How are your savings? Is your financial house in order? Do you feel like you are keeping up with the Joneses?

It can be difficult to answer these question since open discussions around money are so taboo. Additionally, comparing your financial situation to that of your peers isn’t necessarily useful because your peers might be financing their lifestyle (i.e. nice house, nice car, etc.) with lots of debt.

This is why you have to use aggregated data to benchmark your financial progress. And the most widely recognized benchmark in personal finance is net worth.

As a quick refresher, net worth is defined as:

Net Worth = Assets – Liabilities

In this case, assets are everything that you own (i.e. house, car, bank accounts, securities, rental properties, etc.) while liabilities are everything that you owe to others (i.e. credit card debt, student loan debt, mortgage, etc.).

After netting the differences, we get a financial measure that we can use to compare across households.

The Problem with the “Average” Net Worth

However, using net worth for financial comparisons is not without its problems. Based on the 2019 Survey of Consumer Finances (this is the most recent data, released September 2020), the average net worth for all U.S. households is $746,821.

However, this average statistic is heavily skewed by outliers (i.e. the superrich).

For example, if 9 people all with a net worth of $50,000 were at a bar and then Bill Gates walked in, the average individual net worth would rocket to over to $10 billion! However, this would tell you basically nothing about the wealth distribution of the bar’s patrons.

To correct for this, we use the median net worth, which is the point at which half of the households are above and half of the households are below in value.

So what is the median net worth of all U.S. households? $121,511. This is about than 1/6 of the average net worth.

However, even this number can be misleading as it doesn’t control for life circumstances, such as age.

For example, a 22 year-old with $121,511 is in a very different place financially than a retired couple with the same amount.

The 22-year old likely has decades of future earnings ahead of them, while the retired couple is living off of their accumulated nest egg and can’t (or won’t) work ever again.

What is the Median Net Worth by Age?

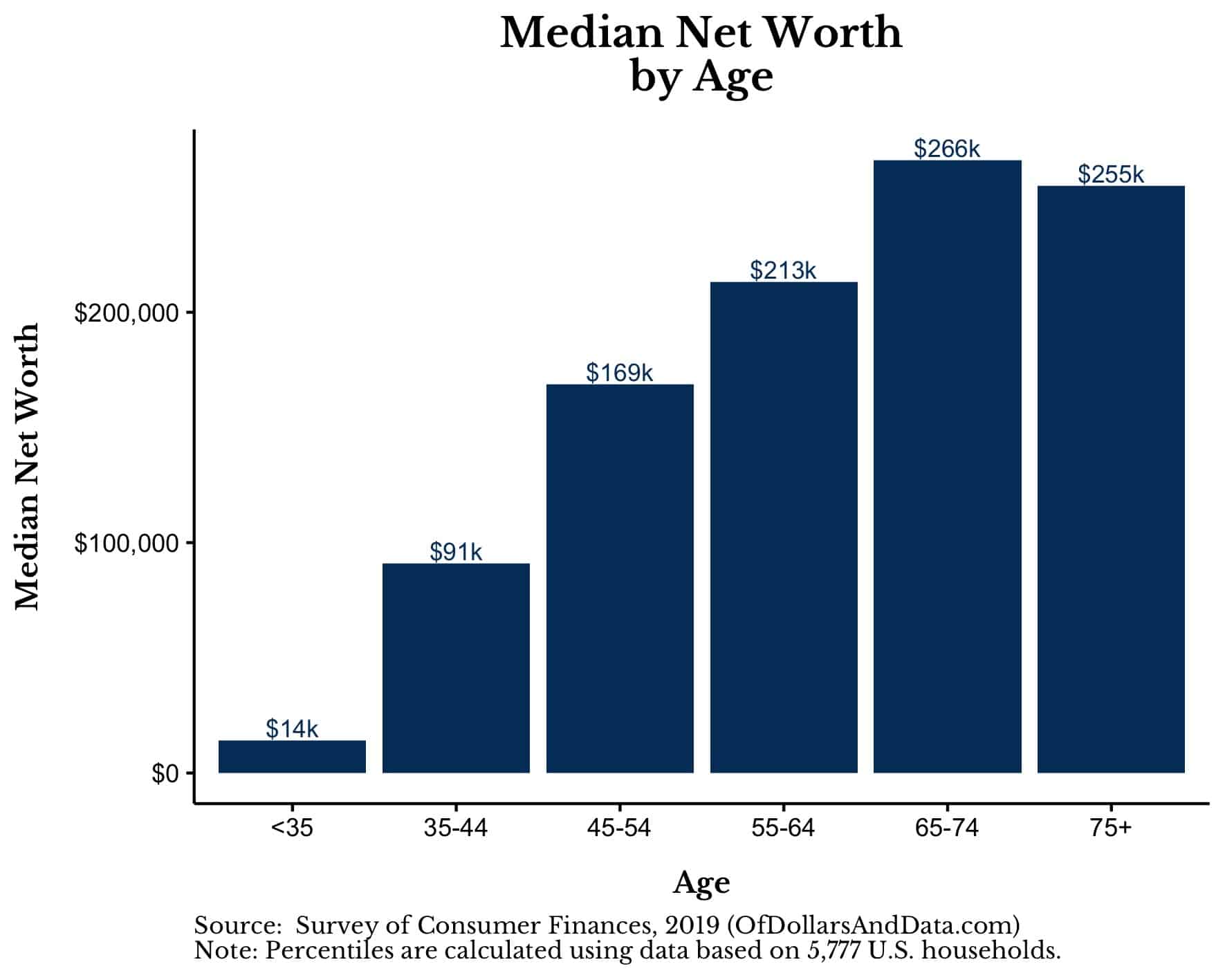

Therefore, after we control for age, the median net worth is far more relatable:

This chart clearly illustrates how age is correlated with net worth as older households have had more time to work, earn, and save money.

However, even this comparison is severely flawed because it groups all U.S. households together regardless of future income/earnings potential. And what is highly correlated with future income/earnings potential? Education.

Therefore, I will now take a look at how educational attainment varies with net worth.

What is the Median Net Worth by Educational Level?

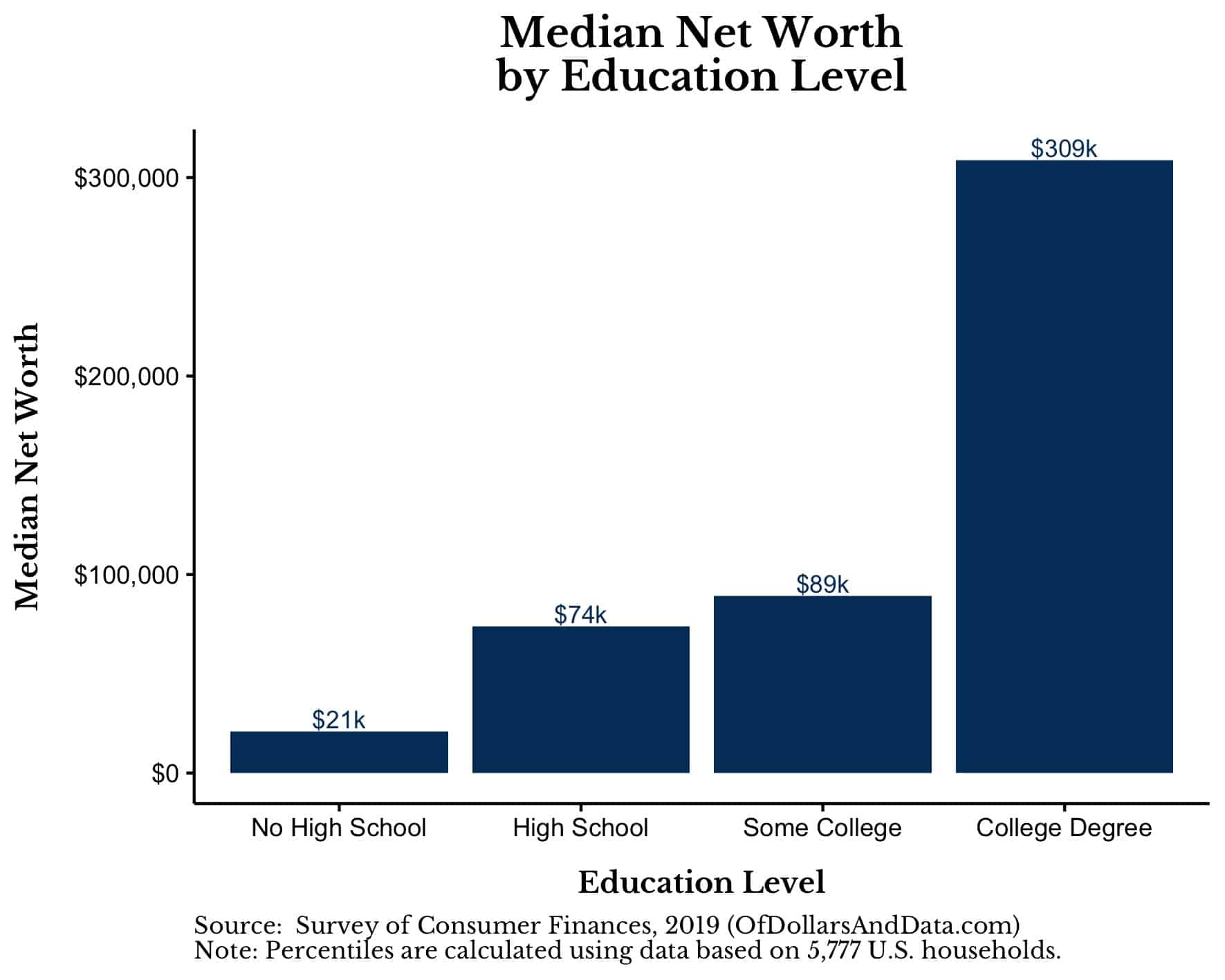

If you dropped out of high school you, on average, will earn significantly less income over your lifetime compared to a college graduate. However, when I Google “average net worth” not a single article that I’ve read corrects for this discrepancy.

If we use the 2019 SCF data to examine median net worth by level of education, you can see what I am referring to:

Just like age tells you a lot about net worth, so does educational attainment. Therefore, we have to control for both of these factors when making financial comparisons.

If you don’t, then you may end up feeling much better/worse than is justified by your life circumstances.

What Happens When We Control for Age and Education?

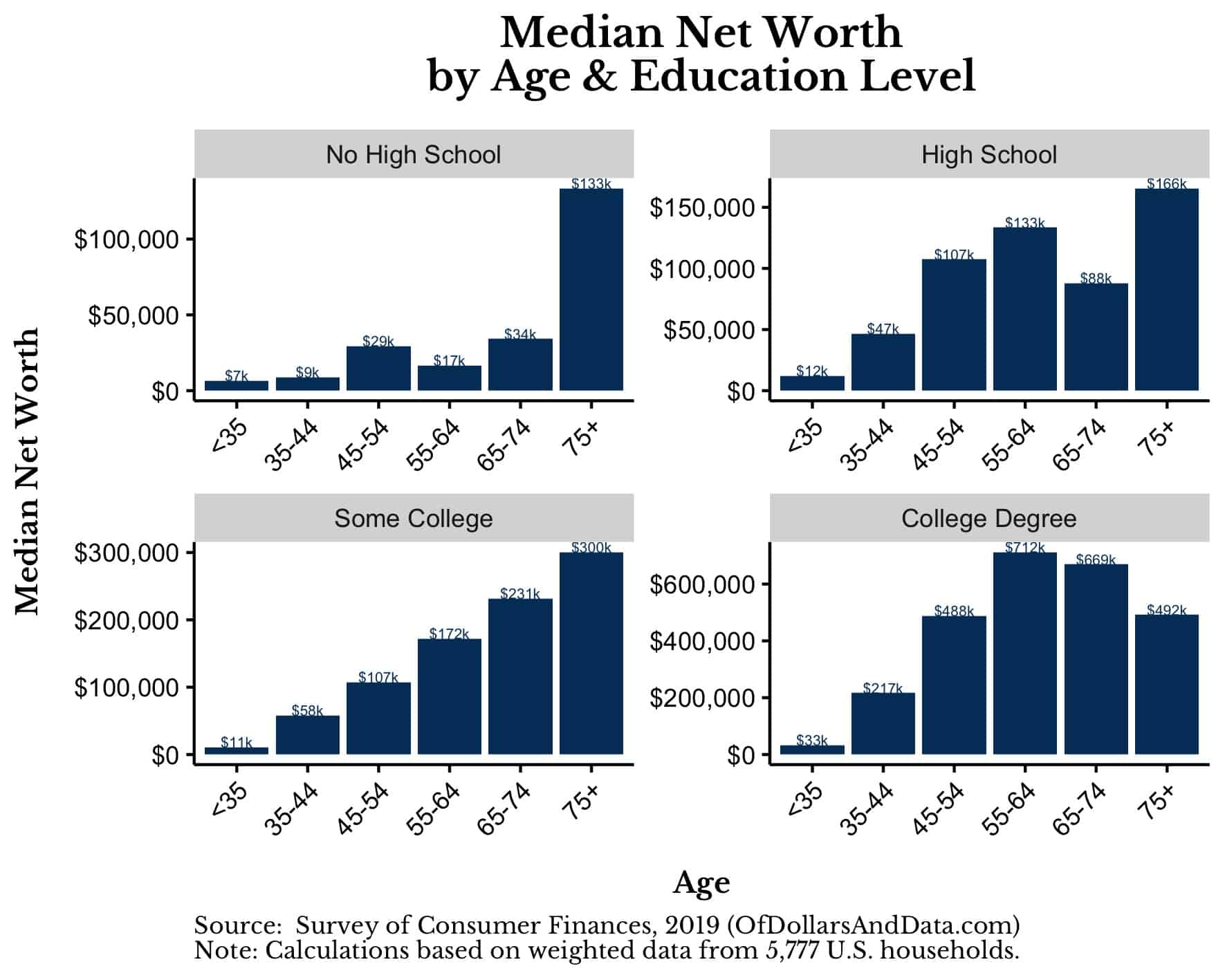

After we control for both age and education, you can start to have more useful net worth comparisons (Note: If you click on the image you can zoom in to see the specific number for a particular age + education grouping):

For example, for all households 35-44, the median net worth is ~$91,000. If you are a college-educated 35-44 with $100,000 you might feel a sense of entitlement at how good you are at managing your finances given you are so far above the median.

This is until you realize that the median college-educated 35-44 year old household has a net worth of $217,000.

Now, there is nothing wrong with being above or below the median, but, if you want to know if you are keeping up with the Joneses, make sure you have the right Joneses.

What About Those Doing Worse or Better Than the Median?

The median can be a useful measure, but we all don’t take the same financial journey. Some of us work in fields that pay more. Some of us get inheritances. Some of us are luckier and some of us are less fortunate.

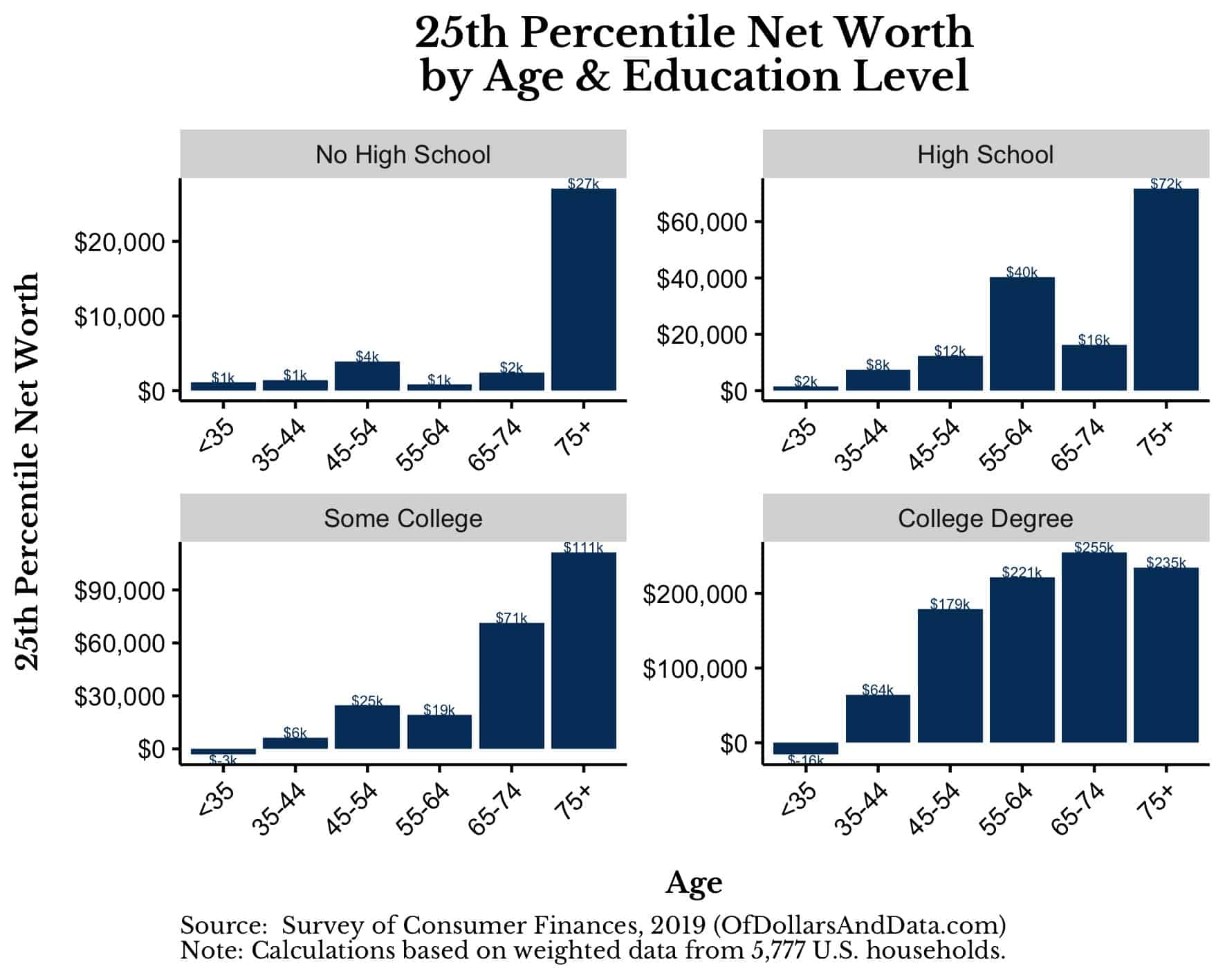

You should keep these things in mind when viewing the financial situations of those outside of the norm. To start, we will look at the 25th percentile of net worth by age and education level:

As you may have noticed, the lower quarter of households under 35 with some college (or more) actually have negative net worths!

This supports my prior point that some of us are less fortunate than others as these younger, more educated households likely had to take on more debt than the rest of their peers.

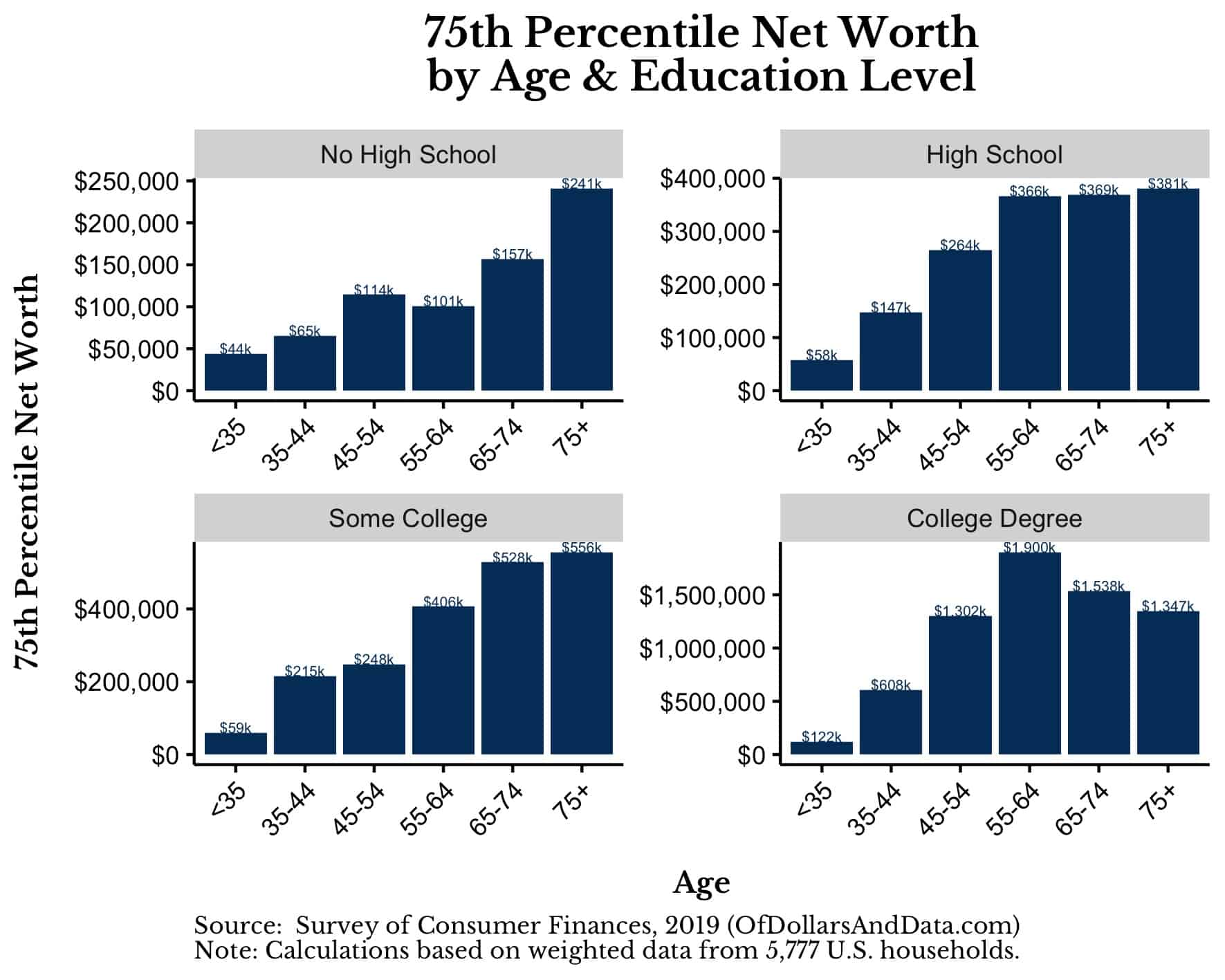

On the flip side, there also exists the 75th percentile households by net worth broken out by age and education:

What’s most interesting about this data to me is how much less variation there is across age groups. Unlike the 25th percentile plot, the net worths by age within each education level seem far more balanced.

Are you in the Top 10%?

After seeing data like this, you should have a better idea of where you are now and where you could reasonably be in the future.

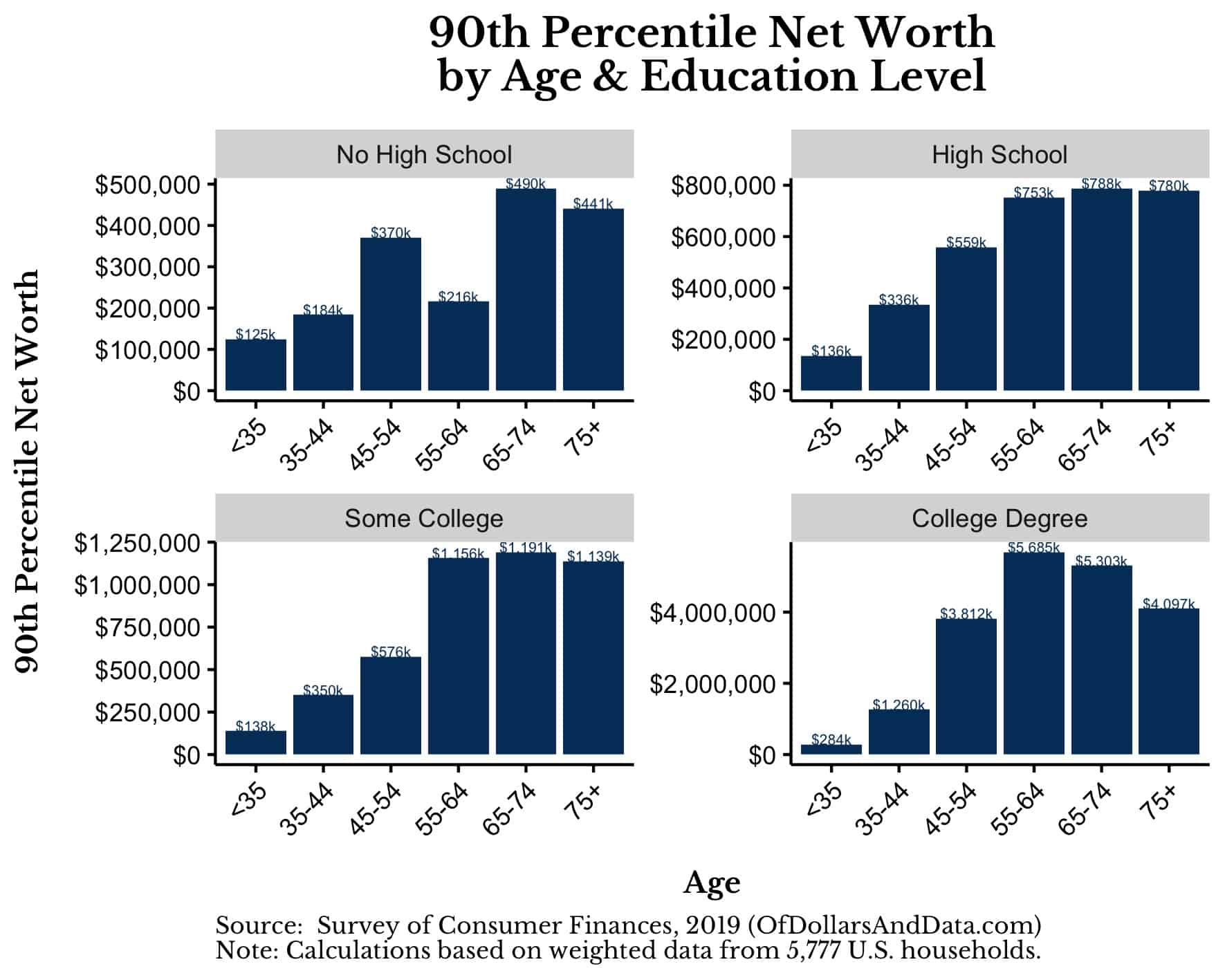

However, if you still want to strive for more, below are the top 10% of households by net worth broken out by age and educational attainment:

If this plot tells you anything it should be that, the further to the right you go on the net worth distribution, the more likely you are going to find people that are either (1) incredibly skilled or (2) incredibly lucky, or both.

This doesn’t take away from the good financial habits that many of these households embody, but if you want to compare yourself to them, don’t forget this.

The Most Important Metric in Personal Finance

Now that you have seen the data on average net worth by age and education, how do you feel?

Are you motivated to strive for more? Are you happy with what you have? Do you think there are areas where you can improve?

The good news is that, while comparing yourself to others in this way can be useful for helping you to stay on track, net worth is not the be-all and end-all of personal finance.

Because the most important metric in personal finance is whether your money is allowing you to live the life that you truly want.

People tend to forget that money is just a tool that we use to fulfill our wants and desires. But once you start chasing money for money’s sake, that’s where things tend to go wrong.

But that’s just my two cents. Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 179. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data