There has been a lot of talk lately in the media about bringing manufacturing jobs back to America. Regardless of the politics involved with this, both sides of the aisle tend to believe that we can revive employment in U.S. manufacturing. The problem is that the data tells a much different story. Before we dive into that, a short history of employment in U.S. manufacturing.

Employment in U.S. manufacturing grew from 9 million workers in 1939 (where the data starts) to a peak of 19.5 million workers in 1979 (see here). Since 1979 employment in U.S. manufacturing has been declining. The largest declines in employment coincided with the dotcom burst in 2001 and the Great Recession in 2008. More interestingly, after these major declines, U.S. manufacturing jobs never recovered. As of December 2016 manufacturing in the U.S. employs 12.2 million people.

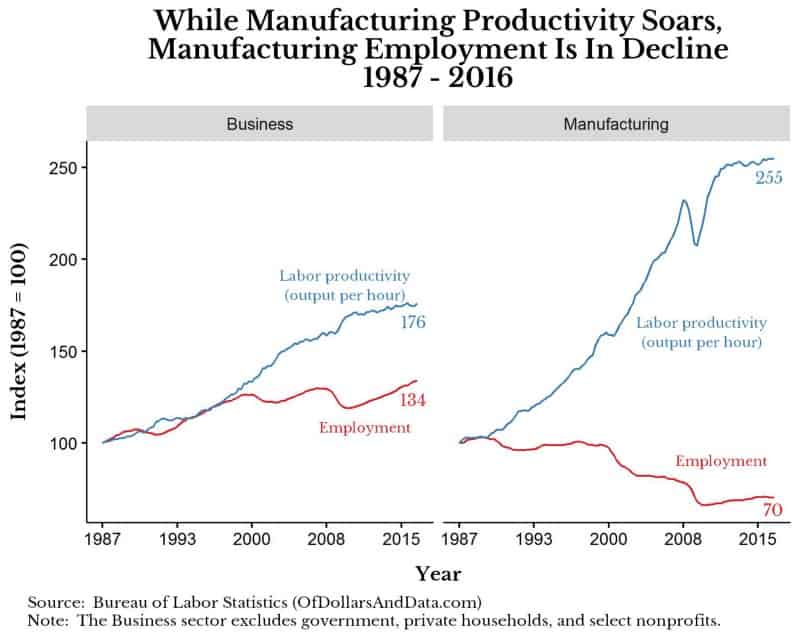

With that being said, why didn’t these jobs come back? My answer, though not the only factor, comes from data provided by the Bureau of Labor Statistics: Productivity. If we compare U.S. employment and labor productivity in the U.S. manufacturing and business sectors, a striking relationship can be seen:

This chart starts in 1987 indexed with a value of 100 for employment and labor productivity. The ending values in 2016 are shown on the chart so you can easily calculate the percentage change from 1987. For now I am going to focus on the right panel which illustrates how labor productivity has sky-rocketed in U.S. manufacturing. To be more precise, a typical worker in U.S. manufacturing can produce over 2 and a half times more goods today than they could produce in 1987, roughly 30 years ago. This means that what it took 100 workers to do in 1987 can now be done by 40 workers.

We are fortunate that more U.S. manufacturing jobs haven’t been lost given these gains in productivity as U.S. manufacturing has only seen a 30% decline in employment (100 -> 70) since 1987. With the increases in productivity shown above, we would only expect to have 40 workers today for every 100 in 1987, given the same level of output. However, we have 70 (not 40) which means total production of goods must be higher than in 1987. This brings me to my main point: employment in U.S. manufacturing is just a numbers game.

(Number of workers) x (Productivity per worker) = Output

Unless you can increase the demand for goods manufactured in the U.S., which would increase output, there is no economic way of reviving employment in this sector. Providing tax breaks and tax incentives to U.S. manufacturers to bring jobs back from overseas cannot compete with the productivity gains that have come as a result of technological improvements over the past 3 decades.

There is another story in this data that explains why these manufacturing jobs are not coming back: the U.S. economy increasingly provides services and digital goods over physical ones. If you focus on the left panel above, you can see that though labor productivity has increased for the business sector, employment has also increased, though to a lesser extent. Technically the BLS measure of the “Business” sector includes “Manufacturing”, but this only makes my point stronger as the trends in the larger economy do not match those of manufacturing sector.

How to Succeed in Today’s Economy Without A Manufacturing Job

Given that employment in U.S. manufacturing will likely not recover to 1987 levels, one way to succeed in today’s economy is to learn the skills that are marketable to employers. For this reason I highly recommend you learn programming. Unlike being a physician or a lawyer, the barrier to entry for becoming a good programmer is not years of required schooling and tens of thousands of dollars in debt. The only barrier to becoming a programmer is your time and effort. That is it. If you spend enough time learning programming and you build something great (i.e. a website, an app, data analysis, etc.) you can use that to build a career. Check out my Learn Data Analysis page if you want to learn more about this. Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 04. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data