I recently saw an interview of Magic Johnson where he talks about one of the most important financial choices of his career. After winning the NBA championship in 1980, Johnson was offered sponsorship deals from Converse, Adidas, and Nike. While Converse offered the most money, Phil Knight, the head of Nike, told Johnson that instead of cash, he could give him shares of Nike.

Johnson, not knowing much about stocks at the time, took the Converse deal. After all, money talks.

But, when Johnson ran the numbers years later, he realized that the Nike stock he turned down would be worth nearly $5 billion today, or 8x his current net worth:

Johnson’s story is familiar to anyone who’s ever sold a stock too soon or passed up an opportunity that went on to experience explosive growth.

I made this mistake many years ago when I only bought one Bitcoin at $8k (to later sell half of it at $52k). I “knew” I should’ve bought more, but I didn’t. You probably have a story of “the investment that got away” as well.

However, I’m here to tell you that this kind of thinking is a mirage. It’s pure fantasy. Because the way you think things would’ve turned out is not the way they actually would’ve turned out. How you imagine an experience is a theoretical exercise. It’s a mental simulation of your past. But, how you live through that experience in real-time tends to produce very different results.

For example, imagine I could turn the clocks back to 2020 and buy 10 Bitcoin (instead of the 1 I did buy) at $8,000 each. Given I sold half of my Bitcoin holdings at $52,000 in 2021, this means that my “mistake” of not buying more Bitcoin cost me $198,000 in realized gains [4.5 Bitcoin*($52k-$8k)] and $76,500 in unrealized gains [[4.5 Bitcoin*($25k-$8k)] I would still have today. That’s $275,000 I missed out on.

But, this is me looking back today with perfect hindsight. It’s not real.

Do you know what actually would’ve happened had I bought 10 Bitcoin in 2020 at $8,000? I would’ve sold all of it when it hit $16,000 in late 2020. After all, why not lock in a $100,000 gain in a few short months? It would’ve been irresponsible for me not to sell it.

So my mistake isn’t $275,000, but closer to $75,000 (at best). In reality, I probably would have sold even sooner than $16,000. All that volatility would’ve driven me out long before I had a six figure gain.

It’s easy to imagine how our financial lives would’ve turned out had we sold this or bought that. But, when you go through the motions of living it, you will see that things wouldn’t necessarily turn out as planned.

This is true for you as it is for Magic Johnson. Johnson sees his foregone Nike deal as a $5 billion mistake. However, for all we know, he might have sold some (or all) of his Nike stock well before it was ever worth $5 billion. If not to pay for his lifestyle, then possibly because of Nike’s price volatility.

Johnson can only imagine taking the Nike deal today because he knows that Nike turned out alright. But he wouldn’t have known that back then. He is cursed by the privilege of knowledge.

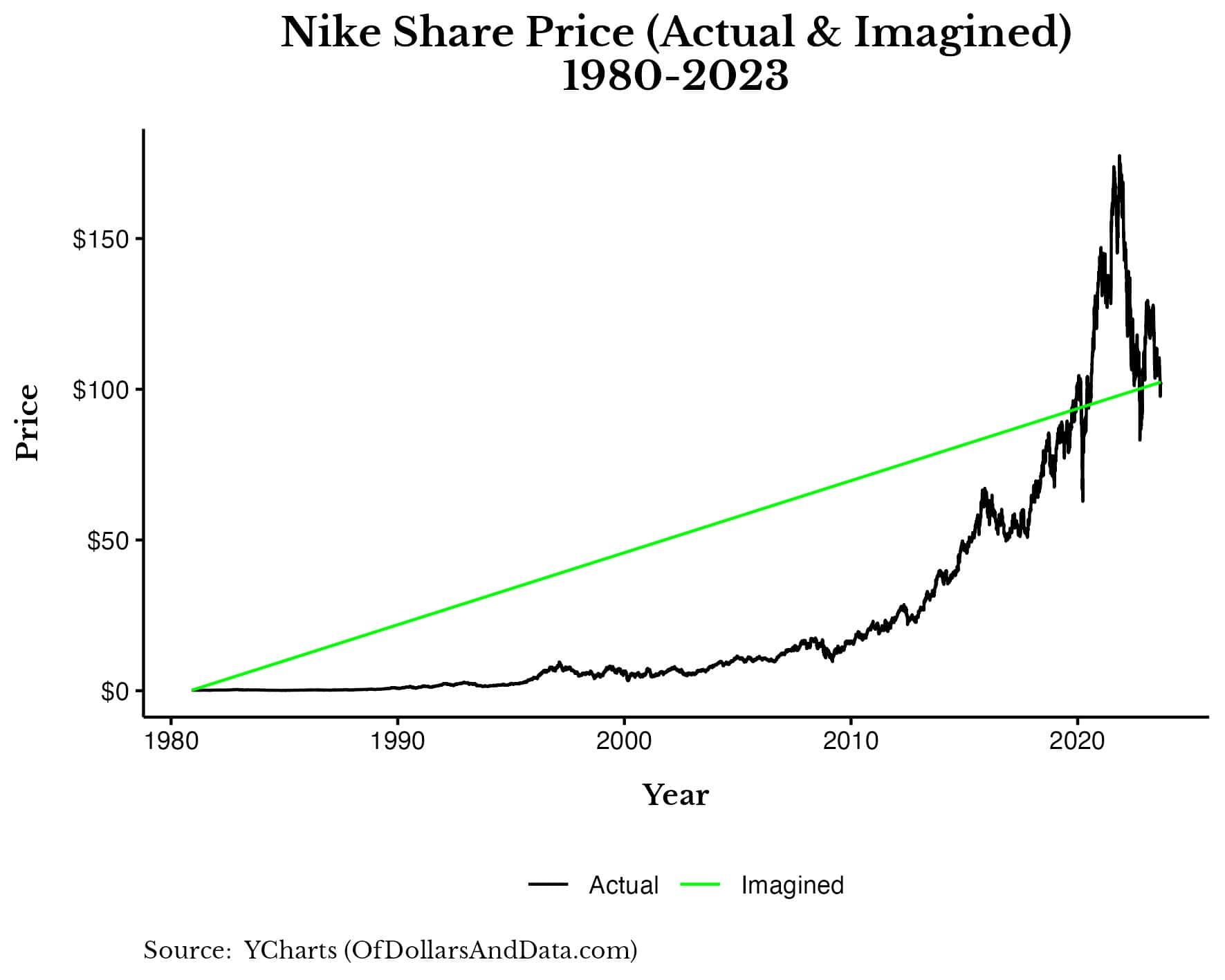

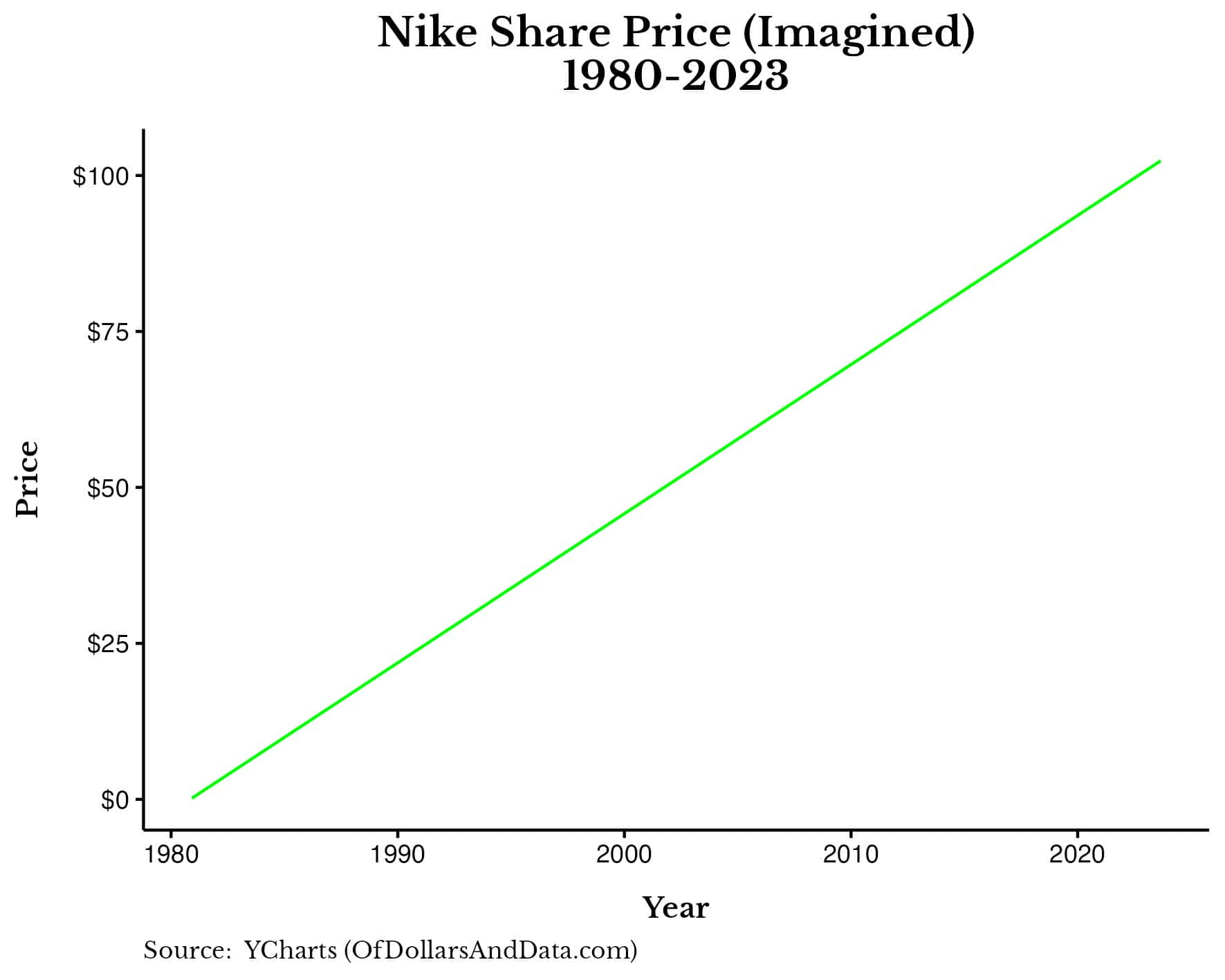

We can demonstrate this visually by imagining Nike’s stock price (split-adjusted) from late 1980 to today with a constant linear growth rate:

This is how Johnson might imagine what it would’ve been like to hold Nike from 1980 until now. Just smooth sailing all the way to $5 billion.

This is how Johnson might imagine what it would’ve been like to hold Nike from 1980 until now. Just smooth sailing all the way to $5 billion.

But, this isn’t at all what it felt like in real-time. Below is a chart of Nike’s actual stock price over this time period with the imagined growth (from the prior plot) included as well:

As you can see, the path to over $100 a share wasn’t so straight and narrow.

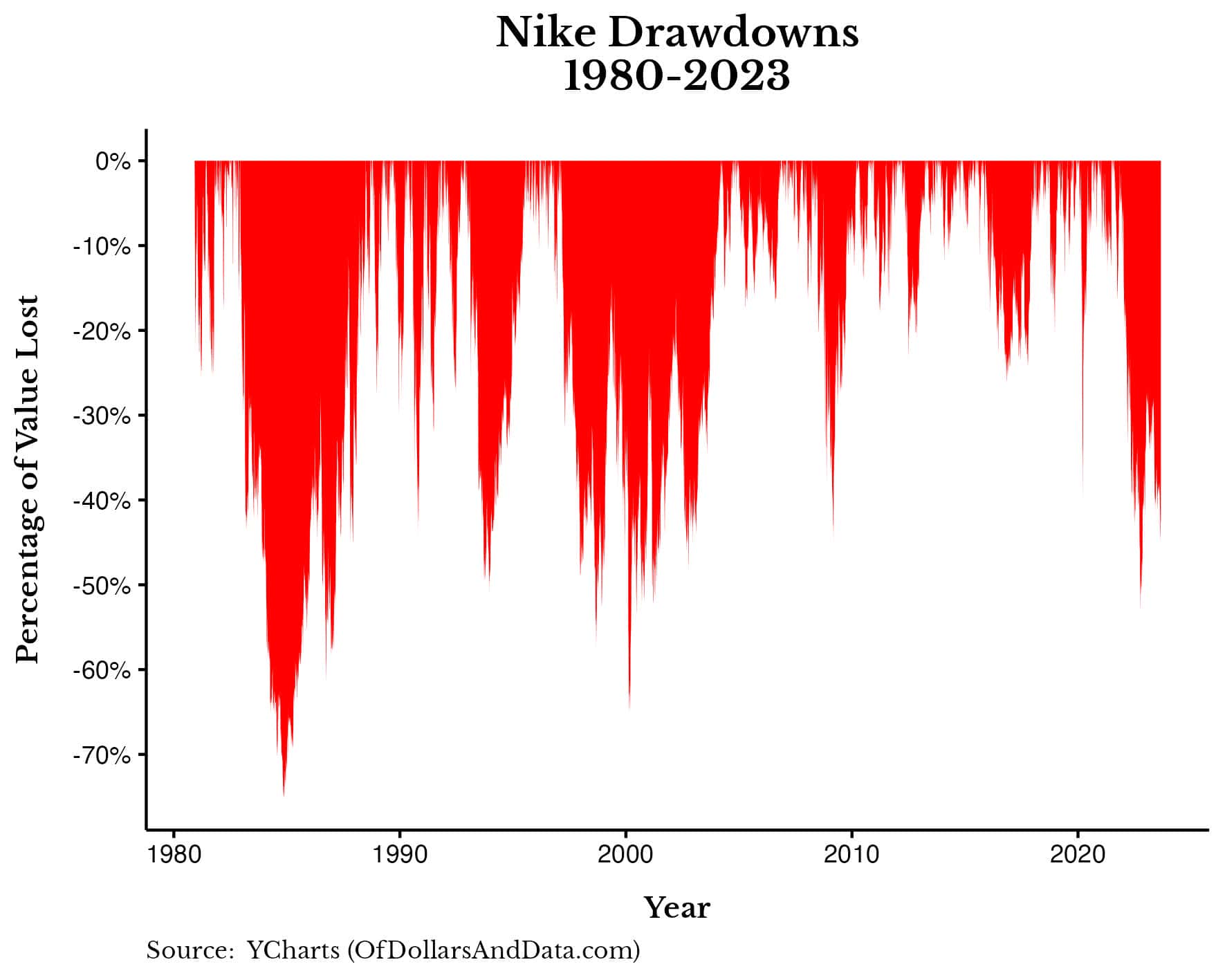

In fact, when we plot the drawdowns in Nike’s stock price since 1980 we see that its price was cut in half on four separate occasions:

Now put yourself in Johnson’s shoes and imagine you took the Nike deal back in 1980. Within four years, your precious equity from the not-yet-legendary Phil Knight is down 40% and over 70% off its all-time highs. Think about how that would feel. Imagine the doubt you would have about your own judgement and the future of Nike. Of course you should have taken the Converse deal. What were you thinking?

This thought experiment demonstrates how easy it is to fantasize about the money that you could’ve made. But, it applies to every facet of your life as well. That job you should’ve taken? That person you should’ve married? They’re all decisions that you’ve selectively sterilized to fit your idea of perfection.

Unfortunately, in doing so, you’ve ripped away all of life’s rich complexity. You’ve taken away the ups and downs and replaced them with a straight line. But, as you know, this isn’t how life works. Life is filled with challenge, risk, and volatility. Yet, living in the past removes all of that. It smooths the edges of existence until existence ceases to exist.

The irony in all of this is that Magic Johnson should be the last person on Earth to regret not taking the Nike deal. A few years after contracting HIV in the early 1990s (when HIV/AIDS was far more lethal), Johnson was able to get on an experimental drug treatment a year and a half before it came into widespread use. Without that treatment, who knows whether Johnson would still be here today.

It reminds me of a recent tweet I saw from Morgan Housel:

Bad luck is easy to identify when you fail and good luck is easy to ignore when you succeed.

This is why you should never look down the road not taken. Because that road never leads to where you think it should.

Thank you for reading.

If you liked this post, consider signing up for my newsletter.

This is post 362. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data