With the Russian invasion of Ukraine and the recent decline in tech stocks, it’s easy to be pessimistic about markets (and the world) right now. I get it. Following the situation in Eastern Europe in real time on Twitter and trying to think about how it might play out can be maddening.

Will the conflict last days or years?

How much blood will be shed?

Is this the beginning of World War III?

I don’t know the answers to any of these questions, but I don’t think many others do either. As the saying goes, “Predictions are hard, especially about the future.”

But there is one thing that might have some idea about where things are headed—the stock market. As Barton Biggs stated in Wealth, War, & Wisdom:

This is why I will argue that it is so important to listen to the market. In other words, at crucial turning points observe what markets do and ignore what the experts and commentators say about what is going on.

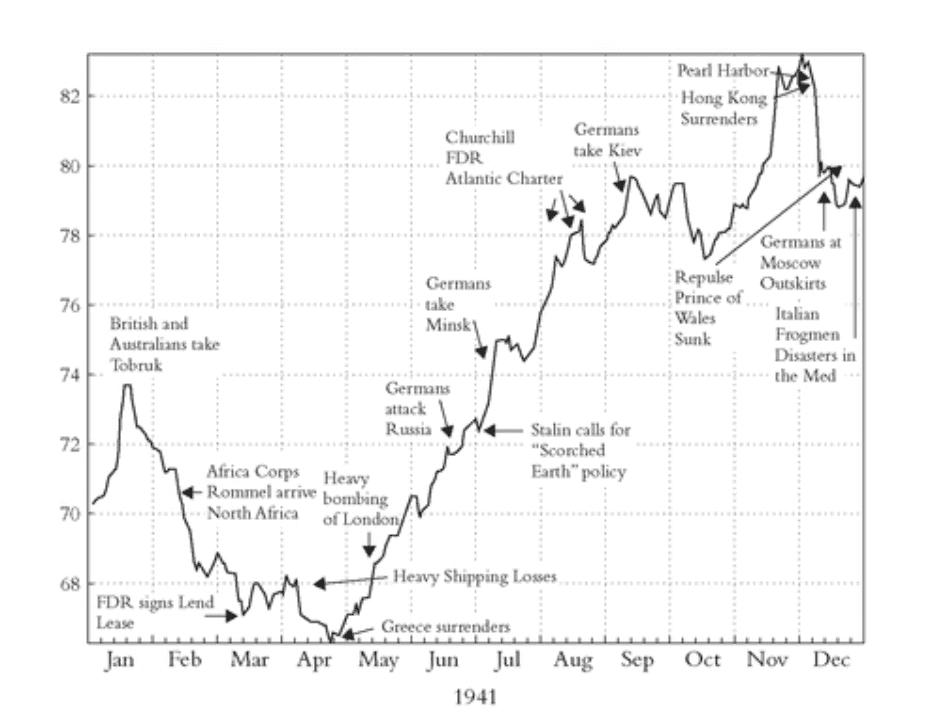

Biggs’ book highlights how equity markets around the world were able to anticipate major events in World War II far sooner than many individual experts. For example, Biggs highlights how the UK stock market rallied in May 1941 even as London experienced heavy bombing:

Biggs theorizes that this rally was in anticipation of the German attack on Russia, which would turn the war into a two-front war and lessen the focus on Britain. Despite Biggs’ thorough analysis, I was still a bit skeptical about the market’s clairvoyance.

However, this all changed in March 2020. I still remember watching the market bottom and then rip upward even as the COVID crisis continued to get worse. The confusion of seeing my portfolio go up with increasing COVID cases and rising uncertainty is something that I will never forget.

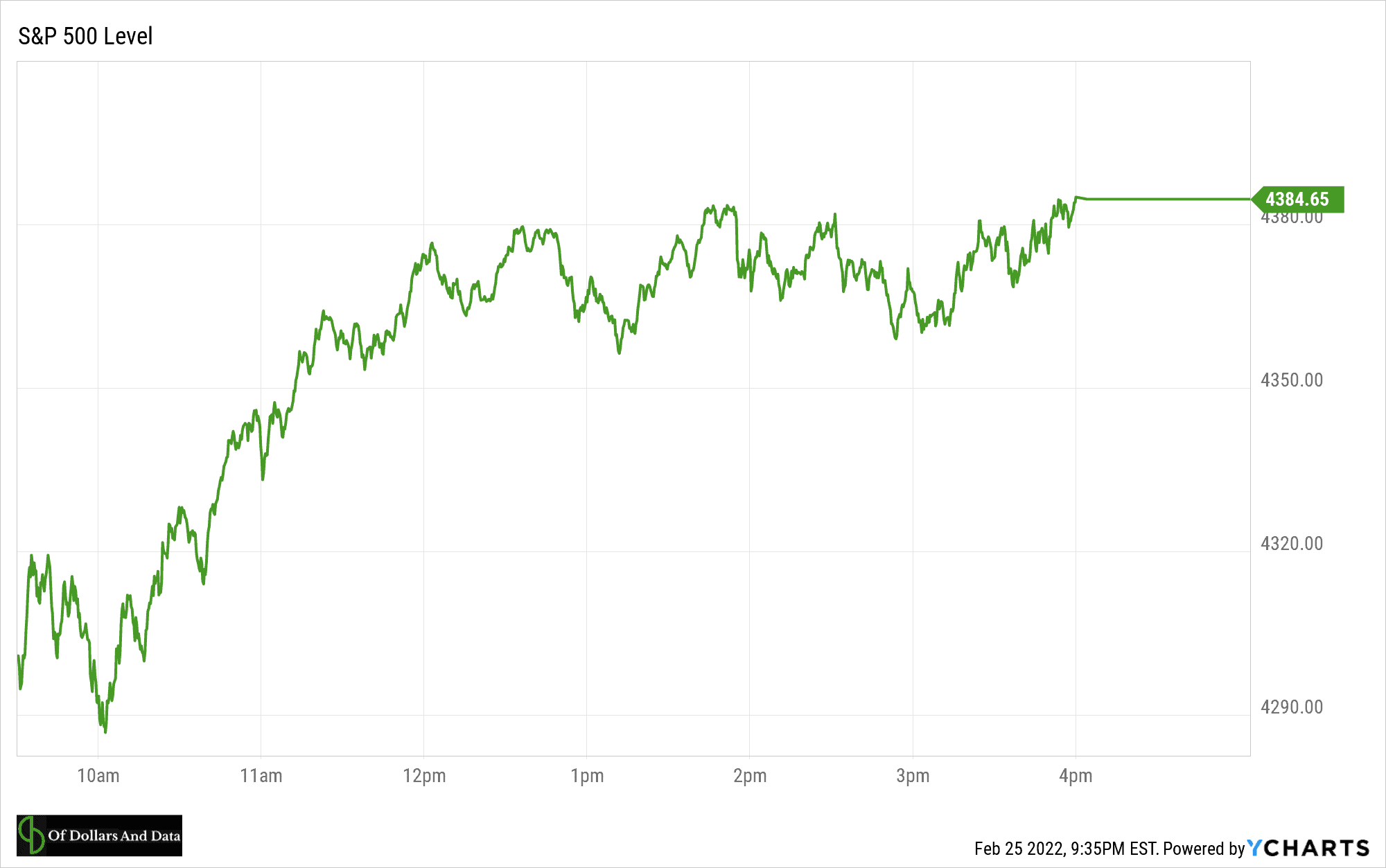

I tell this story because I had a similar experience last Friday (on a much smaller scale) as the market opened down only to finish up 2.24% despite what sounded like worsening news coming out of Ukraine:

Of course, this could be a false rally, but it gives me hope. It gives me hope that, despite the onslaught of negativity, the market knows something good that I don’t. But what could it be? After all, we have no idea what Russia will do going forward.

But what we do know is that the world is watching. And watching unlike ever before. Think about it. This is the first time in human history that people have been able to watch a war play out in real time from around the globe. Videos of the conflict are spreading like wildfire on TikTok, Snapchat, and every other major social media platform.

And, as this information is spreading, more and more people are seeing the horrors of war first hand. Think about how this will change the conversation around war. Think about how it will impact the decisions of future policy makers. Of course, maybe it won’t have any impact at all, but I am optimistic that it will.

I’m optimistic because there is a difference between reading about something and experiencing it firsthand. I had this realization in March 2020 when I got a taste of what Barton Biggs wrote about in Wealth, War, & Wisdom. And today I am hoping that humanity has a similar epiphany when they see the destructiveness of war online.

Of course, I don’t know the future, but I believe that the world will continue to improve for most people. The vast majority of humans are living longer, better lives than they were a few generations ago. For example, in 1850 only 25% of the people in the UK made it to age 70. Today that number is 85%.

But progress isn’t just limited to the developed world either. Incomes are continuing to rise globally and infant mortality has been plummeting basically everywhere. Why is this happening? Because people around the globe are working together. The story of humanity over the last few centuries is not about division, but cooperation.

The best demonstration of this is “I, Pencil” by Leonard Read. In it Read explains how creating something even as simple as a pencil requires human cooperation on a massive scale. Milton Friedman summarized Read’s idea beautifully in this video:

Literally thousands of people cooperated to make this pencil. People who don’t speak the same language, who practice different religions, who might hate one another if they ever met! When you go down to the store and buy this pencil, you are in effect trading a few minutes of your time, for a few seconds of the time of all those thousands of people. What brought them together and induced them to cooperate to make this pencil?

There was no Commissar sending out orders from some central office. It was the magic of the price system. The impersonal operation of prices that brought them together and got them to cooperate to make this pencil so that you could have it for a trifling sum. That is why the operation of the free market is so essential, not only to promote productive efficiency, but even more, to foster harmony and peace among the people of the world.

It is this global cooperation that first occurred in markets and that is now happening online that will change the future of humanity.

Despite the wars, depressions, and sicknesses of the last 100 years, we somehow pulled through. The optimists triumphed. As we face similar challenges in the days and years ahead, the question is: will the optimists triumph yet again?

I think so. What about you?

Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 283. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data