It seems like the world of cryptocurrency has come back from the dead. Bitcoin is once again trading around $50,000, NFTs are selling at record volumes, and payment providers are continuing to expand their crypto services. For crying out loud, images of pet rocks are selling for over $1 million.

What is going on here? Was there some revolution in cryptoland that I missed? Did the world suddenly wake up, break out of its pattern of denial, and realize our collective crypto future?

Nope. Nothing of the sort.

What actually happened? Prices went up. That’s it.

Now that I’ve seen this cycle play out multiple times over the past few years, I’ve come to realize something simple, yet profound:

Price rules everything around me.

What I mean is that prices are what drive our narratives around asset classes, not the other way around. It’s not that crypto actually had a revolutionary change in the past month and then prices moved accordingly. Rather, prices went up and now people are attributing that change to some fundamental change in the space.

This is why it is misleading to say that crypto “died” when prices plummeted a few months ago just like it’s misleading to say that crypto is “back from the dead” now that prices have partially recovered. No, crypto didn’t lose 50% of its utility 3 months ago and then re-gain that utility recently. What really happened was that the price changed. That’s most of the story.

As J.C. Parets, from AllStarCharts, once tweeted:

Price moves, then an army of story tellers all over the world make up stories to justify those price moves. Then price moves again, and the story tellers go to work. Rinse & repeat. That’s why we follow price and ignore the story tellers.

This is a simple framework for understanding how prices drive narratives for cryptocurrencies and other asset classes as well. In fact, price changes seem to be a leading indicator of eventual changes in narratives, not the other way around.

In Wealth, War, & Wisdom Barton Biggs demonstrated this by showing how price movements in the stock market seemed to anticipate events in WWII before they happened.

For example, the London stock exchange rallied in May 1941 even as London endured its heaviest bombing during the entire war. Biggs believes that this rally was in anticipation of Germany’s attack on Russia in the following month, which would reduce Germany’s focus on Britain and turn the Soviets into a British ally.

A similar kind of rally occurred in U.S. stocks in late March 2020 even though outcomes from Covid-19 were getting objectively worse. But this isn’t the first time in history that markets recovered as economic conditions deteriorated. As Richard H. Pells once proclaimed:

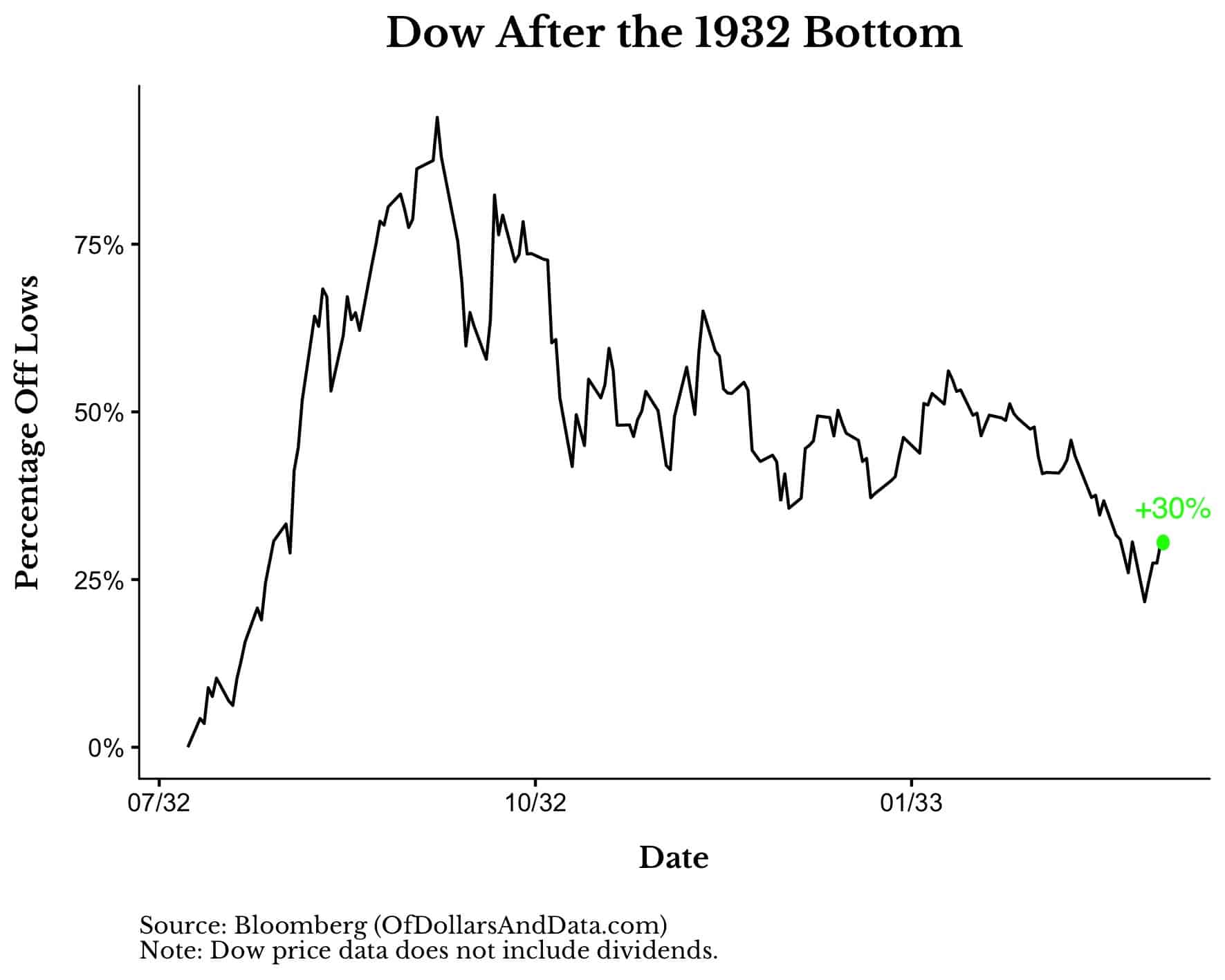

Economically, the winter of 1932-1933 was the worst in American history.

Did stocks bottom during this turbulent time? Nope.

In fact, during the winter of 1932-1933 the Dow was up 30% from its bottom six months prior:

Prices had already started moving onward even before the recovery was underway. If that doesn’t illustrate the power of prices, then I don’t know what does. Because prices drive behavior which then drive prices in a non-stop feedback loop.

I’m not immune from this cycle either. I’ve personally gone back and forth on crypto mostly because of how the price has changed over time. Annie Duke, the author of Thinking in Bets, would call this resulting since I am using the outcome (i.e., price) to determine whether investing in this asset class is a good (or bad) decision. I shouldn’t be doing this, but it’s hard not to.

You can use other metrics (i.e., number of transactions, number of people holding, etc.) to judge a cryptocurrency’s worthiness as an investment, but if the price isn’t moving, it’s hard to believe the hype. As Cliff Asness is fond of saying:

If these strategies are truly horribly overcrowded then someone has apparently forgotten to tell the prices.

This is why prices matter so much for defining our collective narrative about assets. Because, at the end of the day, prices are what dictate your returns, not fundamentals. Of course, improving fundamentals should lead to higher prices in the long run, but in the short run anything can happen.

This explains why investing can be so infuriating at times. Because you can’t survive on fundamentals alone. You can’t feed your family when companies increase their earnings, but you can feed them when prices go up.

Prices, therefore, rule everything. Prices determine returns and, ultimately, prices determine wealth. So you can beat the drum of fundamentals all you want, but it won’t change a thing in the meantime. It’s sad, but true.

And many famous investors have learned this in recent years. Chanos, Einhorn, and many others have seen subpar performance and not because of their talent. I’d argue that these investors were probably right on the fundamentals, but that hasn’t mattered. Because being right on the fundamentals doesn’t do a thing when prices move against you for so long.

And, unfortunately, there’s no silver medal for being right eventually. You either get profits or losses and there is nothing in-between. I wish this wasn’t the case, but I don’t make the rules.

As Benjamin Graham so famously said:

In the short run, the market is a voting machine but in the long run, it is a weighing machine.

Unfortunately, it looks like we are still voting. Thank you for reading!

Also, for anyone wondering, yes, the title of this post was inspired by a Wu Tang song.

If you liked this post, consider signing up for my newsletter.

This is post 257. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data