When the markets fall and the streets run red, the lone wolf survives, but the pack dies.

In 1906, the British scientist Francis Galton made a discovery that would forever change our knowledge about group decision making. Before his revelation, Galton was of the opinion that the future of society could not be trusted to the less educated masses. He believed that a few select individuals were far better for the job. In order to test his hypothesis, Galton had people from all walks of life guess the weight of an ox at a country fair. After collecting 787 guesses and calculating the average, he realized the masses weren’t so dumb after all. Their collective guess was within 1 pound of the true weight. The Wisdom of Crowds by James Surowiecki shares Galton’s reaction to this discovery:

The result seems more creditable to the trustworthiness of a democratic judgment than might have been expected.

Ever since Galton’s realization, the evidence has been building for the wisdom of the crowd. This is especially true in investing, where markets behave in an efficient manner most of the time. Therefore, it is usually in your best interest to follow the crowd (i.e. accept market prices as fairly accurate). And why wouldn’t you? Social proof, as Robert Cialdini refers to it, is one of the most powerful psychological influences. This elevator prank and the Asch conformity experiments illustrate this well. However, though following the crowd will benefit you most of your life, it can also lead to financial ruin in particular moments. And that is what I want to talk about today.

When Crowds Get it Wrong

Despite the overwhelming evidence that the market is usually correct, there have been a handful of cases where the market consensus was grossly inaccurate. These errors typically occur during moments of high emotion (i.e. fear or greed) and they defy logic. As Edward Chancellor wrote in Devil Take the Hindmost (emphasis mine):

In his Theory of Cognitive Dissonance, Leon Festinger argued that people will tolerate increasing degrees of dissonance if they are motivated by a sufficiently enticing reward…A description of speculators in William Fowler’s circle during the 1860s provides an illustration of this behavior. They were engaged, wrote Fowler, “in bolstering each other up, not for money, for we thought ourselves impregnable in that respect, but by argument in favor of another rise. We knew we were wrong, but tried to convince ourselves that we were right.”

These kinds of errors occur when individual beliefs are lost in favor of the group’s beliefs. Gustav Le Bon summarized this idea beautifully in The Crowd: A Study of the Popular Mind:

The most striking peculiarity presented by a psychological crowd is the following: Whoever be the individuals that compose it, however like or unlike be their mode of life, their occupations, their character, or their intelligence, the fact that they have been transformed into a crowd puts them in possession of a sort of collective mind which makes them feel, think, and act in a manner quite different from that in which each individual of them would feel, think, and act were he in a state of isolation.

When the crowd starts to behave erratically and you start seeing behavior that you haven’t seen before, look out. See exhibit A:

LOL

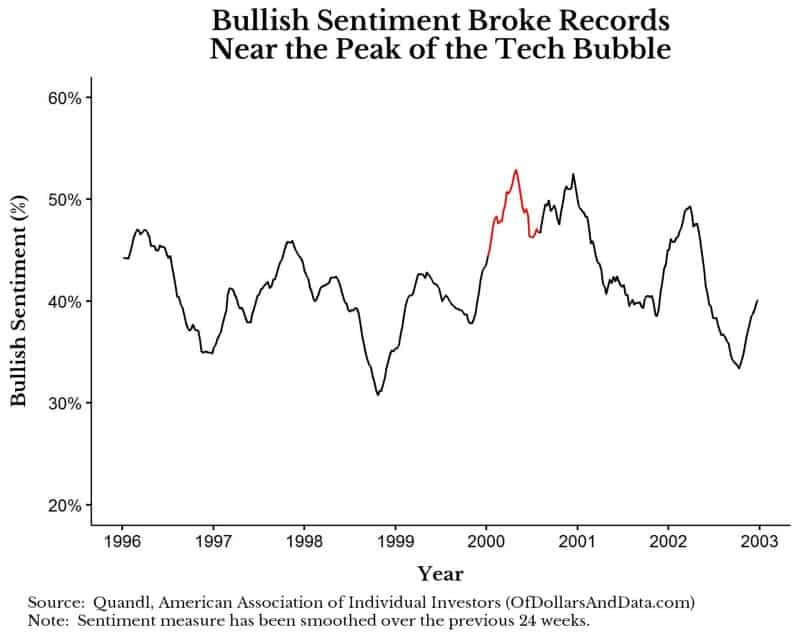

For another example of crowd madness, let’s consider the tech bubble of the late 1990s. When looking at sentiment readings from the American Association of Individual Investors (AAII), bullishness hit a peak in early 2000, shortly before the bubble began to burst:

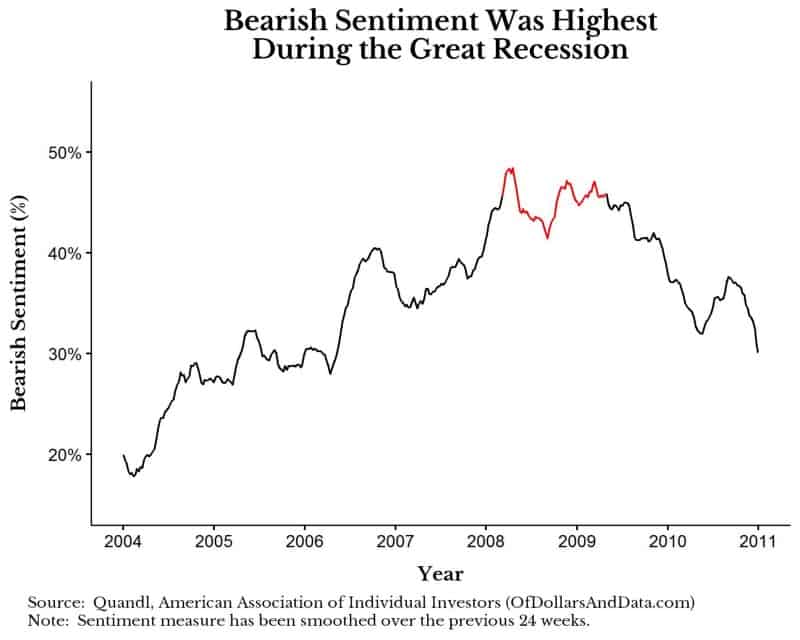

The mistaken bullishness on the part of the market is completely explained by the high expectations (i.e. hope/greed) of that era. However, the crowd can also get it wrong in the other direction as well. For example, the market bottom during the Great Recession in March 2009 coincides with some of the highest bearish sentiment on record:

This doesn’t imply that you can look at sentiment alone and figure out what the stock market is going to do next, however, sentiment may provide insight as to when markets are not behaving normally. As Cliff Asness from AQR capital stated:

I kinda get excited these days at the 150th percentile…to me [this represents] something that we’ve never seen before. I made this up, but it’s 150% of the prior 100th percentile.

When you are seeing multiple indicators at their extremes, you should take notice. I am not implying that you should change your actions, but realize that this is the same herd behavior that has dominated markets for centuries. Why is this important? Because when you can recognize that the crowd is mad, you can prevent yourself from following along and making large investment errors (i.e. selling during a panic). I don’t consider buying during a bubble to be an investment error because bubbles can take years to form. The foregone gains by waiting on the sidelines could be worse than the losses during the subsequent decline.

How to Resist the Crowd During Times of Panic

So how do you resist the madness of the crowd? Don’t deviate from your investment philosophy. My investment philosophy is more or less just keep buying and avoid risky assets that are not equities (i.e. gold, commodities, cryptocurrency). Don’t get me wrong, it can be hard to follow this when the social pressures start to mount. For example, I have a friend who invested 5% of his net worth in Bitcoin years ago. In the last few months his Bitcoin has grown to over 50% of his net worth. He is beating me. Maybe he is lucky. Maybe he is smarter than me. I don’t know, but I am not going to change what I do based on what the crowd is doing. Or, as a re-imagined Game of Thrones quote:

When the markets fall and the streets run red, the lone wolf survives, but the pack dies.

Be the lone wolf. Thank you for reading.

If you liked this post, consider signing up for my newsletter.

This is post 39. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data