Mark Zuckerberg was once asked what he thought of The Social Network, the film that tells the beginnings of Facebook. Mark laughed and said he was amazed at how many little things the filmmakers got perfectly right, while also getting the major plot points completely wrong. For example, Mark recalled how every piece of clothing in the film was an exact replica of clothing he actually owned, yet his motivation for starting Facebook had nothing to do with chasing a girl. For the record, Mark met his current wife Priscilla before he started FB. Mark elaborates on this point (emphasis mine):

They frame it as if the whole reason for making Facebook and building something was because I wanted to get girls or because I wanted to get into some kind of social institution…They just can’t wrap their head around the idea that someone might build something because they like building things.

I like this quote because it embodies Mark and everything he stands for. He builds things with computers. That is what he does. He did it at Harvard and he did it at Facebook. Everyday he continues to build the largest community in human history with the help of dedicated employees, lines of computer code, and large metal servers. But, I’m not here to talk about Facebook or Mark Zuckerberg.

I am here to ask YOU to find what you do. This isn’t an easy task, and it may take years before you find it, but I promise that it is out there. And no I don’t want you to think of this as solely “finding your passion.” That phrase, which I have used many times previously, is so overused that the “passion” feels all but extinguished at this point. I am talking about finding what you do. This is a far more aggressive form of discovering your purpose on this planet. I can’t tell you exactly how to do it, but I can try to illustrate what it feels like when you find it. How? By telling you about what I do.

So what do I do?

I make financial data come to life using visualizations. I turn cold, hard facts into vibrant, flowing charts. I do all of this in the hopes of explaining a complex financial topic in a much simpler manner. My goal is to make you see something you hadn’t seen before. While I don’t always accomplish this goal every week for every reader, I do hope that, occasionally, you come away amazed.

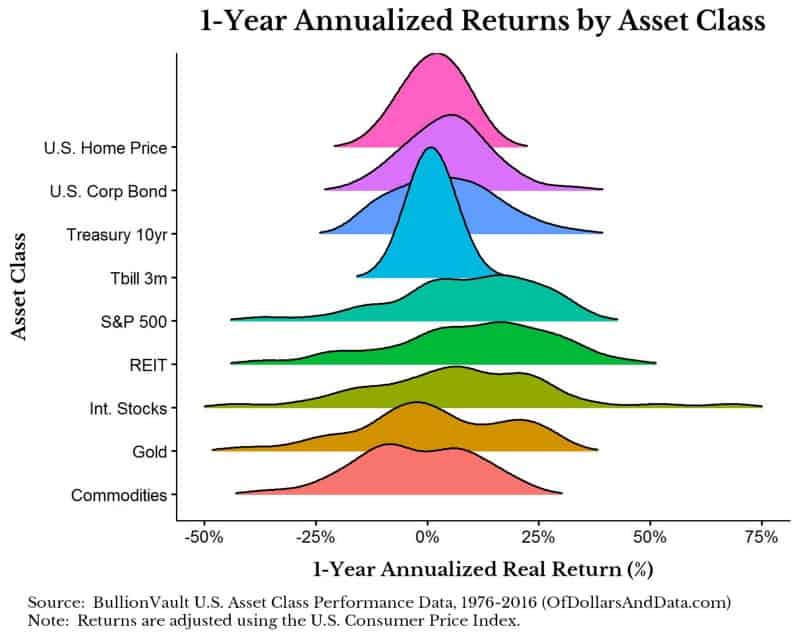

For example, consider the 1 year real returns for 9 different asset classes from 1976–2016. I could make you a table with the average return and standard deviation for each asset class.

Or, I could show you this:

Which one do you think is more effective in allowing you to compare asset classes and get an understanding for their risk and reward? Don’t get me wrong, the point estimates are useful, but distributions are far more intuitive.

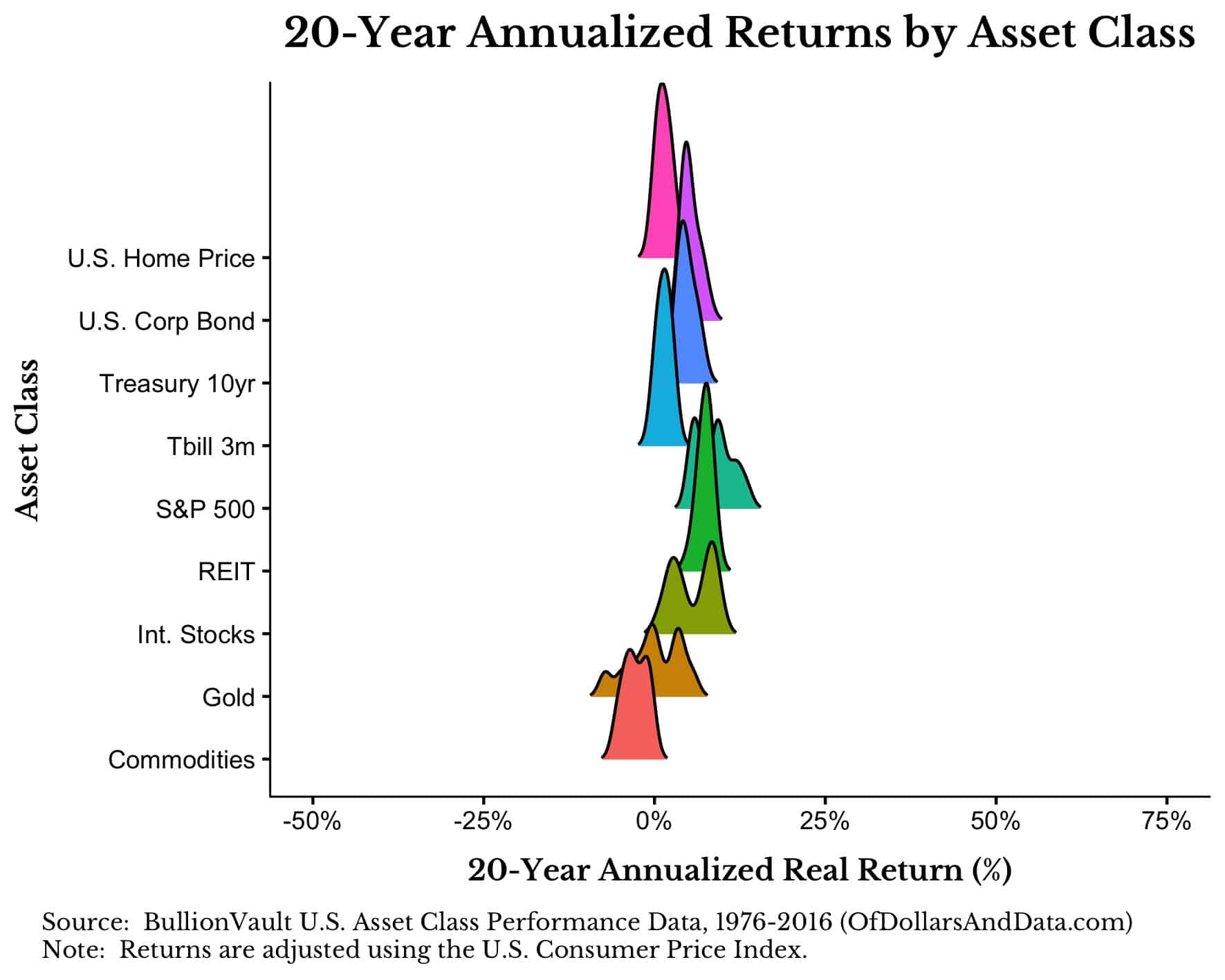

And this is just the beginning. What if I wanted to use this same data to ask a bigger question? What if I wanted to know what the long term returns of these assets looked like? If we plot the 20 year annualized real returns for these same asset classes, a different picture emerges:

With this level of aggregation we can draw many more useful conclusions. For example, we can clearly see that commodities have had negative real returns over longer periods of time and that the return on U.S. housing is close to 0%. So much for the American dream, right?

And this is just the tip of the iceberg. I could take this one chart and run with it in different ways. I could ask why the bond-like instruments have a bell shaped distribution while the equities do not. Or, I could ponder why REITs have performed so well or why gold has the widest distribution of returns.

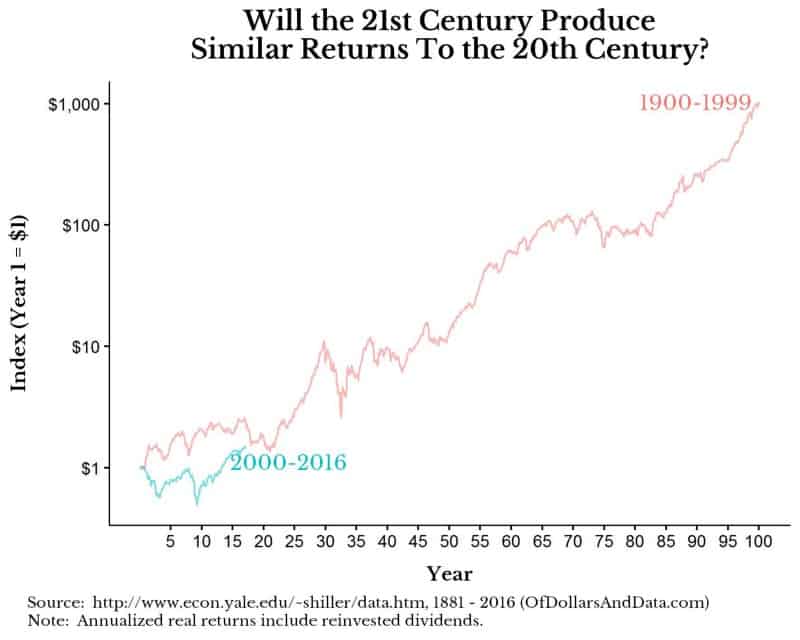

And, just for fun, I can do something like this:

This animation doesn’t necessarily have a big point (i.e. things move toward their average return as the holding period increases), but it looks sick.

So why am I telling you this? Because, when you look at something differently than the rest of the world, that is when you have found your purpose. When you see beauty in what others may see as mundane, pay attention. That’s your calling. I don’t know whether it will be finance or art or comedy or music or whatever, but YOU will know.

In my case, while most of the world may see investing as all about money and greed, I could not disagree more. Investing is the grand equalizer of the world. It does not care about your gender, race, religion, sexual orientation, or any other aspect of your identity. Market returns do not discriminate. Gains and losses are shared without prejudice. And, no matter how smart you are, you cannot outsmart the market consistently. This fact is humbling and showcases the incredible power of the market. It is amazing to me how the market acts more like a biological system than almost anything humans have ever created. The market has fractal properties and it’s always evolving. Morgan Housel calls it the unsolvable puzzle.

But, more than just that, investing and the markets reflect stories that encompass all of modern history. Consider this chart of the U.S. stock market that displays the real returns with dividends for the 20th century and for the 21st century (thus far). Note the y-axis is a log scale:

Each line with its many peaks and valleys contains the influence of hundreds of millions of individuals making trillions upon trillions of collective decisions. War, peace, life, death, innovation, destruction, division, and cooperation. They all exist in the chaotic lines above. Despite all of that chaos, there is incredible beauty. Why? Because the story of markets over the last few hundred years is a story of massive human cooperation. I have discussed this idea before here, but I cannot restate its importance enough. By investing, you are participating in the very act that is bringing about increased human cooperation and improved well being around the globe. You are helping businesses to employ individuals and, hopefully, make their employees’ lives better. While the system is far from perfect, especially at distributing the gains, things will get better with time.

You may not see it like I see it, but that’s okay. Either way, I want you to go out and find that thing that you see differently. Find the thing that you want to show the world. If you really think about it, there is nothing stopping you. Find what you do. Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 40. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data