Janine Shepard was on a training bike ride in the Blue Mountains 100km northwest of Sydney, Australia when her life changed forever. She was riding with her fellow cross-country ski teammates in preparation for the 1988 winter Olympics when a speeding utility truck hit her off her bike.

Upon impact Shepard broke her neck and back in 6 places, snapped 5 ribs on her left side, and had gravel embedded throughout the right side of her body. She was rendered unconscious and had lost 5 liters of blood by the time she arrived at Prince Henry Hospital in Sydney.

Though Shepard received lifesaving surgery, she was told that she was partially paraplegic and would never walk again. Despite the grimness of her situation, she recalls her lowest point being when she first returned home weeks later. She remembers being in a wheelchair, having no feeling below the waist, and attached to a catheter bottle when her mother said:

I wonder if life will ever be good again?

Shepard realized that she had lost everything she had valued and worked towards. Her identity was shattered. While in this pit of despair Shepard remembers telling herself, “maybe rock bottom is the best place to start.” It was here that Shepard started to recover.

Out of that dark moment, things slowly got better for Shepard. First she could move her feet again. Then she could walk with two people assisting her. Then just one person assisting. Eventually she was able to walk while only holding on to furniture around the house.

Today she can walk unassisted and has made an incredibly inspiring comeback as a motivational speaker around the world.

Shepard’s story illustrates a valuable lesson on life and in markets: sometimes the largest declines have the greatest recoveries—the rise after the fall.

In The Happiness Hypothesis: Finding Modern Truth in Ancient Wisdom, Jonathan Haidt echoes this sentiment:

One of the most common lessons people draw from bereavement or trauma is that they are much stronger than they realized, and this new appreciation of their strength gives them the confidence to face future challenges…people who have suffered through battle, rape, concentration camps, or traumatic personal losses seem to be inoculated against future stress:

They recover more quickly, in part because they know they can cope.

Haidt describes the dramatic transformations that individuals can undergo after a troubling experience as post-traumatic growth. In addition to realizing their inner strength, post-traumatic growth can help individuals strengthen their relationships with loved ones and change their priorities toward the present.

Few things have the power to bring people together and make them appreciate each moment as much as a trauma.

While markets don’t have the same personal reactions to trauma as individuals, there is evidence that some of the strongest recoveries occur after the largest declines. Though this “market post-traumatic growth” won’t be true for all markets across all time periods (i.e. Japan, Greece, etc.), we see some indication of this in the U.S.

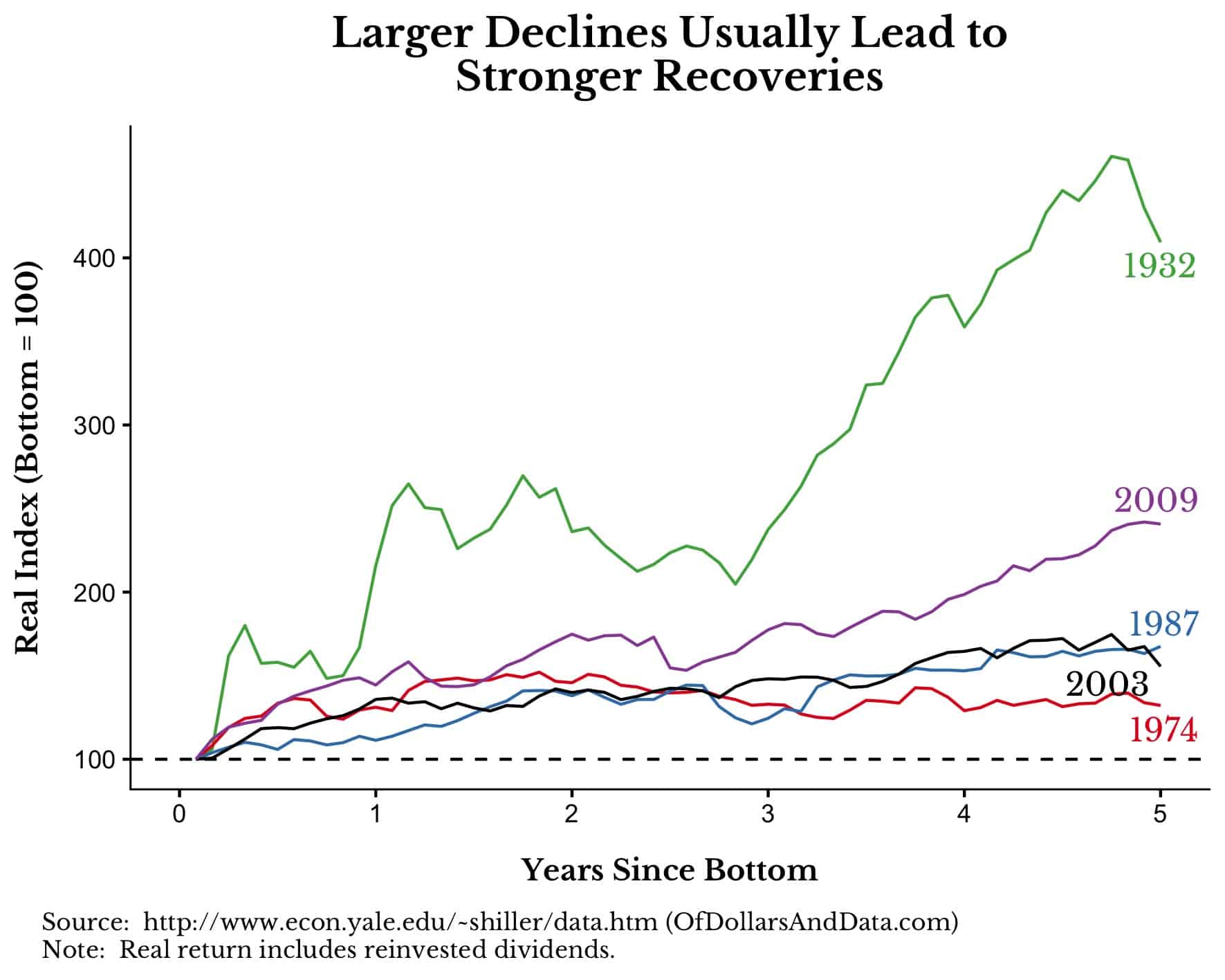

For example, below I have aligned the major market bottoms of 1932, 1974, 1987, 2003, and 2009 and how the market recovered over the next 5 years:

As you can see, the 2 worst declines (1932, 2009) had the strongest recoveries over the next 5 years. I agree that this sample size is far too small to prove anything conclusive, but the limited evidence suggests that larger declines are followed by bigger recoveries.

This brings us to today. As of the closing bell on December 31, 2018, the S&P 500 was down 14.75% from its all-time intraday high on September 21, 2018. Now that we are entering 2019, you are probably wondering:

What does the market usually do when it is down 14.75% going into a new calendar year?

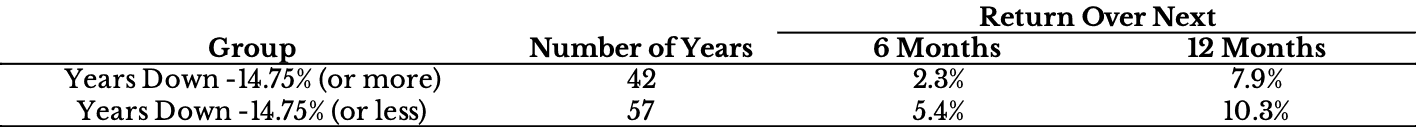

There have been 42 years since 1920 that the market has started a new year down 14.75% (or more). The following table compares the 6 and 12 month returns for these years with the years where the market was down 14.75% (or less) going into a new year:

As you can see, when the market is down 14.75% (or less) it tends to outperform those markets when it is down 14.75% (or more) over the next 6 to 12 months. However, if we subset to those years where the market is down a lot more, the story changes.

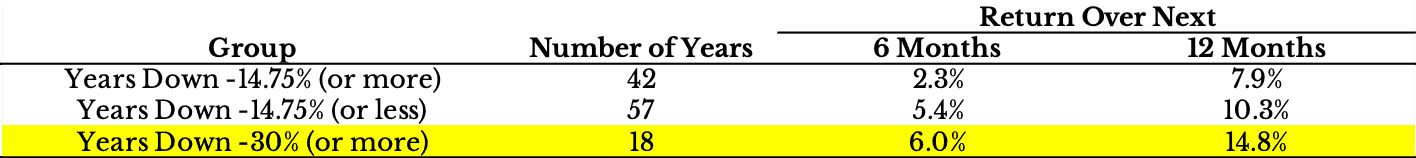

For example, if we look at the 18 years where the market started down 30% (or more) from its all-time highs we see the following:

Now, the years where the market starts down 30% (or more) outperform the years where they start down 14.75% (or less)! This illustrates how, at least in the U.S., larger declines have typically been met with stronger recoveries.

Logically it is easy to argue for why this makes sense. Market participants get emotional and they sell. As a result, the market becomes more oversold than what would be justified by the decline in underlying business fundamentals. This explains why, historically, earnings been less volatile than prices.

As William Bernstein noted in Rational Expectations, though prices fell by 90% during the Great Depression, dividends were only cut in half. While I don’t know what the future will hold, I wouldn’t bet against the post-traumatic growth of the U.S. stock market.

Started From the Bottom

In markets and in life we will experience bouts of hardship and setbacks. We will see our portfolios decline. We will lose the ones we love. We may even lose ourselves from time to time. The question isn’t whether these kinds of events will happen, they surely will. The question is: What will you do when they come about?

Of course there is no silver bullet to life. There is no fool-proof way to guarantee success and recovery through trauma. Some events are far too scarring to survive and recover from. This is true with markets and with people. Some things cannot be saved.

Many of those that started from the bottom will never make it out. It is a tragic truth that despair can consume for generations. Sometimes winners keep winning and losers keep losing.

Despite this grim reality, I know what mankind is capable of.

I know of men that have traversed the jungles of the Amazon and the frigid lands of the Antarctic. I know of a woman who lives with only half a brain and a man who endured 4 hours in the icy waters around the Titanic. I know of those that overcame their background, that have moved mountains, and that have played the odds and won.

I don’t know what I will write about in the future, but I can tell you that it will highlight the power of the mankind to persevere through the worst of circumstances. Thanks for the last 2 years everyone. It has been one hell of a ride. As always, thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 105. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data