A little over two years ago, I published Just Keep Buying: Proven ways to save money and build your wealth. Back then, it looked like my timing couldn’t have been worse. The S&P 500 was 8% off its highs and sentiment was deteriorating by the day. When the market reached its lows in October 2022, U.S. stocks were down nearly 25% and all of my haters made sure to remind me of it. They said things like:

“I’ve just kept buying and gotten poorer following this book’s advice.”

“Of course he published a book called ‘Just Keep Buying’ after a 10 year bull market.”

“Now do Japan.”

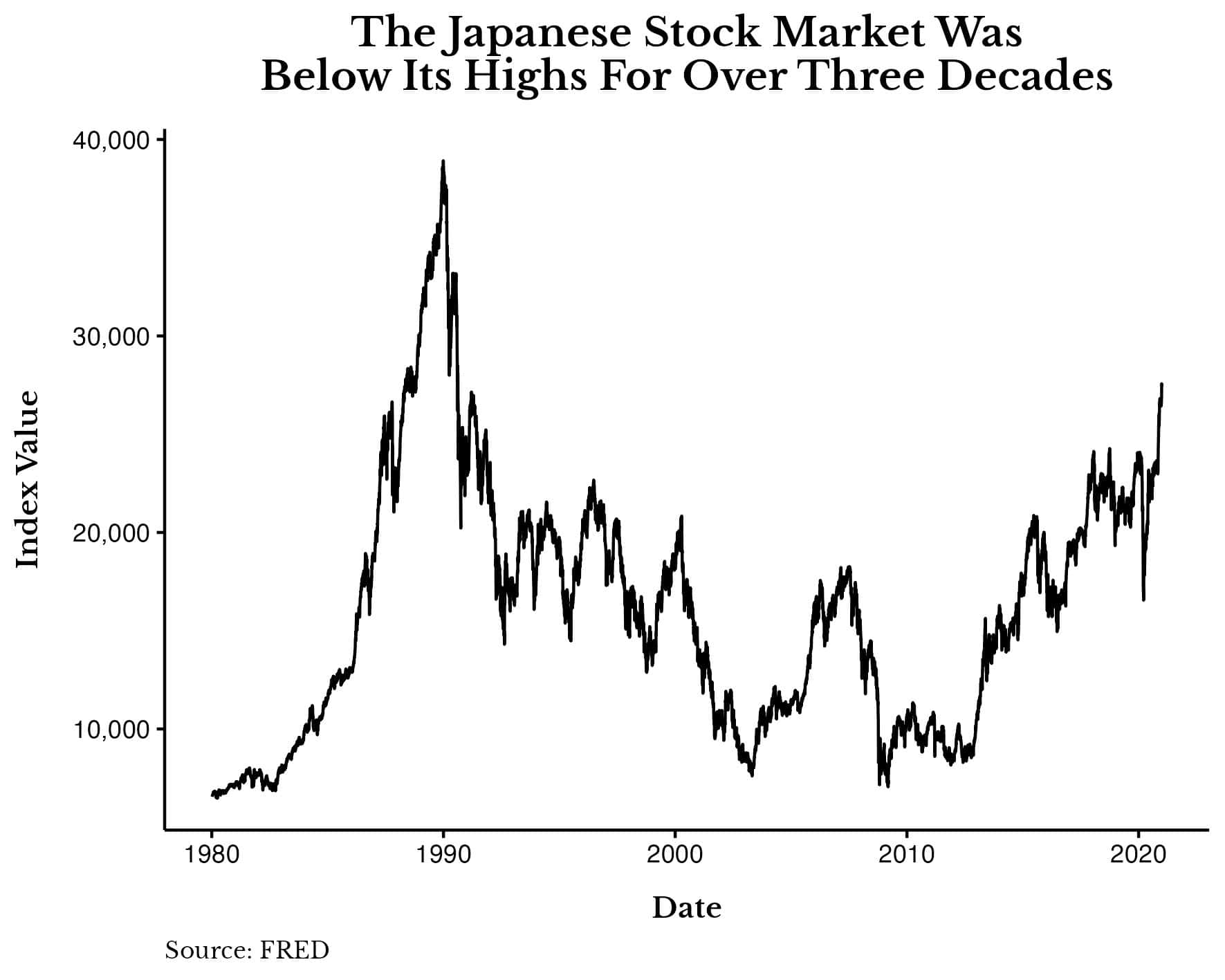

The last comment is a standard in the stock market bear’s playbook. Anytime someone argues that stocks will eventually recover from a decline, the most prominent counterexample is Japan, a country whose equity market crashed and then went sideways for over three decades. When I published Just Keep Buying, Japan’s Nikkei index had been below its 1989 highs for over 30 years:

Looking at this you can see why “Now do Japan” became such a meme for stock market permabears. Every time someone claimed that stocks usually recover, Japan was staring us right in the face. The bears were right to point this out. They were right to demonstrate that markets can take longer to recover than we initially imagine.

However, they were wrong to focus so much on Japan. Why? Because Japan had arguably the greatest asset bubble in history. And you shouldn’t make generalized arguments based on outlier performance.

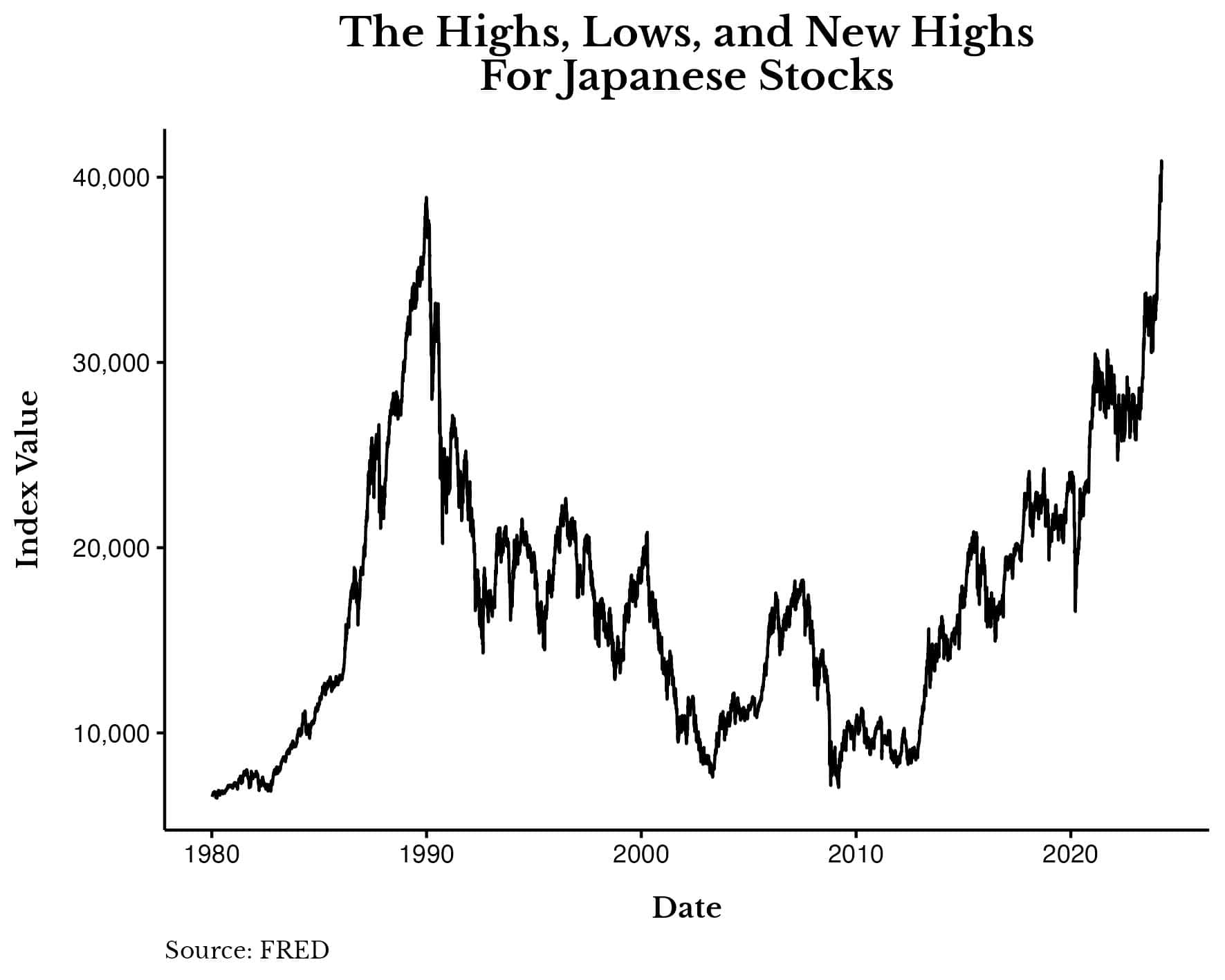

But guess what? None of that matters anymore. If you’ve been following markets lately, you already know that the permabulls have gotten the last laugh. As the chart below illustrates, about two months ago, Japan’s Nikkei index surpassed its 1989 high after 34 years:

Don’t get me wrong, this is a dreadful equity market performance overall. As much as I love celebrating new highs, I don’t want to gloss over how rough this period was for Japanese equity investors.

On the other hand, it’s also true that investing in Japanese equities would have been far less painful for someone who was buying over time. While we like to imagine a hypothetical investor who bought at the 1989 peak and is still holding today, it’s far more likely that someone would have been buying throughout their life.

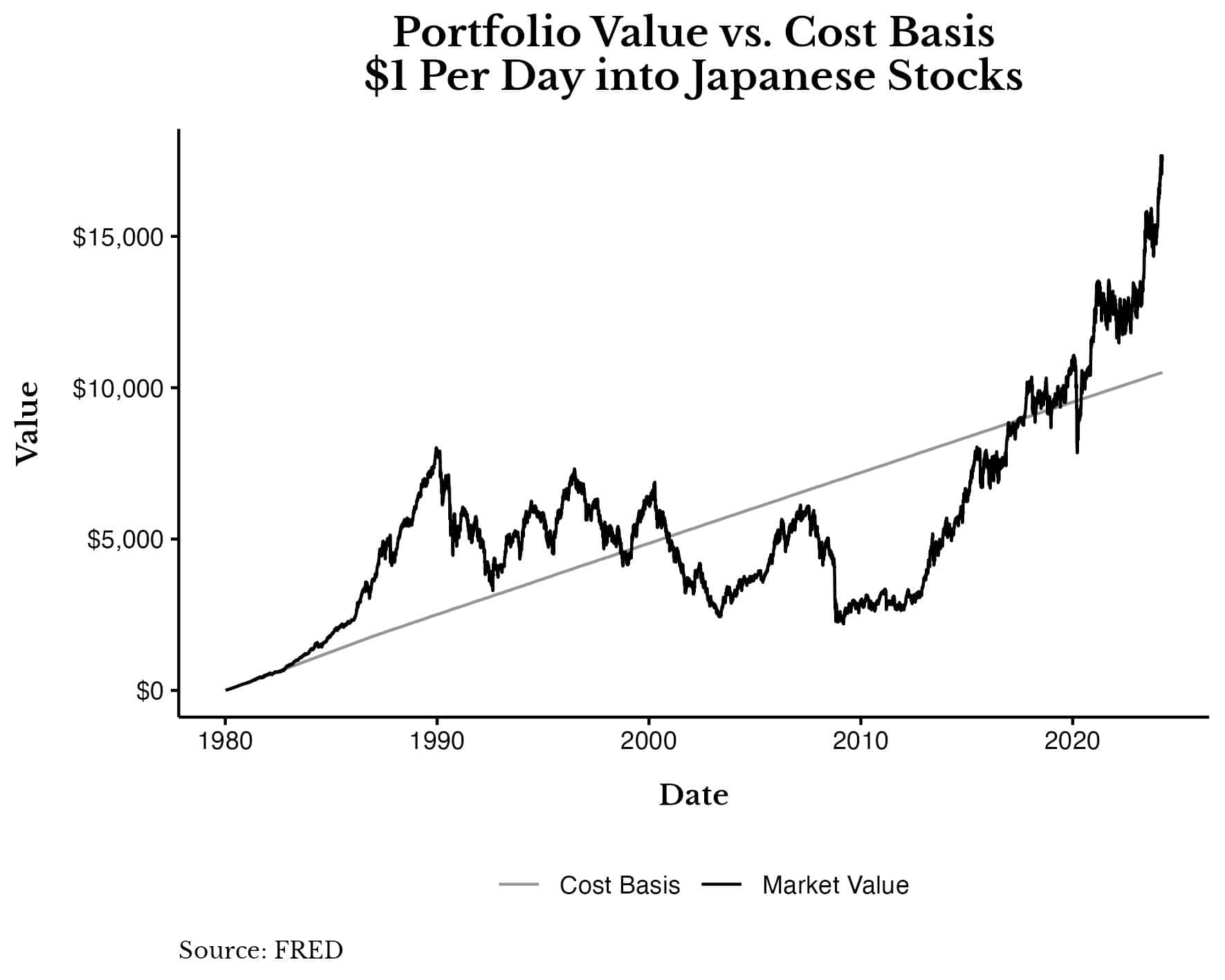

For example, imagine someone who invested $1 per day into Japanese stocks starting in 1980 (in the run up to the 1989 bubble). If they had done so, their portfolio wouldn’t have been underwater following the crash in the early 1990s. In fact, it wasn’t until the year 2000 that their portfolio value would dip below its contributions (aka cost basis):

This demonstrates that, when investing over time, a Japanese investor would have only been underwater from 2000 to 2017, a 17-year period. The rest of the time, it would have (more or less) been in the green. While this outcome isn’t ideal, it’s arguably 2x better than someone who invested at the 1989 peak and had to wait 34 years before seeing a positive return.

This demonstrates the hidden beauty underlying a strategy like Just Keep Buying. Even in one of the worst equity markets in history, someone who bought over time would’ve done okay if they had just stuck with it.

Thankfully, Japanese investors have started to take notice. I recently found out that Just Keep Buying has sold over 80,000 copies in Japan, or roughly 33% more than what it sold in the United States. Yes, I am big in Japan as they say. I remember hearing about metal bands in the 1980s that failed to gain popularity in the U.S., but were “big in Japan” and now I have some idea of what that feels like.

Either way, I’m honored that the idea of Just Keep Buying has taken hold in the one equity market that everyone gave up on long ago. There is a bit of poetic justice in it. Because I remember all the people who called me an idiot or naive or “intellectually undemanding” when I first said Just Keep Buying back in 2017. I heard the same things when the market crashed in 2020 and once again in 2022.

But, somehow, here we are. Stocks are near all time highs (even on an inflation-adjusted basis) and we have record economic activity in the U.S. The strategy works. Buying over time works. It’s not just backtests. It’s not just the Fed. It’s real.

Of course, there will be some future period where we aren’t so fortunate. There will be many years where Just Keep Buying seems to have failed you. I guarantee it. But in those moments you have to remember this one.

Because there will be no shortage of skeptics in the future. There will be no shortage of people telling you that stocks are a bad investment, that they’re too expensive, or that they’re a scam. They’ve been saying stuff like this since the Great Recession in 2008, since Businessweek’s Death of Equities cover in 1979, and far before that.

And guess what? They are saying the same things today. And maybe they’re right. Maybe the conflict in the Middle East will bring about World War III. Maybe AI will take all of our jobs. Maybe the U.S. will collapse under the weight of its financial obligations. Maybe, maybe, maybe.

I don’t know if the naysayers will be right. But, if they are right, they will only be right for a moment. Then their moment will fade and our forward march of progress will continue.

So, you have a choice—do you want to bet on the years where things fail or do you want to bet on the decades where they succeed? I’ve made my decision and have my entire career riding on it. Thankfully, the markets are answering back.

Happy investing and thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 394. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data