What is the most important number in personal finance?

I used to think it was net worth, or possibly liquid net worth, but I have since come to the conclusion that these measures have some serious limitations. Net worth, for example, isn’t the best indicator of financial acumen because it doesn’t come with any context. It doesn’t tell you how someone got their net worth.

For example, if Person A has $1 million in net worth and Person B has $900,000 in net worth, you might assume Person A is better off financially. But what if I told you that Person A got most of their net worth from an inheritance while Person B got theirs through hard work and savings? Does Person A still seem like a better financial bet?

Or what about Person C who has a $1 million net worth mostly held in real estate? Seems like a good life until you realize that they are in debt up to their eyeballs. This is how Dave Ramsey became a millionaire in his early 20s before declaring bankruptcy after his loans got called in. He learned the lesson the hard way—not all net worth is created equal.

Given these limitations surrounding net worth, is there a better measure of financial competence? Is there a more important number in personal finance?

Enter the lifetime wealth ratio.

The Lifetime Wealth Ratio (“LWR”)

The lifetime wealth ratio (“LWR”) is a concept invented by the financial blogger J. Money at Budgets are Sexy back in 2015. J. Money defined the LWR as:

Lifetime Wealth Ratio = Net Worth / Total Lifetime Income

As a quick refresher, net worth is defined as:

Net Worth = Assets – Liabilities

Where assets are everything that you own (i.e. house, car, bank accounts, securities, rental properties, etc.) and liabilities are everything that you owe to others (i.e. credit card debt, student loan debt, mortgage, etc.)

For total lifetime income you need to aggregate all of your income throughout your working life including inheritances.

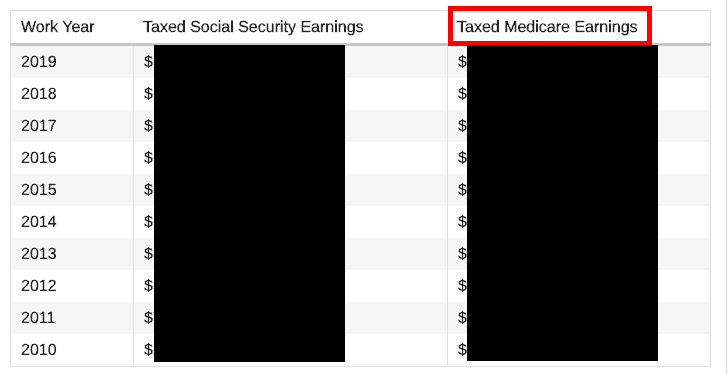

For U.S. Residents, you can get a record of your lifetime earnings by creating a my Social Security account here. Once you are logged in, you can click “Earnings Record” on the right side to get your Taxed Social Security and Taxed Medicare earnings annually. It will look like this (without the black boxes):

Since there is a maximum taxable earnings for Social Security, you should use your Taxed Medicare earnings for calculating your total lifetime income.

The next step is simple: divide.

After taking my net worth and dividing by my total lifetime income, I got 36%. That’s my LWR. Of all the income I have ever earned (before taxes), I have been able to turn 36% of it into wealth.

In the original article, J. Money provided his own rankings for how to interpret your LWR:

- 0%-10% – Meh

- 10%-25% – Now we’re cooking!

- 25-50% – You’re on fire, baby! Give me your number!

- 50-100% – Marry me.

- 100%-1,000% – How do I get into your will?

Despite how unscientific his ranking system is, this is a far better way of determining your financial competence than net worth.

Why I Like the Lifetime Wealth Ratio

The reason I prefer the LWR to something like income or net worth is that it controls for both the stock and the flows in your personal finances. Your net worth is a stock (i.e. a snapshot of your accumulated wealth) while your income is a flow (i.e. a measure of how your wealth is changing through time). They are both great, but limited.

The LWR, on the other hand, uses both stocks (i.e. your net worth) and flows (i.e. your total lifetime income) to judge your financial skill. It is basically a measure of how good you are at converting your income (a flow) into wealth (a stock).

I particularly like the LWR because it allows you to benchmark the two most important things in personal finance (your saving ability and your investing ability) at the same time. If you are a good saver or a good investor (or both), you will have a higher LWR than someone who isn’t.

However, this measure is not without its problems.

The Problems With The Lifetime Wealth Ratio

As much as I admire the LWR for providing a better benchmark of financial prowess, it has three major flaws.

Firstly, the ratio is skewed against young people simply because they have had less time for their assets to compound. It is basically impossible for a young person to have a LWR above 100% unless they got extremely lucky with their investment portfolio. Why? Because after paying taxes, how else could someone have a net worth more than the income they took home?

Secondly, the LWR is biased against high earners who have to pay higher taxes. For example, if you made $500,000 when you were 22 and lived like a total hermit, you might be able to save $250,000 as a result. That is a LWR of 50% despite being an incredibly good saver. I’d put this person in the top decile of financial responsibility though they only scored a 50%. The issue is that the LWR penalizes those individuals who pay more in taxes.

Lastly, this ratio is the least useful for anyone who has had low income for a long period of time. Why? Because, as the data shows, those with low income spend basically all of their money on the necessities (food, rent, etc.) Without extreme saving measures, it is very difficult for these people to build wealth. This is why the LWR isn’t a great measure of their financial skills because having low income for a long time will just add deadweight into the denominator of the LWR.

Given these limitations, is there a way we can adjust the LWR into a slightly more useful metric?

Let me present the Wealth Discipline Ratio.

The Wealth Discipline Ratio™ (“WDR”)

What is the Wealth Discipline Ratio (“WDR”)? It is identical to the LWR, except we remove some level of basic spending from your income each year.

Why do we do this? Because everyone has to spend some money on the basic necessities to get by. Therefore, we should remove this “necessity spending” from your total lifetime income because there is no way you could’ve saved or invested that money. My theory is that money that you never had a chance of saving or investing should not count against you when it comes to building wealth.

However, money that you could have saved/grown should be counted. This is why this measure is called the Wealth Discipline Ratio, because it looks to answer the following: Of every dollar in wealth that you could have built through saving + investing, how much did you actually build?

This is a measure of your financial discipline through both savings and investing. It’s not just your savings rate, because it also incorporates how you use your savings to invest and increase your wealth.

The WDR is defined as:

Wealth Discipline Ratio = Net worth / (Total Lifetime Income – Basic Lifetime Spending)

Unfortunately, there is no perfect way to calculate basic lifetime spending, but we can make some assumptions to get started.

For example, the federal poverty guidelines are a decent representation of unavoidable levels of income needed to survive in this country. If we assume you don’t want to live in poverty, then you need to spend at least this amount to live, no matter what.

In 2020, a single adult earning less than $12,760 or a family of four earning less than $26,200 were considered to be in poverty. Therefore, you should reduce your annual income by some amount in this range when calculating your wealth discipline ratio.

What’s the right amount? This is a complex question to answer, but I suggest coming up with a minimum spending requirement for each city you have lived in and then removing that amount from your income while you lived there. Yes, this minimum spending requirement would be after-tax spending that is then removed from pre-tax income, but go with it for the simplicity. [Author’s Note: Ideally, we would subtract your basic lifetime spending from your lifetime after-tax income, but after-tax earnings are far harder to compile/calculate than your pre-tax earnings through the SSA.]

After subtracting my estimated spending from my pre-tax income for every year of my working life (I used a spreadsheet), I discovered that my wealth discipline ratio was a little less than 50%. This means that of every dollar I could’ve saved and invested to build wealth, I took ~50 cents and did so. The other 50 cents I spent to make my life easier and more fulfilling (i.e. having a shorter commute, going on vacations, etc.)

But is 50% good? What is the ideal WDR?

The Ideal Wealth Discipline Ratio?

Unfortunately, I don’t think an ideal WDR exists, but it can still be useful for understanding your financial history.

For example, if your WDR is less than 10%, you are probably living a “you-only-live-once” kind of lifestyle and you may want to consider saving/investing more. However, this doesn’t imply that a higher WDR is always better. In fact, a very high WDR (100%+) might be a sign of someone who is prioritizing money over living a more fulfilling life.

I can’t say with certainty because no single financial measure is perfect. However, the WDR can provide some good insight into what you are doing with your money and how you might be able to change to reach your financial goals.

Because the only thing that matters in personal finance is whether you can live the life that you truly want. If you can, then, financially, you have won. If you can’t, then what do you need to change to get there? I can’t answer this for you, but maybe increasing your wealth discipline ratio is a good place to start.

Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 197. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data