I know you’ve probably heard the advice many times before:

“Don’t copy your neighbor’s investment decisions.”

“Don’t follow the crowd.”

“Don’t succumb to FOMO.”

For most of my (short) investment career I would have told you the exact same thing. But I’ve started to change my tune. Why? Because if you think about the logic of copying vs. not copying your neighbors’ investment decisions, it’s almost always better to copy.

Before I explain why this is true, I want to be clear that when I say “neighbors” I don’t mean your literal neighbors. I mean all the other investors in your domestic market. So if you are a U.S. investor, your neighbors would be all other U.S. investors. If you are a Japanese investor, your neighbors would be all other Japanese investors, and so forth.

So why is copying your neighbors a good idea? Because you effectively ensure that your wealth grows at around the same pace as everyone else in your community. If your portfolio were to deviate too much from the portfolio of your neighbors, you could end up getting left behind. Let me explain.

To Copy or Not to Copy?

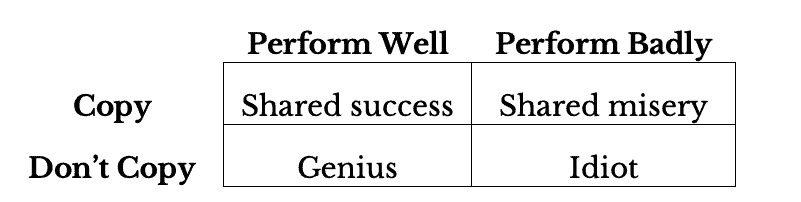

Imagine a 2×2 matrix with your decision to copy (or not copy) your neighbors’ investment decisions on the left and how well your portfolio performs along the top. So, there are four combinations: Copy-Perform Well, Copy-Perform Badly, Don’t Copy-Perform Well, and Don’t Copy-Perform Badly. From these combinations, you can imagine how each case would play out:

- Copy-Perform Well: You copy your neighbors and you all do well. Good times and shared success all around.

- Copy-Perform Badly: You copy your neighbors and you all do poorly. Tough times and shared misery.

- Don’t Copy-Perform Well: You don’t copy your neighbors and you crush it. You look like a genius. This is the dream outcome for a contrarian.

- Don’t Copy-Perform Badly: You don’t copy your neighbors and you underperform. You look like an idiot. This is the nightmare outcome for a contrarian.

Visually, this 2×2 matrix would look like this:

From this matrix it’s clear that not copying your neighbors leads to far more divergent outcomes. As a result, we can infer that the worst quadrant to be in is Don’t Copy-Perform Badly. If you don’t believe me, consider a thought experiment.

Imagine a world where everyone else’s wealth has doubled while yours hasn’t changed at all. Now think about how much harder it would be for you in this world. Imagine trying to outcompete others to buy a house or paying for your children’s education. It would be awful.

But now imagine what would have happened had you copied your neighbors all along. When their wealth doubled, yours would have doubled as well and you wouldn’t be relatively worse off.

Though this example is extreme, it illustrates why not copying your neighbors can be such a risky proposition—the cost of being wrong is larger than the benefit of being right. If we assume that most investors come to this same conclusion, then it helps explain why we see herding behavior so frequently.

For example, one area where this seems to be true is the equity home bias puzzle (i.e. home country bias).

Why Copying Can Lead to Home Country Bias

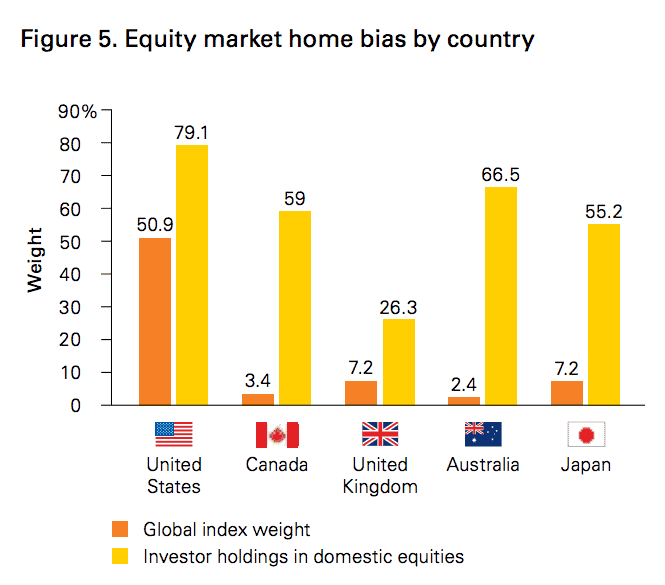

As a quick refresher, home country bias is the observation that most investors overweight their holdings in their domestic market, relative to that market’s share of global market capitalization.

For example, U.S. investors (historically) have held about 80% of their portfolio in U.S. stocks though U.S. stocks only represented 50% of global market cap. The same has been observed in many other countries as well:

Many have argued that home country bias is bad because you could miss out on gains from elsewhere in the world. And I agree with this from a diversification perspective. However, going back to our decision matrix above, down weighting your home country while everyone else doesn’t is essentially putting yourself into the bottom right quadrant if things don’t go your way.

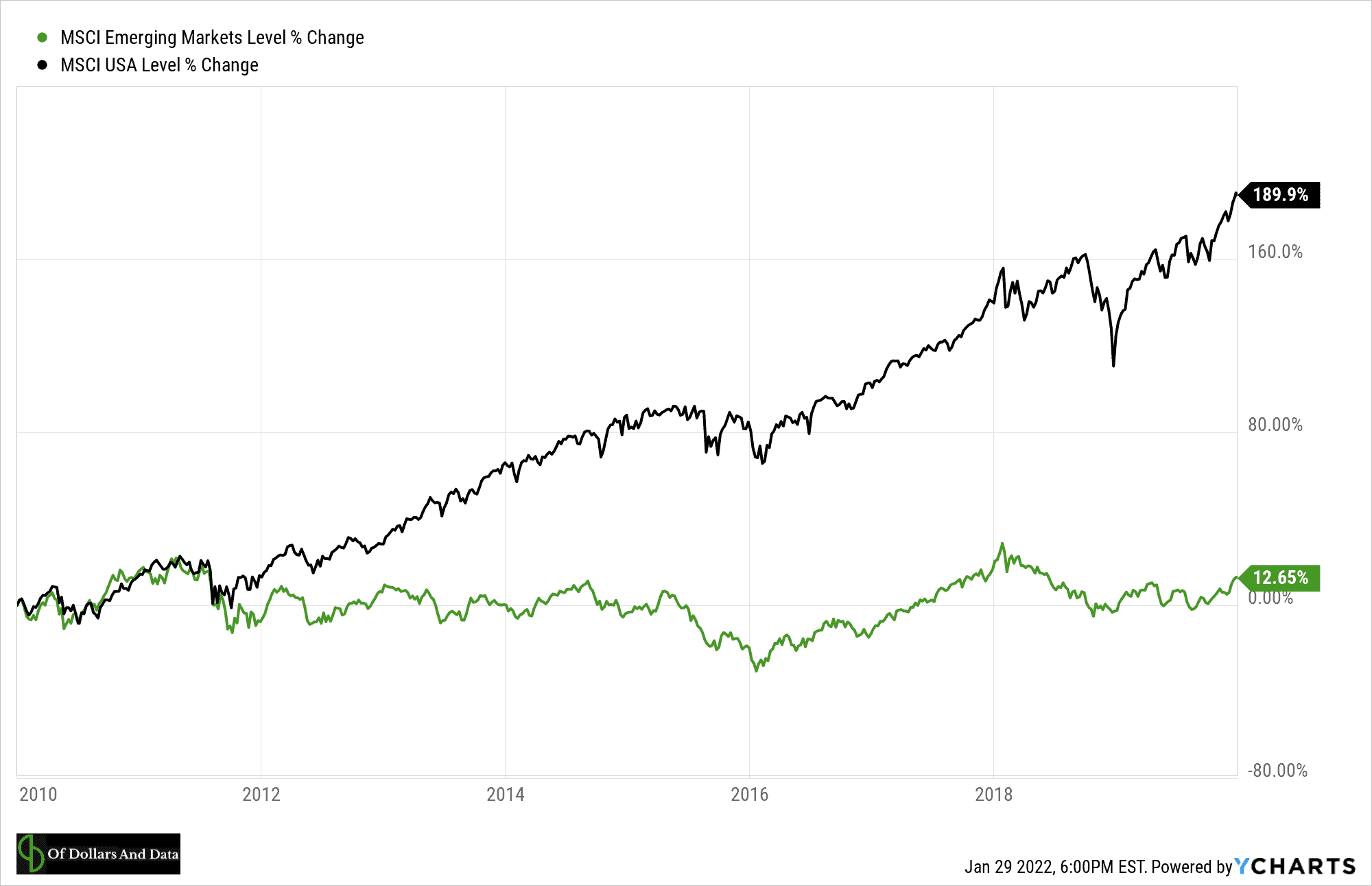

Any U.S. investors who owned international stocks over the past decade knows this all too well:

Seeing this you can understand why those U.S. investors with a home country bias are doing much better than those without one.

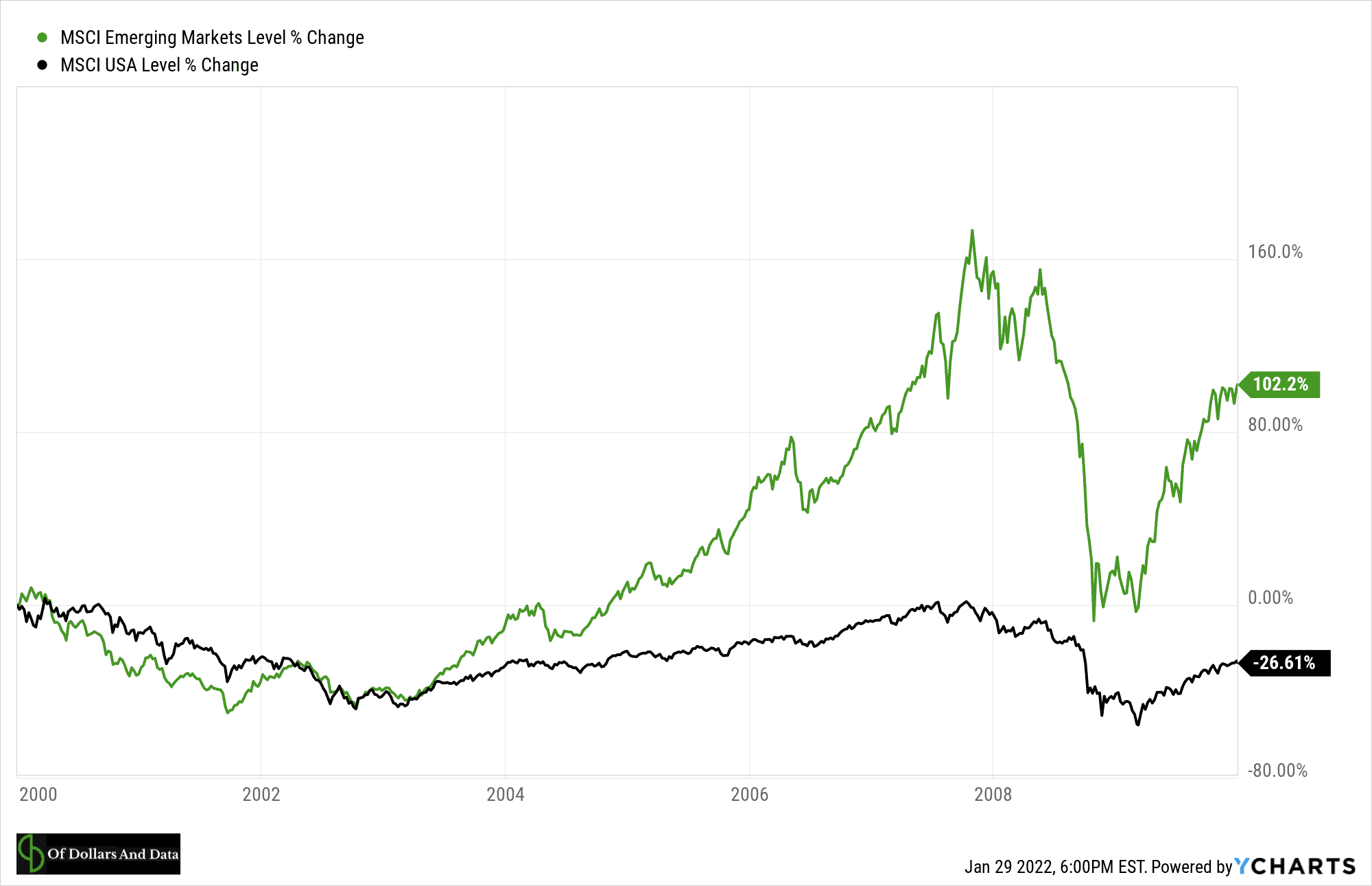

But all you need to do is go back one decade before that (2000-2009) and the story flips:

Based on this chart you can see why it would be prudent for U.S. investors to have an allocation to international equities. However, based on our decision logic above it also makes sense why many investors may still choose not to.

If we assume people don’t want to get left behind, then over-allocating to your domestic market makes sense. You don’t want to see your society get rich while you had a good chunk of your money invested elsewhere. From this perspective, home country bias is a perfectly rational way to hedge your relative wealth.

If you are a U.S. investor, you might see this and think that it’s time to abandon international stocks altogether. Unfortunately, this would probably be a deviation away from what other U.S. investors seem to be doing. For example, among pension funds, domestic equity allocations have declined from 67% in 2000 to 38.5% in 2020.

Though I haven’t found recent data on home country bias among U.S. retail investors, I would bet that they have more international stock exposure today than they did in 2000. Therefore, assuming you want to copy your neighbors, your international stock exposure is here to stay.

In addition to hedging your relative wealth, copying your neighbors’ investment decisions is also a great way to free yourself from your investments.

Copying is Mental Freedom

One of the reasons why I am a big fan of indexing is because of the mental freedom it provides you from identifying with your investments. I say “identifying with” because when you make active investment decisions you will judge yourself based on how these decisions turn out.

A similar process occurs when you choose not to copy your neighbors’ investment decisions (i.e. “Don’t Copy” in the 2×2 matrix above). When you decide to not allocate your portfolio similarly to your peers, you are basically making bets about the future. And these bets will make you feel like a genius (or an idiot) depending on how they turn out.

Fortunately, copying your neighbors, like indexing, frees you from this mental prison. So when the market declines 30%, you don’t think of yourself as an idiot. It just’s bad luck, not something you did wrong.

Given this, you can see why copying is such a great strategy from a behavioral perspective. Because if copying can prevent you from making a terrible investment decision (even if just once), then it’s worth its weight in gold.

Regardless of how you decide to allocate your portfolio, following the crowd isn’t as irrational as it initially seems. If anything, it is a core tenet of index investors around the world, whether they realize it or not.

Happy investing and thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 279. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data