The age of cryptocurrency is upon us and Bitcoin is leading the pack. If you don’t know what Bitcoin is, please explain your whereabouts over the last 6 months, or tell me where you keep your cryogenic sleep chamber. My friends, my friends’ friends, and all of the FinTwit (finance Twitter) universe have been ensnared in the jaws of cryptocurrency. As a result, I have decided to do some digging beyond my original Bitcoin post.

However, rather than explain Bitcoin or the blockchain, which Patrick O’ Shaughnessy’s Hash Power podcast has done beautifully, I want to discuss Bitcoin’s investment performance and the role it can play in your portfolio. To start, think about how you would answer the following question:

Does Bitcoin belong in an optimal portfolio?

Yes? No? If so, how much? If not, why not? It’s not easy to answer because you probably haven’t run the numbers. Well, thankfully, I have. Before I give you the punchline, let’s consider what the optimal portfolio actually is in this case:

Imagine it is September 2010. Bitcoin is just budding onto the scene and you have the next 7 years over which to invest. What asset class mix at that time would lead to the highest risk-adjusted return for the next 7 years?

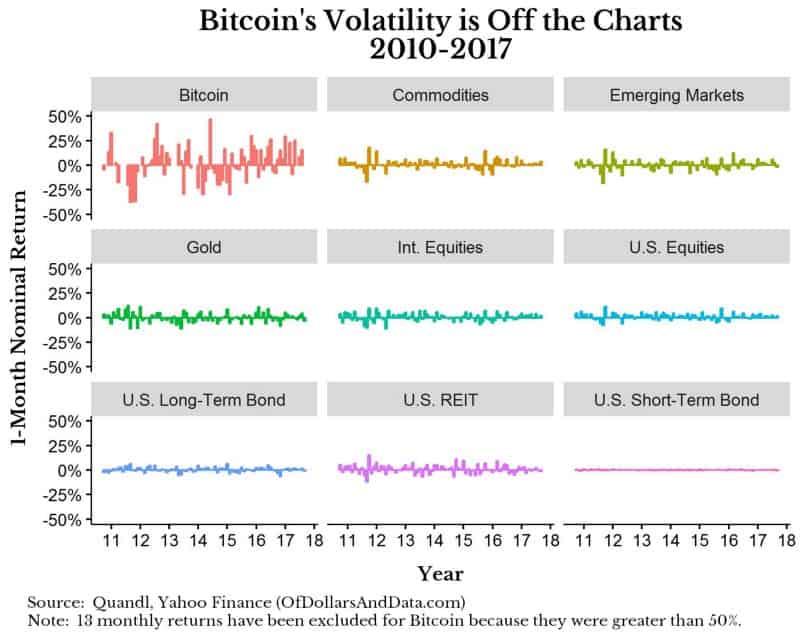

Obviously, no one can know in advance what the optimal portfolio will be, but, given we have historical data, we can figure out what it would have been in hindsight. So, let’s look at asset class returns over the previous 7 years. To do this, consider the 1-month nominal returns on the following asset classes:

What you will notice is that Bitcoin is by far the most volatile asset class of those listed. What is even more striking is that for aesthetic reasons I had to exclude 13 observations for Bitcoin that had a monthly return greater than 50%. Please read that again. A monthly return greater than 50%. This is unheard of for an asset class.

In fact, Bitcoin had an average monthly return of 25% from September 2010 to September 2017 (highest among all assets listed). I understand that this is being heavily skewed by outliers, but its median monthly return is still 7% over this time period. This is crazy when you compare it to the 1.4% median monthly return of the S&P 500 over this same period. I understand that these two returns are not necessarily comparable for a host of reasons, however, the difference is striking.

But the question remains: with its volatility and high average returns, does Bitcoin offer value in the optimal portfolio? The answer is yes. Bitcoin does add value to a portfolio, but only when held in small doses. In other words, a little Bitcoin goes a long way. Specifically, I found that the optimal portfolio over September 2010 — September 2017 contained:

- 54% U.S. Equities (Ticker = SPY)

- 44% U.S. Long-Term Bonds (Ticker = VBLTX)

- 2% Bitcoin

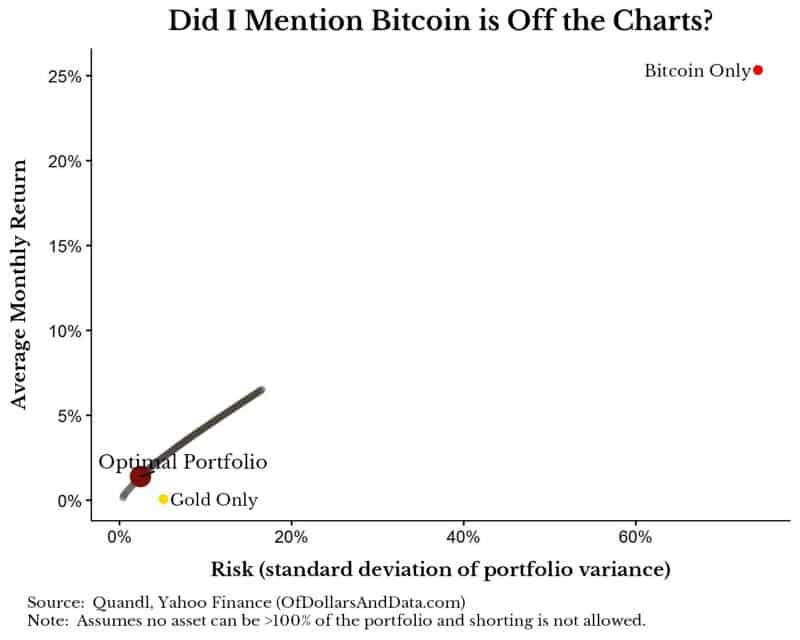

If we were to plot the efficient frontier (monthly return on y-axis and risk on x-axis) we would see Bitcoin is far from the optimal portfolio and unlike all other assets:

When I first saw this I thought I had made a programming error, but no. As I mentioned earlier, Bitcoin has averaged a 25% monthly return since inception. Even if we subset to 2015 and beyond, Bitcoin has had an average monthly return of 10% (or a 8% median monthly return) compared to ~1% for the S&P 500. Additionally, I included the “Gold Only” portfolio in the chart above to illustrate how differently Bitcoin has behaved when compared to Gold. Bitcoin is not the new Gold. It is some other beast entirely.

This chart leads to a bigger question though: why does the optimizer recommend holding such a small amount of Bitcoin in the optimal portfolio? It seems to me like Bitcoin’s volatility has a large negative impact on its inclusion in a portfolio. Therefore, the solver optimizes to include a little bit of Bitcoin for its highly positive returns, without adding much risk to the portfolio. Remember, Bitcoin has grown over 6000x since September 2010, compared with a little over 2x for the S&P 500. Who had the ability to buy and hold Bitcoin over this time period is a mystery to me.

Some Caveats About “Optimal” Portfolios

Before concluding I want to note some caveats about my optimal portfolio analysis.

- Firstly, we only have 7 years of data. This is far from enough to draw any true long term conclusions about an asset’s behavior. While it is true that the distribution of asset class returns shift over time, I would argue that you need over a decade (and ideally 2+ decades) to start to understand the nature of an asset class. This is what makes Bitcoin so wild and intriguing right now.

- Secondly, remember that the optimizer is only as good as its inputs. If we had more data or a different set of assets, the optimizer could give us a completely different solution. This is what makes optimizers so effective and so useless at the same time. It gives us the perfect solution to a problem we aren’t solving for anymore. Or, as Marshall McLuhan famously stated:

We look at the present through a rear-view mirror. We march backwards into the future.

Bitcoin for the the Next 7 Years?

I would be a fool to tell you that I knew where Bitcoin (or any other cryptocurrency) was headed. Maybe it is a big bubble and I am analyzing something as useless as a tulip, or maybe this is the future of permission-less transactions that overthrows entire industries. Either way, I now have some evidence that Bitcoin might be worthy for investors, though in small doses. Remember, this is not me recommending you to go buy Bitcoin or any other cryptocurrency. Do plenty of research and think for yourself before you enter into any position.

Lastly, will we still be talking about cryptocurrencies 7 years from now? I have no idea, but I am excited to see how it plays out. Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 43. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data