Nearly all articles written about investment and personal finance (mine included) focus heavily on financial assets despite the fact that most of your value (like mine) is likely not contained within financial assets. Most of your financial value is already contained within yourself, waiting to be unlocked over time. What I am talking about is a concept called human capital, or the value of all of your skills and knowledge. Your human capital can be thought of as an asset that you use to earn money. Understanding this concept should provide the motivation behind why you should save and invest.

The thing about human capital is that we can value it if we make some assumptions. To understand these assumptions I will review a concept called present value. Essentially, present value is the amount of money that a future payment is worth today. So if a bank promised to pay you 1% interest on your money over a year, you could give them $100 today and get $101 a year from now. Applying this logic in reverse, $101 a year from now has a present value of $100 today, assuming we use 1% as our interest rate (commonly called the “discount rate”).

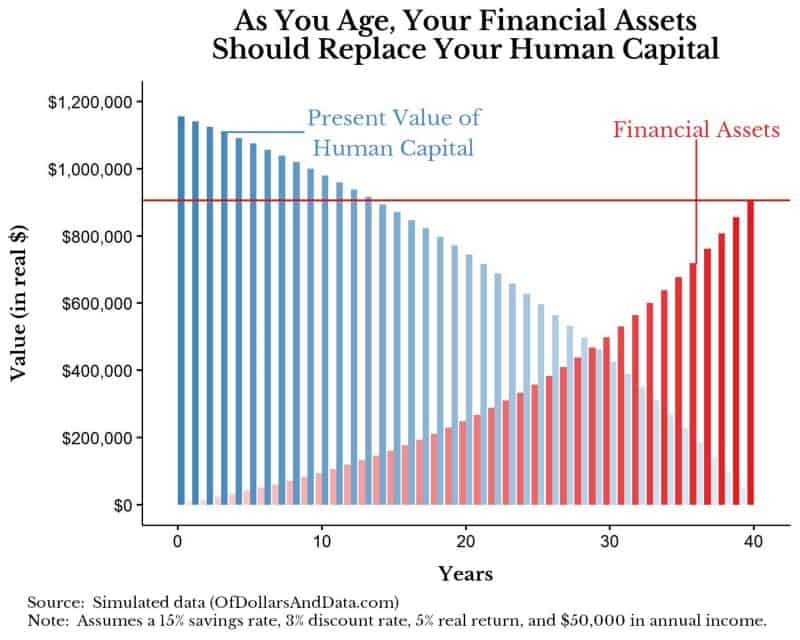

Armed with this knowledge, we can figure out the value of your human capital by determining how much money you would make each year in the future and bringing all those payments back to the present. This is not easy and I won’t go into detail on the math, but we can simplify the process with some assumptions. If we assume someone makes $50,000 annually for 40 years with a 3% discount rate, the present value of their human capital would be worth $1.1 million. This means that all of their future income is worth about $1.1 million today. I used a discount rate of 3% because most personal injury lawsuits use a discount rate of 1% to 3% when valuing lost income.

Okay, so you might be thinking, “Why does this matter?” It matters because your human capital is a dwindling asset unless you invest in it. Each year you work reduces the present value of your human capital. As a result of this, the only way to prevent yourself from not having income in the future (ignoring Social Security) is to either invest, save, or increase your skills so that you are able to invest or save.

Visually the idea is simple:

The above plot shows the importance of saving money and investing as, over time, you should be able to replace part of your human capital with financial assets that earn you money.

As a result of this thinking, I don’t usually imagine money as something we use to purchase goods, but as tool that can be used to produce something. Think of it like this: by saving and investing, you are rebuilding yourself as a financial asset equivalent that can provide you with income when you no longer work. So though you have stopped the 9 to 5 grind, your money has not.

The importance of this concept also applies to a few other domains including: educational loans and athletes going bankrupt. As I mentioned, your human capital is always dwindling unless you invest in it through acquiring further skills. However, this is only true if you can get those skills without incurring significant costs. For example, going $150,000 in debt for a master’s degree that will not increase your income substantially is a bad financial deal. Using the plot above for context, by doing the master’s degree, you ended up shifting the red bars to the right to pay off your debt, which also gave your financial assets less time to grow. All of this for a slight bump in your human capital (the blue bars).

As for athletes going bankrupt, the idea of human capital is more relevant than almost anywhere else. The financial problems of many professional athletes has to do with the mismatch between their human capital (i.e. 5 years at $2–5 million) and their investment rate. If I had to model their human capital it would drop off for most of them after they left their sport, which is usually a span of 4–6 years. The problem is that most athletes probably don’t save or invest much, and if they do, was it enough to live a particular lifestyle for the next 30–50+ years? Probably not. I don’t blame them though. Humans didn’t evolve to have massive amounts of resources dumped upon them over a short time period and then expected to conserve these resources over decades.

Why You Are Your Own Best Asset

Despite all of the talk of investing on this blog, your skills and knowledge will do far more for you than any amount of investment returns over your lifetime. I’d argue that you wouldn’t be able to invest without the ability to work hard or the ability to save, which are both related to your human capital. So keep at it and keep grinding away. Until next week…thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 14. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data