Two years ago today the world was in a panic. The U.S. stock market was nearly 33% off its highs (the largest decline since 2008/2009) and no one knew what would come next.

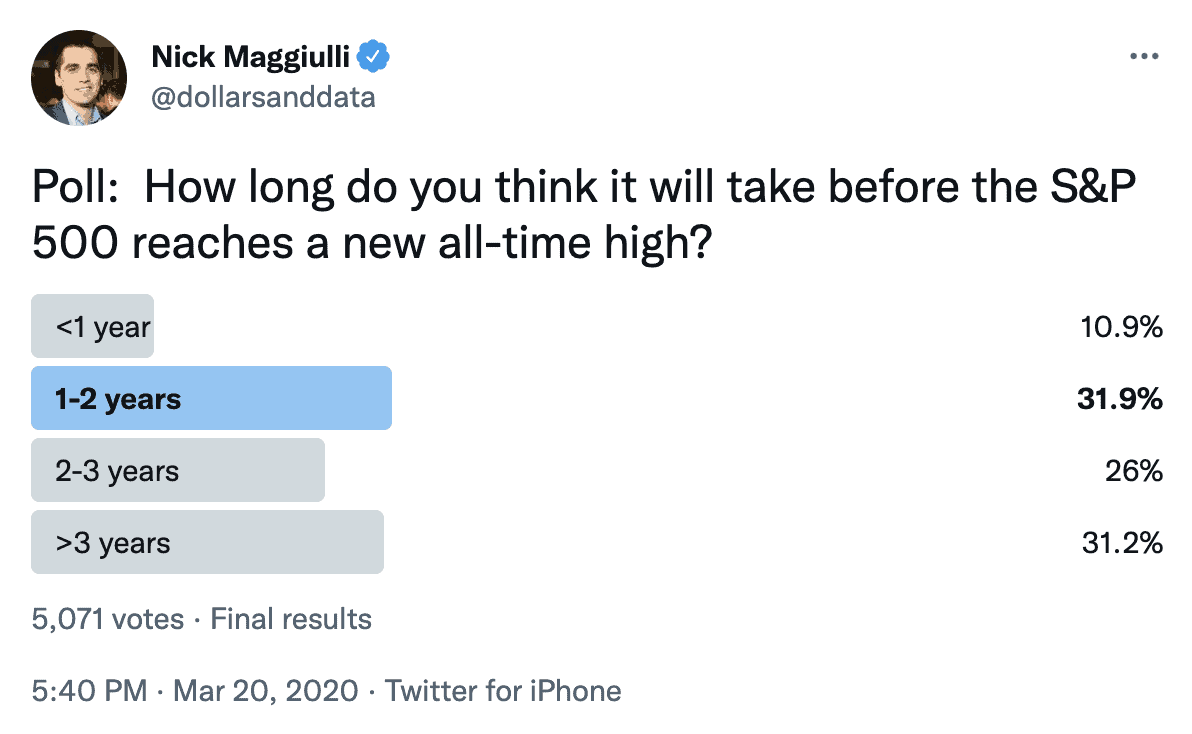

Around that same time I started to wonder how long it might take for the market to recover. How long would it take until we reached a new all-time high? I had no clue. So I asked Twitter what they thought and got the following results:

Over 5,000 votes later and Twitter had decided—the recovery would take 1-2 years. But that was just the most popular answer. Technically, the median estimate was 2-3 years, with 31% of investors thinking it would take over three years for the market to recover.

But there were the 11% of investors that claimed that markets would recover in less than a year. I’m not going to lie, despite my general bullishness on markets, I was not one of them. Though I had claimed that coronavirus would cause a “small, but temporary, pullback” on February 11, 2020, by March 22, 2020, I felt like I had gotten it wrong. A 1-2 year recovery seemed more likely to me.

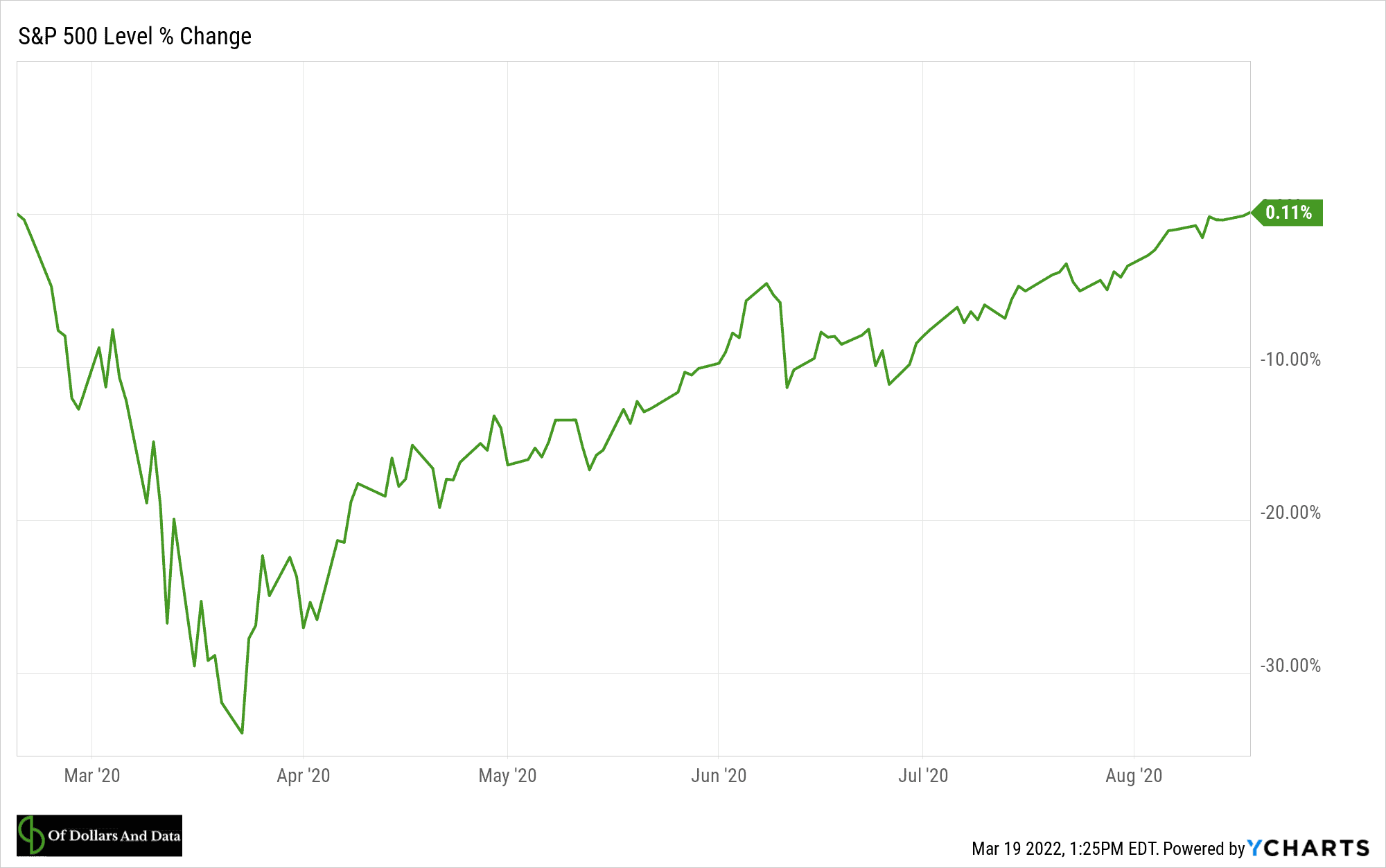

However, though my February 11, 2020 prediction was wrong in its magnitude, it turned out to be right with regards to timing. Because what happened next surprised almost everyone. As you probably remember, less than five months after the market bottomed on March 23, 2020, it was at a new all-time high:

Even the most optimistic investors were too pessimistic.

It’s much easier to see this when we consider how fast this recovery was from a return perspective. With the market down 33% and the median estimate predicting a 2-3 year recovery, this implied a 14%-22% annualized return. Even those who thought that the market would recover in one year were implying a 50% annualized return.

But what actually happened? A five-month recovery that resulted in a 164% return (on an annualized basis). It blew every estimate I saw out of the water. Of course, there may have been some people who thought markets might recover this quickly, but I don’t remember any public predictions of this sort. And trust me, I asked.

What happened from March 2020 to August 2020 reminds me of an incredible piece Drew Dickson wrote on Amazon that had an intriguing thought experiment.

Imagine it’s 2007 and a bunch of research analysts are debating what Amazon’s revenues will be like in 2020. One group of these analysts (let’s call them the “value” group) believes that Amazon will have $27 billion in revenue in 2020. But another group (let’s call them the “growth” group) thinks Amazon will have $37 billion in revenue by this time.

The two groups disagree on almost everything. They have different assumptions about expected GDP growth rates, Amazon’s margins, and what Amazon’s earnings will look like in 2020. Yet, despite their differences, both groups turned out to be astronomically wrong. Because Amazon’s revenues weren’t $27 billion or $37 billion in 2020, they were $386 billion!

This demonstrates why Amazon has been such an exceptional stock, but it’s also demonstrates how upside surprises are often overlooked by investors.

Why is this true? Because people hate losses much more than they love gains. As a result, they spend far more time thinking about downside surprises (market crashes) than upside surprises (extraordinary growth). Nevertheless, upside surprises happen more often than people realize.

One area where this true is in retirement. The common cultural fear is to “run out of money in retirement”, but the evidence suggests that the opposite (i.e. growing your wealth in retirement) is far more likely.

For example, Michael Kitces did an analysis where he discovered that retirees following the 4% rule in a 60/40 portfolio were more likely to 4x their wealth than deplete any of their principal after 30 years. In other words, if you started retirement with $1 million in a 60/40 portfolio and withdrew 4% a year, your chance of ending up with $4 million was higher than your chance of ending up with under $1 million after 30 years. This result seems absurd, but only because we have been bombarded with the opposite message (i.e. you will run out of money in retirement) for so long.

But I understand why we make these kinds of mental errors, especially when it comes to investing—we don’t have a great grasp of compounding. We don’t understand geometric growth as well as we understand linear growth, because it’s just not that intuitive. Consider the lily pad riddle I heard many years ago and you will see what I mean:

Imagine it’s 10:00 AM on a small pond with a single lily pad. If the number of lily pads on the pond doubles every minute, and the entire pond is full of lily pads by 11:00 AM, at what time is the pond half full of lily pads?

When I first heard this riddle my gut reaction was to say “10:30 AM” because that is the half way point between 10:00 AM and 11:00 AM (when the pond is finally full). This answer feels right because it assumes linear growth. However, the lily pads are growing geometrically (2x every minute), not linearly. This is why my gut reaction was wrong. Very wrong.

The correct answer is 10:59 AM, just one minute before the pond is full. Why? Because, as the riddle states, the number of lily pads doubles every minute. Therefore, the pond (by definition) will be half full just one minute before it is completely full. Hence, 10:59 AM.

This is why even the optimists can be too pessimistic. Because we are using linear thinking to imagine a geometric future. It just doesn’t work.

But if you can fight back against your default way of thinking, you might see things a bit differently. This is probably why I’ve become increasingly bullish on our future. Because I’m finally beginning to understand compounding. More importantly, I’m seeing it play out in my real life as well. I’m experiencing things that I only used to write about.

And, to be honest, it makes me optimistic. But, maybe, not optimistic enough.

Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 286. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data