Imagine you just got a new job offer or you’ve been working in a job for a few years without a raise. Should you ask for more? Or should you wait it out? How much does a raise early in your career actually affect your long-term finances?

The answer is…it depends. It depends on the size of your raise, the timing of your raise, and how much of your raise you save as well. This article will dig into each of these factors and demonstrate why the size and the timing of a raise matter far less for your long-term finances than how much of your future raises that you save.

Let’s begin by examining the affect of raise size.

How Important is Raise Size?

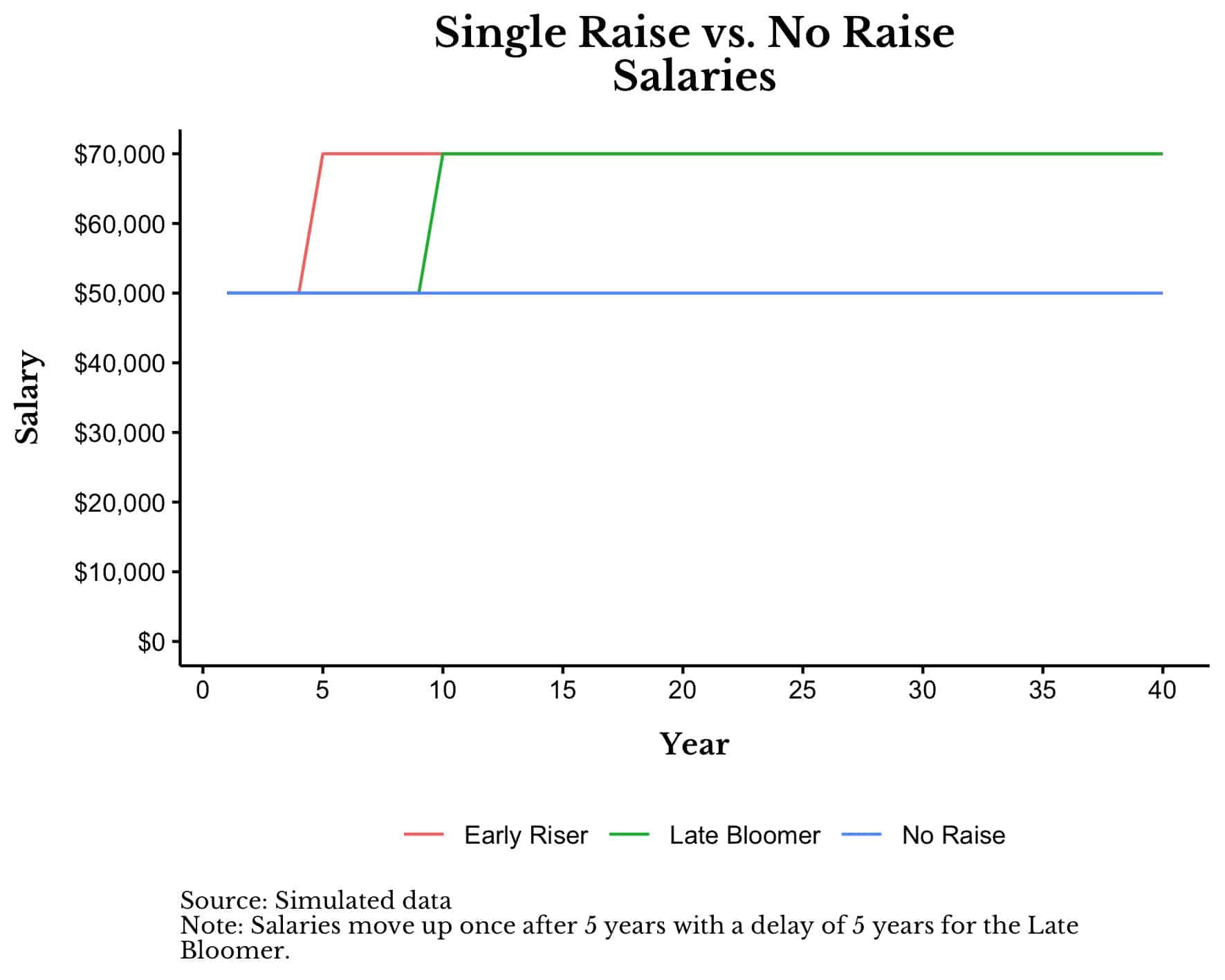

Imagine three people who all make $50,000 a year at age 25. One of them gets a raise of $20,000 (40%) after 5 years. We will call them the Early Riser. Another gets a raise of $20,000 (40%) after 10 years. We will call them the Late Bloomer. The third never gets a raise (“No Raise”). Assuming all three work for 40 years, here is how their salaries will look over time:

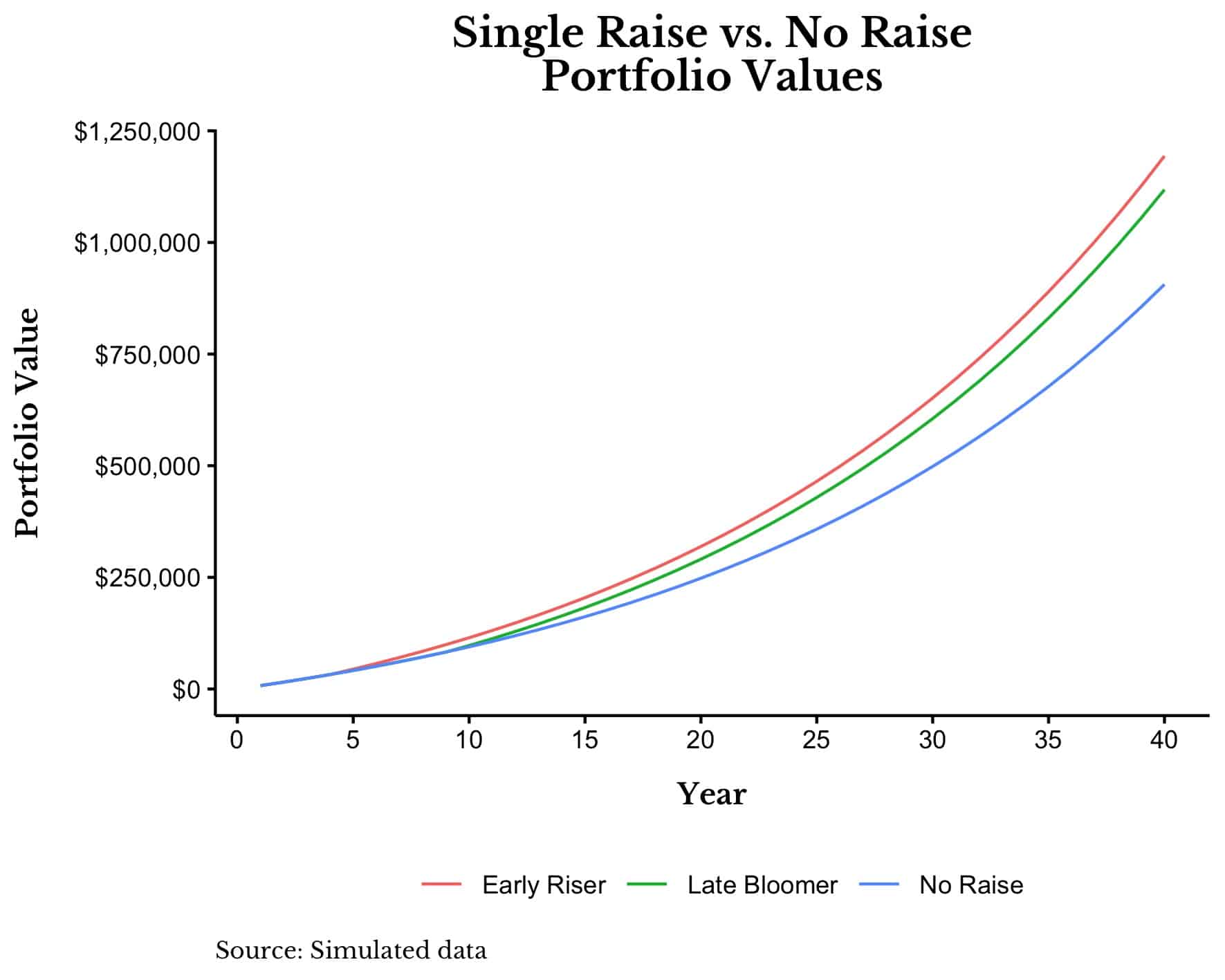

If we assume that all three individuals save 15% of their income every year and earn 5% annually on their money, how much would they have when they retired at age 65 (after 40 years)?

The Early Riser would end up with $1.19M, the Late Bloomer would end up with $1.11M, and the person who never got a raise would end up with $0.91M. On a percentage basis, the Early Riser has about 7% more than the Late Bloomer and about 30% more than the person who never received a raise by retirement.

Note that these relative differences are not affected by savings rate or investment returns. So even if all three people earned 20% on their money annually or saved 50% a year, in retirement the Early Riser would still have 7% more than the Late Bloomer and 30% more than the person who never received a raise.

Visually, you can see the portfolios of these three individuals in the chart below:

As you can see, the impact of getting a raise at all is much larger than any minor timing differences in when you get that raise. However, even this sizable difference can be overcome quite easily if the person who never received a raise is somehow able to save more money. For example, if the person who never received a raise saved 20% each year instead of 15%, they would end up with more money in retirement than either the Early Riser or the Late Bloomer.

Of course, raise size matters (especially at the extremes), but if you don’t happen to get the exact raise you wanted, it probably won’t have a big impact on your finances in the long run. For example, if instead of a 40% raise, we gave the Early Riser a 10% raise at age 30, in retirement the Early Riser would only have 8% more money than the person who never received a raise. 8% isn’t 0%, but having 8% more at age 65 isn’t going to significantly impact your lifestyle in retirement.

Now that we have looked at the impact of a single raise, let’s look at the impact of multiple raises over time.

What About Raise Timing?

Despite the analysis in the prior section, most people don’t just get one raise and then stop. People tend to get multiple raises, especially earlier in their career. For example, researchers at the Federal Reserve Bank of New York found that an individual’s income grows most rapidly in their first decade of work (ages 25-35). Therefore, if we want to examine the differences in getting a raise earlier, we need to look at what happens when someone gets multiple raises over time.

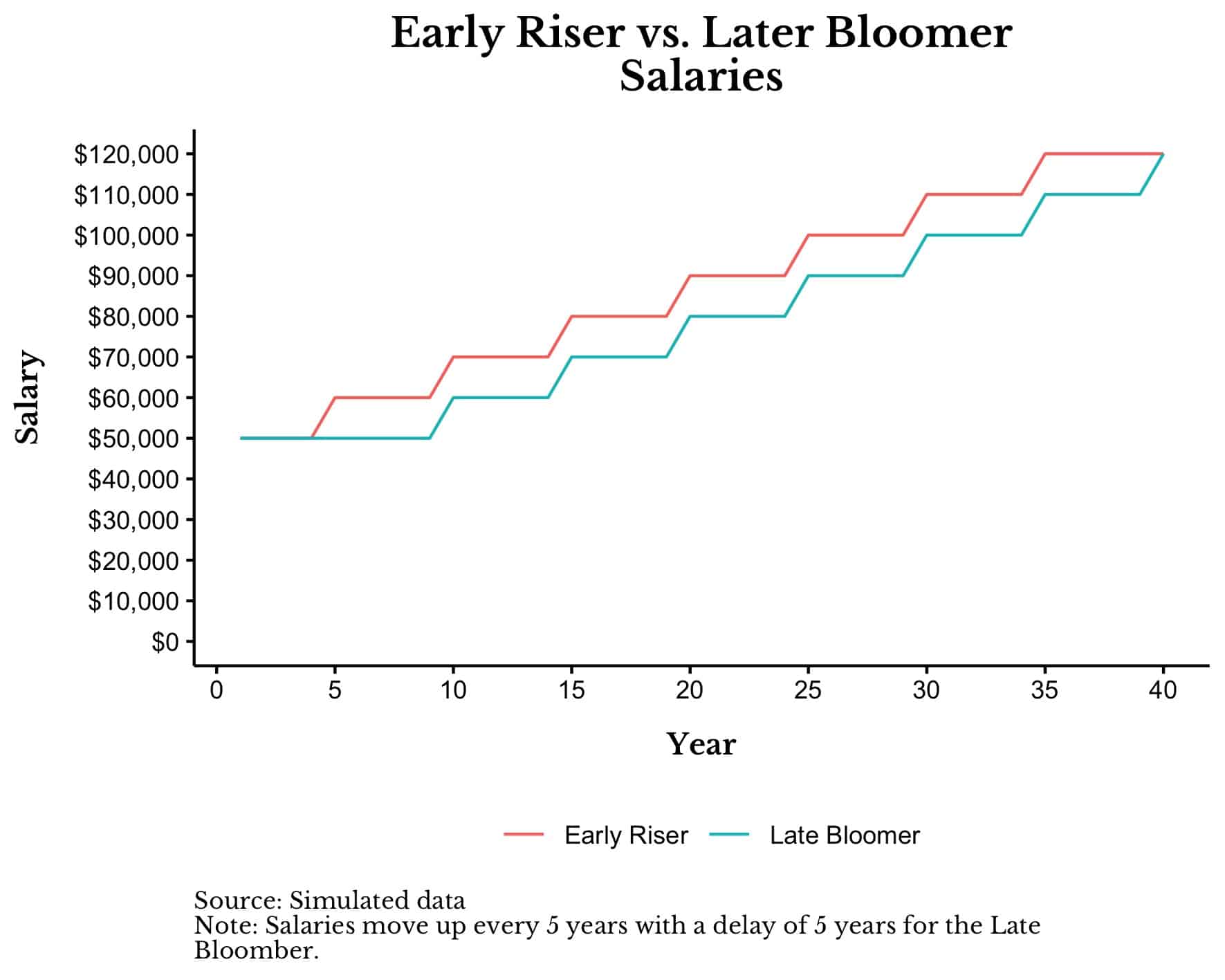

To do this we will consider two people who start their careers at age 25 making $50,000. One of them (the Early Riser) gets their first $10,000 raise after five years (at age 30) and another $10,000 raise every five years until retirement. The other (the Late Bloomer) gets their first raise after 10 years (at age 35) and another $10,000 raise every five years until retirement.

Both of them have the same salary path, except the late Bloomer has their raises five years after the Early Riser does. The purpose of this is to examine how the timing of raises would impact long-term wealth accumulation.

To make sure we are all on the same page, below is a chart showing the salaries of the Early Riser and Late Bloomer over time:

Assuming that both individuals save 15% a year and earn 5% on their money, at age 65 the Early Riser would have $1.35M while the late Bloomer would have $1.21M. In percentage terms the Early Riser ends up with about 12% more money than the Late Bloomer.

This is a decent sum, but still one that is unlikely to have any significant impact on their retirement. I raise this point because it illustrates that being a little delayed in your career isn’t that detrimental to your long term wealth assuming you have the same expected career trajectory.

More importantly, these simulations illustrate that raise size is likely to have a bigger impact on your long term finances than raise timing. Though the compounded advantage of having a raise earlier in your career is nice, it can’t compete with getting a much bigger raise later that allows you to save more money. With that being said, we now turn to our final section which looks at how much of your raise you save and why it’s so important for wealth accumulation.

How Much of Your Raise You Save is Far More Important

So far we have analyzed raise size and raise timing under the assumption that your savings rate remains fixed over time. However, for most people this isn’t true. As people earn more, they tend to save a larger percentage of their income. As a result, we need to examine how much of your raises you save after you get them.

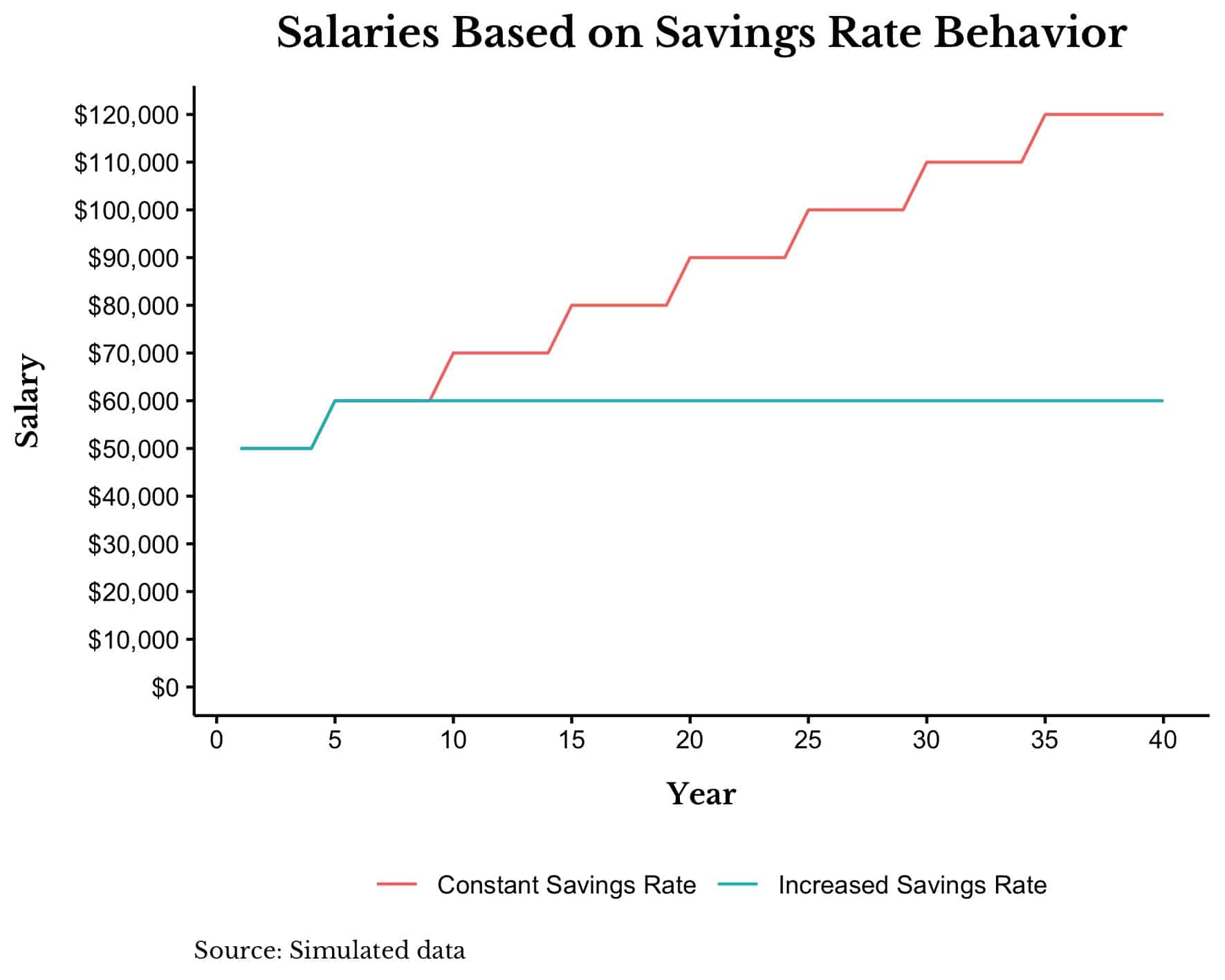

To do this we are going to compare two people at age 25 making $50,000 a year. One of these people will save the same 15% per year while getting $10,000 raises every five years (“Constant Savings Rate”). The other person will save 15% for the first five years, get a one-time $10,000 raise, and save all of that raise every year until they retire (“Increased Savings Rate”). For this individual, saving their entire raise is similar to increasing their savings rate from 15% to 30%.

For visual clarity, here is how the salaries of these two individuals will look like over time:

To clarify, the legend in the above chart is accurate (but might be confusing). The person with the rising salary over time has a constant savings rate while the person who gets the single raise has an increased savings rate (following their raise).

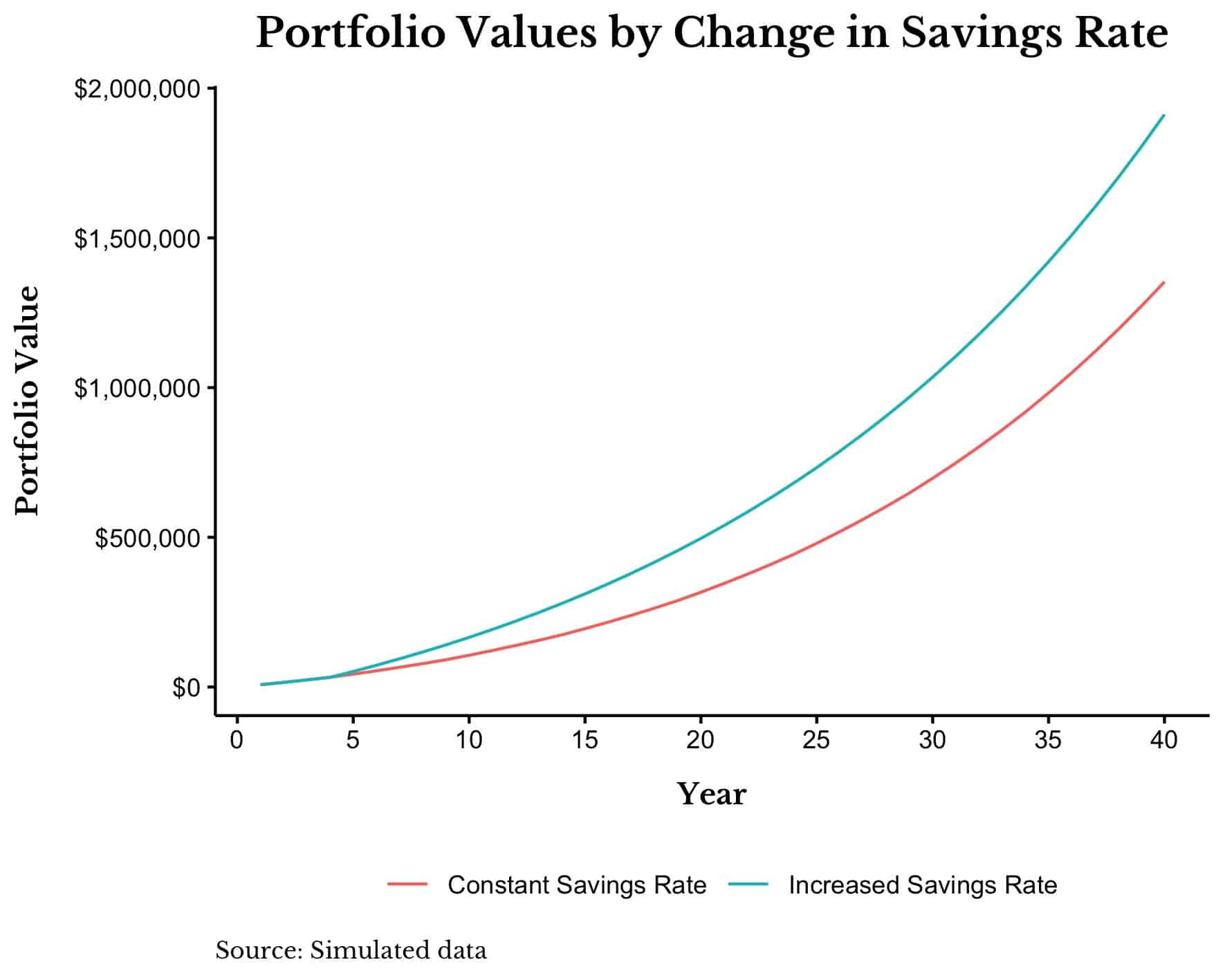

If we were to have them save their money while earning 5% a year for 40 years, this is what their portfolios would look like over time:

As you can see, the person with the lower income but twice the savings rate (“Increased Savings Rate”) does far better than the person who receives more raises but saves a lower percentage of their income (“Constant Savings Rate”). In fact, the person with the increased savings rate ends up with 40% more money by retirement than the person with the constant savings rate and the much higher income.

Of course, the person with the increased savings rate had to make far more monetary sacrifices than the person with the constant savings rate, but this goes to show the importance of how much of your raise you save in comparison to raise size or raise timing.

But don’t take the wrong lesson from this. I am not advocating that you save 100% of your future raises. Though saving 100% of your future raises would maximize your long-term wealth, it probably wouldn’t maximize your long-term happiness or fulfillment.

As I have written before, you only need to save about 50% of your future raises to stay on track financially. This implies that some lifestyle creep is completely fine (and I actually encourage it). While how much of your raise you save is important, don’t forget that you can improve your lifestyle while still building your wealth.

Putting it All Together

When it comes to how a raise early in your career will affect your future finances, the devil is always in the details. Based on the simulations above, here is what I can conclude:

- Raise size matters: Choosing a career with higher expected earnings growth will make it easier to build wealth than one with lower expected earnings growth. If you care about money a lot and you are in a career that doesn’t have those opportunities, find a path to make it into one that does.

- Raise timing isn’t that important: Being a few years behind schedule in a career won’t be that detrimental to your long-term wealth as long as you are on the same general career path as your peers. So if you get passed over for a promotion, it’s not necessarily the end of the world. This is a long game and one raise is rarely a make-or-break moment.

- How much of your raise you save matters the most: The amount you save each year will have a bigger impact on your long-term wealth than raise timing or raise size (to an extent). Of course it is far easier to save money when you are earning more of it, but even if you aren’t, you can always save more of your future raises to counteract this.

While earlier, bigger raises are obviously going to make it easier to build wealth, I wouldn’t necessarily give up if you haven’t gotten them just yet. Careers are more like marathons than sprints. Longevity is far more important than impressing early.

I know this personally after changing careers at age 28 and taking a big pay cut in the process. I basically had to re-build my reputation from scratch and it took time. A lot of that process was posting on this blog, a project I started four and a half years ago. And I’m happy to say that today marks the 250th post.

My life has changed so much since then and I couldn’t be happier with the results. It just takes time, lots of effort, and a little bit of luck. While a raise early in your career is nice, building the career you truly want is so much better.

Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 250. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data