It’s embarrassing to admit, but I didn’t learn to tie my shoes until I was 10 years old. While most children master this simple task by age five or six, I struggled with it for nearly half a decade. And it wasn’t for a lack of trying either. I still remember the shoe-tying mantra like it was yesterday:

Loop, Swoop, and Pull.

Loop, Swoop, and Pull.

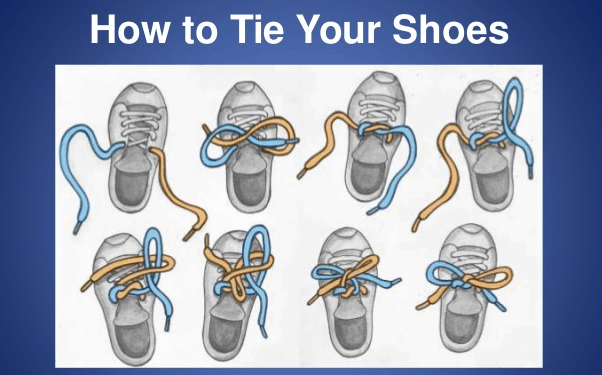

This is the way that the vast majority of children learn to tie their shoes. Visually, the method looks something like this:

Well, I tried “Loop, Swoop, and Pull,” but to no avail. I looped, I swooped, then it all fell apart. This happened over and over again and I just couldn’t get it. No matter how many people tried to show me this method, it didn’t work.

I eventually got so frustrated with trying, that my mother bought me curly shoe laces that looked something like this:

All you had to do was “Pull” and your laces were tight. This solution worked for me and I went on with life.

Then, sometime in 4th grade, something miraculous happened.

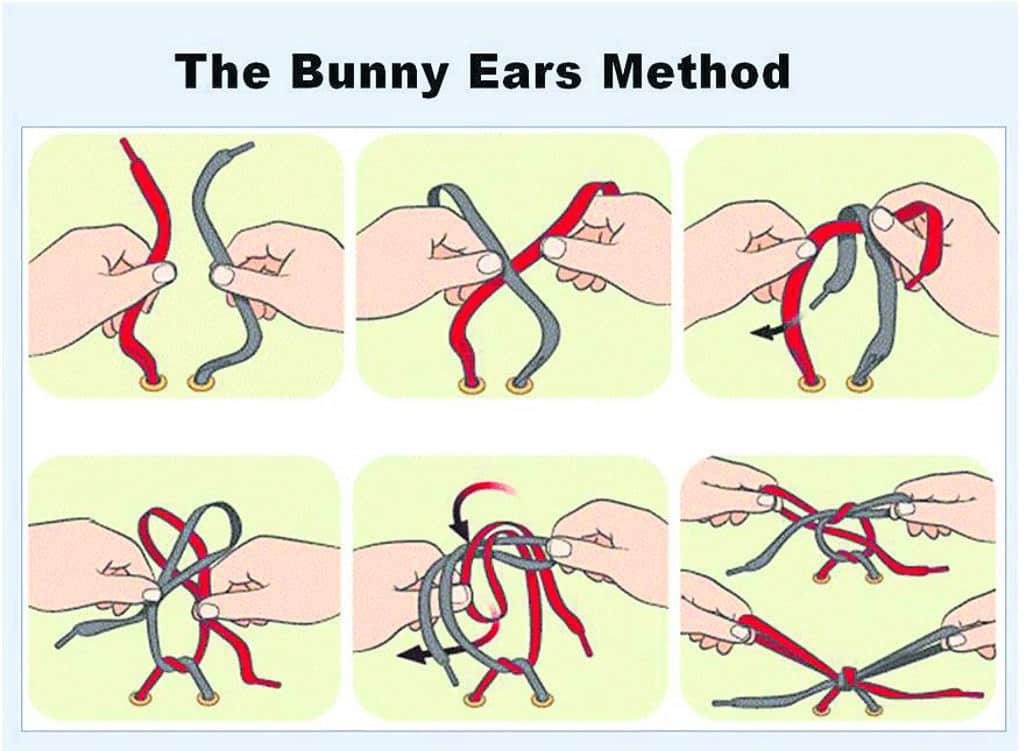

One day this kid named Mark asked me why I had curly shoelaces. I told him the unfortunate truth that I couldn’t tie my shoes. I explained the “Loop, Swoop, and Pull” method just wasn’t for me. He said, “Have you tried the Bunny Ears?”

I replied, “What’s the Bunny Ears?”

Mark said, “Let me show you,” then shattered my shoe-tying reality into a thousand pieces. He taught me something in less than a minute that I still use to this day. I remember how happy I was when it finally happened. All the teasing and feelings of inadequacy disappeared in a single instant. I could just imagine myself saying, “No I don’t need curly shoe laces anymore. I can do Bunny Ears now.”

For the uninitiated, here is what the “Bunny Ears” method of shoe-tying looks like:

Though I find this method much easier than “Loop, Swoop, and Pull,” maybe you don’t. But that’s okay because no one cares all that much about the best method for tying shoes. No one is going to get into a heated argument about Bunny Ears vs. Loop, Swoop, and Pull.

But, if you change the topic of conversation to the best way to govern people, the best way to eat, or the best way to invest, then you will have a fight on your hands. Unfortunately, there is typically no “best way” to do anything in life. Everything has its tradeoffs.

For example, I used to wholeheartedly believed that individual freedom was the highest ideal that a society could strive for. But given everything that has happened with COVID-19, I am not so sure that individual freedom is all it’s cracked up to be.

Consider the case of Vietnam, a country where individuals don’t have the same level of absolute freedom as a typical Western country. As of August 2020, Vietnam has had a little more than 1,000 coronavirus cases and less than 30 deaths despite having a population of 95 million people and sharing a border with China. How have they been so successful at fighting this global pandemic? They put anyone infected with COVID-19 into government-run quarantine centers, among other things.

Do you think they could ever do such a thing here in the United States? Not a chance. If some Americans are complaining about wearing masks, just imagine how they would react after being told to report to a government-run center? Exactly.

Arguing for freedom as the highest ideal in society simply overlooks the costs associated with such freedom. Erich Fromm made this argument in Escape from Freedom where he highlighted some of the downsides of living in a Westernized democracy. I highlight Fromm’s point to reiterate that, like many things in life, the “right” way to do something is in the eye of the beholder. What works for you may not work for someone else, and vice versa.

For example, Jim Simons, the brilliant mathematician behind the most successful hedge fund on Earth, has been known to smoke three packs of cigarettes a day. Does this mean you should? Of course not. As Greg Zuckerman noted in The Man Who Solved the Market:

When asked how someone so devoted to science could smoke so much, in defiance of statistical possibilities, Simons answered that his genes had been tested and he had the unique ability to handle a habit that proved harmful to most.

What works for Simons’ biology probably won’t work for yours.

It’s hard to accept this in a world where we expect there to be a right and wrong answer. Smoking is always bad. Freedom is always good. Well, not always.

This same logic explains why people on a vegan diet and people on a carnivore diet argue so vehemently against each other despite clear evidence that both diets can improve health outcomes. A person on a standard American diet of highly processed foods and sugars is likely to see health benefits when deviating away from this diet regardless of the direction of the deviation. But don’t tell the carnivores and vegans that, many of them are too busy trying to disprove the other side.

If you apply this framework to investing, you can come away with profoundly different insights on what it means to be a steward of capital. For example, I recently discovered that of the 5,586 companies in the world that are over 200 years old, 56% of them are in Japan. Yes, Japan. The laughing stock of the investment world and ground zero to the greatest asset bubble of all time is also home to most of the world’s oldest companies.

And while we may joke about what has transpired in Japanese equity markets over the past few decades, this attitude might just be misplaced perspective. After all, what is a 30-year drawdown to a company that is over 200 years old? Does it really matter that the Japanese Nikkei stands at 22,880 today though it peaked at 38,957 on December 29, 1989? If your goal is profit-maximization, then, yes. But, what if your goal is long-term sustainability and not capital growth for the sake of capital growth? There’s a lesson in that.

Ultimately, all that matters is that you find what works for you. Not what works for your neighbors, not what works for your colleagues, and not what works for your peers. What works for you. Life is in the eye of the beholder.

It’s taken me far too long to realize this despite being literally handed this lesson when I was 10 years old. Because sometimes the world gives you Loop, Swoop, and Pull when what you really needed was Bunny Ears.

Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 200. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data