry Ritholtz asked Lewis on Masters in Business, “Was there any criminal intent [at FTX]?” Lewis stated (see 58:44):

I don’t want to answer the question because I left the question for the reader to answer. I intentionally didn’t answer the question because I didn’t want my thumb on the scale. So I don’t really want to answer this in interviews…It’s quite possible that stuff will come out in the trial that will change my views. So I don’t know. I’m withholding judgement.

I can’t blame Lewis for not assigning criminal intent to SBF especially given that he probably didn’t have all the information. Maybe Lewis should have waited for all the facts to come out before finishing his book, but that’s another discussion altogether.

But, what I can blame Lewis for is his belief that FTX would “still be sitting there making tons of money” today had there not been “a run on customer deposits.”

Of all the things Lewis said about FTX and SBF, this is by far the most egregious. Why? Because Lewis believes that SBF just got a little unlucky. But, in reality, SBF was always going to crash and burn, it was just a matter of time.

How do I know this? Because of how SBF viewed risk. In Going Infinite, Lewis paints SBF as this savant who has this deep understanding of probability, markets, and expected value calculations. But, SBF’s own public comments suggest otherwise.

We can see how flawed SBF’s thinking on risk was in this twitter thread, posted by my friend and fellow blogger Matt Hollerbach (aka Breaking the Market). In particular, in this part of the thread SBF asks us to consider the following wager:

- Imagine you have $100,000 and there is a weighted coin that lands heads 10% of the time and tails 90% of the time

- When the coin lands tails, you lose whatever you bet.

- When the coin lands head, you win 10,000x your bet.

- If offered to play this game, how much of your $100,000 bankroll would you bet?

SBF goes on to say that the Kelly criterion (the optimal bet size for maximizing long-term wealth) would suggest betting only 10% of your bankroll (i.e. $10,000). However, SBF says he would bet 50% ($50,000), or 5x the mathematically optimal long-term bet size.

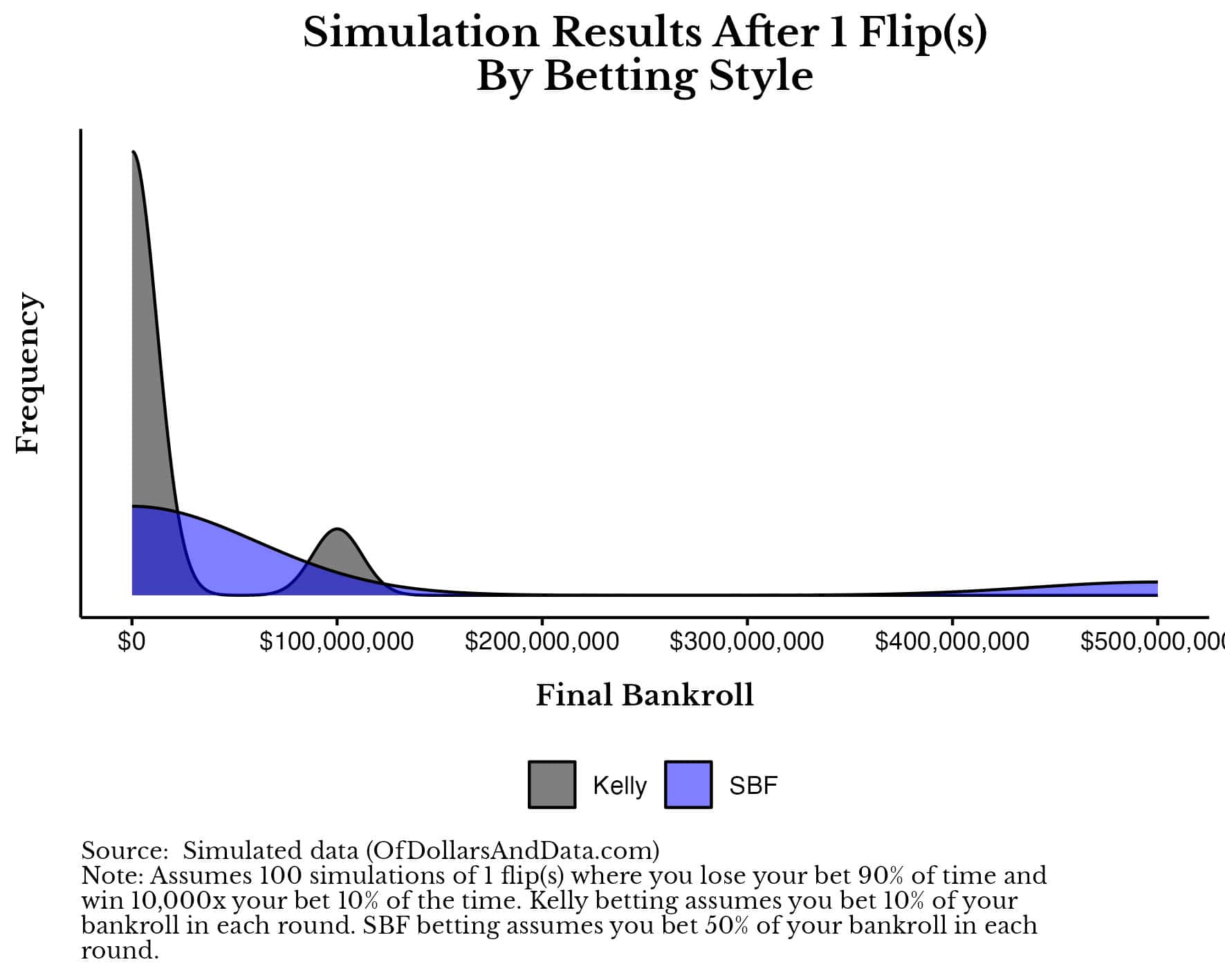

Assuming you were only going to play this game one time, SBF’s logic makes sense. We might as well go as big to maximize our wealth. You can see this visually if you were to run 100 simulations of this 1-flip game, as SBF’s betting style outperforms the Kelly bet in the simulations where you win (aka the coin lands heads):

The outcomes for SBF’s betting style (in blue) have a far right tail that the Kelly betting style (in grey) does not have. In a 1-flip game, SBF beats Kelly in terms generating the most wealth possible.

But, what if you were to keep playing this game for more than one round? Would the results change?

Yes, and dramatically so.

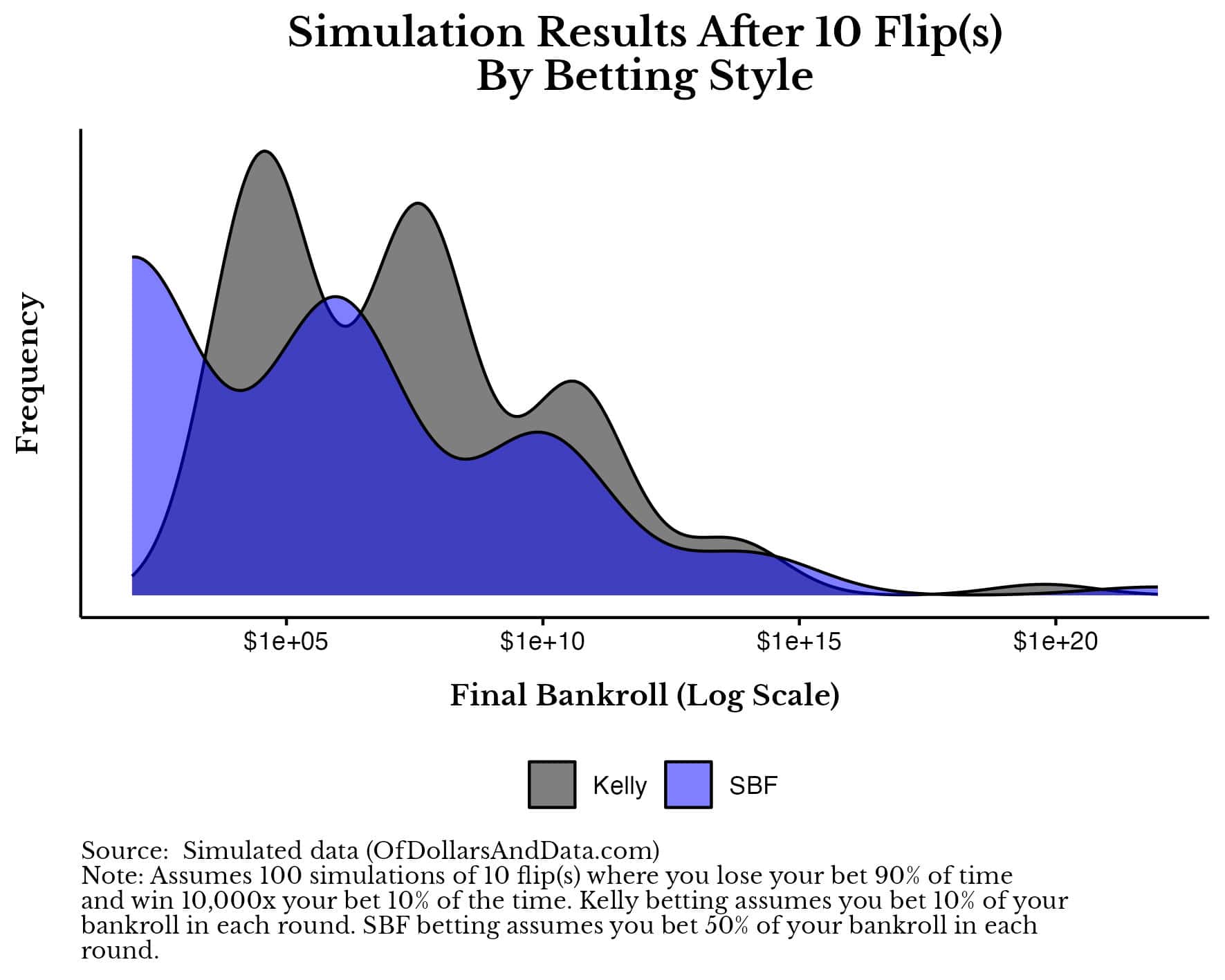

Playing this game for 10 rounds and plotting the results (using a log scale to show the size of the final bankroll), you would see that SBF’s betting style starts to lag the Kelly criterion except in the most extreme cases (e.g. when flipping many heads):

This is where SBF’s understanding (or should I say misunderstanding) of risk starts to harm him. As you can see, there is a huge left tail (i.e. worse outcome) for SBF’s betting style.

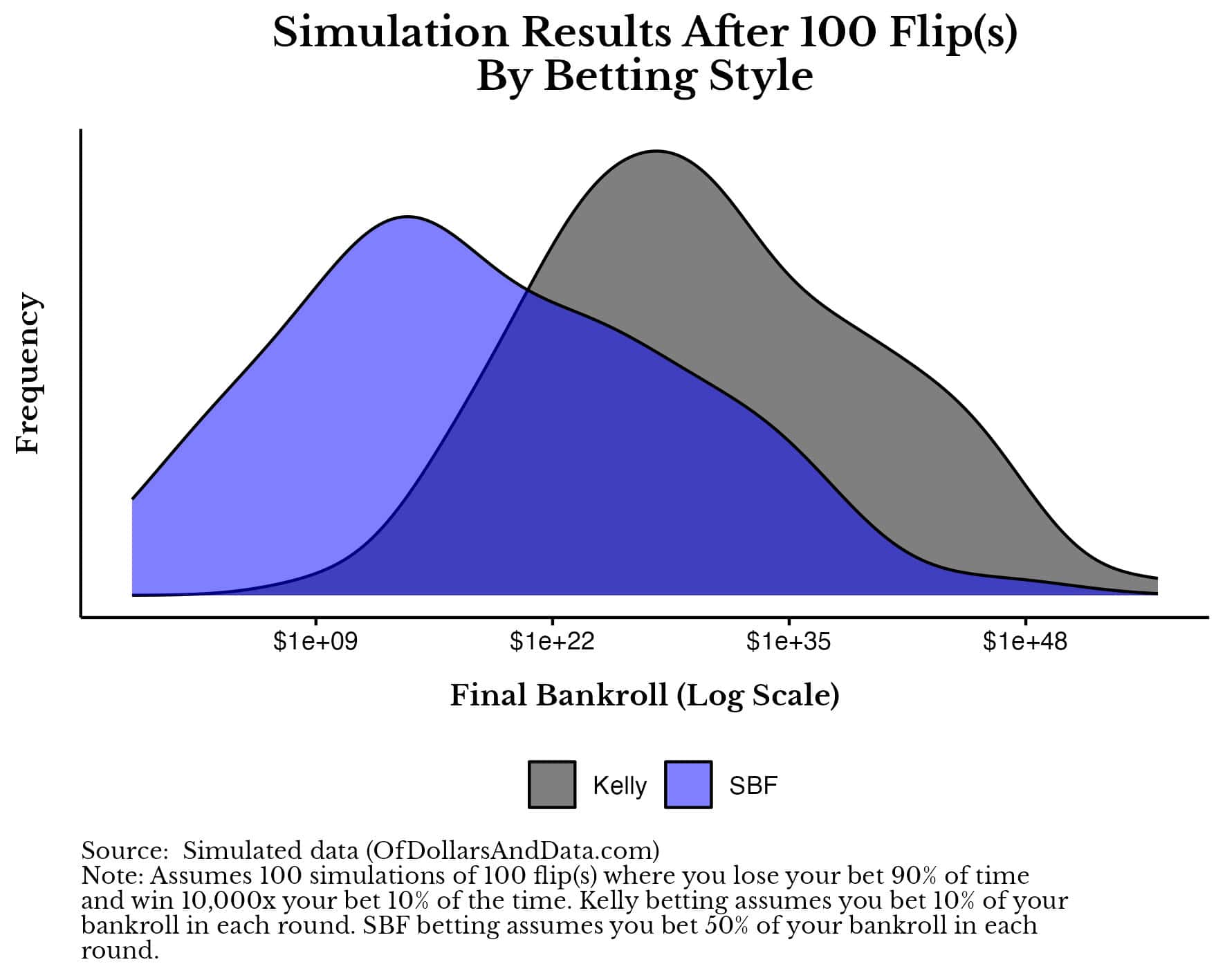

This left tail only gets more exaggerated as we continue to play the game. By the time we extend the game to 100 flips, the Kelly criterion wins hands down:

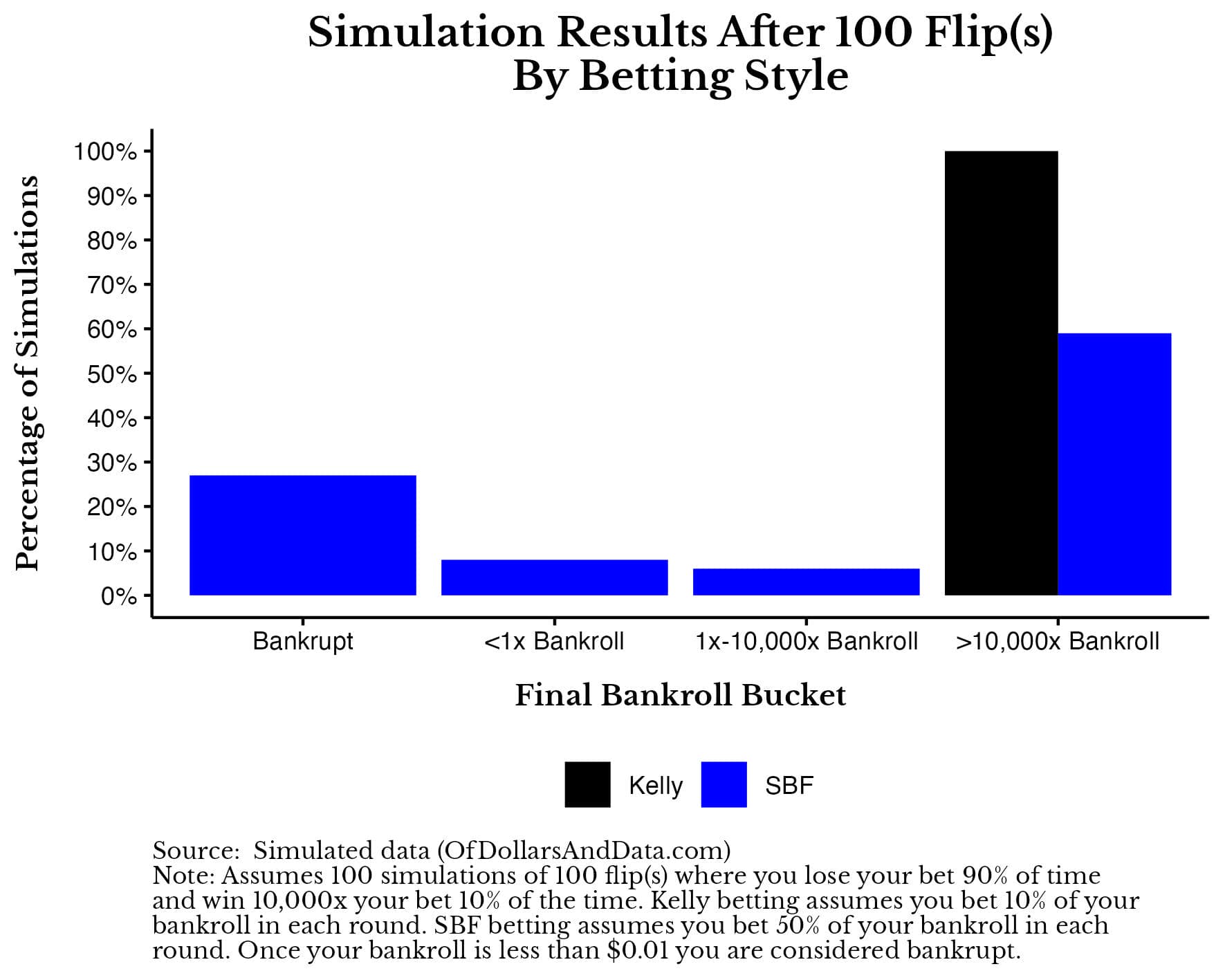

Bucketing these results to show your final bankroll relative to your starting bankroll, you can see that SBF’s betting style ends up bankrupt (final bankroll < $0.01) about 25% of the time:

This is where SBF went wrong. He wholeheartedly believed in a philosophy that encouraged him to take very big risks that, ultimately, led to his downfall.

Matt Levine provided the perfect thought experiment illustrating SBF’s flawed ideology last week:

“If you have a 1% chance of making a trillion dollars and a 99% chance of going bankrupt and spending the rest of your life in prison, would you take that bet?” Let us assume that that bet has a positive expected value, that having a trillion dollars to spend on pandemic preparedness and AI alignment and politics and whatever adds more than 100 times as much utility to the world as sending you to prison forever subtracts. Would you do it?

Nobody asked Bankman-Fried that exact question in March 2022, as far as I know, but it turns out that that was the game he was playing. He was almost certainly going to lose! He lost.

This is the conclusion Lewis should’ve ended his book with. Because we don’t know what really happened behind the scenes at FTX, but we do know how SBF thought about risk. And it was how he thought about risk that led to his undoing.

Thank you for reading.

If you liked this post, consider signing up for my newsletter.

This is post 367. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data