Now that the U.S. Presidential election has been decided in favor of a Biden/Harris administration, you might be wondering how this will impact your future finances. The most direct way that a new presidential administration can affect your finances is through changes to the tax code (should they come to pass). However, a change in the executive branch could also indirectly affect your finances through its impact on markets.

Therefore, today I plan on examining Biden’s proposed tax plan, the likelihood of it passing next year, and how a Biden/Harris administration could impact markets in the near term. Let’s begin.

Biden’s Tax Plan: Higher Taxes on Higher Incomes

If you have spent any time studying Biden’s tax plan, you already know that it raises taxes on those with high incomes in a big way. Some of its key features include:

- A new 12.4% social security tax on incomes above $400,000 (split between employers and employees)

- Corporate income tax increase from 21% to 28%

- Repeal of the Trump tax cuts (currently set to expire in 2025)

- Long-term capital gains rate increase from 23.8% to 39.6% on incomes above $1,000,000

- Elimination of the stepped-up basis rule

If you make a lot of money from either capital or labor, then Biden’s plan will cost you money. Not only does it increase taxes on labor income by repealing the tax cuts put forth in the Tax Cuts and Jobs Act of 2017, but it also adds a new social security tax for those making above $400,000. As a reminder, social security taxes currently phases out at an income of $137,700, but Biden’s plan would phase them back in after your income reaches $400,000.

In addition, investors with high incomes (>$1,000,000) would see their long-term capital gains rate climb from 23.8% to 39.6%, a significant increase. And since capital gains taxes are voluntary (i.e. you choose when to pay them by choosing when to sell your assets), a change of this size would incentivize investors to realize their gains (i.e. sell) before the new law takes effect. After all, wouldn’t you rather pay 23.8% now than 39.6% later? Despite the perverse incentives that such a policy change could create, I will discuss later why such a selloff is unlikely to occur.

Lastly, the most important change in Biden’s plan is the elimination of the stepped-up basis rule. As I have discussed previously, the stepped-up basis rule allows you to pass on any asset to your heirs tax-free as long as your total estate is valued below $11.6M (if single) or $23.2M (if married) at the time of your death. By eliminating this rule, Biden’s plan is essentially imposing an estate tax on any estate with unrealized gains, regardless of its size.

While I agree that most of the proposed changes of Biden’s plan focus on those with high income, the elimination of stepped-up basis will impact anyone who inherits property regardless of their income/wealth. But it makes sense why Biden eliminated stepped-up basis in his plan—it would raise a good amount of revenue. As the Tax Foundation reported:

According to the Joint Committee on Taxation, not taxing gains at death results in a loss of about $40 billion each year.

And when you consider that wealth inequality and income inequality have gotten worse since COVID started, Biden’s tax plan aims to shrink the gaps by taxing both high labor income and high capital income in big ways. Whether or not this will work to reduce inequality in the long run is another discussion entirely.

If you happen to be somebody that would be impacted by Biden’s proposed tax plan, I wouldn’t worry much at the moment, because it is unlikely that it will pass in the coming year.

Why Biden’s Tax Plan is Unlikely to Pass in 2021

Though the Biden administration has big plans for the tax code, I doubt they will become law anytime soon. Why? Short answer: the Senate. But, more specifically, because Senators from Georgia. Let me explain.

Currently, the Senate has 53 Republicans, 45 Democrats, and 2 Independents (who vote with the Democrats). That is a 53-47 voting split in favor of the Republicans. However, with the recent election results, the split is now 50-48 in favor of the Republicans, with 2 Senate races still pending for Georgia.

These races are pending because on election day no candidate in the Georgia Senate race got a majority of the votes. As a result, both Senate races will go to a runoff (1 v 1) election in January to find the winner. So, the Democrats need to win both Senate races in Georgia in January to secure a 50-50 split of Democrats and Republicans in the Senate for 2021.

And though most bills require a 3/5 majority (i.e. 60 out of 100) in the Senate to become a law, for proposed tax changes, a process called budget reconciliation can be used that only requires a simple majority (i.e. 51 out of 100).

And while the Democrats won’t technically have a simple majority in the Senate with a 50-50 split, they will have enough for a tie. And in the case of a tie in the Senate, the tie-breaking vote is always cast by the head of the Senate, the Vice President.

So you can see why these two Senate races in Georgia are so important for the Democrat party. By winning both races, Biden’s tax legislation can make it through the Senate since Kamala Harris will cast the tie-breaking vote.

However, there is just one big problem with this plan. Traders on PredictIt, the online betting market, believe that there is only a 24% chance that the Democrats will win both Georgia Senate races and gain the three seats needed for their simple majority.

This implies that there is a 76% chance that the Democrats won’t gain the Senate seats needed and that we will have legislative gridlock in Washington. With such gridlock, the Trump tax cuts are likely to stay the law of the land until at least the end of 2022, when the Democrats will have another chance to gain more Senate seats.

So before you rush ahead to sell off your assets to lock in a lower capital gains rate, remember that the higher capital gains rates proposed by the Biden plan are unlikely to materialize anytime soon.

How Might the Stock Market Perform During a Biden Presidency?

Though legislative gridlock in Washington seems like the most likely outcome in 2021, we have far less clarity on how the stock market will perform during a Biden presidency. However, history can be a useful guide.

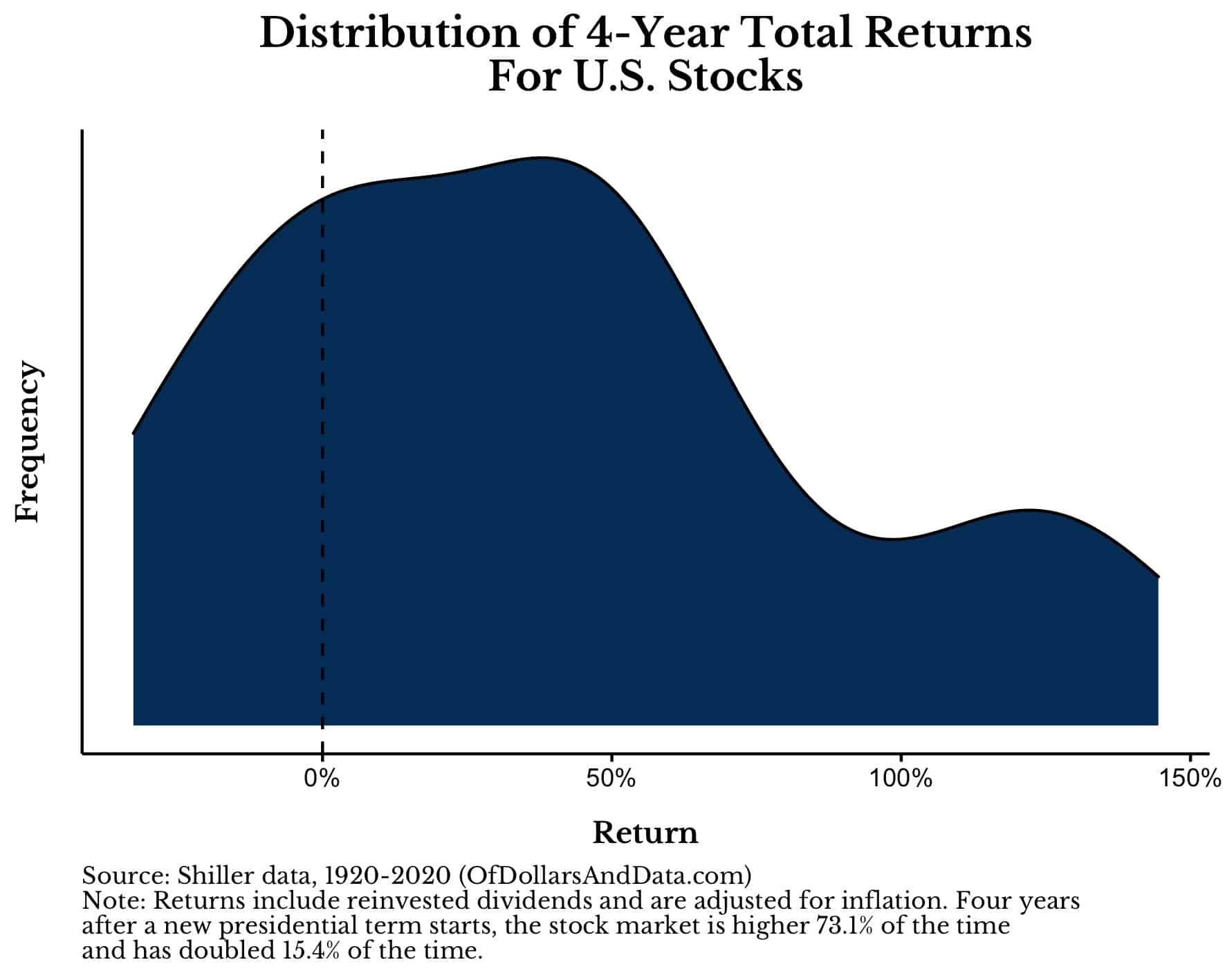

Looking back to the start of every presidential term since 1920, the U.S. stock market has been higher at the end of the term (4 years later) about 73% of the time:

This means that there was a one in four chance of a negative return over one presidential term, but also a one in six chance that the market would double (or more) within four years! It’s hard to imagine the stock market doubling in size from January 2021 to January 2025, but similar things have happened in about 15% of all presidential terms since 1920.

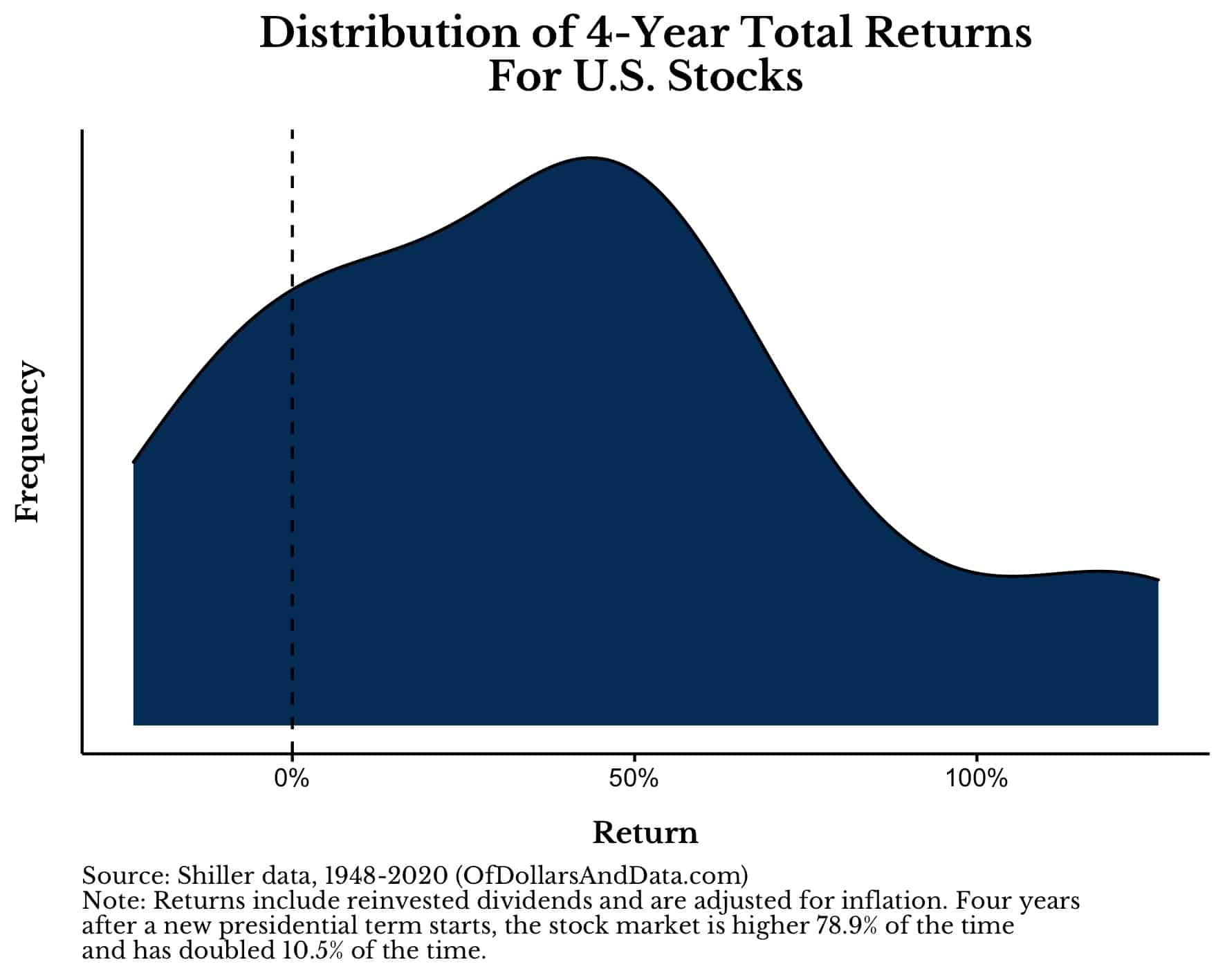

And even if we only use the post-war period (1948 onward), the chance of a doubling in one presidential term is still over 10%:

This illustrates the kind of growth that the U.S. stock market could experience during a Biden presidency. Of course, the future doesn’t have to be like the past, but do you really want to bet against the continued expansion of the American economy?

This illustrates the kind of growth that the U.S. stock market could experience during a Biden presidency. Of course, the future doesn’t have to be like the past, but do you really want to bet against the continued expansion of the American economy?

But, in addition to this historical data, a Biden presidency has the hope of a world without COVID-19. Though this has nothing to do with Biden specifically, if a viable COVID-19 vaccine were to be developed while he is in office, I could only imagine that a global market rally would follow. [Author’s note: I wrote this on Sunday night (11/8/2020), and, coincidentally, the next morning (11/9/2020) Pfizer announced their vaccine which was shown to be 90% effective. And, yes, a market rally ensued.]

So while no one knows exactly how markets will perform during a Biden presidency, the bullish case seems to be more convincing than the bearish case as of now. Of course, this is coming from someone who has been consistently bullish and will likely remain so.

The Bottom Line

No matter how you feel about the recent election results, a Biden presidency will likely have less of an impact on your finances than you initially imagined. This has more to due with the possibility of legislative gridlock and less to do with Biden’s policy proposals.

Nevertheless, some of you will convince yourself that a Biden presidency is super bullish or super bearish and make portfolio changes based on that belief. But, you are likely doing yourself a great disservice. As my colleague Ben Carlson recently demonstrated, U.S. stocks tend to rise (and fall) regardless of which president/party is in office.

This result suggests that if you are worried about how a president might impact your finances, then you should focus on their policies and not the stock market. Happy investing in 2021 and beyond, and thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 212. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data