In their natural environment, every mammal gets 1 to 1.5 billion heartbeats. This is true of the half ounce Estruscan shrew to the 180,000 pound Bowhead whale. Even humans, before the advent of sanitation and modern medical technology, got about 1 billion heartbeats (we get closer to 2.2 billion now). All of this holds despite the large differences in mammalian lifespan. For example, the Estrucan shrew will live about 2 years while the Bowhead whale can live to about 200 years. The difference? Heart rate. The shrew’s heart is racing at somewhere near 1,000 beats per minute while the Bowhead whale is only doing 10 beats.

Think about how profound this is. One of the shortest lived mammals and one of the longest lived both have the same expected number of heart beats at birth. The term for differently sized systems displaying similar behavior is known as scale invariance and can be applied to non-biological systems as well.

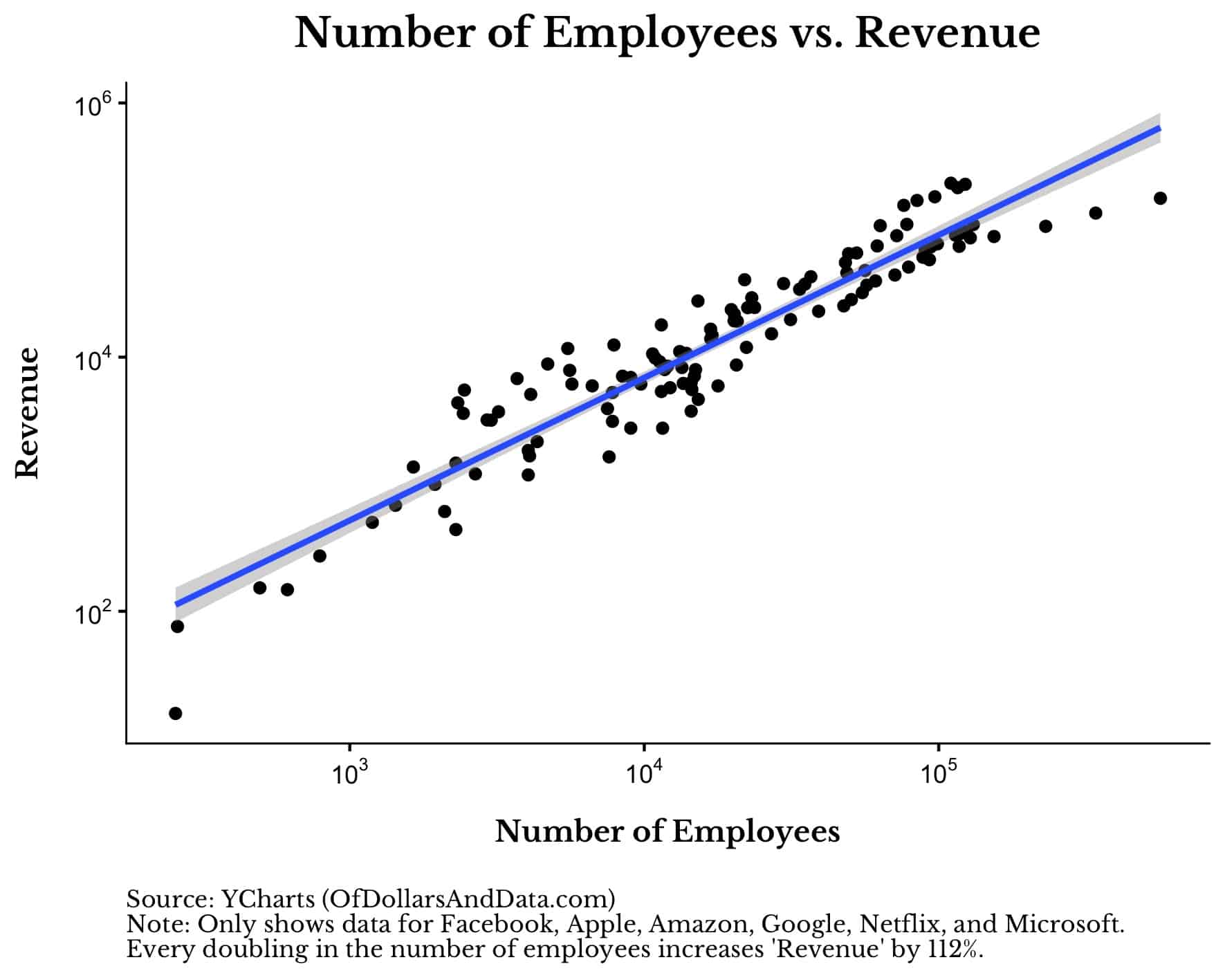

For example, if we look at the FAANGM stocks (Facebook, Apple, Amazon, Netflix, Google, Microsoft) and plot their number of employees versus their annual revenues over their lifetimes (on a log-log chart) we would see a striking relationship:

As the number of employees increases, company revenue increases slightly exponentially/superlinearly. To be exact, every time the number of employees doubles (a 100% increase), revenue goes up by 112% (more than double). This corresponds to the slope of the line above at 1.12 (on a log-log scale). Note that this does not imply causality between these two metrics, but that, in a successful business, they tend to move together in some organic fashion.

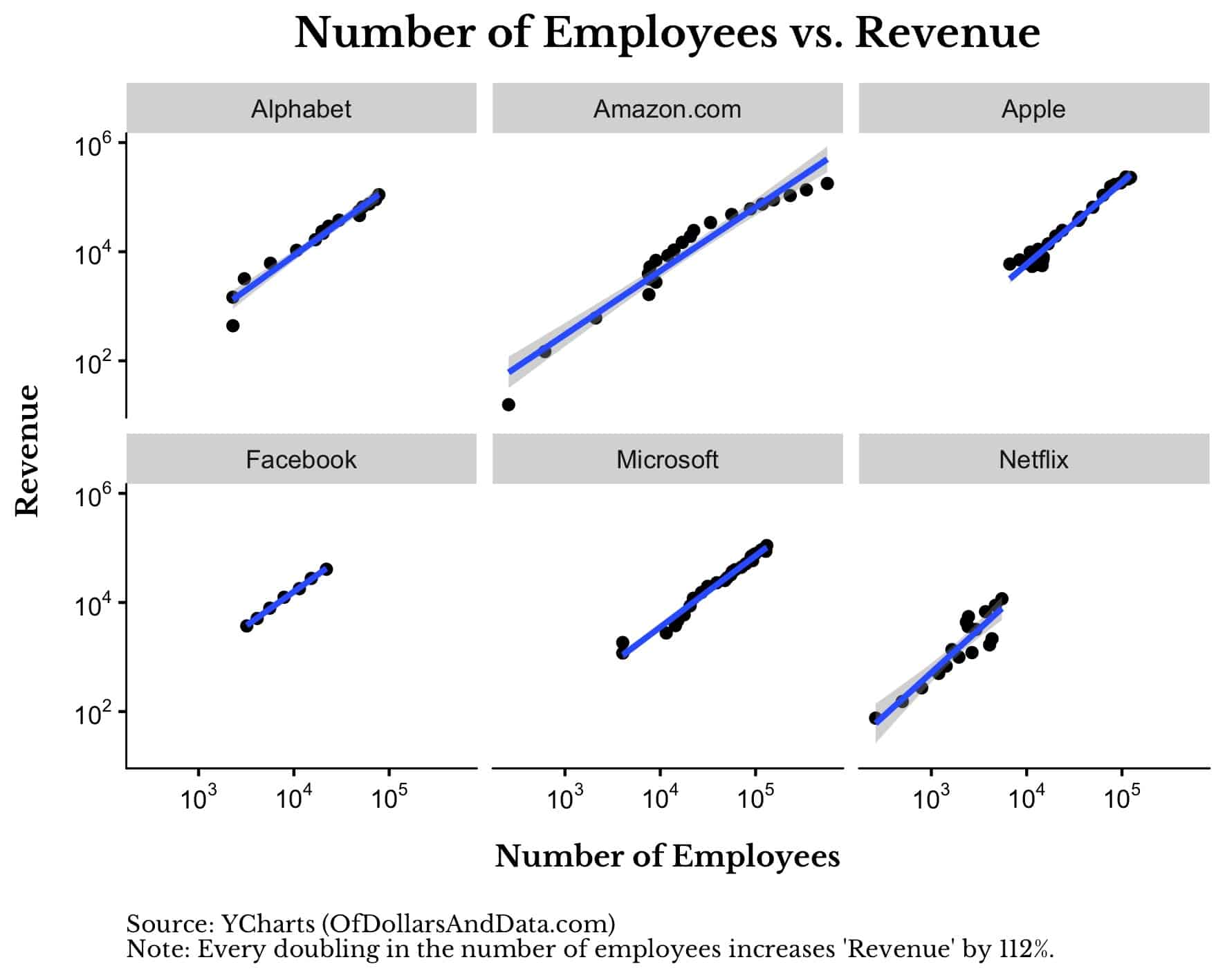

What’s even more amazing is that this relationship holds across all of these individual companies despite their different business models and hiring practices:

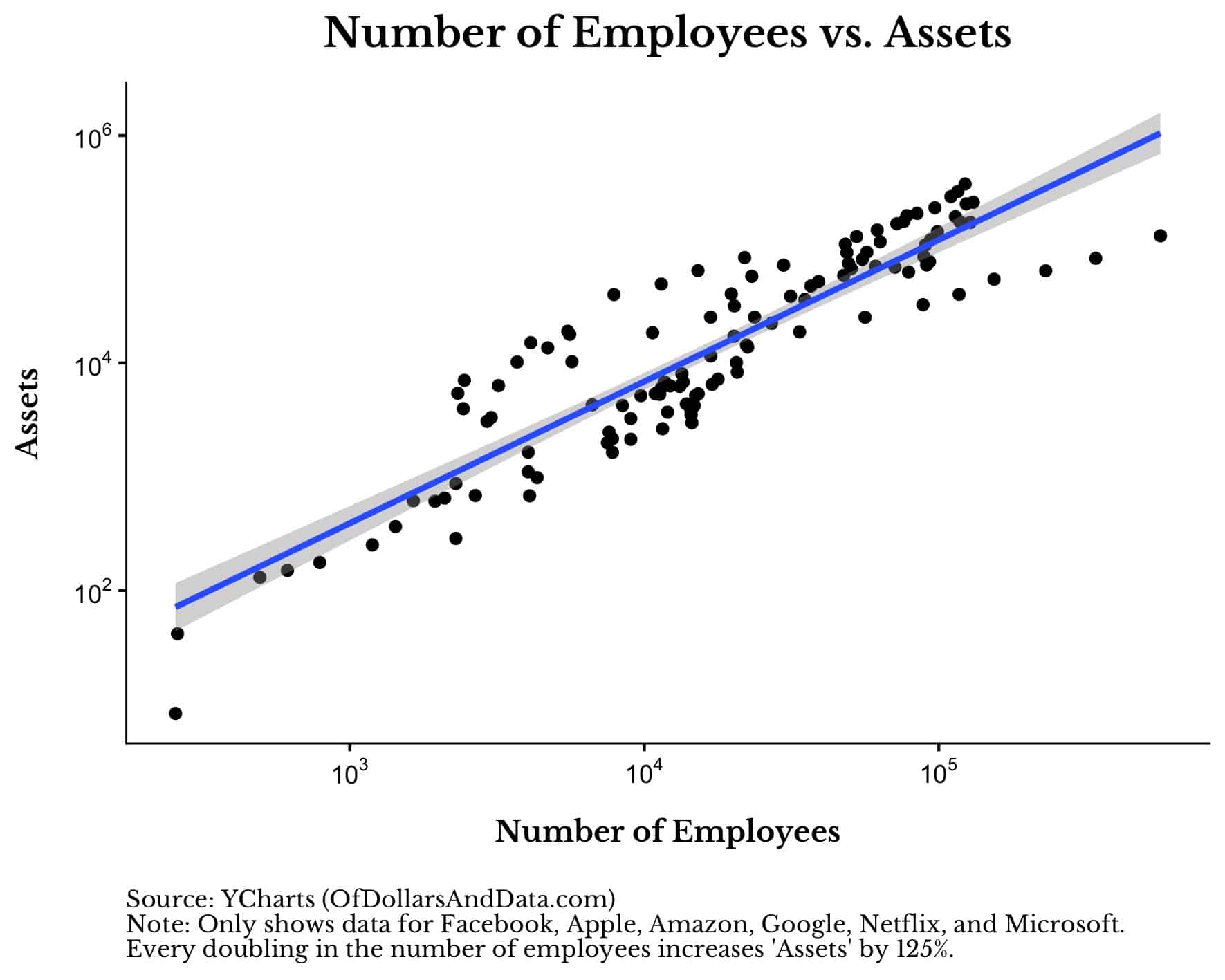

For example, Netflix prides itself on being “lean”, Amazon hires thousands of warehouse workers, and Apple has a large retail presence, yet they all seem to adhere to some natural law related to company size and revenue as seen by their similar slopes. I found the same thing when comparing the number of employees to total assets as well, except the scaling exponent was slightly higher at 1.25:

This isn’t just true for the FAANGM stocks either. Similar conclusions were found when examining the 28,853 companies in the CompuStat database in Chapter 9 of Scale: The Universal Law of Life, Growth, and Death in Organisms, Cities, and Companies.

My point is that certain complex systems follow a natural order that you cannot easily bypass. Geoffrey West, author of Scale, writes:

The existence of these remarkable regularities strongly suggests that there is a common conceptual framework underlying all of these very different highly complex phenomena and that the dynamics, growth, and organization of animals, plants, human social behavior, cities, and companies are, in fact, subject to similar generic “laws.”

These laws are immutable. They define how the world works. They are what will always be true.

For investors there are also certain things that will always be true. Yes, I could tell you about the consistency of fear, greed, and human nature, but Jim O’Shaughnessy and Morgan Housel did it better. I could tell you about the importance of luck in investing, but Michael Mauboussin did it better. No, what I would rather discuss is one of the oldest maxims in all of finance:

You cannot have more reward without taking on more risk.

This will be true today, tomorrow, and a thousand years hence. It will be true after every company in the Dow Jones has been replaced, after the final national anthem has been sung, after the last human takes its last breath. It will be true during high tide and low tide. It will be true whether the polar ice caps grow thicker or melt away. It will be true when the sun expands into a red giant and swallows the Earth whole. Across all space and time we cannot escape the link between risk and return.

Don’t get me wrong, some investors some of the time have violated this maxim by finding systematic mispricings in markets, but these were rare and eventually arbitraged away. Today doing the same thing is near impossible.

Yet, investors time and time again continue to believe they can get high returns with little risk to their own detriment. This was true in cryptocurrencies where the party of massive monthly gains came with the hangover of 70% drawdowns. And most recently we see it in the city of Chicago, which is taking out debt at 5.25% in expectation of earning more than this for its pension funds.

Of course the city of Chicago could pull this off if their investment portfolio averages above 5.25% over the lifetime of the bond, but remember even an “average” return could spell disaster if there are any major bumps in the road. As I have said before, the investment journey is more important than the destination, especially when you are borrowing money. Given this, if I were the city of Chicago, I wouldn’t take that bet.

Don’t Fight What You Cannot Change

While I do not know what future assets returns will be, I do know that if you want more than what is offered, you will need to take more risk. Don’t try to fight this because you cannot change it. Just like you cannot change human behavior and you cannot change the role that chance will play in your investment outcomes. These are all things we have to live with.

One of the most incredible ideas I learned while reading Scale is related to something else we all have to live with—the end of life itself. West writes (emphasis mine):

You can see, for instance, that if all heart and cardiovascular disease were cured, life expectancy at birth would increase by about six years. Perhaps more surprising is to learn that if all cancer were cured, life expectancy at birth would increase by about only three years—and at age sixty-five, only by a little less than two years.

Isn’t that an amazing fact? Even if we cured cancer, we only add 3 years to life expectancy. Of course this is still a noble goal because it would prevent so much pain for so many people, but it doesn’t change the fact that life leads to death. It doesn’t change what will always be true. So take your 2.2 billion heart beats and make them count. They are the only ones you will ever get.

If you want to expand your mind and how you view complex systems, I highly recommend Scale. Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 87. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data