A war is currently being fought every day throughout the world. This war was here before you were born and will be around long after you are gone. I am talking about the war between fear and evidence. While humanity has access to more information today than any point in human history, facts continue to fall flat in the face of compelling narratives that rely on emotional appeal, especially fear. As The Science of Fear summarized so well:

Fear sells. Fear makes money. The countless companies and consultants in the business of protecting the fearful from whatever they may fear know it only too well. The more fear, the better the sales.

I completely agree. Humans are wired to respond to stories that rely on emotions, not cold, abstract numbers. The fact remains that it is far easier to relate to the death of a celebrity than it is to the deaths of thousands of people from a natural disaster on the other side of the planet. You don’t feel like you know those thousands like you “know” that celebrity. Or as Joseph Stalin so infamously said:

The death of one man is a tragedy, the death of millions is a statistic.

Despite our predisposition to react to emotional appeal, we can fight back. How? Evidence. Though fear is winning the war, everyday a small group of people win a few more battles using evidence. As I stated last week in Phil Huber’s post about evidence-based investing:

Fear is loud. Evidence is quiet. Listen to the evidence.

For example, consider the following “quiet” evidence:

- Since 1983, over 95% of passengers involved in a plane crash in the U.S. have lived to tell their tale.

- Somewhere between 70 and 80% of all gunshot victims survive their shooting.

- 165 people lived through the atomic bombing of Nagasaki after surviving the bombing at Hiroshima 3 days prior.

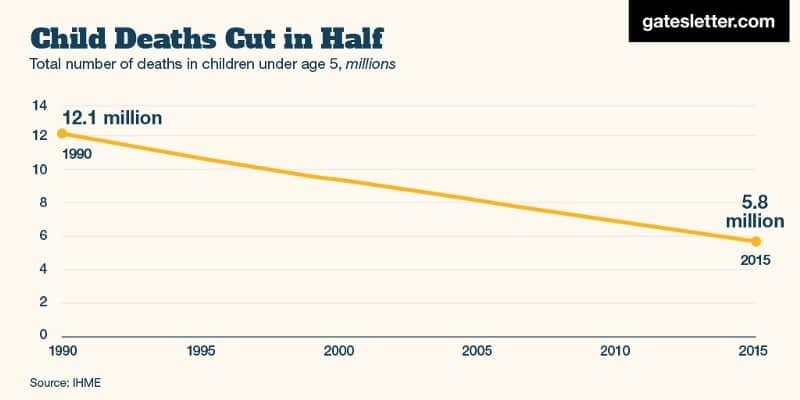

- Bill Gates calls the image below “the most beautiful chart in the world” (I couldn’t agree more):

And these are just a few examples of the overwhelming evidence that our biggest fears are not as bad as they seem and that human life is generally improving around the world. If you need more convincing, read Morgan Housel’s What A Time To Be Alive.

So, how is this related to investing? This is the primary goal of evidence-based investing (EBI) — to purse investment strategies backed by data and facts rather than narratives and emotion. EBI is about favoring history over uncertainty. Or, as my favorite investing quote of all time states:

Fear has a greater grasp on human action than does the impressive weight of historical evidence.

Read that quote again. Seriously. Let it sink in. Now, consider what Warren Buffett said regarding a similar subject:

In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; a flu epidemic; and the resignation of a disgraced president. Yet the Dow rose from 66 to 11,497.

Do you feel the impressive weight of evidence crushing your fear? You should. If not, I can probably guess your counter argument. What about the Black Swan? The nuclear war? The apocalypse? What if Taleb is right? He might be, but it wouldn’t matter anyways. If the apocalypse happens, your financial assets are irrelevant. So, who cares? Anything else though, our society and financial markets will survive. Terrorist attack? Hurricanes? Pandemics? These are all awful, but we’ll be fine.

So What Does the Evidence Say?

This week I will attend the 2nd Annual Evidence-Based Investing Conference (EBI East) in New York where some of the best investment thinkers in the world will discuss the evidence surrounding a variety of investment topics. With this in mind, I wanted to share just a few of the key points from evidence-based investing that you can use to improve your investment outcomes:

- Keep your fees low. It’s not about active vs. passive, it’s about high fee vs. low fee. Future returns are not guaranteed, but your future fees will be, so keep them lower.

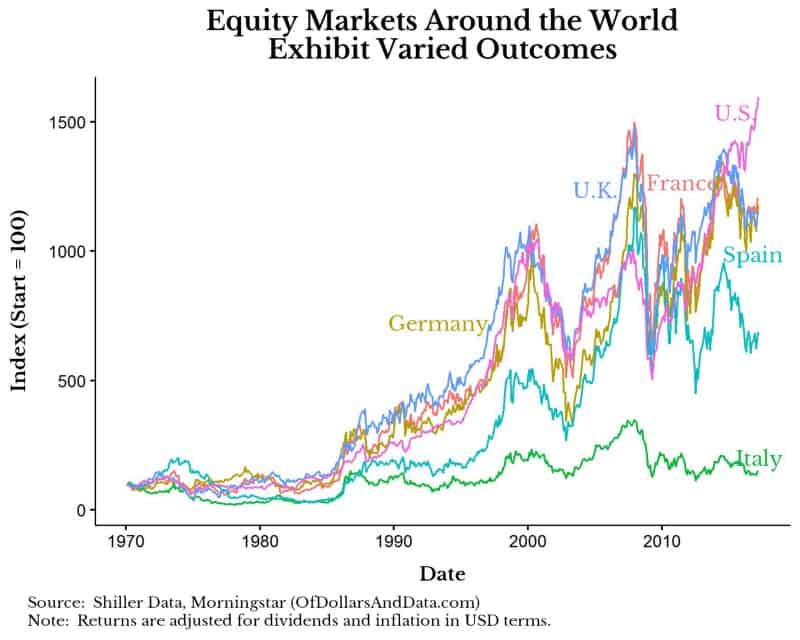

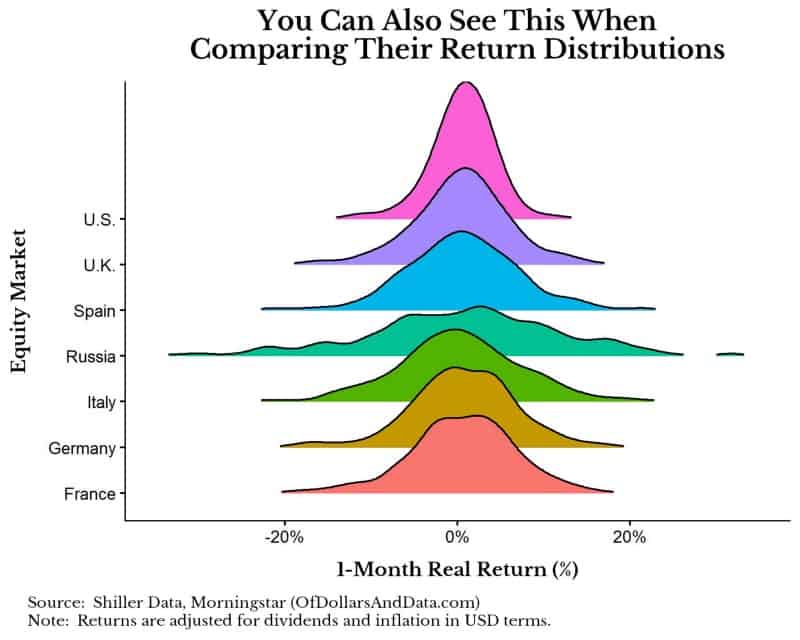

- Diversify adequately (even within equities). During financial panics riskier assets tend to fall together, but this can be mitigated by having some portion of your portfolio in much safer assets (i.e. U.S. Treasuries or cash). However, during normal times you will notice that global equity markets display a wide range of outcomes. This implies you should diversify across these markets as well (Many thanks to Jake from EconomPic for helping me get this data. Follow him on Twitter):

- Some strategies can beat the market, but they are difficult to stick with. For example, there is plenty of historical evidence for factor investing (smart beta) strategies that beat the market. However, these strategies will regularly experience bouts of underperformance, making them difficult to stay invested in. Remember, even Warren Buffett underperforms for shorter periods of time quite regularly. If you decide to invest some money using a smart beta strategy, set your expectations accordingly.

- Investor behavior matters more than investment analysis. Your ability to (1) not sell during a panic and (2) acquire income producing assets on a fairly regular basis (i.e. consistent savings), will do far more for your investment success than your attempt to find the next Amazon. Investing is a highly emotional game, so I would argue that knowing your investing self is just as important as knowing your investment portfolio.

We Are Trying to Get the Message To You

Despite the barrage of gloom and doom that comes from parts of the financial media, there is a group of people trying to turn the tide so that this:

Fear > Evidence

becomes this:

Fear < Evidence

And this group will keep fighting the war between fear and evidence. Day in. Day out. One blog post. One podcast. One book. One chart at a time. We are out there and we are spreading the word. Or, as Metallica so boldly said in their debut album in 1983:

We are trying to get the message to you

Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 44. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data