Recently I finished an incredible book by Alan Lightman called Einstein’s Dreams. The book describes a series of short thought experiments about worlds in which time behaves differently from our own. Naturally, I thought it would be fun to imagine how investing might work in some of these alternate realities as well. I doubt any of my conclusions are “right”, so I ask you to think about what might happen in these worlds. Feel free to leave comments below. Enjoy!

The Immortals

A woman celebrates her 212th birthday, yet she is one of the younger members in society. A man says “I do” for the 36th time, but he isn’t even half way to his final marriage. Two friends meetup after having not talked in centuries. Ideas come and go, but people have not. Because, in this world:

Suppose that people live forever. (Lightman p. 91)

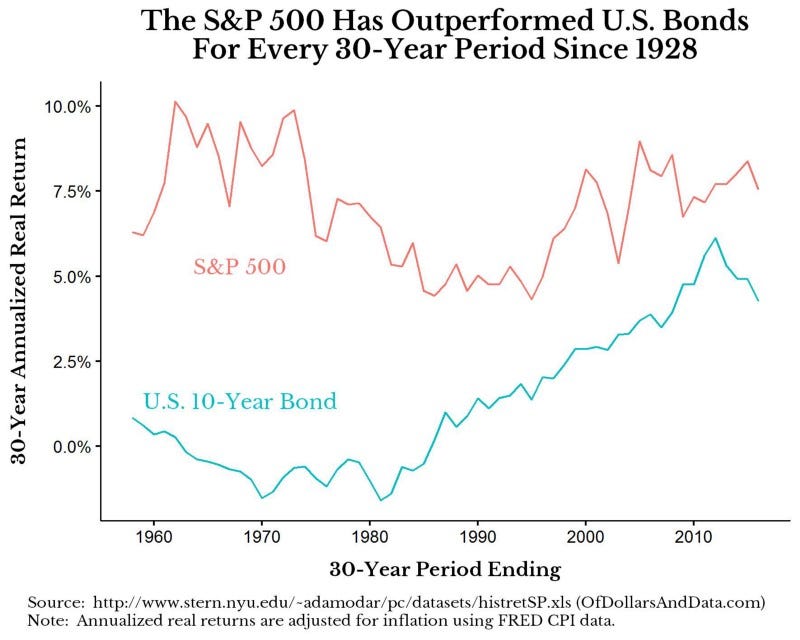

With the benefits of eternal life, the average investor invests more like a college endowment than a modern day retail investor. An infinite time horizon should have that effect. For example, how much of your portfolio (if any) would you put in bonds given that equities have always outperformed bonds historically? As a reminder, consider this chart from this post:

When you have all the time in the world, would you own anything other than “riskier” assets? Even if you lose money on them, you can make this up over decades (or centuries). I understand that there are liquidity arguments to be made here, but outside of that, the case for bonds seems weak.

However, it also seems possible that the historical relationship between stocks and bonds would break down in this new world. For example, I would guess that returns on riskier assets would fall somewhat. With more time to make up losses, investors should be willing to accept reduced returns as a result. This effect shouldn’t be particularly large, but it probably matters to some extent.

So where does this leave our hypothetical investors of eternity? They should experience lower aggregate returns on risky assets, and investors wanting higher returns would need to take on far more risk to get it (i.e. private equity, leverage, etc.). However, there might be other unanticipated effects of infinite life. For example, some individuals might give up investing altogether and live off of their labor for eternity (i.e. no need for retirement). Some may try get rich quick schemes until one finally worked. Some may become so rich that they are forced to redistribute their wealth if they pass some threshold. Who knows?

Flashforward

“AMZN $4,000” lit up the screen as the television host announced Amazon’s move into asset management. Amazon’s flagship fund is the first ever to pay investors to own them. Before another word can be spoken, darkness ensues and the trader’s vision comes to an end.

This is a world of changed plans, sudden opportunities, of unexpected visions. For in this world, time flows not evenly, but fitfully and, as a consequence, people receive fitful glimpses of the future. (Lightman, p. 66)

Despite people experiencing random visions of the future, investing in this world would likely be very similar to our own. In our world, investors with inside information can trade on it (illegally) and they would be tough to notice unless they were a larger player in the market. How is this any different from trading based on a “vision” of the future? For example, it would be near impossible to tell insider trading from “vision” trades without a smoking gun, so markets would try to find these vision traders and capitalize on their signals, if possible.

Unfortunately, there are 2 elements that limit the financial success of visions. Firstly, not all visions are related to financial information, so most glimpses of the future would be irrelevant for making money. Secondly, some financially related visions would not be worth all that much.

For example, if I told you in October 2017 that the Dow Jones would be at 22,000 as of December 2018, how much money could you make off of that? Yes, you could buy put options today with the DJIA at ~22,800, but you have no idea when those options would be most valuable. Maybe you would get returns in the lower double digits off of this. I wouldn’t be complaining if I knew this, but this information is unlikely to make me filthy rich either.

Some of the best future financial information you could get, on the long side, would be the price of some currently small, publicly traded company. You could buy call options and wait it out. Without hyperinflation or some insane reverse stock split scheme, this would likely work well. The only thing better might be a vision of the winning lottery numbers. Good luck with that.

Concentric Dilation

They all stood frozen around the grand clock. Not a heart seemed to be beating, but they were beating…very…slowly. If you averted your gaze outward from the clock, you would see people moving at increasingly faster speeds. At the furthest points away from the clock, people would seem to move like a flash of light.

From this place, time travels outward in concentric circles — at rest at the center, slowly picking up speed at greater diameters. (Lightman, p. 54)

What does this world of concentric time mean for our average investor? This should depend on their goals. Younger investors may decide to take advantage of the time dilation present in this world by investing in a portfolio at the outskirts then traveling toward the center. Since time passes more slowly in the center, these young investors will age very little while their portfolios experience centuries of growth. Genius, right?

Wrong. The only problem with this idea is that everyone else would be trying this as well. If everyone is running around through time trying to get rich, who is actually doing the work to grow the economy at the outskirts? It is obviously a logical flaw. I tried to imagine the steady state scenario of this world, but, frankly, it is beyond me. I have no idea how society would organize itself with the ability to travel forward (but not backward) in time very quickly. What do you think?

This “Time” is Different

Investing and time will forever be linked together. What is investing but the sacrifice of current consumption in expectation of increased future consumption? Investors who want to get rich quickly tend to forget this truism and the importance of being patient. I understand this, but even I am surprised by the time horizons over which some of the greatest investors tend to think.

For example, I recently asked a question on Twitter about 20 year returns for a variety of asset classes and Corey Hoffstein, a quantitatively focused investor, replied:

20-years is a short period.

I was shocked by his response. How so? 20 years is at least a third of my investing life. How can this be short? But…he is right. This is the kind of thinking that I have seen time and time again by the wisest investors. Jason Zweig once spoke about how he measures his investment time horizon “in centuries” and Benjamin Franklin left money in his will to the cities of Boston and Philadelphia with a stipulation that it compound for 100 years before first being drawn upon. When you think about time over longer periods, investing seems much simpler and the payoff much more obvious.

I hope you enjoyed these thought experiments. If you want to read more about, I highly recommend Einstein’s Dreams by Alan Lightman. I will be back to my usual charting self next week. Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 42. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data