In late February 2019 I attended a live Masters in Business taping between Barry Ritholtz and the famed investor Howard Marks. During the Q&A session, an architect in the crowd asked Marks:

How do you know where you are in the market cycle without paying attention to macroeconomics?

The end of Marks’ response was phenomenal (see 1 hour in to this video):

You have to understand that there are no physical laws at work in investing. And the future is uncertain, and vague, and random. And psychology dominates.

Richard Feynman said, “Physics would be much harder if electrons had feelings.” You come in the room, you flip up the switch, and the lights go on. Every time! Why is that?

Because the electrons flow from the switch to the lights. They never flow the other way. They never go on strike. They never fall asleep. They never say, ‘Ah today I don’t feel like flowing from the switch to the light.’ That’s physical science.

You have to understand the distinction between your field [architecture] and the field of investing, where there are no laws. There are only tendencies.

Marks’ comment highlights how there are no secret laws at work in markets. X will not always cause Y. Old patterns break, new patterns emerge, then those patterns break. Rinse. Repeat.

Just consider the case of Long Term Capital Management and their observation that interest rate spreads normalized. They believed that this was a law of the markets and estimated that the most they could lose in a single day was $35 million.

Why? Because they never expected spreads to go beyond a certain range for a certain amount of time. It couldn’t happen because it had never happened before.

However, after spreads failed to normalize on a Friday in August 1998, LTCM lost $553 million, 10x greater than their worst case scenario. Markets are truly lawless.

But, this doesn’t mean that markets don’t have “tendencies.” So, what are these tendencies? I’ve looked at the data (for equity markets in particular) and have a few hunches:

Stocks Will Provide Long-Term Positive Returns

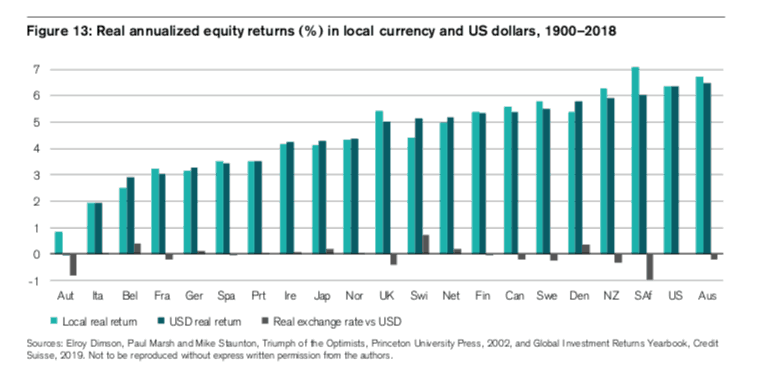

The historical evidence illustrates that equity markets around the globe have provided long-term positive returns to investors. Credit Suisse recently released their annual Global Investment Returns Yearbook which highlights this:

As you can see, across 21 developed markets there have been generally positive inflation-adjusted equity returns. While these returns have varied across countries, the vast majority of them are in the 3%-6% range. There is no law stating that equities must have positive real returns going forward, but there is a tendency towards this.

Higher Returns Do Not Come Without Volatility

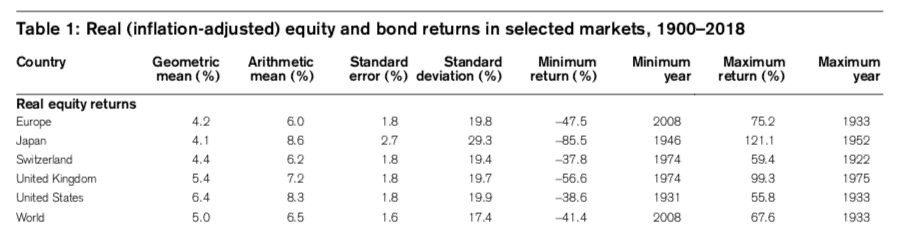

While the above chart suggests that you can put your money in stocks and sleep tight, the reality is far more punishing. Going back to Credit Suisse report we can see just how badly some of these markets crashed throughout history:

What stood out to me was how all the stock markets above experienced at least one an annual decline of at least 37%. More importantly, world equities, which represent a diverse set of countries, declined by 41% in 2008.

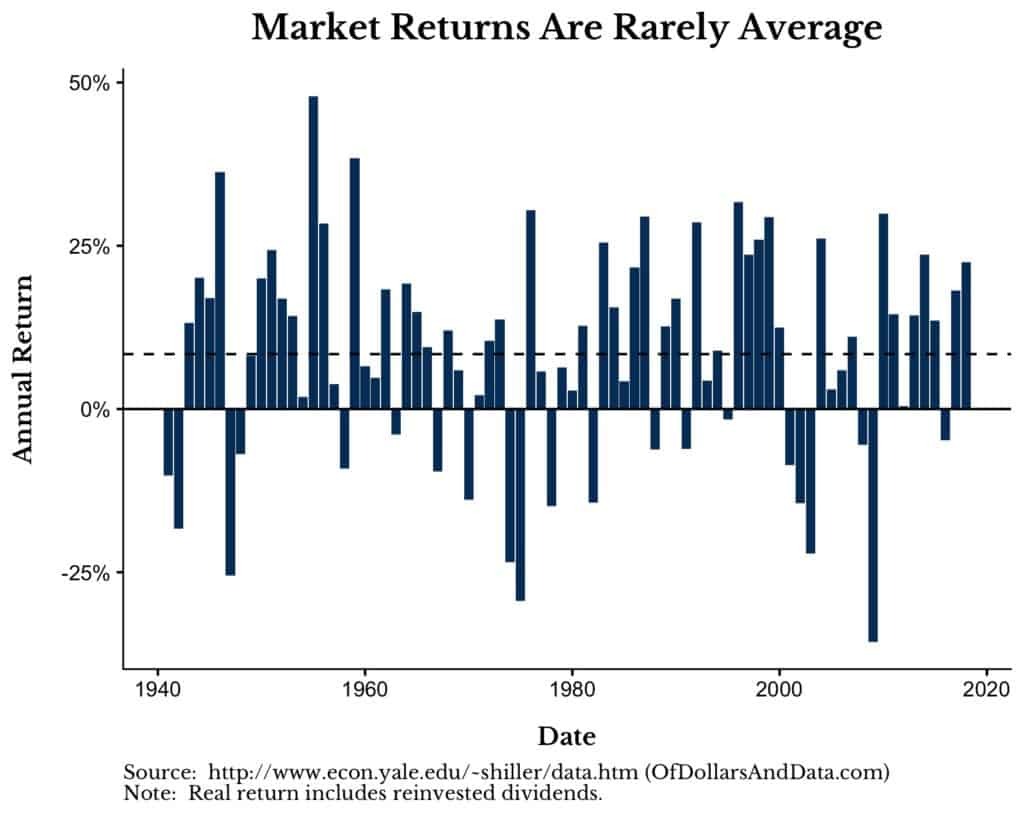

This is true because markets are volatile. If we look at the annual real returns (with dividends) for the S&P 500 since 1940 we can see this clearly (Note: the dashed line is the average real return over this period):

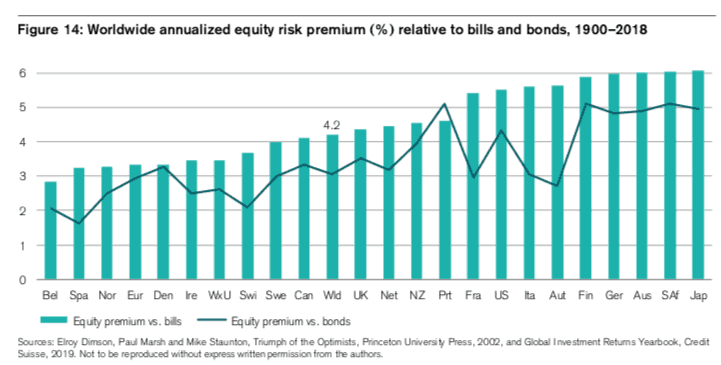

Large crashes and volatility help explain why equities have a positive real long-term return. You are being compensated for taking risk. You can see this by examining the positive equity risk premium across a sample of countries from 1900-2018 (once again from the Credit Suisse report):

Once again, there is nothing written in the stars that suggests that equities have to return above bonds or bills. In fact, there will be periods where they will underperform. However, there has been, and will likely continue to be, a positive return premium to investing in global stock markets. The growth you obtain from these markets you pay for by stomaching the volatility.

Markets Occasionally Crash and Recover

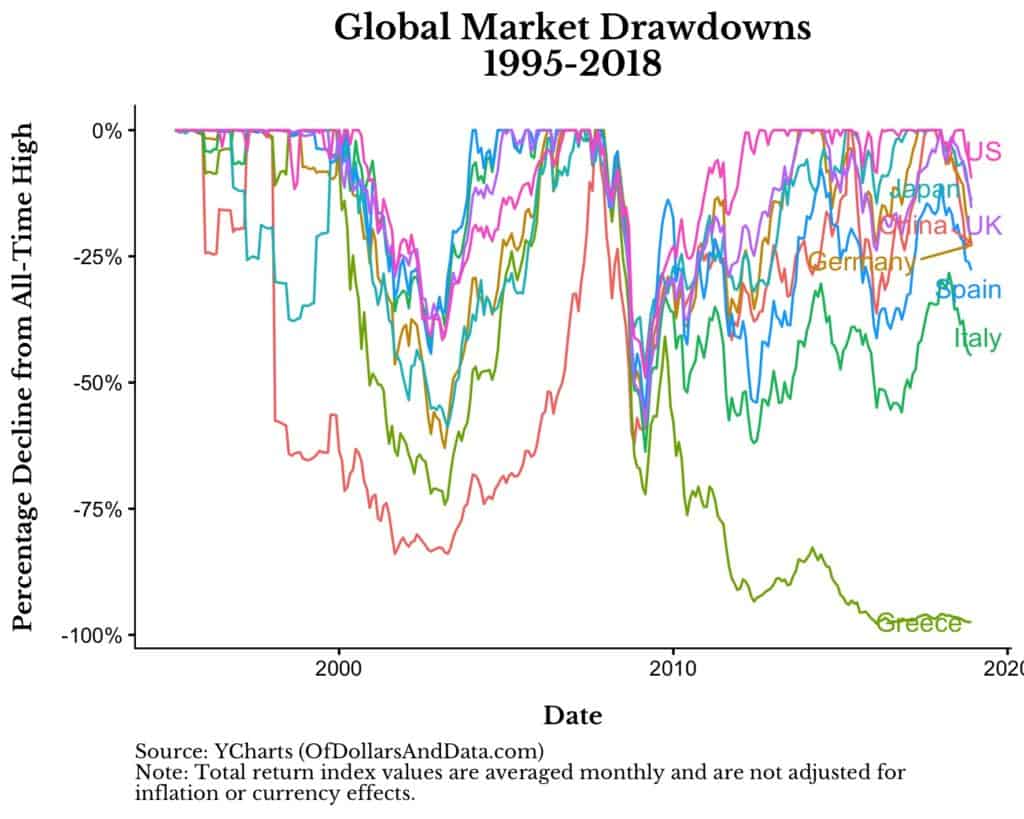

As I have shown before here and here, markets crash from time to time, but then they recover:

But, this is not a law, only a tendency. Just ask Greek equity holders since 2008 or Japanese equity holders since 1989. Market crashes happen because of a shift in investor psychology. Many times this shift is warranted, but other times the market is oversold and a recovery becomes inevitable.

Cheap Stocks and Rising Stocks Tend to Outperform The Rest

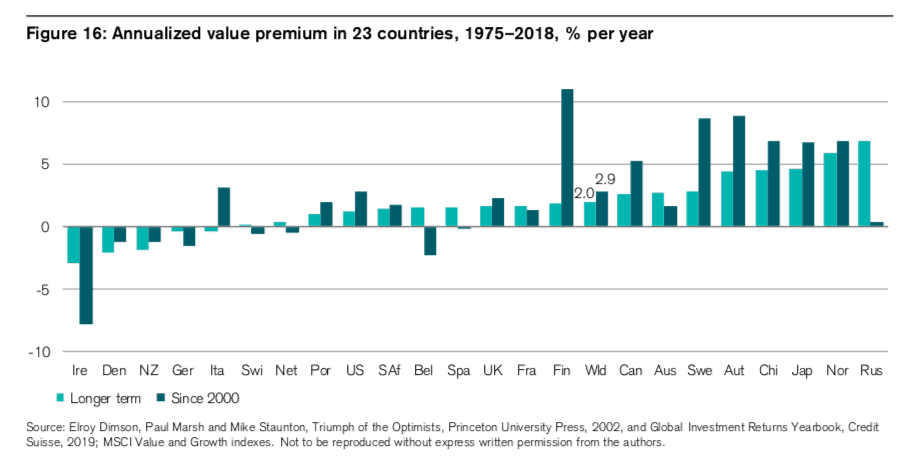

Though stocks in aggregate tend to do well over the long run, cheap stocks (i.e. value) and rising stocks (i.e. momentum) tend to do even better. You can read Corey Hoffstein’s Two Centuries of Momentum, Clifford Asness’s Value and Momentum Everywhere, or go back to Credit Suisse Global Investment Returns Yearbook and you will see evidence of this:

Though value hasn’t worked everywhere all of the time, it has a tendency to work often enough. No matter where you look, those stocks that seem cheap and those stocks that have been recently rising are likely to outperform all the others. Maybe this tendency is dead, but I wouldn’t bet against the two most persistent stock market factors ever discovered.

The Only Law in Investing

You can use all the numbers, tables, and data visualizations you want, but you still won’t be able to quantify the only law in investing: everything is determined by your own behavior. Everything comes back to how you react to information. This isn’t about numbers, it’s about psychology.

It’s about how you react to losing 10%, 20%, 30%, etc. It’s about how you control your emotions on the upside and the downside It’s about imaging an event outside of the parameters of your experience. This isn’t easy, but it is necessary.

I agree that some of your investment success will be out of your control, but most of it is in your control. While you can’t choose your returns, you can choose how you react to them. This is the only law that truly matters. Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 114. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data