“It’s a beautiful thing, the destruction of words.”

-George Orwell, 1984

Do words still have meaning? Or are they, as Kendall Roy from HBO’s Succession refers to them, just “complicated airflow”?

While I want to believe that words still matter, their usefulness seems to be dwindling over time.

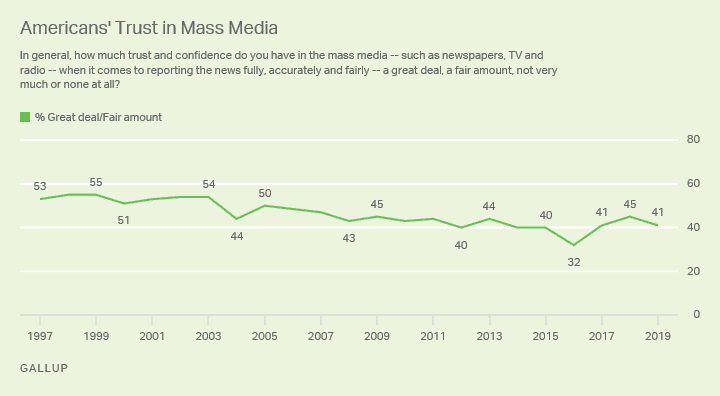

Between the loss of trust in the mainstream media:

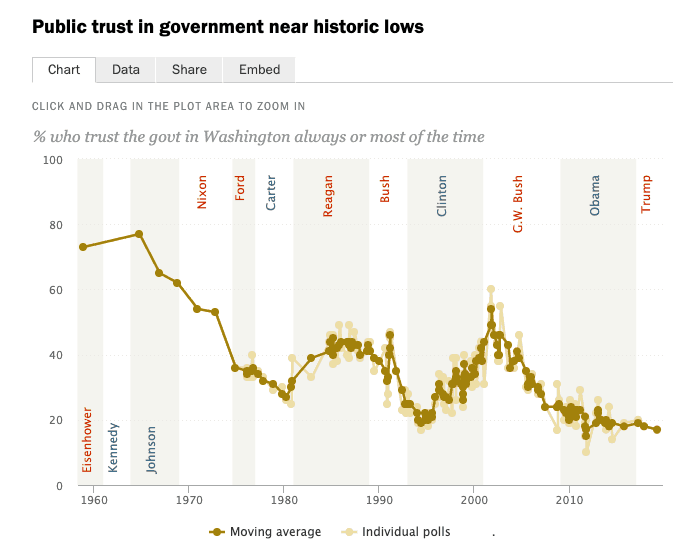

To the loss of trust in government:

The declining value of words is palpable.

Even non-partisan institutions such as the Center for Disease Control (CDC) and the World Health Organization (WHO) are not immune from this critique either (pun very much intended). What do you expect when the CDC recommends not wearing masks and then reverses their stance a month later? It’s no wonder we live in an era of #FakeNews.

Unfortunately, the financial world isn’t exempt from its share of empty words either, even among the most respected names in the industry.

For example, consider how Warren Buffett consistently claims that it is “outrageous” that his secretary pays twice the federal tax rate that he does. Or how Bill Gates told CNBC, “The government should require people in my position to pay significantly higher taxes.”

Oh really Mr. Buffett?

Oh really Mr. Gates?

If the both of you are so concerned about not paying enough in taxes, then why don’t you just pay more in taxes?

There is nothing stopping either Mr. Buffett or Mr. Gates from making additional voluntary contributions to the U.S. Treasury.

Yes, you could argue about how efficiently Buffett and Gates would use their money compared to the federal government, but they aren’t making that argument. They are saying “I should pay more,” then deciding not to pay more.

In fact, Buffett and Gates go out of their way to minimize their tax burden through the use of foundations and other tax avoidance strategies.

Yes, their wealth will do great things for the world (whether they pay their “fair share” of taxes or not), but this example illustrates that you can’t listen to what somebody says, only what somebody does.

In economics this concept is called revealed preferences, and it can be one of the most valuable ways to learn about the world.

For example, consider how Marc Andreessen used revealed preferences to illustrate the irrelevance of job titles:

Andreessen argues that people ask for many things from a company: salary, bonus, stock options, span of control, and titles. Of those, title is by far the cheapest, so it makes sense to give the highest titles possible…If it makes people feel better, let them feel better. Titles cost nothing.

As Andreessen demonstrates, titles don’t reveal how an employer actually feels about the value of an employee’s work. This explains why a “promotion” doesn’t feel like a promotion unless it is accompanied by a commensurate bump in pay.

This same tactic is used by society when referring to people as “heroes” instead of paying them for the true value they provide. While the status associated with being a hero is commendable, I bet that many of the hourly workers currently risking their lives on a daily basis would prefer the tangible benefits of a higher wage.

In the financial world, revealed preferences can be used to separate how someone says they invest from how they actually invest. Or as Nassim Taleb once proclaimed:

Don’t tell me what you think, tell me what you have in your portfolio.

I recently highlighted this distinction when a popular trader on Twitter claimed to be 100% in cash since February 24th despite tweeting about being long a stock on February 25th. Of course we will never know his positions at any point in time, but the fact that he contradicts himself says a lot.

More importantly though, if a trader is really that good, then why would they need to run a subscription service to sell their “secrets”? And what does it tell you when the best trader on Earth is also one of the most discreet?

It’s revealed preferences all the way down, my friends.

But what would I know? Talk is cheap.

Naive?

Yes, I know you have probably heard this idea many times before, but it was only recently that I internalized the importance of paying attention to peoples’ actions over their words.

Maybe I am just naive, but I really wanted to believe that words matter. That facts matter. But, as revealed preferences has so kindly illustrated, they don’t.

It was only after repeatedly noticing these…contradictions that this idea became clear to me.

- For example, if more money doesn’t bring more happiness, then why are so many rich people trying to get their hands on more money?

- If where you went to college “doesn’t really matter,” then why are parents still desperately trying to get their kids into the top schools?

- If it is important to get the facts right, then why do so few people check the facts?

Yes, all of these are vast generalizations, but they all contain a nugget of truth. And that truth is the same message over and over: don’t listen to what they say, just watch what they do.

Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 181. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data