I’ve paid over $350,000 of rent in my life. That averages out to $2,500 a month since mid 2012. And, with near record interest rates and elevated home prices, I may end up paying another $350,000 in rent before I ever buy a house.

I am a part of what you might call the Forever Renter class. This is a cohort of people in their mid-20s to late-30s who are either unwilling or unable to buy a home under current market conditions. Unfortunately, those conditions aren’t moving in the right direction either. As Redfin recently reported, “The median U.S. home-sale price hit a record $383,725 during the four weeks ending April 21, up 5.2% from a year earlier.”

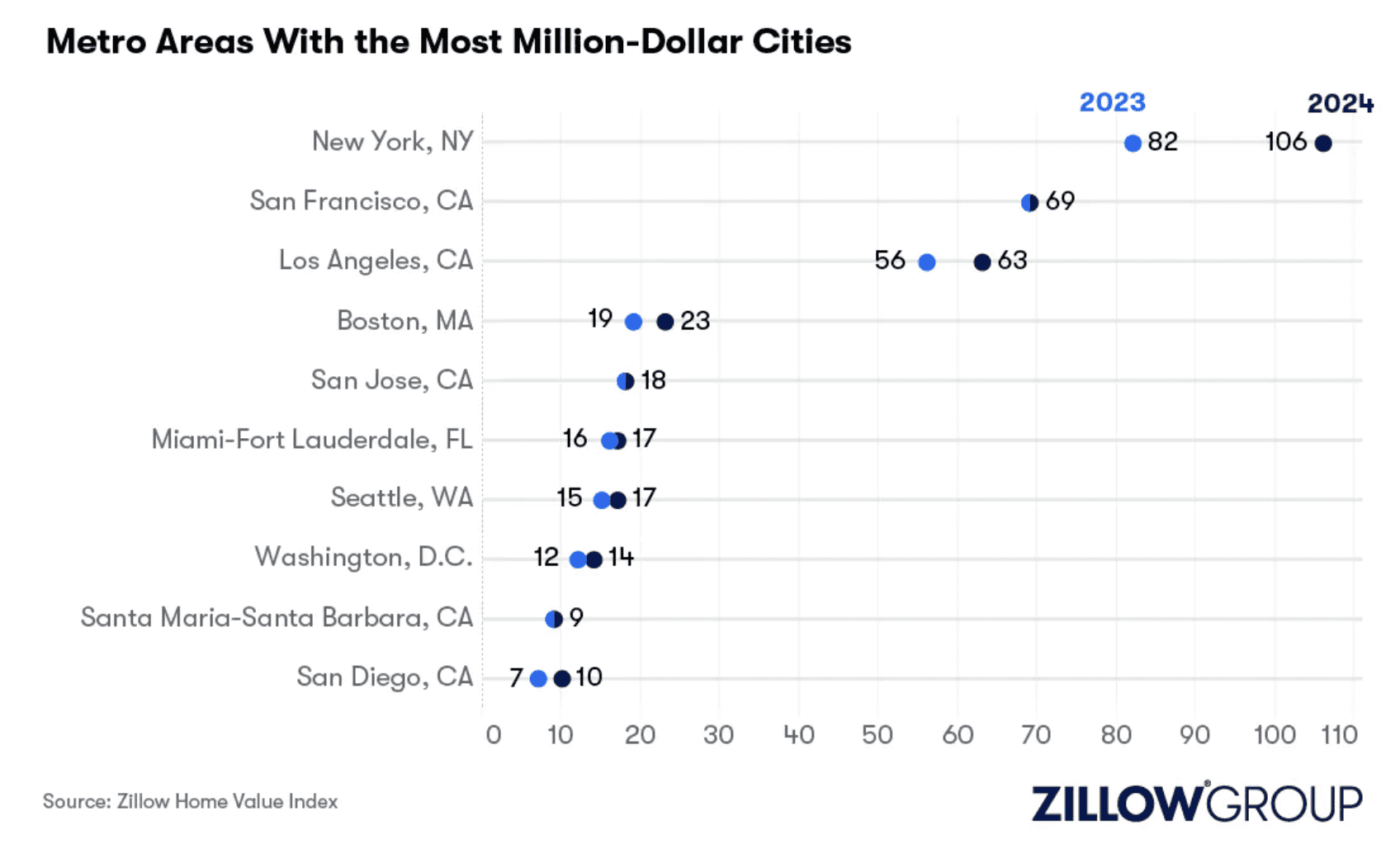

But it’s not just the median U.S. home that is setting records. Homes in many high cost of living areas are near their highs as well. Last month Zillow reported that there are now a record 550 “Million-Dollar” cities in the United States. These are cities where the typical home price is greater than $1 million. While nearly half of these Million-Dollar cities are in California, the New York metropolitan area has the most with 106:

But rising home prices are just one factor impacting affordability. High interest rates are another.

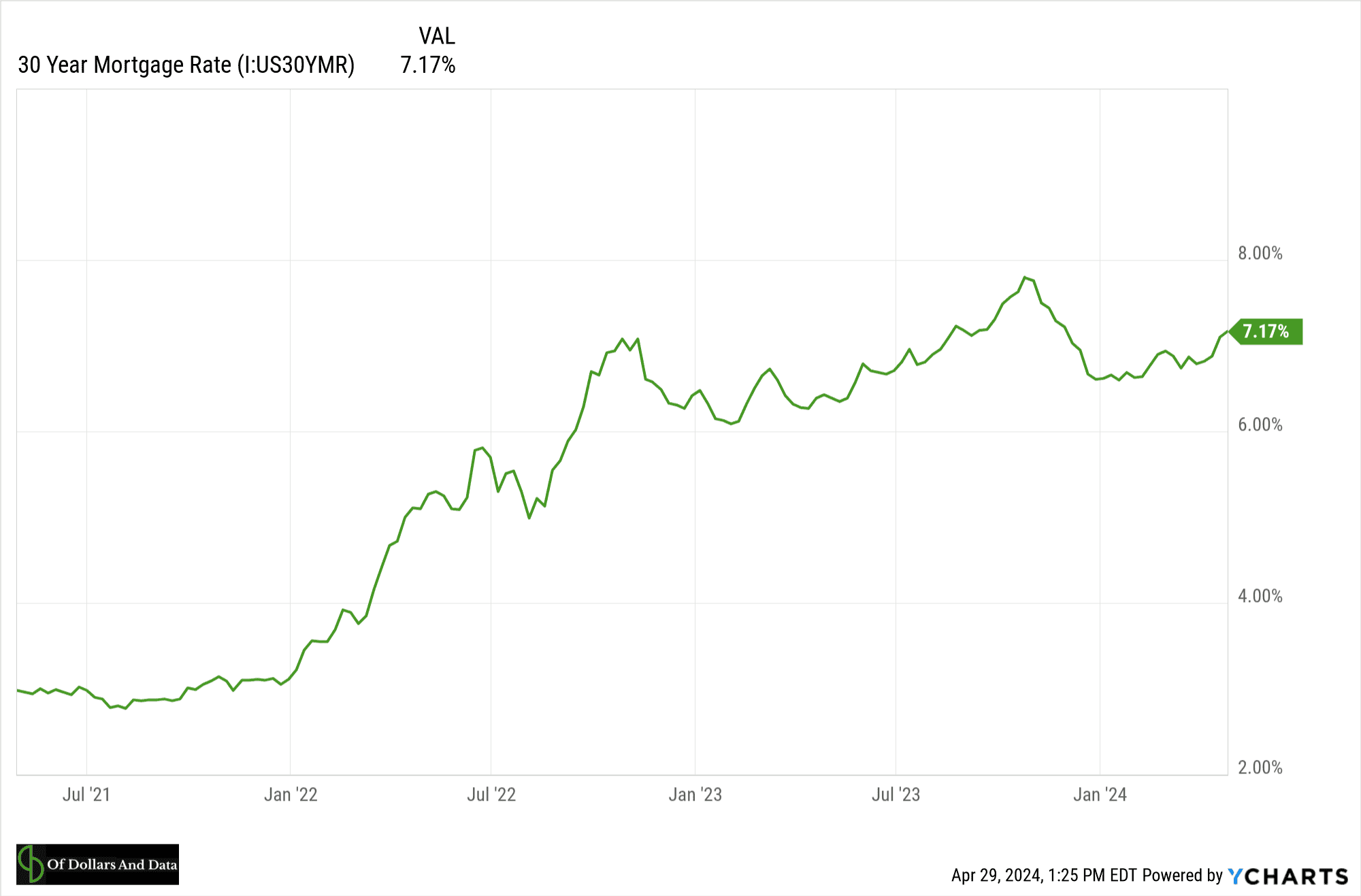

The 30-Year mortgage rate peaked last October at 7.8% before dropping through year end. At the time, the worst of it seemed to be over. However, with inflation coming in hotter than expected this year, many believe that the Fed will no longer cut rates as planned in 2024. As a result, mortgage rates have started creeping up yet again with the 30-Year near 7.2% today:

But the final nail in the coffin for housing affordability is the slow growth in income. Incomes haven’t risen in lockstep with housing prices and mortgage rates. For example, according to the National Association of Realtors, the median family income increased by 18% from $85,806 to $100,876 between 2021 and February 2024.

But the final nail in the coffin for housing affordability is the slow growth in income. Incomes haven’t risen in lockstep with housing prices and mortgage rates. For example, according to the National Association of Realtors, the median family income increased by 18% from $85,806 to $100,876 between 2021 and February 2024.

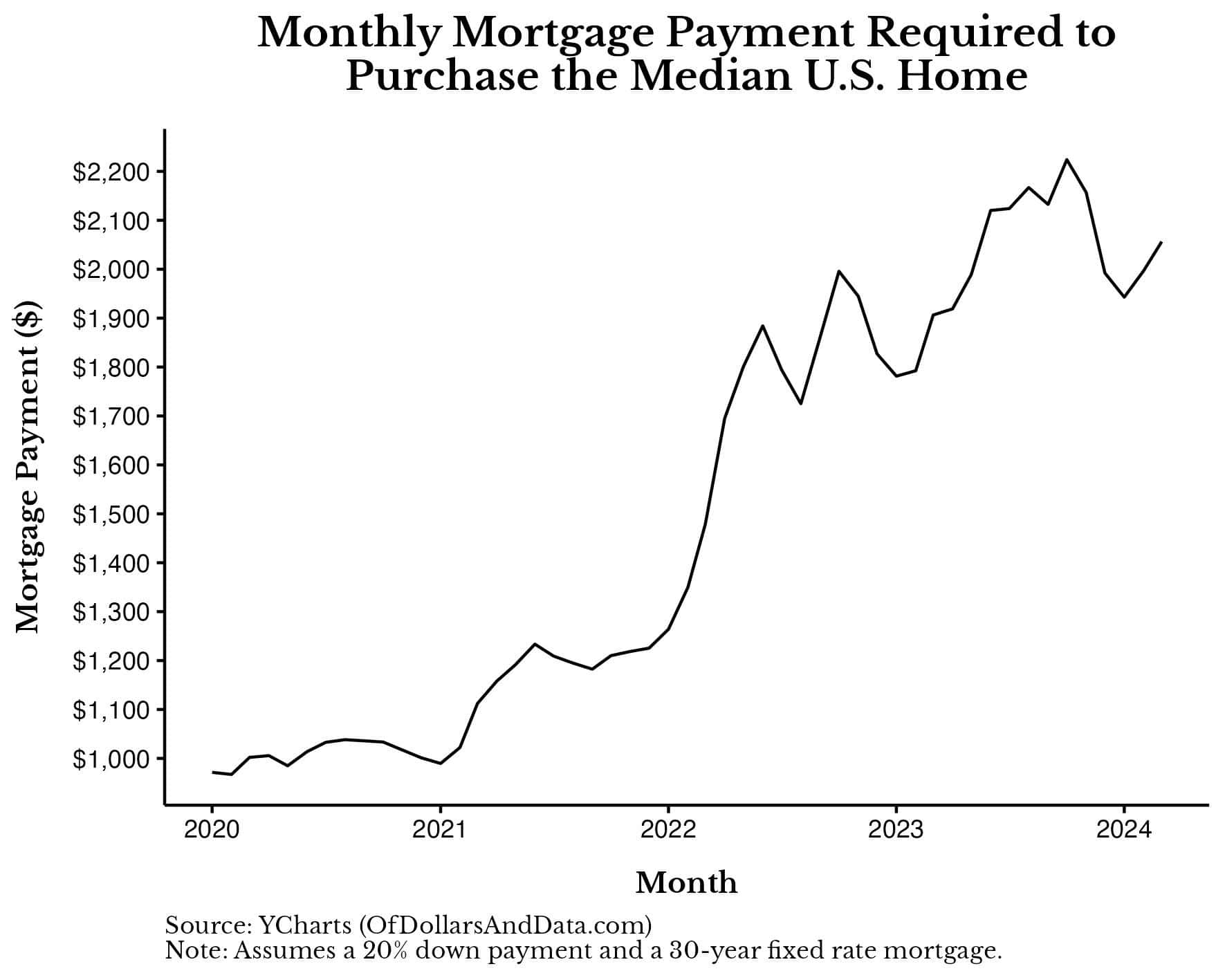

However, over the same time period, the monthly mortgage payment required to purchase the median U.S. home doubled:

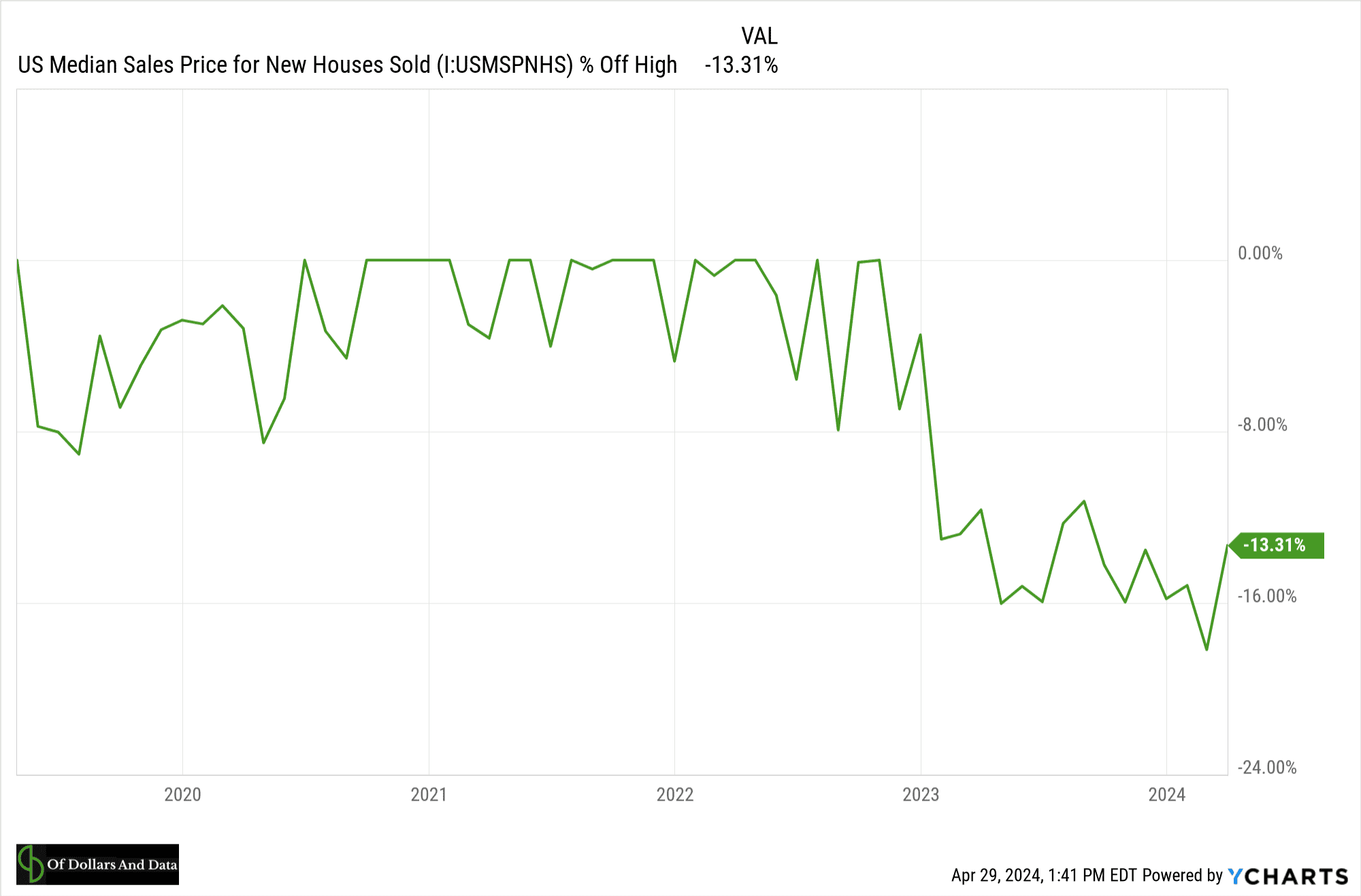

So while American families were getting an 18% raise, their prospective housing cost increased by 100%. Technically, the median sales price for new houses in the U.S. has dropped by 13% since their peak in late 2022:

However, this has done very little to affect affordability. Since rates are still so high, the American Dream remains out of reach for so many.

This is why the Forever Renter class exists. Though incomes have increased, housing costs have increased by far more. It’s gotten so bad that Zillow estimated that homebuyers need to earn nearly $50,000 more today than in 2020 to comfortably afford a home. And, in some cities in California, the amount of additional income needed exceeds $100,000!

But, this only addresses a portion of the Forever Renter class—those who are unable to buy a home. It ignores those who can afford to buy one, but choose not to. Because, even if you could buy a house in this market, should you?

The Unwilling Buyers

For those that have the means to purchase a home in the current housing market, they may still choose not to if renting is much cheaper. While the numbers vary by location, I ran an analysis a few weeks ago that suggests that renting has the upper hand in many high cost cities.

For example, in a place like NYC, a Forever Renter could end up having to decide between paying $4,000 a month to rent or $7,000 a month to buy the same apartment. Even if they could afford such a high housing cost, would that be better than renting and investing the extra $3,000 a month into a diversified portfolio? My conservative estimate suggests not. For the time being, renting wins out.

This is where many in the unwilling Forever Renter class find themselves. They have good jobs. They make good money. But interest rates are also the highest they have been in two decades. As a result, if they want to borrow money to buy a house, they will pay for it dearly.

Given this, their best course of action may be to forgo the mortgage market altogether and save up enough money to buy a house in cash. If that is too difficult, they could at least trying saving up a larger downpayment instead. Rather than putting the standard 20% down, maybe they put 50% down. Anything that helps them reduce the amount of money that they borrow at high rates would be a win.

Alternatively, they could use a “wait and see” approach as well. Maybe they start by saving for a larger downpayment, but if rates drop to a more suitable level sooner, then they pull the trigger and buy a house.

No matter how the future plays out, being flexible with your planning can go a long way in helping you make the right financial decision. And, in the event that the immediate future doesn’t play out in your favor, remember that “forever” isn’t as long as it seems.

Forever Isn’t Forever

As much as I want to go on about the woes of the Forever Renter class, they may not stay as Forever Renters for all too long. The problem with a lot of financial opinions (mine included) is that they can be far too short-sighted. We overindex on what’s happening right now and extrapolate that out into the future. But that’s almost never how the future actually turns out.

Just go back in time with me five years to May 2019. Imagine all the forecasts, price targets, and predictions that were made in that year. How many of them turned out to be right? None. Not a single one predicted what happened in the next year. And I wouldn’t expect them to.

The same thing will be true with regards to the U.S. housing market. Right now things look bleak. The vast majority of 20 and 30 somethings can’t afford a home today. But this doesn’t mean that they won’t be able to afford one later. Just look at what is happening in Austin, Texas as an example of what could be. Developers started building more homes and prices have dropped by 18% since May 2022. Increasing supply works. Go figure.

Of course, this won’t happen everywhere (for a host of reasons). But it illustrates how a difficult situation is unlikely to stay difficult indefinitely. Something’s got to give. A solution will present itself. Whether that solution is the one we want is another story entirely. In the meantime, here are some options that can help you during your “forever renter” period:

- Earn more: If you feel like you will be forever priced out of the housing market, start finding ways to earn more. I know this won’t help in the short run, but raising your income is the best thing you can do to improve your financial situation in the long run. If you have both Saturday and Sunday off every single week, then there is no excuse to get started on something that can eventually increase your earnings.

- Consider other housing arrangements: Being more open with where you live and who you live with as you wait for market conditions to improve. Living with roommates, moving to a lower cost of living area, or downsizing can help reduce your living costs temporarily as you save up to buy your desired home.

- Be flexible: Buying a home will likely be the biggest financial decision of your life, so don’t rush into it. This is especially true in an unfavorable housing market. Be willing to adjust your timeline and keep saving until the right opportunity comes along. When things aren’t looking good, being flexible enough to wait out the storm has its advantages.

While things don’t look great now, I am a firm believer that the housing market will become less daunting…eventually. Until then, happy investing and thank you for reading.

If you liked this post, consider signing up for my newsletter.

This is post 397. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data