Last week I sold half of my Bitcoin at $52,013. I owned one coin, which I acquired at $8,000, and sold half of it merely to rebalance back to a smaller allocation within my overall portfolio. I’m not bullish or bearish on Bitcoin. Just sticking to my investment plan.

I tweeted about my sale and the Bitcoin community was immediately up in arms. I got over 900 comments in an endless onslaught of jokes from Bitcoin reply guys:

“Have you considered how you will explain this mistake to your grandchildren?

“What did you make your wife and her boyfriend for dinner?”

“Have fun staying poor”

Oh, there was also this absolute gem about my “paper hands”:

I didn’t know we used the term “paper hands” when selling at an all-time high for a 5x after tax profit, but live and learn.

All jokes aside, this interaction illustrates the increasing cultishness within sects of the Bitcoin community. When a simple rebalance is taken as an attack on your faith, it says a lot. As I explained recently, I have no qualms with Bitcoin. I don’t think it’s going to $0. In fact, I would classify myself as a supporter of Bitcoin and decentralization generally.

However, I don’t agree with some of the pro-Bitcoin arguments that have been put forth. For example, consider this tweet that likens the U.S. today with post WWI Germany:

Currently reading “When Money Dies” the history of hyperinflation in Weimar Germany.

One of the wildest aspects I never knew was that early on people all thought they were getting rich.

They were selling hard assets for what they thought were insanely high prices in marks!

I don’t disagree that there are parallels between the rising asset prices we see today and the rising asset prices back then. However, this is where the similarities end!

Did anyone of those 5,000 people (or the original tweeter) actually read When Money Dies? Because I did (for the 2nd time) and things then could not be more different than today. Here are just a few examples illustrating this:

- Collapse in foreign exchange value: “The mark’s fall began gradually. In the war years, 1914-1918, its foreign exchange value halved, and by August 1919 it halved again. In early 1920, however, although the cost of living had risen less than nine times since 1914, the mark only had one-fortieth of its overseas purchasing power left.”

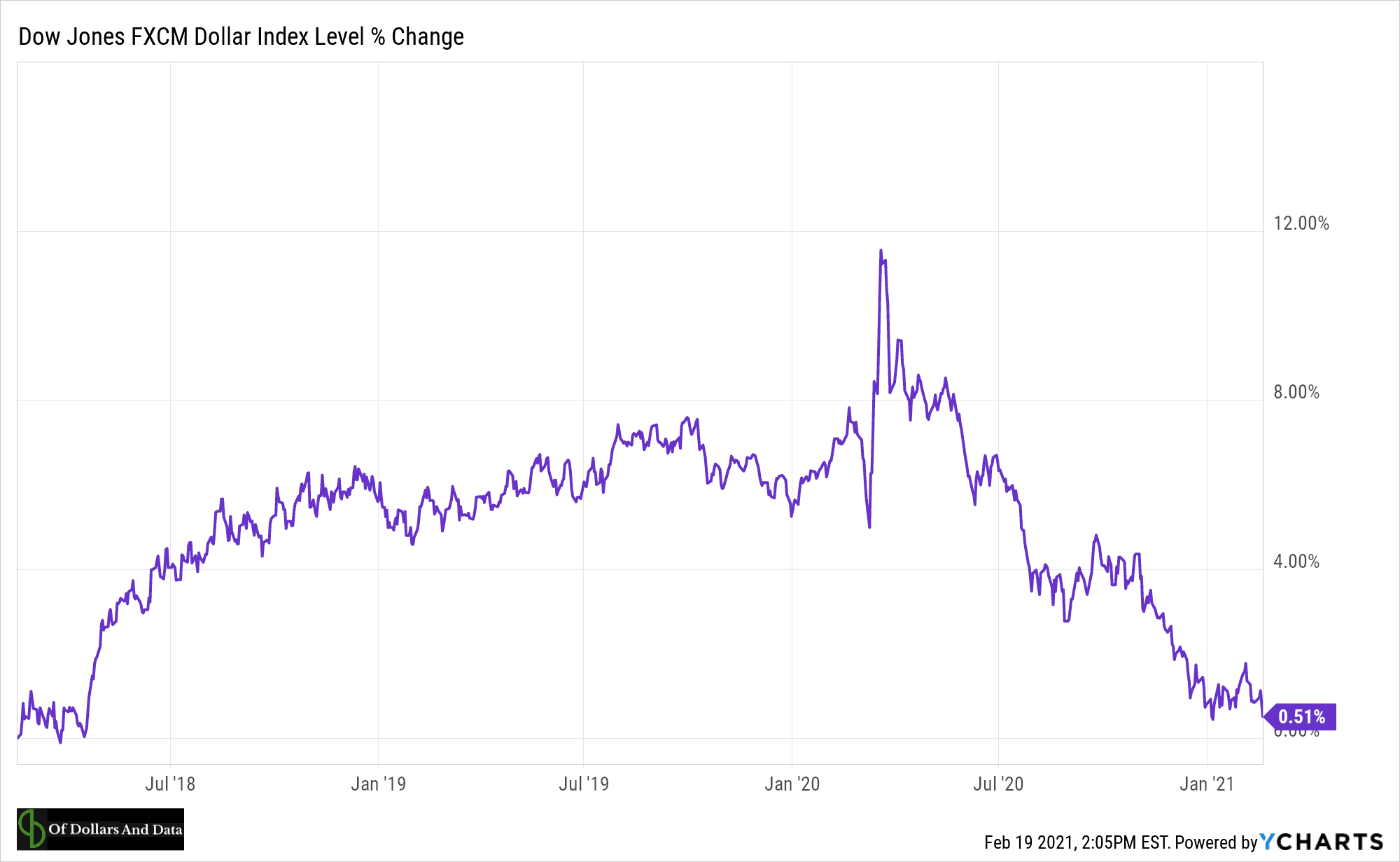

- Note that is was before the hyperinflation in marks in the early 1920s. Where is the equivalent change in USD’s purchasing power? Nowhere to be found. In fact, over the last three years, the Dow Jones FXCM Dollar Index is basically flat:

Yes, over the last year the U.S. Dollar has declined in value by about 6% (according to this index), but that is light years away from what happened with the German mark.

- No national debt: “A year before Germany’s great inflation is thought to have started, Germany’s national debt had been all but wiped out.”

- Absolutely no parallels to the growing U.S. national debt today.

- Large decrease in bankruptcies: “Before the war, when the mark was sound, there were normally about 9,500 bankruptcies a year. As wartime inflation increased, the number regularly dropped from 7,739 in 1914 to 807 in 1918.”

- While individual bankruptcies in the U.S. did decline by 30% in 2020, commercial bankruptcies were up 30%. But this has far more to do with U.S. fiscal policy and the effects of COVID-19 than inflation.

I could go on, but you get the point. It’s easy to make arguments when you cherry pick the facts. However, when you look at the full collection of evidence, When Money Dies illustrates that the U.S. is nothing like post WWI Germany. In fact, the U.S. isn’t like any other regime that has experienced a large currency devaluation. As Clint Ballinger noted in The Myth of Hyperinflation:

There are differences in details and emphases, but the basic story of outside coercion…internal corruption…bad policies on banking…etc. are the same in Weimar and Venezuela as in Zimbabwe.

As always, the “printing” is the result, not the cause.

Ballinger’s analysis suggests that the root causes of hyperinflation are much deeper than printing money. While I agree that the U.S. has many, many issues, we are not a society on the brink of failure. We have first world problems. More obesity than starvation. More inequality than poverty. More outrage than violence. For God’s sake, we had an insurrection with more selfies than gunshots.

I don’t say this to belittle the problems that we do have, but to put a sense of perspective on them. Because it is this perspective that seems to be lacking. For example, some believe that the U.S. dollar is on a clear path to being worthless while at the same time making every other financial decision in their life through the lens of U.S. dollars.

They pay their mortgage with USD. They buy their food with USD. They even measure how well Bitcoin is doing in…USD.

Odd isn’t it? That this soon-to-be worthless paper is how Bitcoin’s success is judged. But I don’t think that many of the people who preach the coming collapse of USD actually believe it. Because when push comes to shove, USD is still how they measure value.

As I’ve written before, “Don’t listen to what they say, just watch what they do.”

And based on what some people are doing, it seems clear that there exists this false Bitcoin reality. A reality where those who own Bitcoin are rich and those who don’t are poor.

But that’s not how value works. What about all assets that existed before Bitcoin? Do those not count as having any value? What about all the skills of all the people across the globe? Are those skills no longer useful in a Bitcoin-dominated future?

Is the nurse in Albuquerque going to “have fun staying poor” because they don’t own any Bitcoin? What about the lawyer in Seattle or the construction worker in Atlanta? No Bitcoin means no value, right? What about Morgan Housel who just sold a quarter of a million books? As far as I know he owns 0 Bitcoin. Is he going to “have fun staying poor” too?

At some point you can only laugh at how ridiculous the logic gets. But it’s only this way because some people believe it is an us versus them mentality. But this isn’t necessary. For Bitcoin to succeed, the U.S. dollar does not have to fail! It’s not zero sum. They can coexist together in harmony because they have different uses.

Bitcoin is a digital store of value (a volatile one at that) and the U.S. dollar is a currency. There exists a possible future where Bitcoin is $100,000 a coin or $500,000 a coin and the U.S. dollar is still the world’s reserve currency. How likely is this? I don’t know. I don’t make market calls or price predictions, I just rebalance according to my investment plan.

And no one should be offended when I do. No one should take it as a personal insult when I (or anyone) sells Bitcoin. It’s toxic to the movement and to getting people interested in this asset class.

After all, why would you care so much about what someone else does with their money? I don’t care when you sell the S&P 500 or buy Dogecoin or anything of the sort. If you ask I will provide my opinion, but it’s your money. Do what you want.

And to be crystal clear, I don’t disagree with all of the pro-Bitcoin arguments, just some of the more extreme ones. For example, I agree that the U.S. dollar is a terrible investment and that printing more money will make the U.S dollar worth less. However, worth less is not the same as worthless. It’s a slight nuance, but it makes a world of difference.

But without this nuance, we can end up in these extreme echo chambers that look nothing like the real world. Twitter and the internet only exacerbate this issue. As Kurt Andersen wrote in Fantasyland:

Before the Internet, crackpots were mostly isolated and surely had a harder time remaining convinced of their alternate realities. Now their devoutly believed opinions are all over the airwaves and the Web, just like actual news. Now all the fantasies look real.

Bitcoin isn’t a fantasy. It has value. But this doesn’t imply that other things don’t. I only wish that more people would realize this so we could find some common ground and move into our semi-decentralized future together.

Until then, I will try my best to have fun staying poor. Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 229. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data