When George Washington died in 1799, he didn’t know about dinosaurs. In fact, no one did. The first dinosaur bone was technically discovered in New Jersey in 1787, but its significance wasn’t recognized at the time and the bone was eventually lost.

A few decades later in the 1820s, Gideon Mantell came across dinosaur bones in England, but got little credit for his findings. It wasn’t until 1841 when Richard Owen, a rising star in paleontology, coined the term dinosauria, meaning “terrible lizard”, that dinosaurs began to enter the mainstream.

While it might seem shocking to you how ignorant many of our ancestors were, it’s only surprising because we have something they don’t have—the privilege of knowledge. Just think about how many things you do on a daily basis that rely on discoveries from the last two centuries:

- You wake up to an alarm. November 18, 1883 was the first time in U.S. history that clocks were standardized across the country with the creation of Eastern Standard Time (EST).

- You take a shower to stay clean and prevent the spread of germs. The first person to prove that diseases could be caused by microorganisms (i.e. germs) was the Italian entomologist Agostino Bassi in the early 1800s.

- You grab food out of your refrigerator. Though Fredic Tudor was shipping ice cut from the lakes of New England to the Caribbean in 1805, the first refrigerator for home/domestic use wasn’t invented until 1913 by Fred W. Wolf Jr.

And I could go on. The fact is that all of these innovations, and many more, happened after Washington’s death in 1799. And while it might be easy to see how much the world has changed in the last two centuries, it isn’t as easy to see how much the investing world has changed without digging into market history.

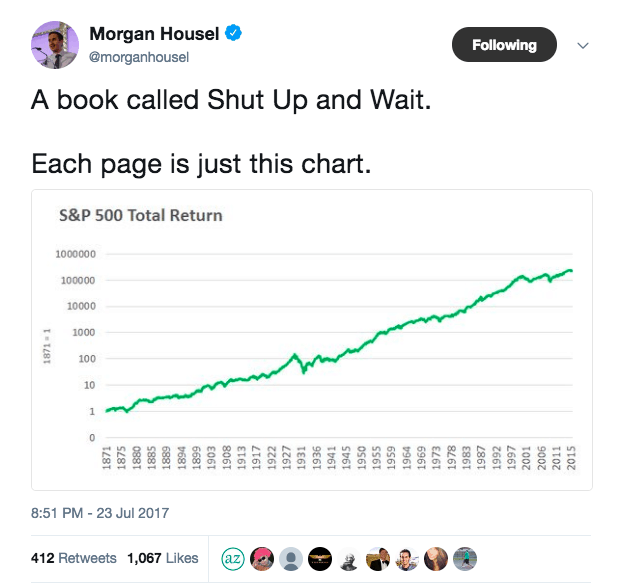

Finance bloggers, myself included, fall victim to the privilege of knowledge as well. Just consider this incredible tweet by Morgan Housel:

His point is obvious: those who bought and held a basket of U.S. stocks would’ve been handsomely rewarded over time. However, though buy and hold might seem obvious now, that’s only because we have the benefit of hindsight, ubiquitous data, and modern computational resources. A century ago, who had access to anything remotely this useful? No one.

People didn’t have the documented market history and technological capabilities we have today, so why should we have expected them to “buy and hold” back then? If anything, their history was riddled with banking panics and far more instability, so I can’t blame them.

For example, from 1871-1940, the U.S. stock market grew at a rate of 6.8% a year after adjusting for dividends and inflation. No investor in 1940 could’ve know this, because the data going back to 1871 wasn’t compiled by Robert Shiller and his colleagues until 1989. Even worse, of the few diversification options available many had high transaction costs (i.e. sales loads/fees).

Remember, less than 4% of stocks have accounted for the all of the wealth creation in the U.S. stock market (above U.S. Treasuries) since 1926. Cheap diversification is a recent luxury.

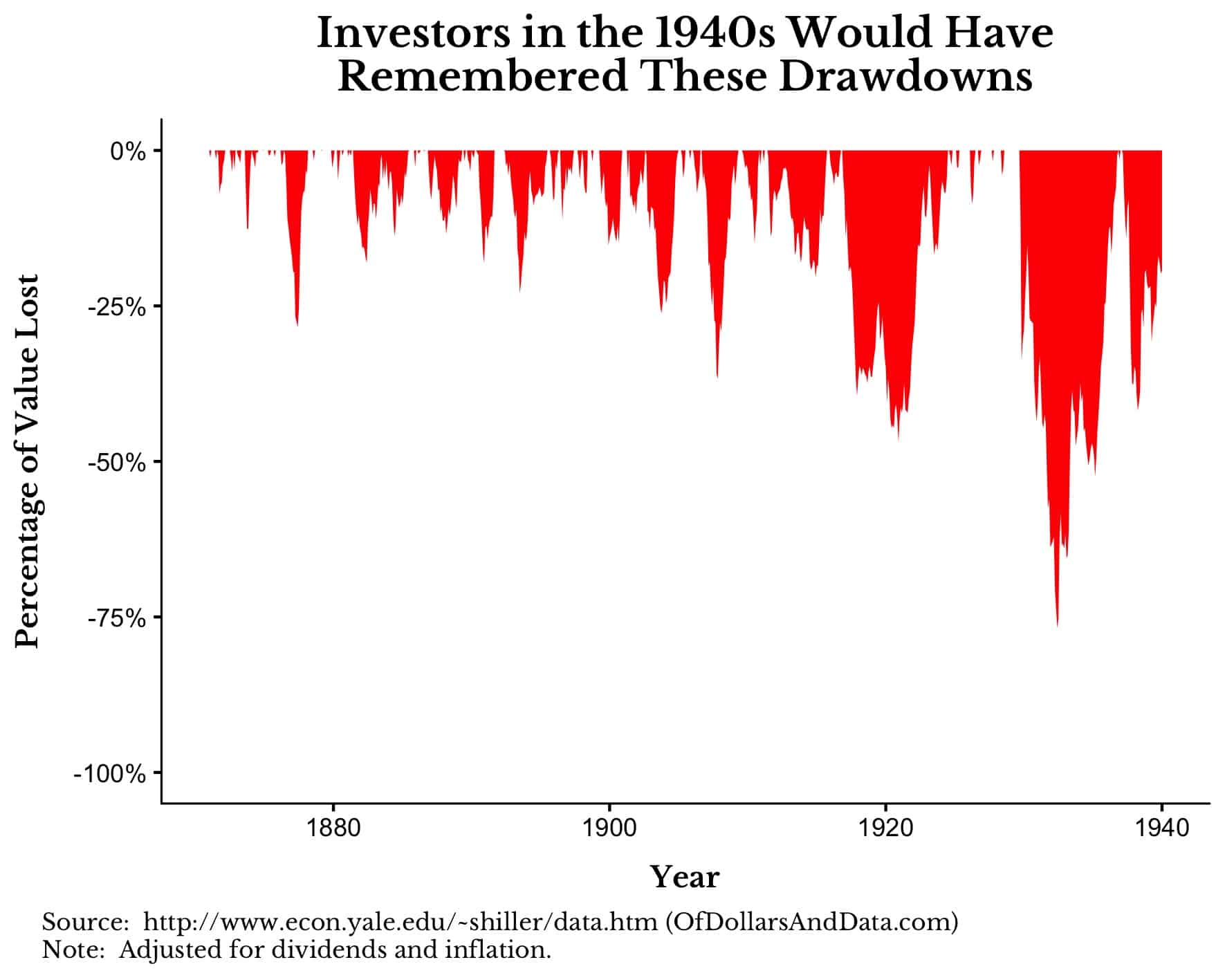

So what did investors in 1940 rely on when making investment decisions? Mostly narratives and emotions. Many of them remembered the market trauma of the 1930s as highlighted in the incredible book The Great Depression: A Diary by Benjamin Roth. Examining the plot of U.S. stock drawdowns since 1871 illustrates why:

I bring up this point to reiterate that we shouldn’t take market history for granted, because most investors never had such a detailed history to rely on.

This is why grabbing data from 50 years ago and making statements like, “If you had bought X…”, is all market fantasy. The investment world has changed so much in the last half century that many historical comparisons are useless.

Even in the last few decades our research abilities have improved immensely. Jim O’Shaughnessy once told me that it took him a year working full time in the mid 1990s (using a custom built computer with 2 CD ROM drives) to finish all of the data crunching for What Works on Wall Street. With today’s computational resources it could be done in a few months or less.

Even something as obvious now as the importance of global equity returns may not have been as apparent until Triumph of the Optimists was first published in 2002. The data is getting better and we are getting better at analyzing all of it.

The fact is, before modern technology, people simply didn’t have the information to make the same investment decisions as you and I. Our investment ancestors had to be more emotional in their approach because what other choice did they have?

At least today we can say that we use data to make investment decisions. Whether or not we actually follow the data and stick to our plan is another story altogether.

The Curse of Knowledge (It Will Never Be Easy)

You might be thinking, why does any of this matter to me? Because though our investment knowledge is a privilege, it can also be a curse.

Remember, investing is a game that is based on the preferences and information of other participants. If the other participants have learned things from market history such as “The market goes up in the long run” or “Buy the dip”, then your job as an investor didn’t get any easier though you have more knowledge.

If everyone knows to buy the dip, then they may use that knowledge to stay invested longer, possibly irrationally propping up markets. Obviously, this is conjecture on my part, but just because you know more doesn’t mean your investment journey is going to be easier.

The only thing that will always be true in investing is that risk and reward are intrinsically linked. If you reduce risk, you give up reward.

I don’t see how that will change now, in the next month, or in the next millennium. With the rise of cheap, diversified investing options, you might think that investing has gotten too easy compared to the past, but this isn’t necessarily true. The risk we have reduced as a result of cheap diversification will show up somewhere else.

Maybe, behaviorally, the next panic will be that much harder to hold through than what we would have expected. I don’t know for sure, but nothing comes for free.

We live in the best era in history to be an investor, but that doesn’t mean it will be easy. It will never be easy. Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 79. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data