Last Monday (March 23, 2020) the S&P 500 closed down 33% from its all-time high on February 19, 2020, the most off its highs since 2010. In the 3 days that followed that close, the S&P 500 rallied 16% and the Dow rallied over 20%, leading some news organization to declare that a new bull market had begun.

Of course, very few investors are feeling bullish right now. According to AAII’s sentiment survey, 52% of investors are bearish, higher than any level since 2013 [Author’s note: An earlier version of this article inaccurately stated that bearish sentiment was at the highest level ever recorded].

With this level of volatility and bearishness, it’s hard to believe that March 23 could have been the bottom. When Ramp Capital asked his Twitter followers on March 24 whether we bottomed on the day before, 79% of participants said “No”:

But with such a big market rally, maybe the bottom is in, right? Not necessarily.

Rallies Aren’t Always A Good Sign

As my colleague Ben Carlson recently demonstrated, rallies are common on the way to the actual bottom.

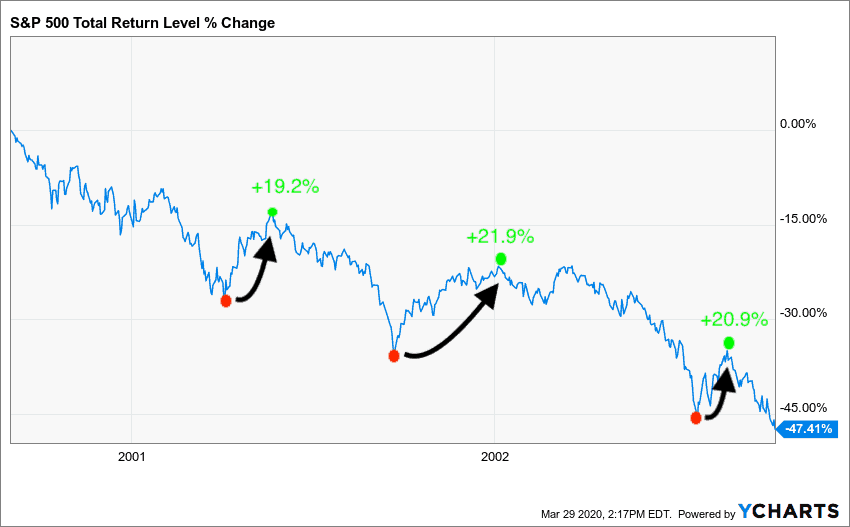

For example, as the DotCom bubble deflated, the S&P 500 (with dividends) had three separate rallies of nearly 20%:

From local bottom to local top, there were three occasions where investors could have thought the worst was over though it wasn’t.

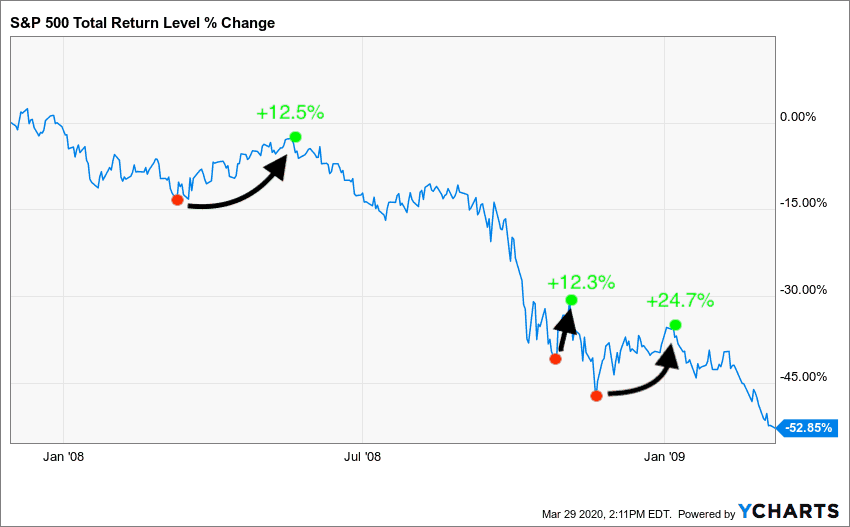

And the Great Recession wasn’t that much better either. The S&P 500 (with dividends) rallied over 12% on two occasions and had one final rally of 24.7% at the end of 2008 before bottoming in March 2009:

Looking at these charts you can see that rallies don’t necessarily mean that the pain is over.

The Stock Market is NOT the Economy

But what makes this exercise even more difficult is the disconnect between what is happening in the stock market and what is happening in the economy. This explains why the Dow managed to rally 20% in 3 days last week despite record jobless claims in the U.S.

This is your friendly reminder that the stock market is not the economy. One can surge while the other remains in tatters and vice versa.

The best example of this comes from The Great Depression: A Diary by Benjamin Roth, which records Roth’s day-to-day experience living through the early 1930s. On September 1, 1932, Roth recorded in his diary:

The month of August just ended has been the lowest point so far in the depression for all kinds of businesses and professional men. The heat has been severe and all kinds of activity are at a complete standstill.

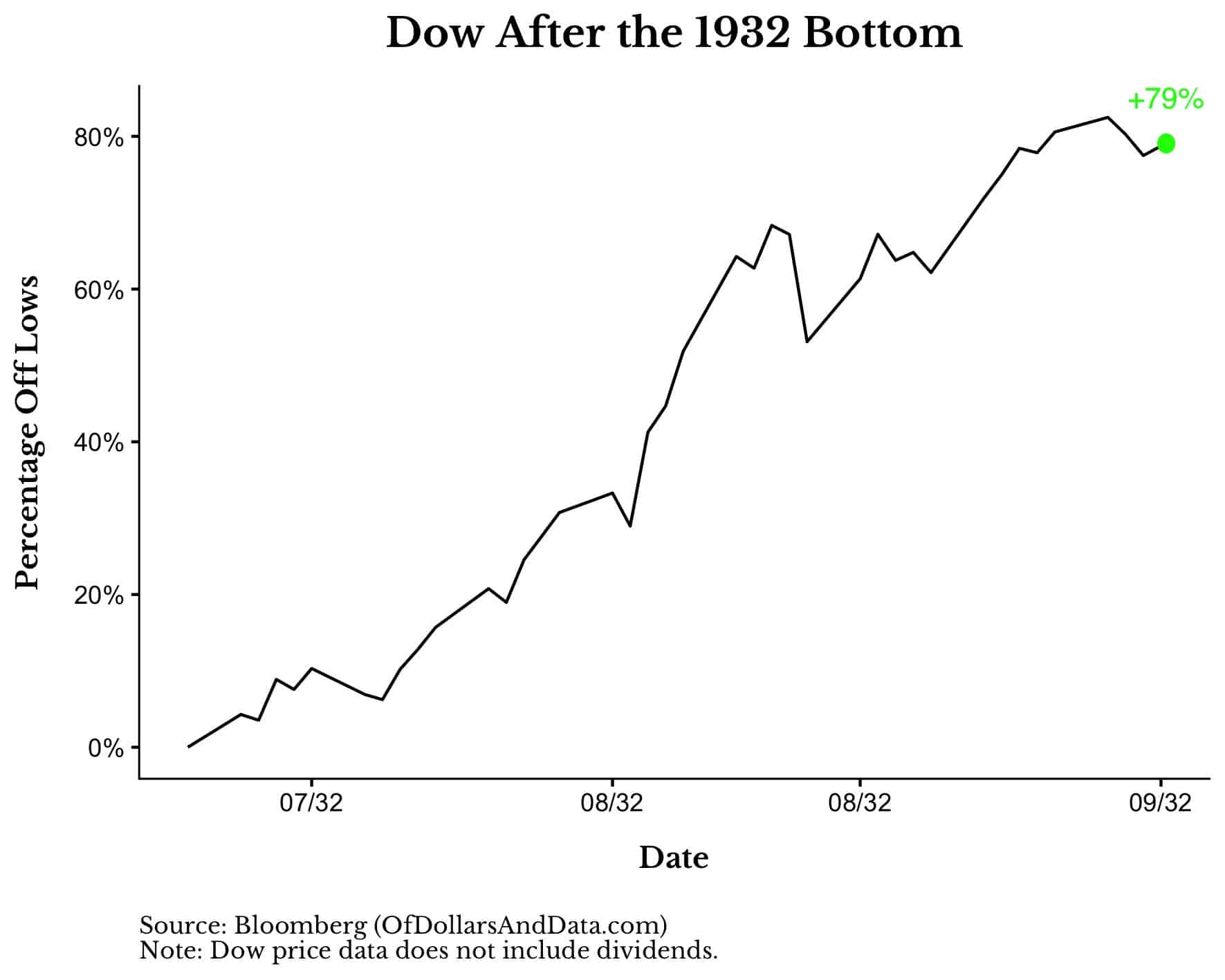

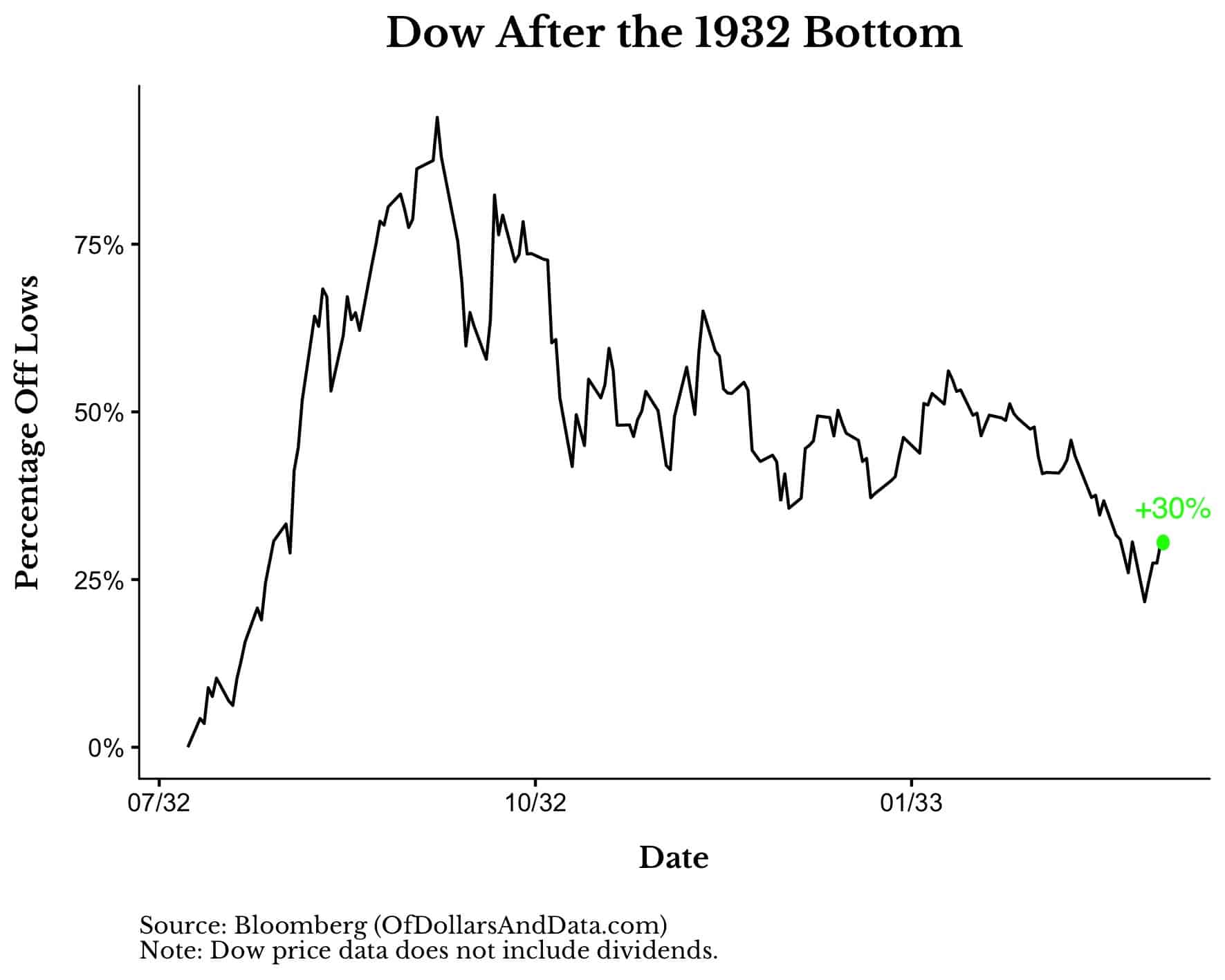

Reading this you might think that the stock market was due for more pain. However, this was written 2 months after the stock market bottom on July 8, 1932. Over this time period the Dow was up 79%:

However, this big rally was short lived. Over the next 6 months, the Dow declined 27% as business conditions worsened. Richard H. Pells stated about this period:

Economically, the winter of 1932-1933 was the worst in American history.

Nevertheless, the Dow was still 30% off the lows near the end of winter in March 1933:

And on March 8, 1933, Roth wrote:

Now after 3 1/2 years of the worst depression this country has ever seen, the end is not in sight.

Think about that. The U.S. had just gone through the darkest point in its economic history with many Americans, like Roth, feeling hopeless, yet the Dow was still 30% off the lows.

Of course, this doesn’t imply that the market will always bottom before the worst has passed, but I wouldn’t necessarily bet against it. In Wealth, War, & Wisdom, Barton Biggs provides numerous examples where the market was able to anticipate key events and turning points in WWII even before the experts.

So…Was That the Bottom?

Will March 23, 2020 go down as the coronavirus bottom? Maybe. Maybe not.

The more important thing to ask yourself is: how you will invest if it was the bottom and how will you invest if it wasn’t?

If you are long now, do you plan to rebalance more into stocks if they fall further?

If you are in cash now, when do you plan to get back in?

How likely was it that March 23, 2020 was the bottom? Why?

These are just some of the many questions you may need to ask yourself as markets remain volatile in the coming weeks (and possibly months).

But don’t stop there. Be specific and write out an investment plan if you don’t have one. It can be as simple as “Just Keep Buying,” or it can be far more detailed. The key is to be prepared for whatever comes next.

My Thoughts on the Bottom

I am not one for making market calls, but I think that when markets were down ~33% on March 23, 2020 we were closer to the bottom than the top. This implies that, even in my worst case scenario, I don’t think markets will go 66% (or more) off their February highs.

I was so convinced of this that on March 23, 2020, I sold my entire 15% allocation to bonds in my IRAs (which have the bulk of my retirement assets) and rebalanced into all equities and REITs.

Yes, bonds can serve a purpose in a portfolio, but once they served that purpose, I had to pull trigger. Full disclosure: I did not sell the 15% allocation to bonds in my brokerage account. Oh well.

Regardless, if March 23, 2020 ends up being the bottom, it means that I rebalanced the bulk of my assets on the best day possible by pure chance. Yes, I had been more bullish over those few weeks and March 23, 2020 is also the day that I published my strongest argument for buying stocks during a crisis, however, this was still mostly luck.

Maybe the market gods are paying me back for that time when my 401(k) rollover forced me to be in cash during a 6% market rally, but who knows?

Of course, it would be great if March 23, 2020 was the bottom, but keep in mind that my last market call didn’t age that well. Either way, this has been an incredible learning experience for me and I hope you have enjoyed following along.

With that being said, stay safe, stay inside, and thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 174. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data