In 2007 Warren Buffett threw down the gauntlet to the hedge fund industry. He said he would bet anyone $1 million that the S&P 500 would outperform a basket of hedge funds over the next decade. Ted Seides, the then co-manager at Protégé Partners, took him up on the offer. Over the course of the next 10 years, Buffett won out and Seides conceded in May 2017.

Well, now there’s a new bet in town. Recently on Twitter, Mark Cuban, of Shark Tank fame, and Peter Mallouk, President/CEO of Creative Planning, got into a spat about Cuban’s tweet concerning Dogecoin. One thing led to another and Mallouk challenged Cuban to a bet about what would outperform over the next decade, the S&P 500 or any set of stocks selected by Cuban.

Cuban countered Mallouk with another bet, stating that either Ethereum or Bitcoin (Mallouk’s choice) would outperform the S&P 500 over the next decade. Mallouk accepted both bets (which were each set at $1 million) after Cuban chose a 50/50 Amazon/Netflix portfolio against the S&P 500. The proceeds from each bet will go to a charity of the winner’s choice. To summarize:

- Bet 1: Bitcoin or Ethereum (Cuban) vs. S&P 500 (Mallouk), over next decade

- Bet 2: 50/50 Netflix/Amazon (Cuban) vs. S&P 500 (Mallouk), over next decade

Whose side are you taking for each bet?

I don’t think either of them have an obvious answer, so let’s dig into each.

Bet 1: The Future of Crypto

Of the two, Bet 1 is clearly the harder one to answer. Since we have no historical data for Bitcoin/Ethereum where their prices aren’t generally increasing, we can’t perform a rigorous statistical analysis. Therefore, Bet 1 is inherently a bet about what you think the future of cryptocurrency will look like. If you believe crypto will be more popular (and not heavily regulated) a decade from now, then Cuban seems more likely to win, but if you think it is a passing fad, then Mallouk seems more likely to win.

Either way, whoever wins Bet 1 is likely to win in a big way. If Mallouk’s belief about cryptocurrency is right, then BTC/ETH will likely have depreciated, and if Cuban is right, then BTC/ETH will likely have continued their journey upward. If I was forced to invest in one or the other for the next decade, I would have to pick the S&P 500 simply because it is far less risky than whatever may or may not happen with Bitcoin and Ethereum.

Of course, this isn’t an easy choice. I do think there is some value to Bitcoin and Ethereum and probably some other cryptocurrencies (which I know nothing about), but there is also undeniable speculation in the space. As a result, I can’t ascertain what percentage of Bitcoin and Ethereum’s current prices are based on value vs. speculation. Given the recent rise of Dogecoin, I know the true answer is a bit of both. Either way, this will be one of the biggest investment questions of the next decade.

Bet 2: Big Stocks vs. All Stocks

Unlike Bet 1, we can simulate how Bet 2 might turn out because we have historical data. How so? Instead of using Amazon and Netflix’s price history (which clearly has an upward bias far in excess of the S&P 500), we can assume that Amazon and Netflix are no different than any other well-established companies. Where can we find a bunch of well-established companies? The Dow Jones Industrial Average.

My thinking is this: what would win between the S&P 500 and an equal-weighted portfolio of two Dow stocks over the course of a decade. To test this, I grabbed the 29 Dow stocks in the index as of November 2005 with full pricing data through April 2021 (sorry GM). I started in 2005 because it was the date furthest in the past for which I could get monthly data for almost all of the stocks in the index. I then simulated every possible 2-stock equal-weight portfolio (all 406 of them) across all 10-year periods since November 2005 and compared their performance (without rebalancing) against the performance of the S&P 500 during the same time period. Here’s what I found.

From the 406 possible 2-stock portfolios, there are 66 separate 10-year windows over which we can compare performance. This gives us a total of 26,796 portfolio-decade combinations where we pit the S&P 500 against a 2-stock portfolio. And guess what? Of those 26,796 combinations, the S&P 500 outperformed the 2-stock portfolio in 52% of them. It’s basically a coin flip. However, if we had included GM (who had a bankruptcy in 2009), the S&P 500’s win rate would be slightly higher. So, slightly better than a coin flip.

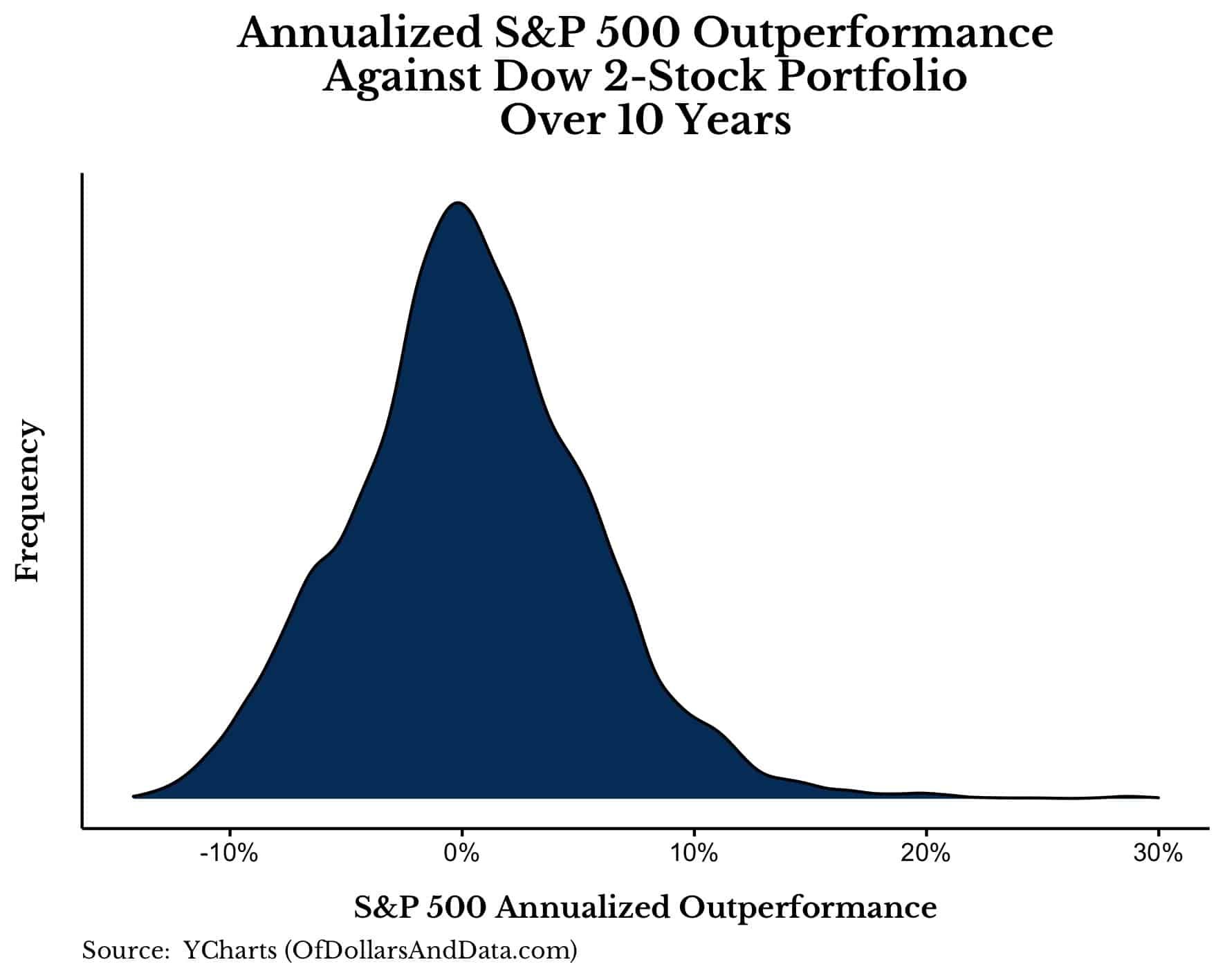

If we look at the distribution of the S&P 500’s annualized outperformance against these 2-stock portfolios, we make another useful observation:

As you can see, though the distribution is centered around 0%, it has a far right tail where some of these 2-stock portfolios perform miserably. One such portfolio that severely underperformed the S&P 500 over this period was AIG/Citigroup. This illustrates the large downside risks that can exist with individual stock ownership.

After reviewing this analysis, the edge is clearly in Mallouk’s favor, but I’m not convinced he’s gonna win this one. Why? Because there are arguments to be made that Amazon and Netflix are stronger/better companies than a typical company in the Dow. Of course, the strength of a company is irrelevant if investors have bid up the stock price too much, but I can at least see the argument for this one. You have two of the greatest companies ever created in human history against a basket of a lot of great companies with some declining ones too.

Therefore, though I would never actually invest in a 50/50 Amazon/Netflix portfolio over the S&P 500 because of the downside risks, I’m gonna give Cuban the benefit of the doubt on this one.

Ultimately, both of these bets have more to do with beliefs about the future than any sort of historical analysis. Whether Mallouk wins both, Cuban wins both, or they split the difference will come down to the evolution of industries on the cutting edge of business and technology.

Fortunately, we don’t need to have strong predictions about the future in order to build wealth. As long as you believe in continued human progress across the globe, you will likely be fine. You can bet on that. Happy investing and thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 240. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data