A little over a month ago I sold all of my Bitcoin. What I thought might be my greatest investment mistake ever turned into a 1-year 47% after-tax profit. I’m not bragging, just lucky. I originally made a small allocation to Bitcoin to hedge against the possibility of a U.S. dollar hyperinflation.

After all, central banks have printed far too much fiat currency and in the coming collapse all those holding Bitcoin will become rich…right?

There is just a slight problem with this thinking—history doesn’t seem to support it. It’s not that Bitcoin won’t rise in price if the US dollar fails, but that its rise in price doesn’t imply a rise in value. Why does this distinction matter? Because even if Bitcoin hits $1 million a coin (price), this does not mean that it will buy $1 million of today’s goods/services (value).

Ultimately, what you and every other investor cares about is purchasing power, not price. And if you look through the historical record of hyperinflations around the globe, you will see that investing in other currencies doesn’t necessarily increase purchasing power. So what does?

The best way to increase purchasing power during a case of severe hyperinflation is to take out debt (in the currency before it hyperinflates) or to own stocks/businesses. Why is this true?

Because during hyperinflations, debt payments trend towards zero in real terms (as the currency loses its value) while stock holdings tend to increase in price to keep up with the inflation.

This was true during Zimbabwe’s recent hyperinflation, where stocks acted as a safe haven and also in early twentieth-century Germany when the mark collapsed. As Frederick Taylor wrote in The Downfall of Money: Germany’s Hyperinflation and the Destruction of the Middle Class:

So, who did well out of the inflation in Germany? Creditors lost almost everything. By contrast, everyone, broadly speaking, who owed money, had their debt liquidated by inflation…Investors in stocks and shares – unlike fixed investments, these increased in price along with the inflation over the years in many cases provided an excellent return.

The stock exchange had become one way of investing wealth before it slipped away…All the same, so long as companies kept selling and growing, as they did for the most part between 1919 and 1922, the market quickly adjusted the value of the investors’ shares to correspond to inflationary movements.

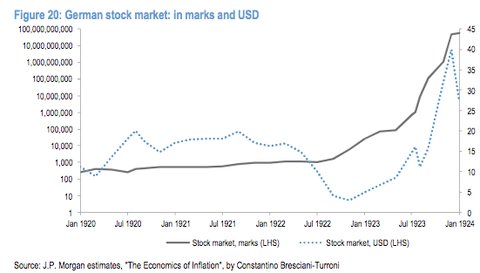

You can see this clearly by looking at the value of the German stock market, both in marks and USD, over this inflationary time period (props to Joe Weisenthal for the graph):

This chart illustrates just how effective stocks were at retaining and increasing their purchasing power during Germany’s hyperinflation. And if you fund your stock purchases with debt, the returns can be even more attractive as some clever German investors realized (from When Money Dies by Adam Fergusson):

Inflation profiteering had consisted of borrowing paper marks, converting them into goods and factories, and then repaying the lenders with depreciated paper.

So, if you truly believe that the collapse of the U.S. dollar is imminent, you should borrow as much money as you can (in dollars) and buy lots of income-producing assets (i.e. stocks/businesses, real estate, etc.)

Of course, the future may not be like the past. Maybe this hyperinflation will be different. Maybe an alternative currency, like Bitcoin or gold, will provide a better long-term safeguard than equities. The evidence for this is still mixed.

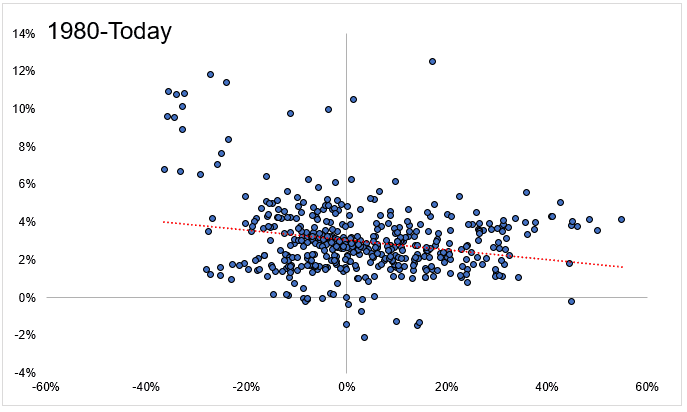

As Michael Batnick recently illustrated, over the last 40 years gold hasn’t been a great inflation hedge (note: gold’s annual return is on the x-axis with annual inflation on the y-axis):

Of course, gold may act differently during a hyperinflation, but, given how rare hyperinflations are, we may not have enough data to say anything definitive.

And, yes, there are other justifications for buying gold or Bitcoin outside of hedging against a hyperinflation, but I don’t know how those will pan out.

What I do know is that there is a difference between price and value. The Bloomberg columnist Noah Smith recently wrote a piece that explains this difference well.

In his article, Smith imagines what would happen if NASA mined a large asteroid made of gold and distributed its contents equally to every person on Earth. At gold’s current market price, every person in the world would have $93 billion!

But, you already know that this wouldn’t increase everyone’s purchasing power by much, if at all. Transferring all that gold to the people of Earth would make us shinier and more fashionable, but the market price of gold would plummet to make it practically worthless. As Smith states:

But in fact, there’s a more fundamental reason why a giant golden asteroid wouldn’t make the world fabulously rich. It’s because wealth mostly doesn’t come from big hunks of metal. It comes from the ability to create things that satisfy human desires.

This is why the best assets to hedge against inflation are those that satisfy human desires in every market environment. You can change the measuring stick from dollars to marks to Bitcoin to gold, but that doesn’t change the underlying value of a business. Of course, as circumstances change, what is considered valuable changes as well.

When Money Dies said it best:

What is precious is that which sustains life. When life is secure, society acknowledges the value of luxuries, those objects, materials, services, or enjoyments, civilized or merely extravagant, without which life can proceed perfectly well but which make it much pleasanter notwithstanding. When life is insecure, or conditions are harsh, values change.

In hyperinflation, a kilo of potatoes, to some, was worth more than the family silver; a side of pork, more than a grand piano…clothing more essential than democracy, food more needed than freedom.

The Only Inflation-Proof Asset

While I don’t know the future with any certainty, I do know that people always have, and always will, pay for things that they value. Having a set of skills that can provide value to people in all market environments is the only way to make yourself inflation-proof.

As Jews fled Nazi Germany during the 1930s, they realized just how true this was (from Wealth, War, and Wisdom, emphasis mine):

Of course when they went to sell their businesses and homes, they found that it was a buyers’ market and the proceeds they received were half of what the true value was. Nevertheless they took what they could get and fled Germany as virtually penniless refugees but still having one priceless possession, their brains.

So, when money dies, you may discover that your greatest asset is YOU. If you are interested in learning more on this topic, check out When Money Dies and The Downfall of Money. Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 136. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data