Ladies and Gentlemen, I am here to report that we have officially entered Act II of the joke as investment meme cycle. The intermission has ended and now it’s AMC (and not Gamestop) that is at center stage.

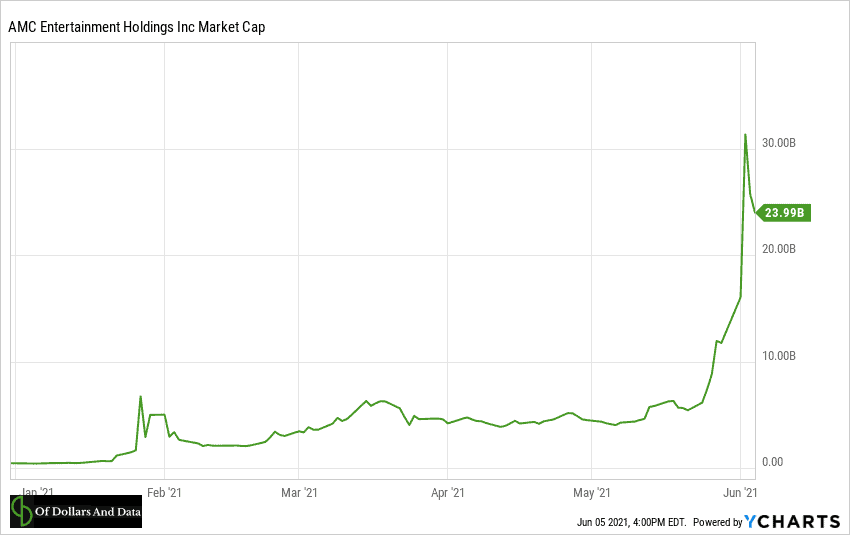

Over the course of the last week, the struggling movie chain saw its stock price surge from $12 to a peak of $70 a share with its market capitalization briefly eclipsing $30 billion. This is 60 times greater than what AMC’s market capitalization was at the end of 2020:

While this is similar to what happened to Gamestop in late January of this year, unlike Gamestop, AMC has done a far better job capitalizing on its time in the limelight. As Matt Levine reported last week, during the frenzy that occurred, AMC raised $587 million through a stock offering. Ironically, the financing acquired through this “joke” may actually help the company to survive.

But the more important question on many investors’ minds right now is: who’s next? Will Blackberry (BB) go to the moon? What about Nvidia (NVDA)? Could Gamestop have another big surge?

These are just some of the inquiries that are making the rounds on the wallstreetbets subreddit that started this movement. While no one knows if we will experience another meme stock rally, my best guess is that this isn’t over yet. As Paulo Coelho wrote in The Alchemist:

Everything that happens once can never happen again. But everything that happens twice will surely happen a third time.

Assuming that there will eventually be an Act III for the meme investors, what’s the most reasonable way to profit off of it? Let’s take a look.

A Better Way to Invest in Meme Stocks?

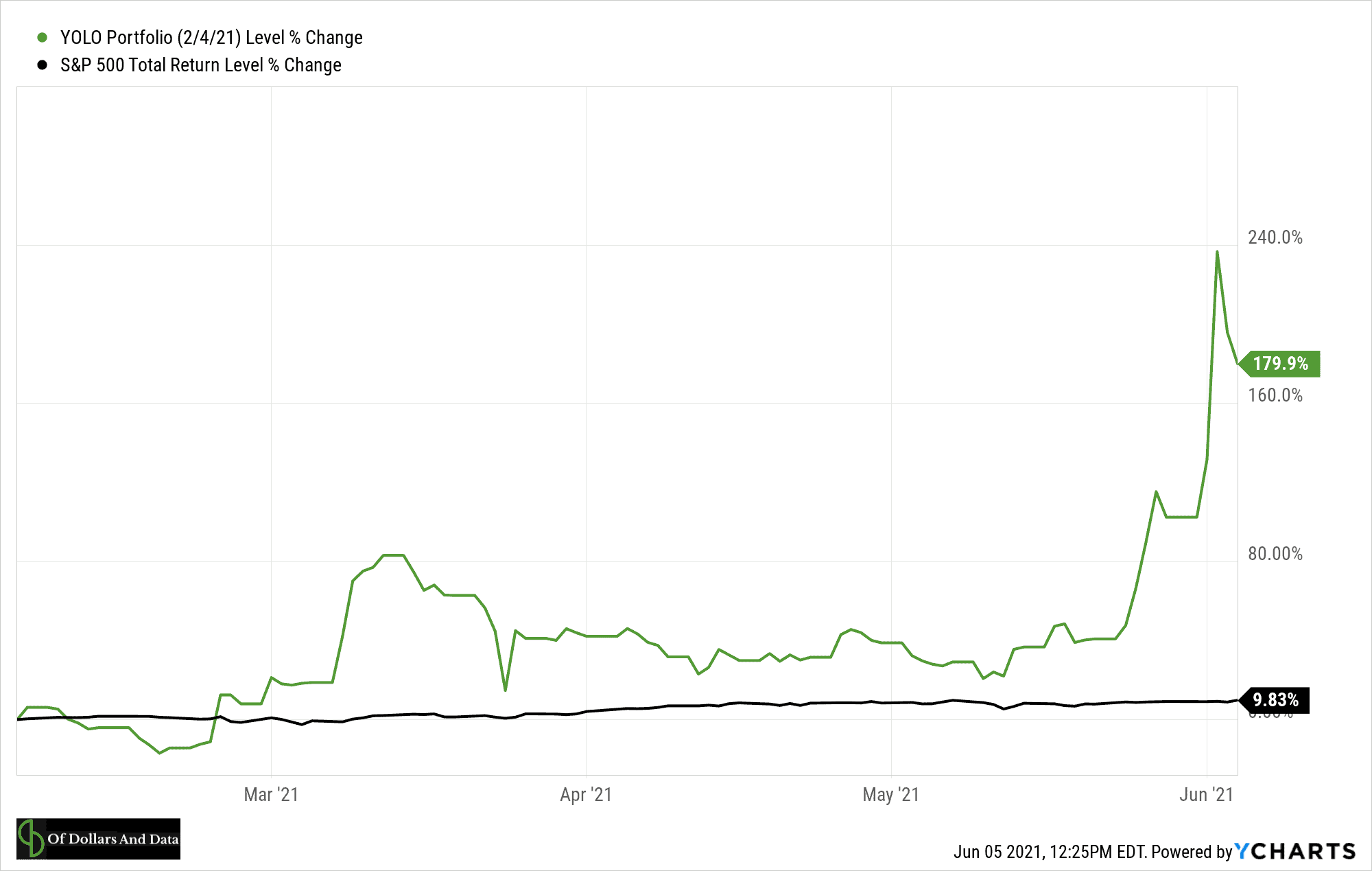

Imagine it’s early February 2021. Gamestop has just come off its first big rally with its price at $53, down from over $300 a share less than a week prior. Wanting to get in on the action, you decide to invest in the five most talked about stocks on the wallstreetbets reddit forum at the time (GME, AMC, BB, TSLA, and PLTR). You split your money equally among the five (20% each) and then wait. How does your portfolio do? Very well.

As you can see from the chart below, from February 4, 2021 through June 4, 2021, this YOLO portfolio would have beaten the S&P 500 by a staggering 170%:

Of course this performance is biased by the most recent AMC rally, but even before this rally, this YOLO portfolio was beating the S&P 500 by 30% as of May 21, 2021.

Seems like a pretty good strategy right? Unfortunately, it’s not that simple. Because the performance of this YOLO portfolio is heavily determined by when you started investing.

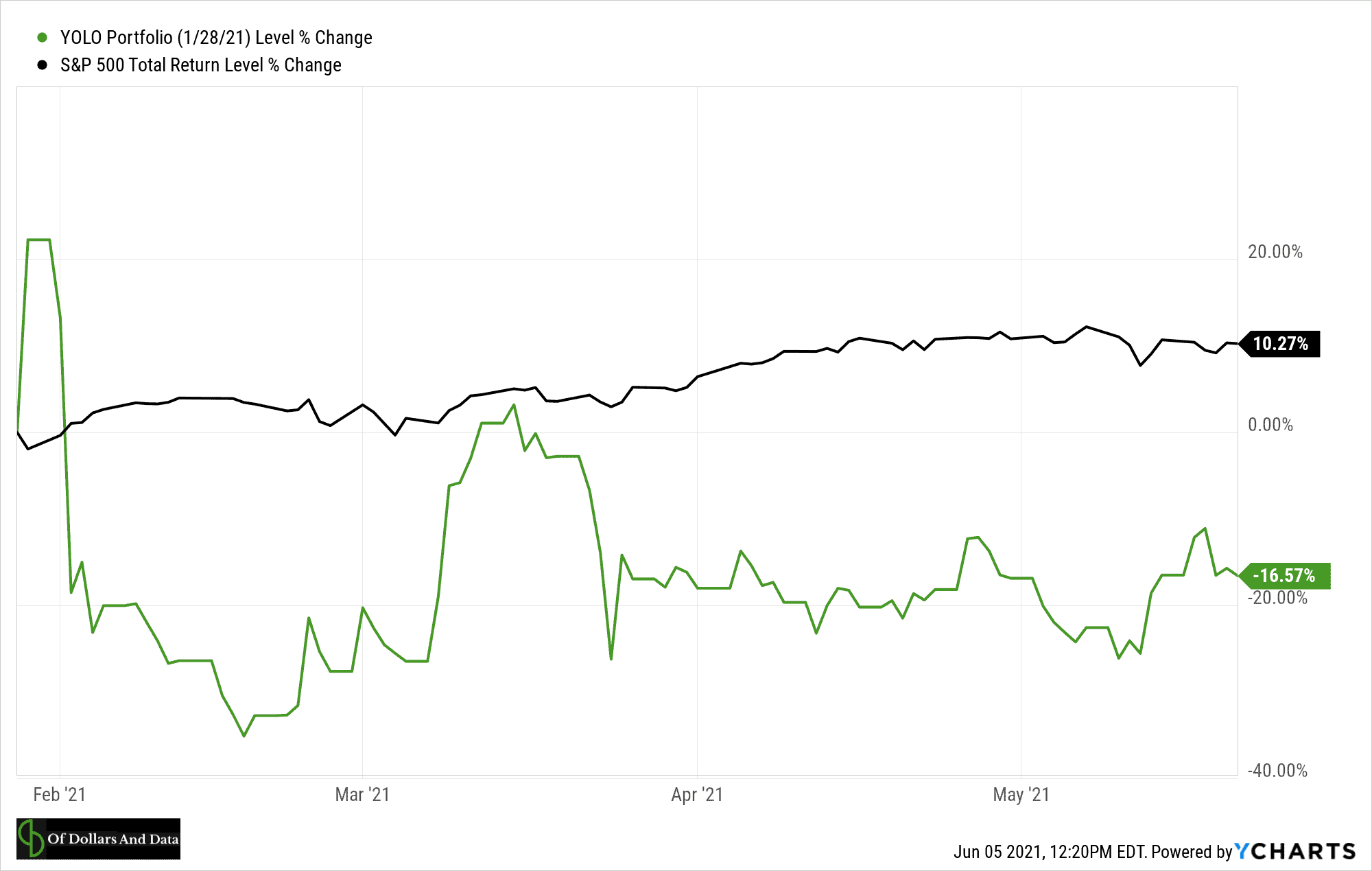

For example, if you had invested in the exact same stocks a week earlier (January 28, 2021) while Gamestop was still in the midst of its first rally, you would have experienced a far different result.

If you plot the performance of the YOLO portfolio against the S&P 500 from January 28 2021 to May 21, 2021, you can see why:

In this case, the YOLO portfolio would have underperformed the S&P 500 by 26% before the most recent rally in AMC. If this recent rally had not occurred, you would have lost out simply because you invested at the wrong time.

This is the main issue with investing in these YOLO stocks—timing luck. Due to the high volatility of the stocks in this portfolio, most of the performance comes down to when you got in. Unfortunately, since AMC (and other meme stocks) are currently in another rally, implementing the YOLO portfolio now may be similar to doing so around January 28, 2021 when these stocks were in an elevated state.

Is there a way to counteract this timing luck? Consider investing your money over time rather than putting it in right away. While this strategy is suboptimal for broad indices, for highly volatile individual stocks, averaging-in can provide a psychological boost that could help you minimize any future regret. While I generally don’t recommend investing in individual stocks, if you want to participate in this movement, averaging into a diversified set of the most discussed stocks on wallstreetbets is probably the way to go.

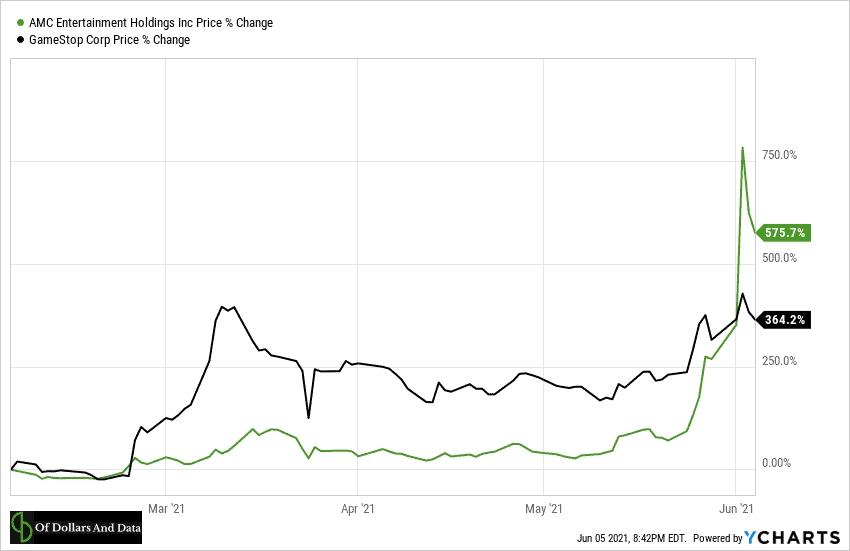

Why? Because the rewards (so far) have outweighed the risks. Just consider the performance of AMC and GME since February 4, 2021 (following the first GME rally and crash):

Since both of these stocks are up 4x-6x, they can easily offset any losses elsewhere in the portfolio. For example, if you have one stock that goes up over 300%, six of your other stocks can get cut in half and you would still make money. This is why having one big winner like GME/AMC can make up for a lot of these tiny losses and then some. It’s this asymmetric reward that makes me think that such a strategy can be profitable in the near term.

Of course, no one knows if we will see another GME/AMC-like event among retail investors, but my take is that this movement isn’t going away anytime soon. While I originally thought that the rise of wallstreetbets was a passing fad, now it seems to be a more permanent part of the investing culture. If you agree, then it seems likely that it’s only a matter of time before another retail-fueled buying frenzy sends one of these meme stocks surging upwards.

Which one? And when? I have no idea. However, by diversifying and averaging-in to your positions, you increase the chance of having some success without having to make such predictions. You can play the game in a far more responsible way, without putting your financial future at risk.

I will be the first to admit that this kind of strategy won’t work forever. There will come a time when wallstreetbets will no longer be the force that can send individual stocks to the stratosphere. Until then, happy investing and thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 245. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data