On January 19, 2023, the U.S. federal government hit its $31.38 trillion debt ceiling and has since been unable to borrow more money. To get by, the U.S. Treasury has resorted to “extraordinary measures” (including redeeming investments from government pension funds) to continue funding its operations.

Unfortunately, these extraordinary measures are dwindling. As U.S. Treasury Secretary Janet Yellen recently noted, unless Congress raises (or suspends) the debt limit, the U.S. government may run out of money as early as June 1.

With such a dire warning, many investors have begun to wonder: what happens if the US defaults on its debt? Though this scenario remains unlikely, it is important to understand the potential consequences of a default and how they could impact you.

In this blog post, I will look at what might happen if the U.S. defaults on its debt, historical examples of other countries that have defaulted, and the implications of a U.S. default on your finances. But before we can discuss what happens if the U.S. defaults on its debt, we first need to define exactly what we mean by a ‘default’.

What is a Default?

When it comes to the term ‘default’ there are two ways that this has been broadly defined:

- An actual default: This is the traditional meaning of the term and it occurs when a borrower fails to make a required principal or interest payment to a lender.

- In the case of the United States (or any other sovereign nation), a default occurs if the government is unable (or unwilling) to make payments on its debt (e.g. if the U.S. failed to make payments on its Treasury bonds). Default in these cases can either be partial (failing to pay back some of the debt) or full (failing to pay back all of the debt). However, this isn’t the only kind of default that can occur.

- A technical default: Unlike an actual (or traditional) default when a government fails to make payments on its bonds, a technical default occurs if the government fails to pay for its other obligations even if its bond payments were made on time.

- For example, the U.S. Treasury could decide to prioritize Treasury bondholders and pay them in full before paying out whatever was left to Social Security recipients and government employees. While this would avoid a default in the traditional sense of the term, it could still negatively impact millions of Americans who rely on income from the U.S. government to pay their bills.

Secretary Yellen recently said that there is no current plan for payment prioritizations, but that could change in the coming weeks as the Treasury’s emergency funding starts to run dry. Robert Van Order, professor of finance and economics at George Washington University, recently told the Washington Examiner how this might unfold:

It’s not like they will have no money. They just won’t have enough, and so they’ll have to figure out what they pay and what story they’ll tell in the capital markets about how soon it will all be fixed.

Now that we have established what the kinds of default that the U.S. might experience in the future, let’s explore what could happen if the U.S. were to default on its debt.

What Could Happen if the US Defaults on its Debt?

As we navigate the political and economic complexities of raising the debt ceiling in the coming weeks, it’s important to understand what could happen if the U.S. defaults on its debt. The consequences of a such an event would have a major impact not only in the U.S., but across the globe. And while we can’t predict the exact outcomes, below are some possible scenarios that could unfold based on economic studies, expert opinions, and historical precedent:

- Global financial turmoil: Given the reliance of the global financial system on U.S. Treasury bonds and U.S. dollars, a default could lead to a loss of confidence in the U.S. government and a global market panic. The most visible impact of this would be declining asset prices and a disruption in international trade. The duration of such a panic would be determined by the severity of the U.S. default and how quickly the U.S. could restore confidence in financial markets.

- Possible recession: Two economists modeled the potential impact of a U.S. default on employment and the results weren’t great. They argued that a technical default (where the federal government fails to make payments for some of its responsibilities) would raise unemployment from 3.4% to 7%, and an actual default (where the federal government fails to make payments to U.S. bondholders) would raise unemployment from 3.4% to above 12%. Such a quick rise in unemployment could lead to reduced consumer spending and a recession.

- Rising interest rates: When the U.S. Treasury failed to make payments on $122 million in Treasury bonds in 1979, short-term interest rates jumped 0.6 percent. This was true despite the fact that the failure to make payments was a clerical error on the part of the Treasury and not an actual default (since all the bondholders were eventually paid back with interest). If the U.S. were to actually default, the cost of borrowing would rise sharply for individuals and businesses, ultimately slowing economic growth.

- Depreciating value of the dollar: A U.S. default could reduce confidence in the U.S. dollar and push many nations to seek out more reliable alternatives. This would reduce the demand for the dollar, decrease its value, and increase the cost of imports in the U.S., leading to higher inflation.

- Lower credit rating: If the U.S. were to default, credit rating agencies would downgrade the U.S.’s credit rating, which would make future borrowing more expensive for the U.S. government. Standard & Poor’s downgraded the U.S.’s credit rating for the first time ever in 2011 even though a default never occurred. Imagine what would happen if one did?

- Impaired government functions: An actual default (and even a technical default) could force the government to delay payments to Social Security recipients, employees, and others who rely on their services. This could disrupt the lives of millions of Americans and severely impact economic growth. The White House released a report in October 2021 that outlined the potential consequences of such a default and how it could impact various sectors of the economy.

- Political fallout: If your job was to get Donald Trump re-elected in 2024, there are few things that would help more than a U.S. default in 2023. Regardless of political beliefs, many Americans will hold the current party in power (Democrats) ultimately responsible in the event of a default. This would influence future elections and public policy for many years to come.

While these scenarios paint a sobering picture of what could happen if the U.S. were to default on its debt, it’s important to remember that no one knows the future. Don’t just take my word for it though. Consider what Warren Buffett said on the topic at the most recent Berkshire Hathaway shareholders meeting:

It’s very hard to see how you recover once…people lose faith in the currency…All kinds of things can happen then. And I can’t predict them and nobody else can predict them, but I do know they aren’t good.

Now that we’ve examined the potential repercussions if the U.S. defaults on its debt, let’s look at what has happened to those countries that have defaulted on their debt in the past.

What Happened When Other Countries Defaulted in the Past?

To further understand what might happen if the U.S. were to default on its debt, let’s consider what happened in other countries that defaulted on their debts. After reviewing the historical record, the most common consequences of debt default include:

- Intentional currency devaluation: When a country can’t pay back its debt, the easiest thing for it to do is print a bunch of money to pay it back. Unfortunately, this process devalues its currency and usually leads to high amounts of inflation. While this is one way to avoid (or get out of) a default, the consequences can be quite severe.

- When Russia defaulted on its debt in 1998, the Russian ruble lost over two-thirds of its value in three weeks. Similarly, after Argentina defaulted on its debt back in 2001, its currency (the Argentinian peso) was devalued by 67% in a matter of weeks as well. While the U.S. is in a different position as the owner of the world’s reserve currency, it seems likely that some dollar devaluation would take place in the event of a default.

- Debt restructuring: If a government decides not to devalue their currency after defaulting on their debt, then they tend to go into debt restructuring. There are two primary ways in which a country’s debt is restructured:

- Haircuts: A portion of the debt in question is written off before being re-paid. In a study of all debt restructurings from 1998-2005, researchers found that haircuts ranged from 13% to 73% of the balance due. A more in-depth historical analysis demonstrated that the average haircut was 37% from 1970 to 2010 across 180 debt restructurings from 68 countries.

- Rescheduling: Unlike a haircut which reduces the total debt owed today, a rescheduling lowers the interest rate and extends the term to pay back the debt over a longer period of time. Once you agree upon a net present value (NPV) for the remaining debt to be paid, research has shown that haircuts and rescheduling yield basically the same results.

- Austerity measures: When a government can’t afford to continue its spending at its current level, austerity measures such as tax increases and spending cuts usually follow. Though these measures are typically politically unpopular, many times they are necessary to get the country back on track financially.

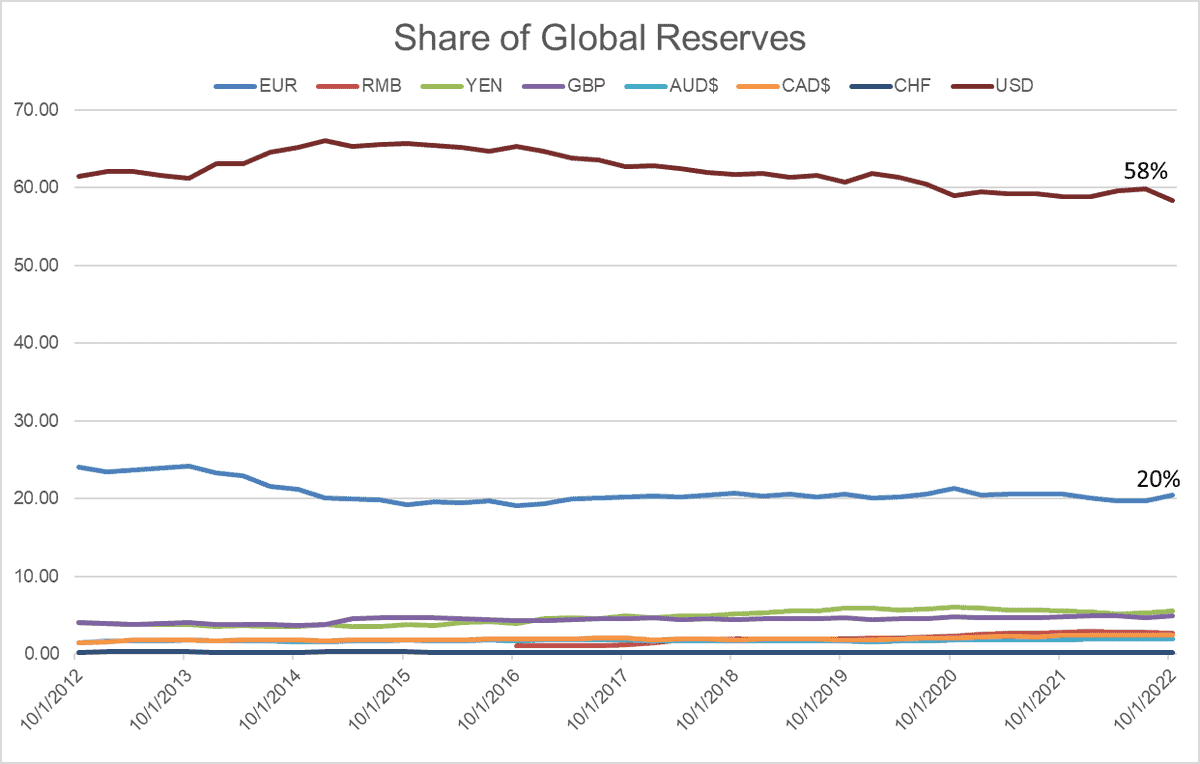

Though these are the common outcomes of a default, the U.S. may be able to avoid some of these in the event of a default. Why? Because the U.S. is the owner of the world’s reserve currency as this chart from Cullen Roche illustrates:

As you can see, though the U.S. dollar’s dominance has declined slightly over the last decade, it is still the most used currency on the planet and no one else is even close.

Because of this, it is possible that the consequences of a default won’t apply as strictly to the United States. Unfortunately, we can’t say for sure because we don’t have any historical data to rely on. We’ve never had a case where the owner of the world’s reserve currency defaulted on their debt. Therefore, we will just have to wait and see how things play out.

Now that we have examined what happened in other countries that experienced a default, let’s wrap things up by looking at the likelihood of a U.S. default and what it means for you.

What Does it Mean For You?

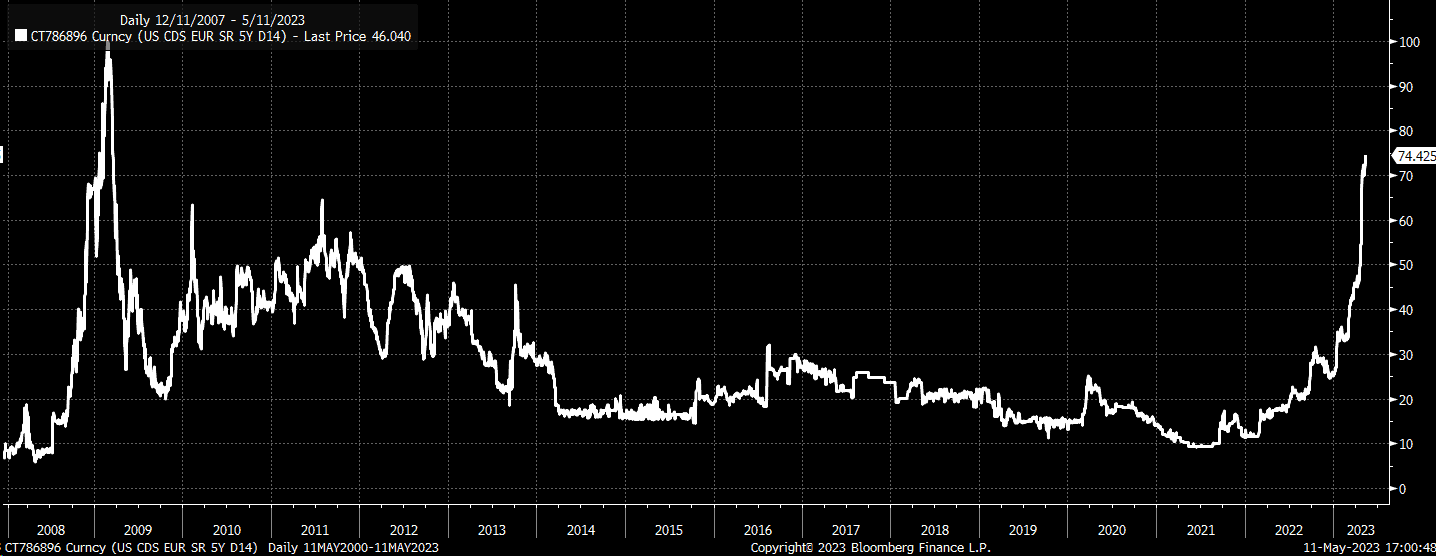

While we don’t know whether the U.S. will default on its debt in the coming weeks, the data isn’t moving in the right direction. As this chart from Michael J. Kramer illustrates, the cost of insuring the U.S. against default over the next five years (US 5-Year CDS) is at its highest level since March 2009:

Similarly, the spread on 1-year CDS has widened to the point where the implied probability of a U.S. default is around 4%. In theory, the probability of a U.S. default should be close to zero as former Fed Chairman Alan Greenspan explained in this 2011 TV interview:

The United States can pay any debt it has because we can always print money to do that. So there is zero probability of default.

Why is the market saying otherwise? Because economic theory is very different from political practice. While the U.S. can print money at will, political gridlock may prevent it from doing so.

This is why I believe that we might experience a technical default in the coming weeks. Given the political situation in Washington, there seems to be a decent chance that we won’t reach a compromise and the U.S. Treasury will have to prioritize bond payments over other government obligations to prevent a default.

If this were to occur, the pressure on Congress would be so immense that they would get a deal done. And they would do it with back pay for all missed government obligations (i.e. Social Security, federal employees, etc.).

Of course, this is just my guess on what happens if we don’t raise the debt ceiling before June 1. Could it be worse? Yes, but I think technical default will scare enough people into compromising. And even if we do experience an actual default, I believe the U.S. government will eventually just print the money and provide it to bondholders (with interest).

So what does this mean for you?

- If you rely on the U.S. government for income, expect a possible delay in this income in the coming months.

- If you own Treasury bonds/bills, there is a slight chance that you won’t be paid back on time and will need to wait for your money.

- If you own stocks or other risk assets, you may see their values decline. The depth and length of such a decline is anyone’s guess.

I don’t say this to fear-monger. It’s not my style. I am a long-term optimist and believe that even if the U.S. defaults, we will be fine. In fact, the first country to ever default on its debt was Spain back in 1557 (and it has since done so 15 other times), yet Spain lives on.

However, I don’t want to go into this situation blindly either. As Mark Twain allegedly once said:

It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.

And while I don’t know for sure whether Congress will raise the debt ceiling, history suggests that this is the most likely outcome. From the U.S. Treasury’s own website:

Since 1960, Congress has acted 78 separate times to permanently raise, temporarily extend, or revise the definition of the debt limit – 49 times under Republican presidents and 29 times under Democratic presidents.

While no one knows what will happen in the coming weeks, one thing is for certain—everyone loves spending money, especially when it isn’t their own.

Happy investing and thank you for reading.

If you liked this post, consider signing up for my newsletter.

This is post 348. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data