Dearly Beloved,

We are gathered here today to honor the memory of value investing.

For those of you that are not acquainted, value investing is the act of picking stocks that are trading below their intrinsic value in the hope that they price correct and provide returns that exceed those of the overall stock market.

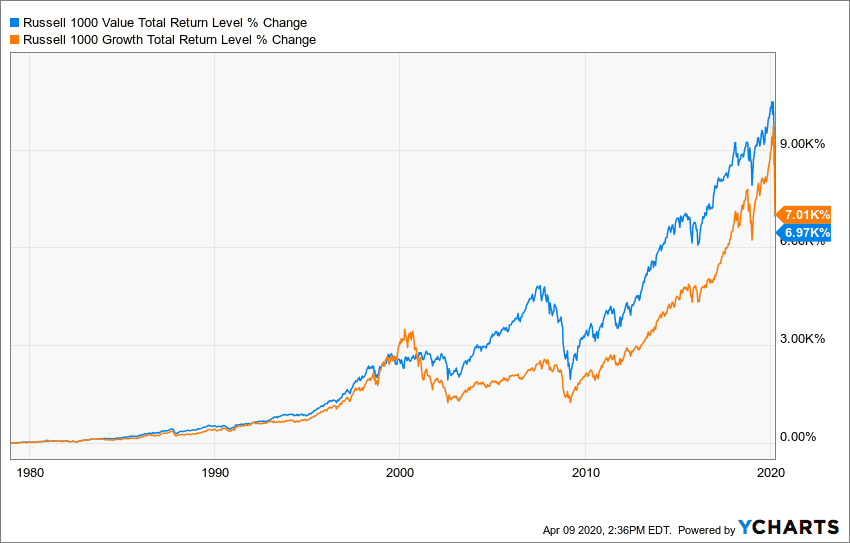

Historically, value stocks have outperformed growth stocks over the long run. However, in recent years, many investors have increasingly questioned whether this still holds.

The time of death for value investing could be noted as of March 18, 2020, when after 40 years of cumulative outperformance, the Russell 1000 Value Index (with dividends) began to underperform the Russell 1000 Growth Index (with dividends) yet again:

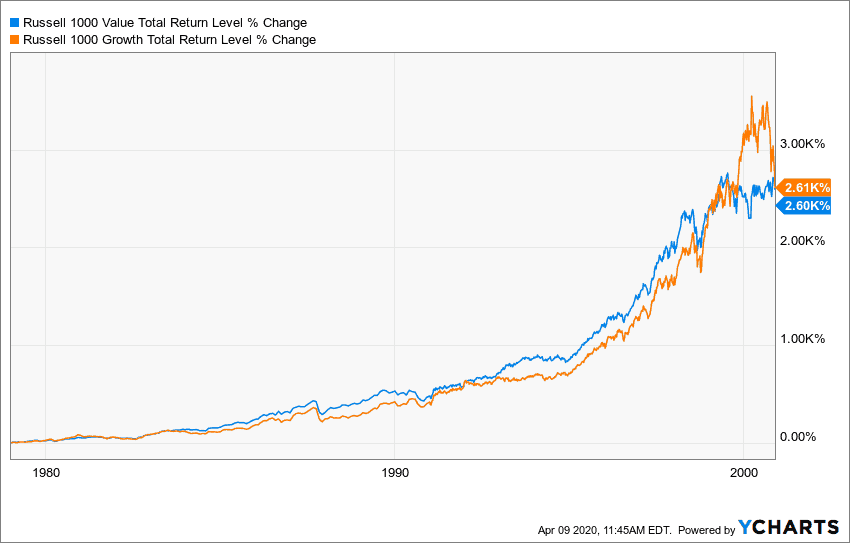

The last time we saw a similar level of cumulative underperformance by value (relative to growth) over such a long period of time was in November 2000, right before the deflation of the DotCom Bubble:

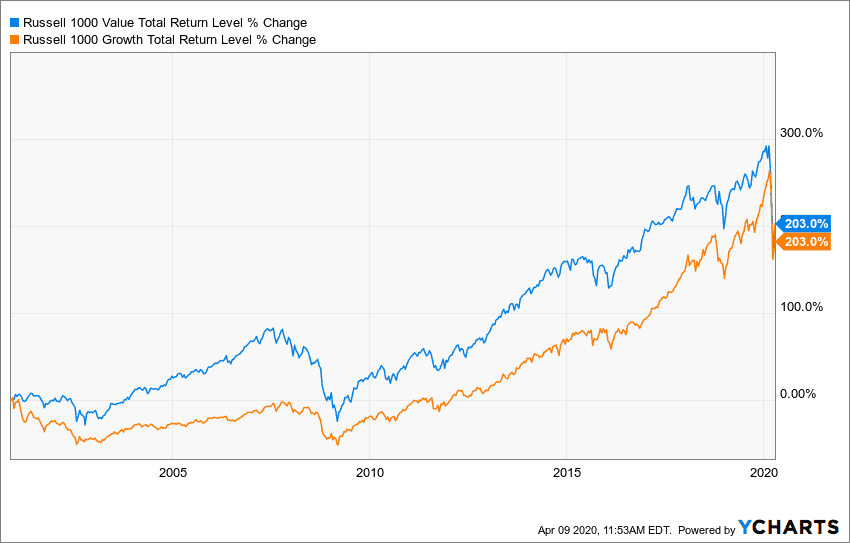

Since then, value and growth have had essentially the same returns through early April 2020, despite value being in the lead for most of that time period:

Does this imply that value stocks will never outperform growth stocks again? Of course not. No one can predict the future performance of the value factor.

However, if you are a value investor (i.e. the vast majority of your equity portfolio is in value stocks), a difficult path lies ahead. Let me explain.

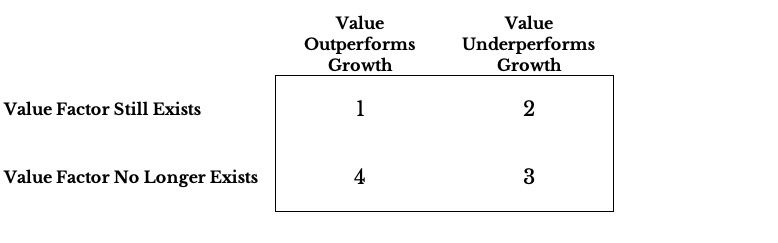

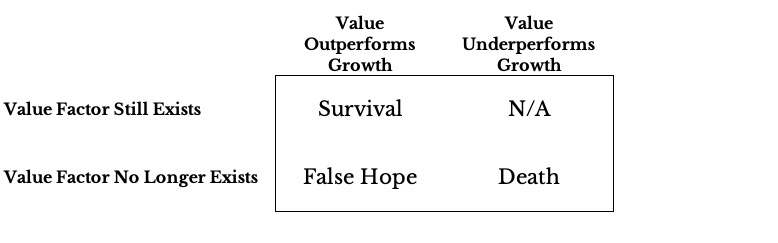

Currently, there are 4 possible future scenarios for value investing:

- Scenario 1: The value factor still exists and value stocks outperform growth stocks over the next few years.

- Scenario 2: The value factor still exists, but value stocks continue to underperform growth stocks over the next few years. I would argue that this scenario is impossible, simply because value’s continued underperformance would (by definition) negate the existence of the value factor or render it so infrequent that it would be as if it didn’t exist.

- Scenario 3: The value factor no longer exists and value stocks continue to underperform growth stocks over the next few years. This scenario, unfortunately, would be the final nail in value investing’s proverbial coffin.

- Scenario 4: The value factor no longer exists, but value stocks outperform growth stocks over the next few years. This scenario could come about as a result of dumb luck.

We can represent these four scenarios in a simple 2×2 matrix:

Now, let’s examine what each of these scenarios represents:

- Scenario 1 is the survival of the value factor. The long awaited rain that ends value’s dry spell.

- Scenario 2 is not applicable (N/A) for the reasons stated above.

- Scenario 3 is the death of the value factor, finally confirmed with time. Thought the factor may have existed historically, we can no longer make the same claim with any sense of confidence.

- Scenario 4 is false hope, or the outperformance of value stocks over growth stocks that is due completely to chance. Arguably, this is the worst outcome possible for a value investor, because it breathes life back into a dead pursuit.

Using our 2×2 matrix again, this is the final result:

Unfortunately for us, the problem with this matrix is that we can only observe value’s performance (the top axis) and then we must formulate our beliefs about the value premium’s existence (the left axis).

This is why even if we see value outperform growth in the near future, value investors won’t have it much easier.

Because in the event of value’s outperformance, value investors won’t know whether they are in the “Survival” scenario or the “False Hope” scenario for a few years, or possibly more.

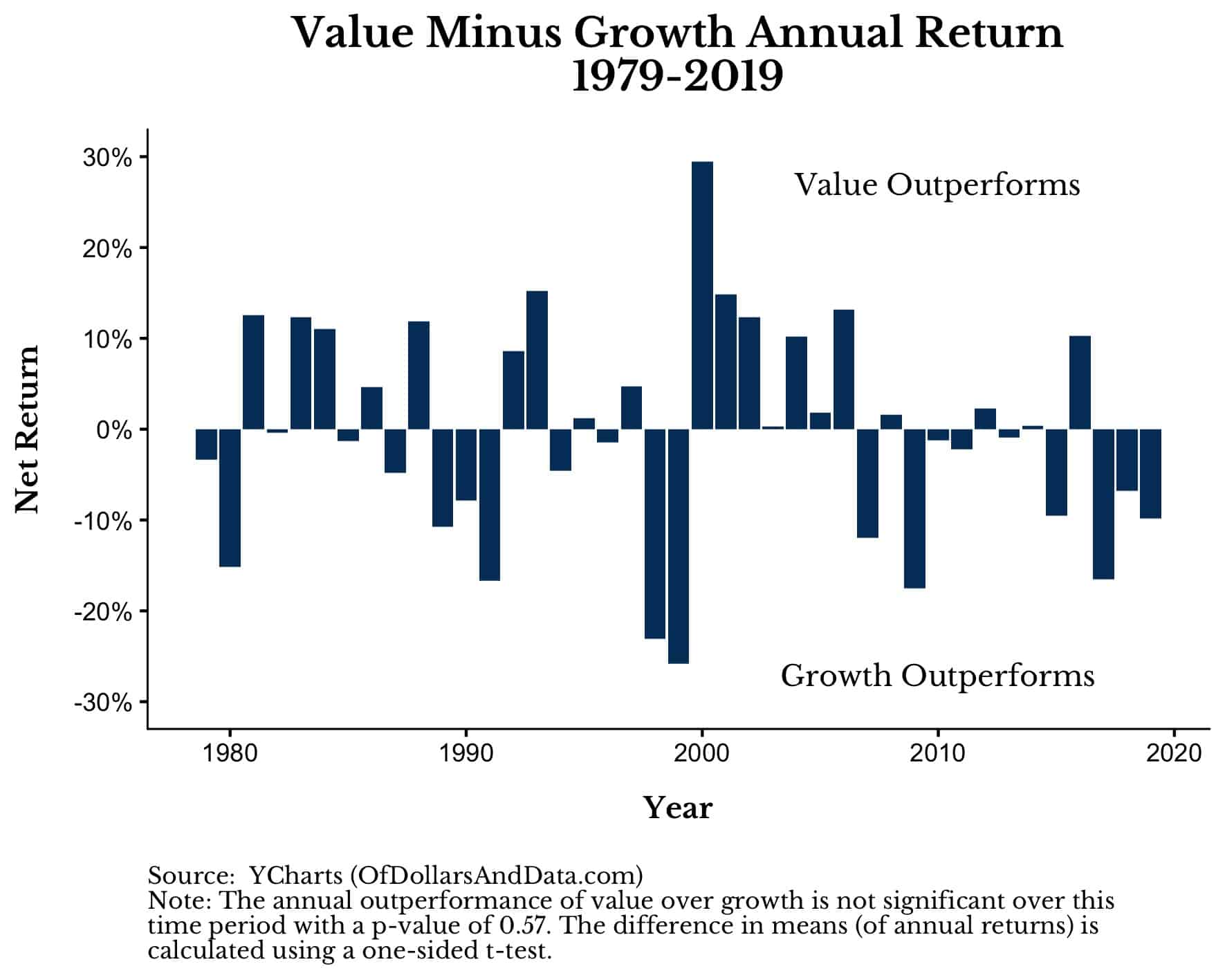

For example, consider the annual net returns of value stocks minus growth stocks since 1979 (Note: I use the Russell 1000 Value Total Return – Russell 1000 Growth Total Return to calculate the net return):

Using this data, value and growth have performed roughly the same over time, with the difference in their average annual return not being statistically different from 0% (p-value = 0.57).

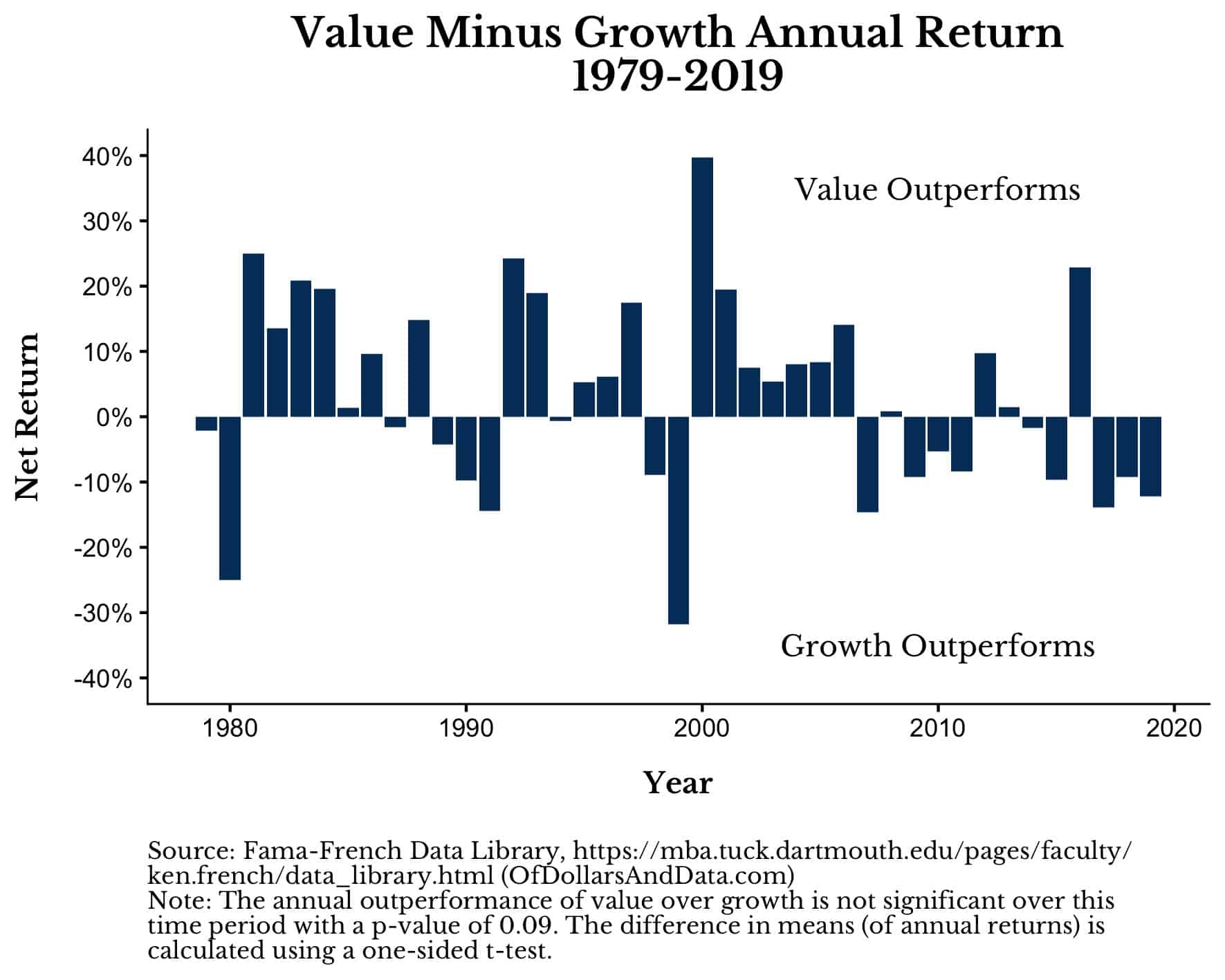

However, when we use the academic definition of value (Fama-French’s “HML”), value stocks do outperform growth stocks, but the difference in their annual returns from 1979-2019 is still not statistically significant:

To gain statistical significance again, we would have to compare annual return performance of the HML going back to 1975 (or earlier).

This analysis demonstrates the difficult path ahead for value investors and those who market these strategies. Because if you have 40-year time periods where you cannot unequivocally demonstrate the outperformance of your active investment approach, then you are going to have a hard sell on your hands.

The problem is that even if value stocks outperform growth stocks in 2020 by a decent amount, value investors shouldn’t celebrate just yet. They may find that their clinking champagne glasses eventually ring hollow.

Because value investing will require sustained outperformance in order to be revived.

And just to clarify, I understand that there are different definitions of value, that the HML value factor seems to have a timing issue, and that changed accounting standards are affecting which stocks are being classified as value.

This problem is far more complicated and nuanced than what I have explained here.

Either way, I am not the first to discuss the difficulties of being a value investor in the modern era, nor will I be the last.

As Jack Bogle, Vanguard’s founder, stated in a speech at the Morningstar Investment Forum in 2002:

In any event, place me squarely in the camp of the contrarians who don’t accept the inherent superiority of value strategies over growth strategies.

In that same speech, Bogle recounted a similar response from Dr. Eugene Fama, one of the academic founders of factor investing. When Fama was asked how he felt about other investors who questioned the value factor, he stated:

How far are they from the slide? If I get far enough away, I don’t see it either.

For the value investors out there (myself included), I hope Fama is mistaken. Otherwise, may the investment gods have mercy upon our financial souls…

The Value in Value

For full disclosure, I have a confession to make: a fair portion of my equity allocation is tilted toward value stocks.

So how can I own value stocks despite the difficulties that lay ahead? Because no outperformance is not the same as no performance.

In other words, even if value stocks don’t beat growth stocks over the next decade, they will probably still make you money.

I, therefore, see the value factor as an option to the upside.

If it still exists, I make more money than I would have made by owning the market portfolio. However, if the value factor no longer exists, then I hope to match the market portfolio in the long run.

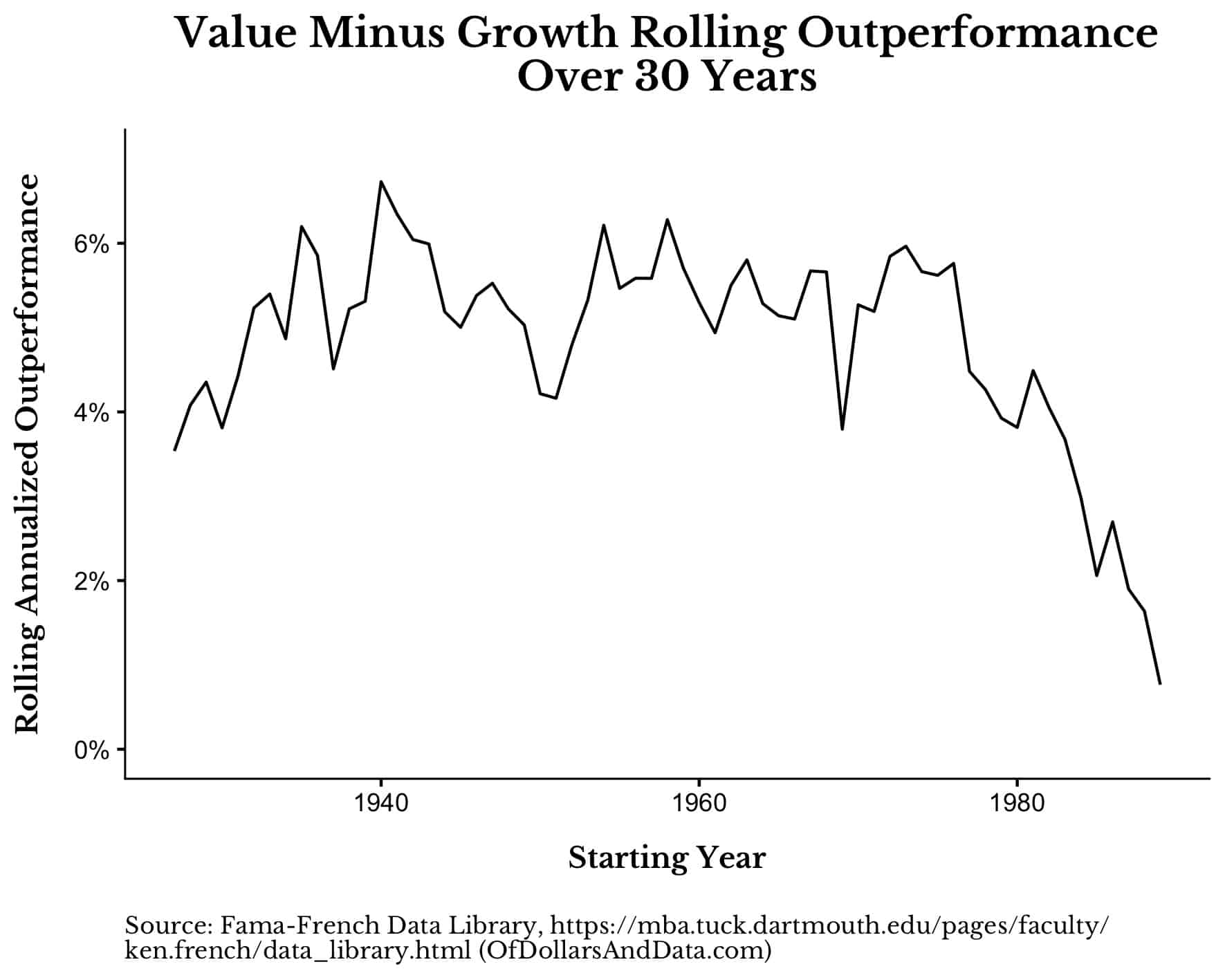

I only say this because, if you look at every rolling 30-year period of the HML since 1927, you can see that value has always outperformed growth on an annualized basis, even with its most recent bout of underperformance:

Of course, the future doesn’t have to be like the past, but I am comfortable betting that it won’t be all that different.

Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 178. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data