It was July 1, 1858 when the idea of evolution by natural selection was first presented to the scientific world. The work was a joint effort between Charles Darwin and Alfred Russel Wallace, both of whom had independently formulated their theories on evolution over prior decades. I know you’ve heard of Darwin and you may have heard of Wallace, but how about Patrick Matthew?

Matthew, a Scottish horticulturalist, had come up with his own theory of natural selection in the appendix to On Naval Timber and Arboriculture in 1831, over 25 years before the joint work of Darwin and Wallace. Despite this, Matthew never fully developed or publicized his ideas and is typically forgotten from the record of history.

I don’t tell this story to disparage Darwin’s fame or to suggest plagiarism on anyone’s part (Darwin deserves a majority of the credit because his ideas were the most developed). I tell it because it illustrates a phenomenon that has repeated itself over the centuries. Newton and Leibniz both invented calculus in the mid-1600s. Carl Wilhelm Scheele, Joseph Priestley, and other 18th century chemists all separately discovered oxygen.

And the list goes on. This concept is known as multiple discovery and explains how three men from the same part of the world independently came up with an idea that changed the way we view life itself. Steven Johnson describes multiple discovery in more detail in How We Got to Now (emphasis mine):

Most discoveries became imaginable at a very specific moment in history, after which point multiple people start to imagine them. The electric battery, the telegraph, the steam engine, and the digital music library were all independently invented by multiple individuals in the space of a few years.

In the early 1920s, two Columbia University scholars surveyed the history of invention in a wonderful paper called “Are Inventions Inevitable?” They found 148 instances of simultaneous invention, most of them occurring within the same decade. Hundreds more have since been discovered.

Johnson’s argument is that broader societal trends influence how we think and act in the world, which explains how multiple discovery events can occur. However, this idea isn’t limited to just invention and scientific revelation, but can also be found in business success. As Charles Slack states in Hetty: The Genius and Madness of America’s First Female Tycoon:

Jim Fisk, whose notorious financial schemes made him the embodiment for the term “robber baron,” was born in 1834, seven months before Hetty. Fisk’s partner, Jay Gould was born in 1836. Steel magnate Andrew Carnegie was born in Scotland in 1835. J.P. Morgan, the financier and banker who would buy Carnegie’s company (over a golf game) to form the colossus U.S. Steel, was born in 1837. John D. Rockefeller, the muscle and brains behind Standard Oil was born in 1839.

Is it just chance that the most famous businessmen and women of the Gilded Age were born within half a decade of each other? Or did they all get swept up in an era that resulted in more income accumulation than any point in American history? Maybe it was coincidence or maybe it was…the right place, the right time.

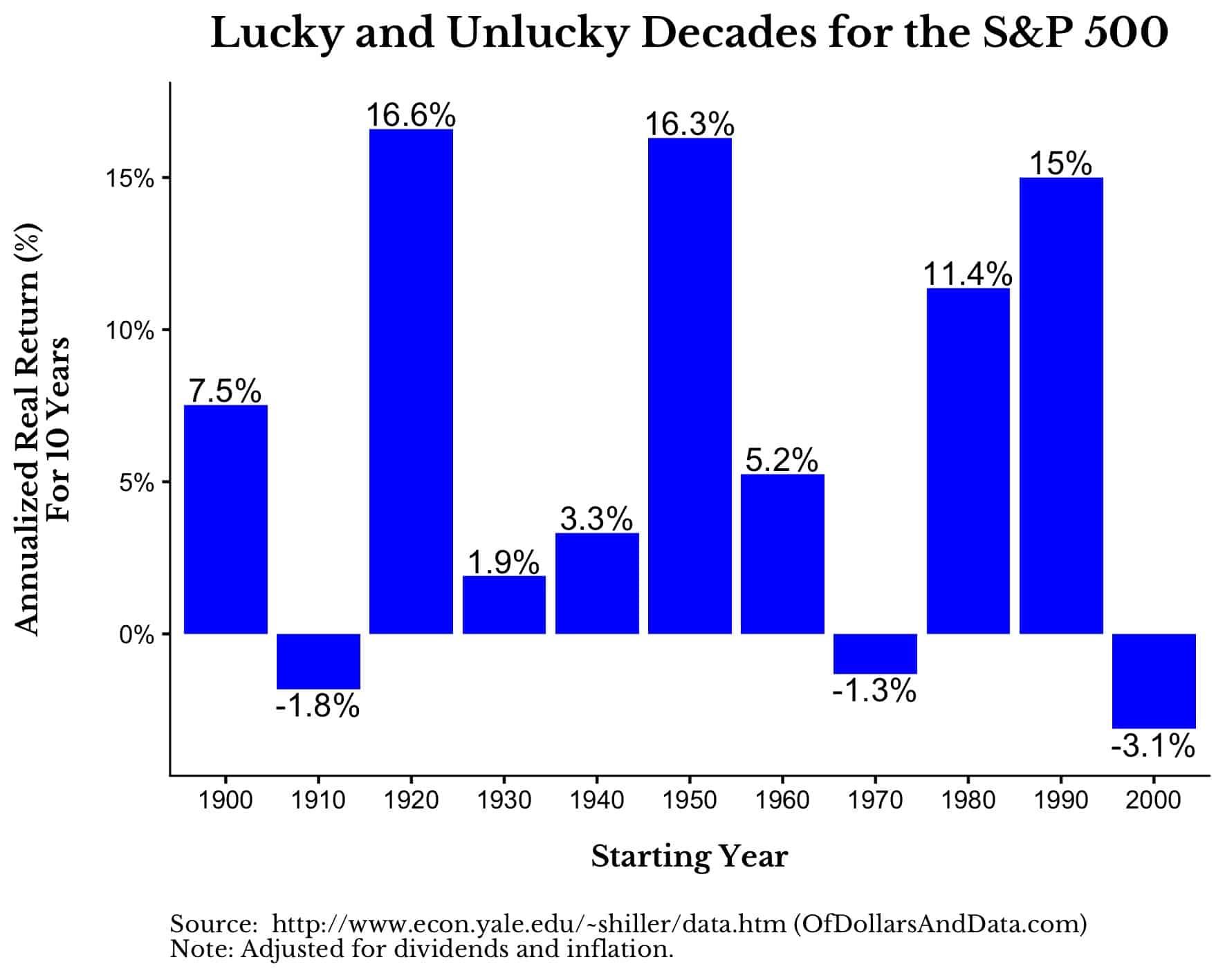

You might think this concept doesn’t apply to you as an investor, but you would be wrong. Just consider the S&P 500’s annualized return by decade:

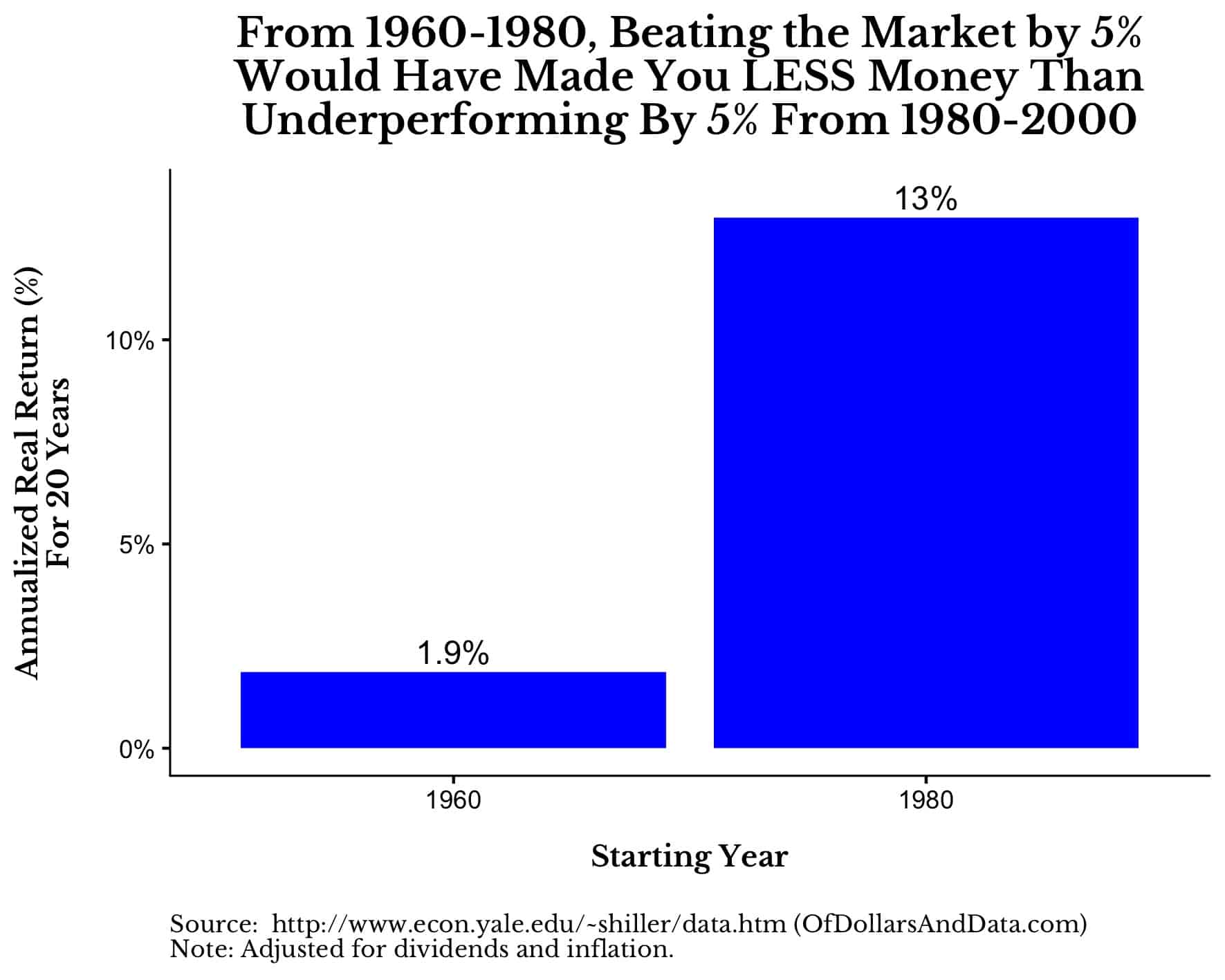

As you can see, when you start can have a big impact on your investment results. Yet, this is just the tip of the iceberg. For example, if you had invested from 1960-1980 and beaten the market by 5% each year, you would have made less money than if you had invested from 1980-2000 and underperformed the market by 5% a year. The gods always have the last laugh:

Yes, this example is cherry picked, but it demonstrates how skilled investors (outperformers) can lose to unskilled investors (underperformers) if they get caught in a bad market. So, my friends, don’t worry about getting excess returns, worry about whether there are returns at all—don’t pray for alpha, pray for beta.

[Author’s note: Technically beta (a measure of market volatility) isn’t the right term to use here, but “pray for beta” sounds catchier than “pray for higher future market returns.”]

Don’t just take it from me though. Consider what Jesse Livermore, arguably the greatest trader in stock market history, proclaimed in Reminiscences of a Stock Operator (emphasis mine):

I think it was a long step forward in my trading education when I realized at last that when old Mr. Partridge kept on telling the other customers: ‘Well, you really know this is a bull market!” he really meant to tell them that the big money was not in the individual fluctuations but in the main movements—that is, not in reading the tape but in sizing up the entire market and its trend.

Ignore the Outcome

I know what you might be thinking, “Okay so I need to hope for high expected returns, but I have NO control over that.” You are right, there is nothing you or I can do to effect future equity returns.

You cannot control that outcome. You cannot control being at the right place at the right time (for the most part). But, you can control your process. You can control who you pick as your financial advisor, your savings rate, the fees you pay, and so much more.

In fact, when it comes to almost every decision you make in life, you should completely ignore the outcomes as long as your process is logical and evidence-based.

This idea comes from Annie Duke‘s book Thinking in Bets where she discusses how most people retroactively judge a decision-making process based on the outcome of the decision. This is why Annie recommends excluding any talk of outcomes when analyzing decision quality, especially when you have incomplete information.

For example, you wouldn’t think that someone who drove home drunk and survived had a good decision-making process. Why? You have information that suggests otherwise.

However, when someone gets rich by day trading you aren’t as sure as to whether this was good decision-making or good luck. You have less information, so you are more prone to judge the decision based on the outcome.

As I have discussed before, focus on your efforts, not your results. It’s the only thing you can control. With that being said, I am once again going to recommend checking out Annie’s book to help you focus on the things you can control.

I recommended it a month ago and Marc Andreessen, one of the kings of venture capital, has since recommended it in his return to Twitter.

I might have influenced his reading list, or I might have just been at the right place at the right time. Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 82. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data