What’s the most important thing when it comes to building wealth? Is it what you invest in? Is it when you start? How about your mindset?

I’ve thought about this question a lot since I started blogging nearly 7 years ago. And, as time has passed, I’ve become increasingly convinced that the best predictor of whether someone is likely to build wealth is—their income. It’s not their asset allocation, their investment knowledge, or their financial goals that matter. Tell me someone’s income and that will tell me more about their ability to build wealth than just about anything else.

I can already hear the replies flooding in, “What about someone’s spending? There are plenty of celebrities who had very high incomes but still went broke!” I don’t disagree. Income isn’t a sufficient condition to build wealth, but, for most people, it is a necessary one. In other words, a high income by itself won’t make you wealthy, but nearly every person who is wealthy had a high income.

Do exceptions exist? Of course they do. Morgan Housel’s The Psychology of Money highlighted the case of Ronald Read, a gas station attendant/janitor who gave away most of his $8 million fortune when he died at age 92. Unfortunately for you, replicating his success would require a combination of extreme frugality and a very long time horizon.

Read invested for 69 years (and worked for 50 of them), during which time U.S. stocks generated a 6.7% annualized return (including dividends and adjusting for inflation). Assuming Read adjusted his monthly contributions for inflation, he would have needed to invest $40 a month into U.S. stocks starting in 1946 to have $8 million by 2014. $40 a month may not seem like much, but in 1946 the average income was around $100 a month.

This means that Read needed a 40%+ savings rate for 69 years all while matching the market’s overall return to build his wealth! This may sound easy in theory, but it is incredibly difficult in practice.

No matter how you look at it, the story of Ronald Read demonstrates that building wealth without a high income requires you to be an outlier on multiple other dimensions. You need more time, less spending, better performance, or some mixture of the three to generate such a large fortune.

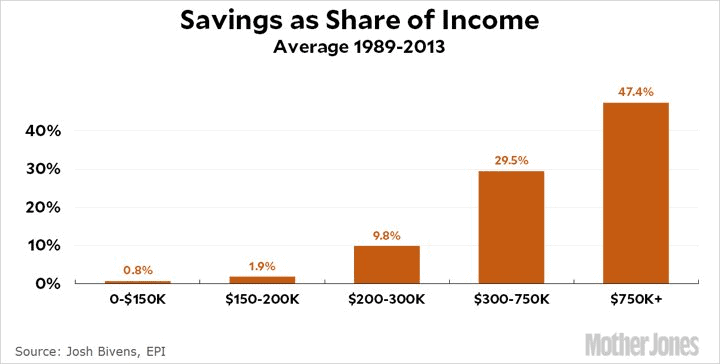

But, there’s a much simpler way—find ways to increase your income. After all, income level is more highly correlated with savings rate than any other metric I’ve seen. As the chart below illustrates, those with higher incomes (on average) save more than those with lower incomes:

But this isn’t the only data source that demonstrates this.

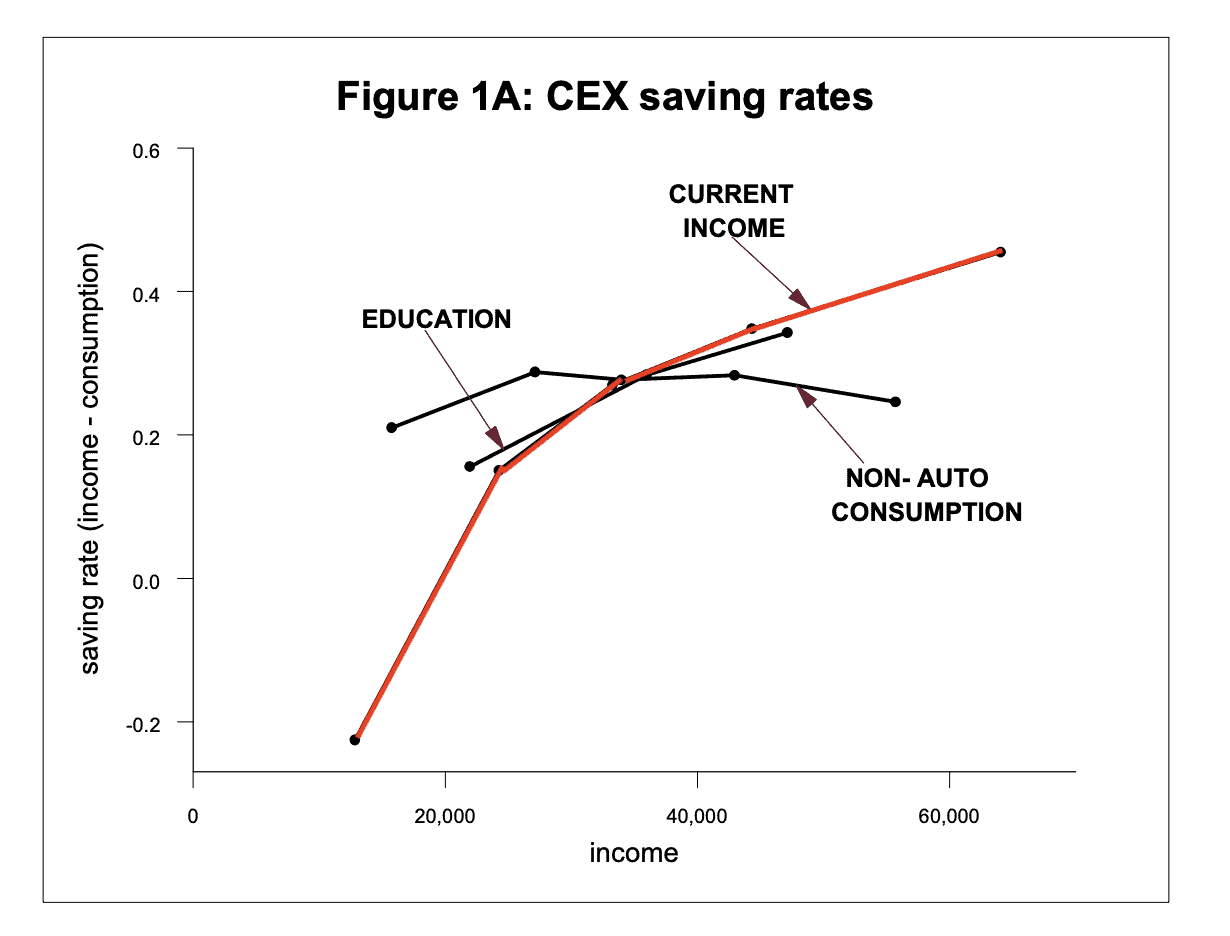

Researchers found the same positive relationship between income and savings rate in the Consumer Expenditure Survey (CEX), the Panel Study of Income Dynamics (PSID), and the Survey of Consumer Finances (SCF) in their paper “Do the Rich Save More?”

You can see this clearly in Figure 1A of their paper which shows savings rates by income level (using the CEX data, emphasis mine in red):

After examining each of these independent data sources, the researchers concluded:

In sum, the results presented thus far strongly suggest that saving rates rise with lifetime income among working-age households.

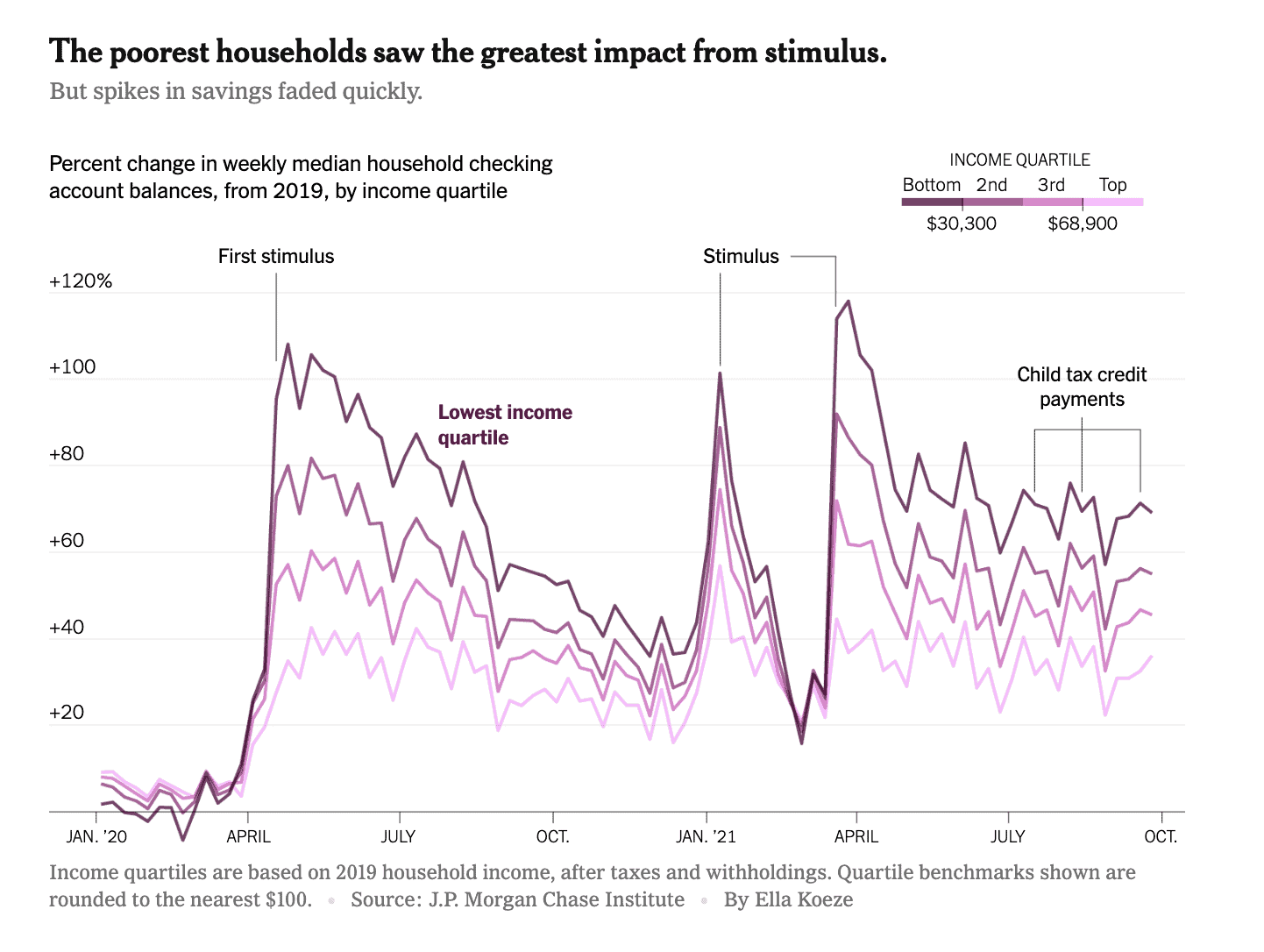

If you still aren’t convinced, consider this analysis from the New York Times which found that the lowest income U.S. households saw the greatest boost to their checking account balances immediately after the COVID-19 stimulus checks were sent out:

As you can see, when you give people more money, they’re able to save more money.

There is anecdotal evidence to support this as well. As one lower income woman stated in this NYT article after receiving two stimulus checks, “‘This is the most money I ever seen in my bank account.”

Her experience echoes that of millions of Americans who received federal stimulus checks, which decreased poverty by the largest amount in five decades.

It might seem obvious that the easiest way to get people to save more money is to give them more money (or have them earn it), but this isn’t obvious for everyone. How do I know? Because I still see many arguments to the contrary.

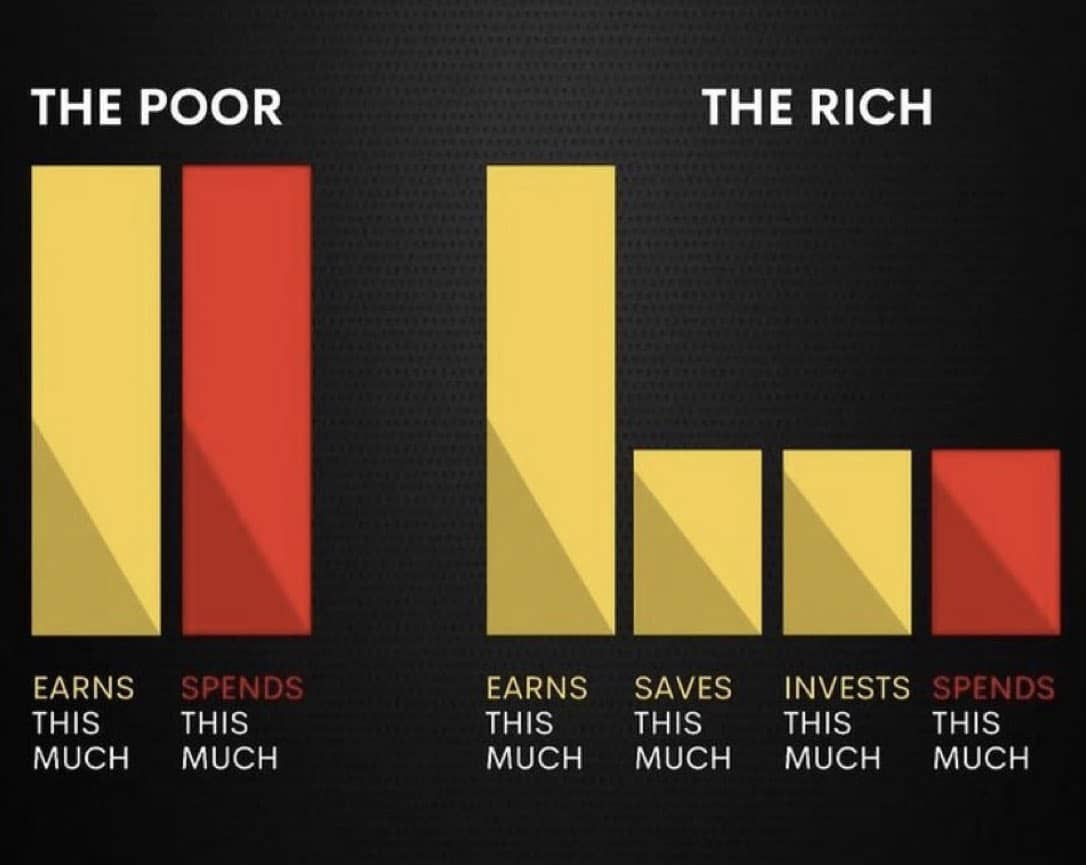

For example, just last week I saw this image tweeted out with the caption “Why the rich get richer”:

It’s disgusting that people tweet shit like this despite there being zero evidence to support it. Why? Because it suggests that the rich and the poor earn the same amount of money, but the poor just can’t control their spending. It implies that poor people have a behavioral problem, when what they really have is an income problem.

This kind of content is so damaging because it reinforces false beliefs about what it takes to build wealth. And, frankly, I’m sick of it. I’ve been writing about this topic for over six years, yet it hasn’t gone away. There are still these idiots out there who tell me to read Napoleon Hill’s “Think and Grow Rich” so that I can “think my way to wealth.”

Are you kidding me? By that logic Black Americans have less wealth than White Americans because they aren’t thinking properly, right? It’s absurd.

But this is what the personal finance industry doesn’t want to admit. They don’t want to talk about the income problem, because it’s much easier to blame “the spending problem.” It’s much easier to demonize lattes than to address income inequality. It’s much easier to harp on behavior when simple mathematics will suffice. As I like to say:

No mindset in the world can make up for an insufficient balance.

You can disagree all you want, but at the end of the day you have to prove your point. You have to provide evidence to support what you are saying. And I know you don’t have it. You can’t prove that mindset matters, but I can prove that income matters.

Income matters for everyone. It matters for the young and the poor. It matters for those currently building their nest egg. And it even matters for the wealthy who are able to earn a lot on their investments today because of the money they earned (and saved) in their past.

Income is the foundational pillar upon which most wealth is built for most people. This doesn’t mean that your asset allocation doesn’t matter or that your mindset is useless, only that your income matters more. So if you truly want financial success, you need to be focusing on paychecks, not portfolios.

Lastly, before you argue that expense tracking or goal setting or “manifesting” your future wealth are more important than income, remember to bring data. I’ll have mine.

Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 358. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data