In every laboratory experiment ever conducted between the fire ant (Solenopsis invicta) and the woodland ant (Pheidole dentata), fire ants have overwhelmed and eaten their woodland counterparts. Because fire ant colonies are typically 100 times larger than woodland colonies, the woodland ants never stand a chance.

This puzzled the myrmecologist (ant researcher) Edward O. Wilson who noticed that both species were found within close proximity of each other in their natural habitat throughout the southern United States. So how does the woodland ant survive despite being vastly outnumbered by its fiery opponents?

Wilson discovered that the woodland ant had evolved a unique strategy to keep its enemies at bay. Unlike most other ants, the woodland ant has two classes of workers — a “minor” class (i.e. a typical worker found in most ant species) and a larger “soldier” class with sharp, powerful mandibles.

The soldier class represents about 10% of the woodland ant population and spend most of their time idle…until they detect a fire ant.

Upon detecting a fire ant, the woodland soldiers go into hunt mode, ripping to shreds every foe they come across. After their initial response, the soldiers patrol the area over the next few hours to eliminate any other fire ants they find.

Wilson provides the punchline in the book Journey to the Ants:

The result of this zeal is that fire-ant scouts seldom make it home. And without dispatches from the front, their colonies are blinded…The hair trigger reaction of the defenders [woodland ants], renders them undetectable most of the time.

What’s fascinating about this survival strategy is that it is only one of hundreds employed by the 9,500+ different ant species across the globe. For example, consider the army ant (Eciton burchellii) which is constantly on the move and uses overwhelming force to devour all insects and even small birds they come across.

When not moving, army ants make temporary nests out of their own bodies (called bivouacs) where they can control the internal temperature and humidity level:

Or how about the leafcutter ant (Atta texana) which lives off of fungus it cultivates underground:

Or the African weaver ant (Oecophylla smaragdina) which constructs nests by gluing together leaves with silk produced from their ant larvae:

My point is that there are many different strategies that ants employ to survive and thrive — there are many ways to win. But, despite these many winning strategies, all ant species follow a few simple rules:

- They all communicate mostly via scent/taste.

- They all rely exclusively on female workers and a queen for the colony (i.e. you have probably never seen a male ant in your life, as they have wings and only live during the mating season).

- They all constantly sacrifice workers for the good of the colony. For example, it is estimated that roughly 6% of some ant colonies die every hour while they are foraging.

Without these rules, most ants would not be able to survive regardless of their specific evolutionary strategies.

This idea is relevant to investing, because as investors, we spend a lot of time thinking about our specific investment strategy (i.e. how much should I put in value stocks? Should I avoid emerging markets? Etc.) despite the fact that a few behavioral rules will likely drive most of our investment success.

I would argue that 70–80% of your investment success will come from these few rules, while the remaining 20–30% has to do with the specific asset allocation strategy you select. Let me explain.

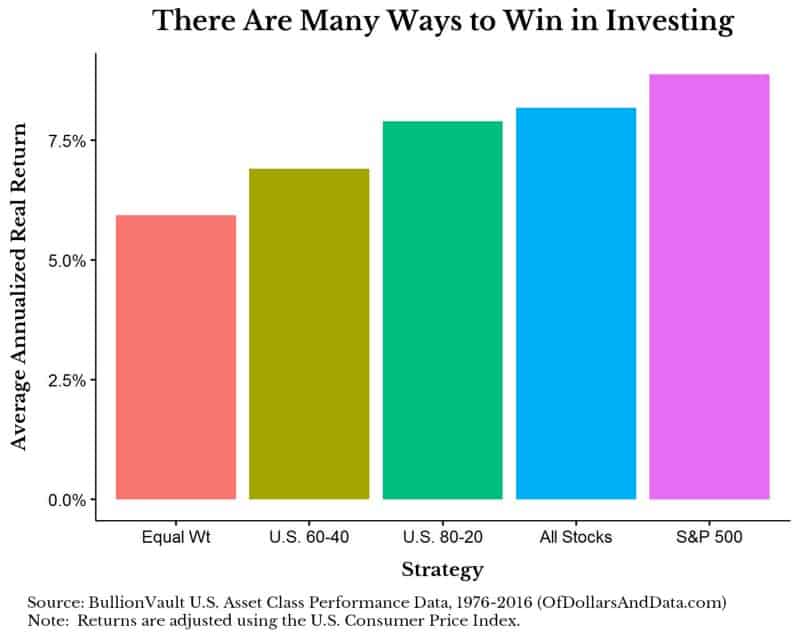

After looking at a variety of investment portfolios over the 40 year period of 1976–2016, I found that the average annual real returns ranged from 6%–9%.

The 6% return portfolio (“Equal Wt”) was an equal weighted portfolio of six assets (U.S.10-Year Treasuries, U.S. 3m T-bills, U.S. Corporate Bonds, S&P 500, Int. Stocks, and REITs) while the 9% return portfolio was 100% U.S. stocks (“S&P 500”).

You can compare their annual performance, along with some other portfolios here:

As you can see, the differences are not that drastic between the portfolios. If we compare the “Equal Wt” portfolio to the “All Stocks” portfolio (which contains 50% S&P 500 and 50% Int. Stocks) we would see a performance difference of about 2% a year.

Don’t get me wrong, having 8% versus 6% annually over 40 years doubles the amount of money you have at the end, all else equal. However, by following a few simple rules you can easily make up for this difference.

Some good rules include:

- Saving money. Your returns won’t matter much if you can’t save money. It is far easier to double your savings rate from 5% to 10% (or 10% to 20%) than to increase your risk adjusted returns. If you were saving 10% on a $50,000 salary, in order to save 20% (all else equal), you would need to raise your post-tax income by $5,000. So you can either attempt to increase your returns from 6% to 8% annually, or double your savings rate. One is unknowable beforehand, the other is completely in your control. You decide.

- Knowing your investment self. Understanding your investor behavior will play a far larger role in your long run investment success than a marginal amount of additional return. Why? All it takes is one bad decision to wipe out decades of good decision making. Your 2%+ premium can be lost in an instant if you don’t understand your risk tolerance.

- Keeping your fees low. Your future returns are not guaranteed, but your future fees are, so keep them in check.

- Using diversification. Don’t get me wrong, every person who has gotten very rich has likely done this through concentrated holdings, however, this strategy is also a surefire way to go broke. Diversification doesn’t necessarily improve returns directly, but it can transform the risk you take, which can indirectly increase your returns through better investment decisions (i.e. you may be less likely to panic). Just remember that underperformance for some asset classes is to be expected when diversifying.

My point is that while asset allocation is incredibly important, the difference in return between different allocation strategies can be mitigated by following the right investment rules.

A Rules Based Approach

One of the most amazing things about ants is how rules based they are. For example, most ants identify a dead ant by the scent of oleic acid. Their definition is so precise that if you put a living ant inside an ant colony after coating it with oleic acid, the other ants will throw it out because they believe that it is dead.

While we might think of this rules based approach as too rigid or possibly “stupid”, rules have enabled ants to succeed in varied environments across the globe.

This same idea is true in investing. Sticking to a decent investment approach has been shown to have incredible long term success. I recently heard about the Fidelity study where they realized that the investors with the best performance were the ones that forgot they had a Fidelity account!

It’s hard to deviate from an investment strategy when you don’t know you have one. So find a strategy that you like and stick with it. Remember, there are many ways to win…if you follow the right rules.

Lastly, if you are interested in learning much more about ant biology, I highly, highly recommend Journey to the Ants. It is an incredible read with even more amazing photographs. Until next week…thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 48. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data