The author John Valliant once said that there is only one certainty when it comes to following tiger tracks:

If you follow them long enough you will eventually arrive at a tiger, unless the tiger arrives at you first.

This was the reality for Yuri Trush and his team who were tracking a man-eating tiger through the unforgiving forests of northwestern Siberia. In order to successfully track a tiger, or any animal for that matter, it helps to imagine how the animal perceives its world. You have to put yourself in the animal’s shoes, so to speak. The behavioral ecologist Jakob Uexküll called this realm of perception the animal’s umwelt, or the subjective experience of objective reality.

You and I are living in the same objective reality, or umgebung as Uexküll would call it, but we have different subjective interpretations of that reality. This difference in experience and interpretation is the umwelt. For a more concrete example, consider what John Valliant wrote in The Tiger: A True Story of Vengeance and Survival:

In the umgebung of a city sidewalk, for example, a dog owner’s umwelt would differ greatly from that of her dog’s in that, while she might be keenly aware of a ‘Sale’ sign in a window, a policeman coming toward her, or a broken bottle in her path, the dog would focus on the gust of cooked meat emanating from a restaurant’s exhaust fan, the urine on a fire hydrant, and the doughnut crumbs next to the broken bottle. Objectively, these two creatures inhabit the same umgebung, but their individual umwelten give them radically different experiences of it.

The same is true when you and I consume the same piece of financial media. For example, when I watch mainstream financial television I focus a lot on the way the pundits speak and very little on the analysis, which can be quite ephemeral. I care more about how people and networks present information (#dataviz) than the underlying message.

If the market were to drop 10% tomorrow, I would not care in the slightest about my personal wealth, but I would care about how this message was being broadcast via Twitter and the mainstream media. You may (or may not) experience such an event in the same way.

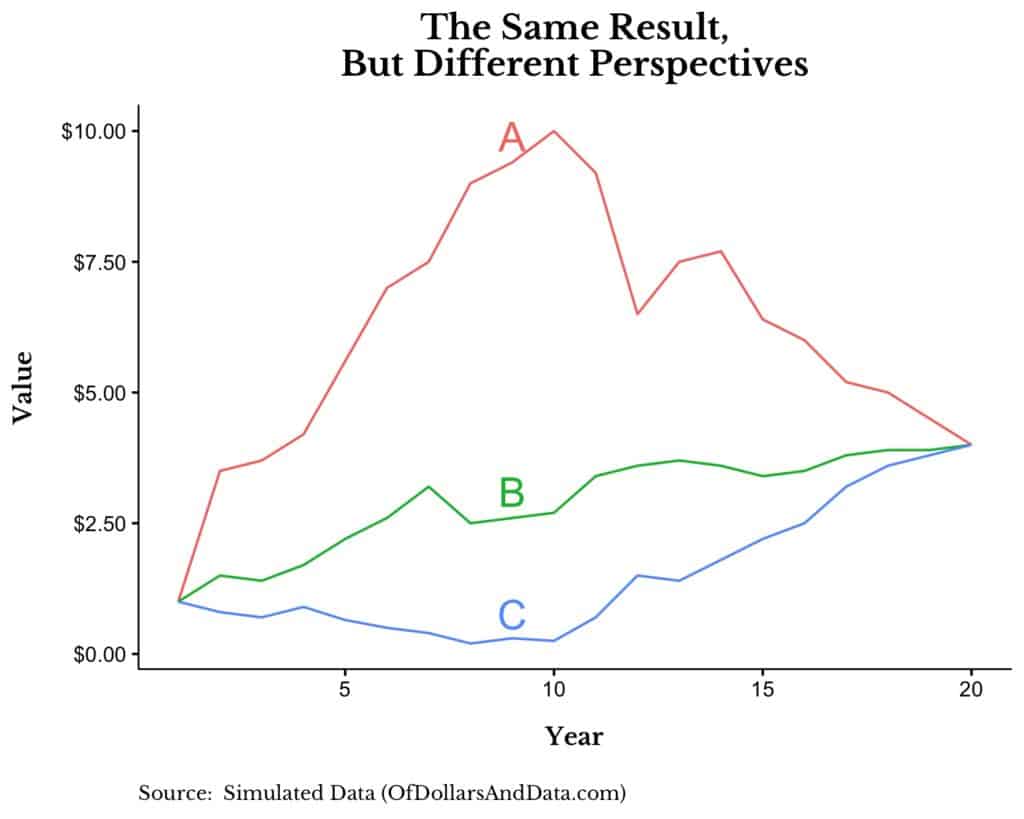

However, your investment umwelt goes beyond consuming financial media to also include how you make investment decisions. For example, consider the case of 3 assets that start at $1 and grow to $4 over 20 years, but with drastically different value paths:

The investors in assets A, B, and C had far different experiences despite ending at the same place. An investor in “A” feels like a loser, in “B” is bored, and in “C” feels like they pulled off a huge comeback. The only thing that differed between them was their subjective experiences along the way. To test your investment umwelt, consider the following question:

Which one of these investments would you want for the next 20 years?

Mathematically you should be indifferent, but behaviorally you won’t be. I am guessing most of you would say, “B” because you get a smoother ride to the finish line. Less volatility and smaller drawdowns are better, right? But, could you hold asset B while you saw others striking it rich with asset A? Not so easy.

And while many of you may shun asset C, this is probably the best option. Why? If you are aged 25-44 (my biggest demographic for this blog), asset C will be cheap while you are still in the wealth accumulation stage of your life. This is why Josh Brown says millennials should be stoked for a market crash, and he is right. However, since we don’t know the future, it would be near impossible to stay with asset C while assets A and B also exist. Once again, the deciding factor is perspective.

This is why you should never forget the impact of your perspective, and the perspectives of others, when making investment decisions. You have to consider someone else’s investment umwelt before you make any important financial choices. When you see friends rushing into the hottest asset class, consider what their goals are. When you hear about a new stock tip from a broker, think about why they would be telling you that. When you feel the panic set in as everyone around you is selling, remind yourself of your long term financial plan.

This is true both in financial and non-financial decisions. You shouldn’t just follow the crowd if their choices aren’t compatible with who you are. I still remember the urge to go to business school after seeing my friends, and my friends’ friends, applying in droves. I had to continually remind myself that this wasn’t right for me despite the peer pressure suggesting otherwise. You will face the same kinds of challenges throughout your financial and personal life, but…will you be able to respond accordingly?

What is Appropriate for You?

One of the most successful marketing campaigns I have ever seen in the wealth management industry started with a simple, yet profound question posed by Ken Fisher:

Are you sure your investments are appropriate for you?

The question is brilliant because it doesn’t try to convince you to buy Fisher’s services, but, rather, asks you to consider a fundamental part of your financial picture. It questions whether your investments are customized to you and your perspective. For example, do you know what makes you tick? How about your biases? What is your financial tipping point? All of these questions, and more, are contained within Fisher’s insightful inquiry. Even now as I re-read Fisher’s question I wonder whether I should re-think my asset allocation, despite being a part-time investment blogger.

Still, you can generalize Fisher’s question beyond investing to address all your decision making. Are you sure your [career/partner/hobbies/etc.] are appropriate for you? It is a deeply personal question, but one we may need to ask from time to time. All it takes is a change in perspective.

For another change in perspective, I highly recommend reading The Tiger. It’s a thriller disguised as a non-fiction book that addresses the conflict between man and nature and so much more. In addition, I have added a “What I’ve Been Reading” section to every post on my site so you can check out some other cool reads I have come across. Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 95. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data