Before you buy your next investment, consider the following question:

When do you sell?

The question seems easy enough, but I’d argue its the most challenging question for investors. Why? Because it forces you to face off against two of the strongest behavioral forces in investing: fear of missing out on the upside and the fear of losing money on the downside. Let’s go through a few examples to explain my thinking:

Imagine you are putting money into your 401(k) every 2 weeks and buying a diversified portfolio of cheap index funds/ETFs. When do you sell?

Excluding rebalancing, you might say, “I will only start to sell in retirement.” That was my gut response as well.

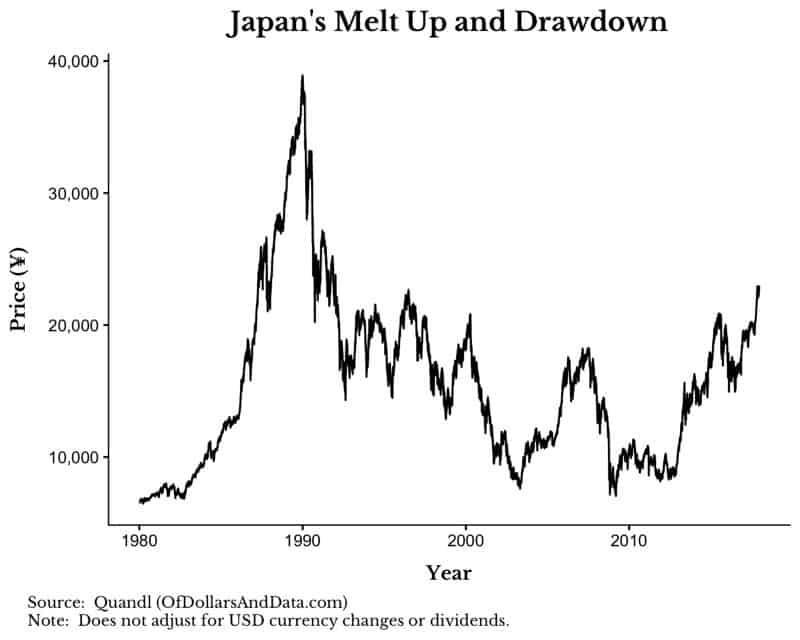

However, what if there is a melt up and valuations start to rise to extreme levels? If the CAPE kept rising from 30 to 40 to 50 … all the way to 100, would you sell then and move to cash? The only time we have ever seen valuations that high was Japan in the late 1980s when the CAPE rose to ~94, and you know what happened afterward:

So, do you cash out as the market heats up, or let is play itself out? We must also consider the flip side of this.

As you near retirement, the market starts drawing down significantly. In dollar terms you are down $100,000, then $200,000, then $300,000 and it is outside of your control. The decades you spent saving, investing, and making the right financial choices are being wiped out in a matter of months. So, do you sell?

It is easy to talk about buy and hold, but very different in a moment of crisis. I haven’t personally experienced anything more than a 10–15% drawdown across my portfolio since I have started investing in 2012, but based on what I have read, it doesn’t sound pleasant.

Large dollar drawdowns are known to be gut wrenching with many people reporting feeling physically sick. So before you talk the talk of not selling in a panic, consider whether you can actually walk the walk.

Now let’s propose a different scenario:

Instead of buying broadly diversified index funds/ETFs in your retirement account, you decide to do some individual stock picking in your brokerage account. Once again, when do you sell?

You might be tempted by Buffett’s wisdom from his 1988 letter to shareholders (emphasis mine):

When we own portions of outstanding businesses with outstanding managements, our favorite holding period is forever.

However, remember that of all the stocks in the Dow Jones Industrial Average in 1901, only General Electric is still in the Dow today. Forever is a lot shorter than it seems.

Assuming you don’t want to hold forever, let’s say you bought two stocks, one of which doubled in a year and the other is down 25% after a year. If you are a typical investor, you will sell your winner to lock in a gain and hold onto your loser so it can (hopefully) recover in price. This is known as the disposition effect and it is a well documented investor behavior.

However, the evidence suggests that selling your winners and holding your losers would (on average) be the wrong move. Why? Stocks that do well over the previous year tend to do well over the next year and stocks that did poorly over the previous year tend to do poorly over the next year.

This is known as momentum factor and it is also one of the most well documented investment results we see across different markets and time periods. This factor combined with the disposition effect provides evidence for how typical investors sell at precisely the wrong time.

The examples above are just two of many different scenarios you will face as an investor. Considering whether to sell an underperforming asset class, or thinking about the tax consequences of your actions will also effect if/when you sell. Nevertheless, being cognizant of the behavioral forces at play in every scenario can make a big difference in your investment results.

The Importance of When to Sell

The question of when to sell is important because it forces you as an investor to put a range on the downside and upside for when you should sell a given investment. It seems obvious after the fact, but I have gotten into many positions previously where I didn’t have a set price range (or selling methodology) in mind.

I thought about this idea while talking with some coworkers about the crypto market. One of them said, “I wish I had gotten into Bitcoin while it was $100.” I responded, “Okay, but when would you have sold?” He didn’t have an answer, and I don’t blame him.

It is hard to conceptualize Bitcoin at $15,000+ before the fact. It is far more likely that he, like me, would have sold out before it got anywhere near $15,000.

I can say with certainty that if I had bought Bitcoin at $100, as soon as it hit $300, or maybe $500, I would have sold. Why? A 3x-5x return is incredible in such a short time frame. Those are the kind of returns I expect over decades in equity markets, so why would I not lock those returns in if I received them in far less time?

Yes, my decision looks silly when Bitcoin hits $15,000 after the fact, but at the time, making 3x-5x in a short time frame is amazing.

So, before you go buy your next investment, ask yourself:

When do you sell?

Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 51. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data