Two years ago I made a prediction that got me laughed out of the room. Before we were ever wearing masks, being socially distant, or discussing web3, I argued that, “If history were to repeat itself…the S&P 500 would be 4x higher by 2030 than where it is today.”

Two and a half months later the S&P 500 was down 33% and the bears had a field day calling me an idiot on Twitter. Thankfully, the market recovered and I still believe in my original prediction. You might be wondering, “How Nick? How could stocks go up 4x from 2020-2029 after the incredible decade they had from 2010-2019?”

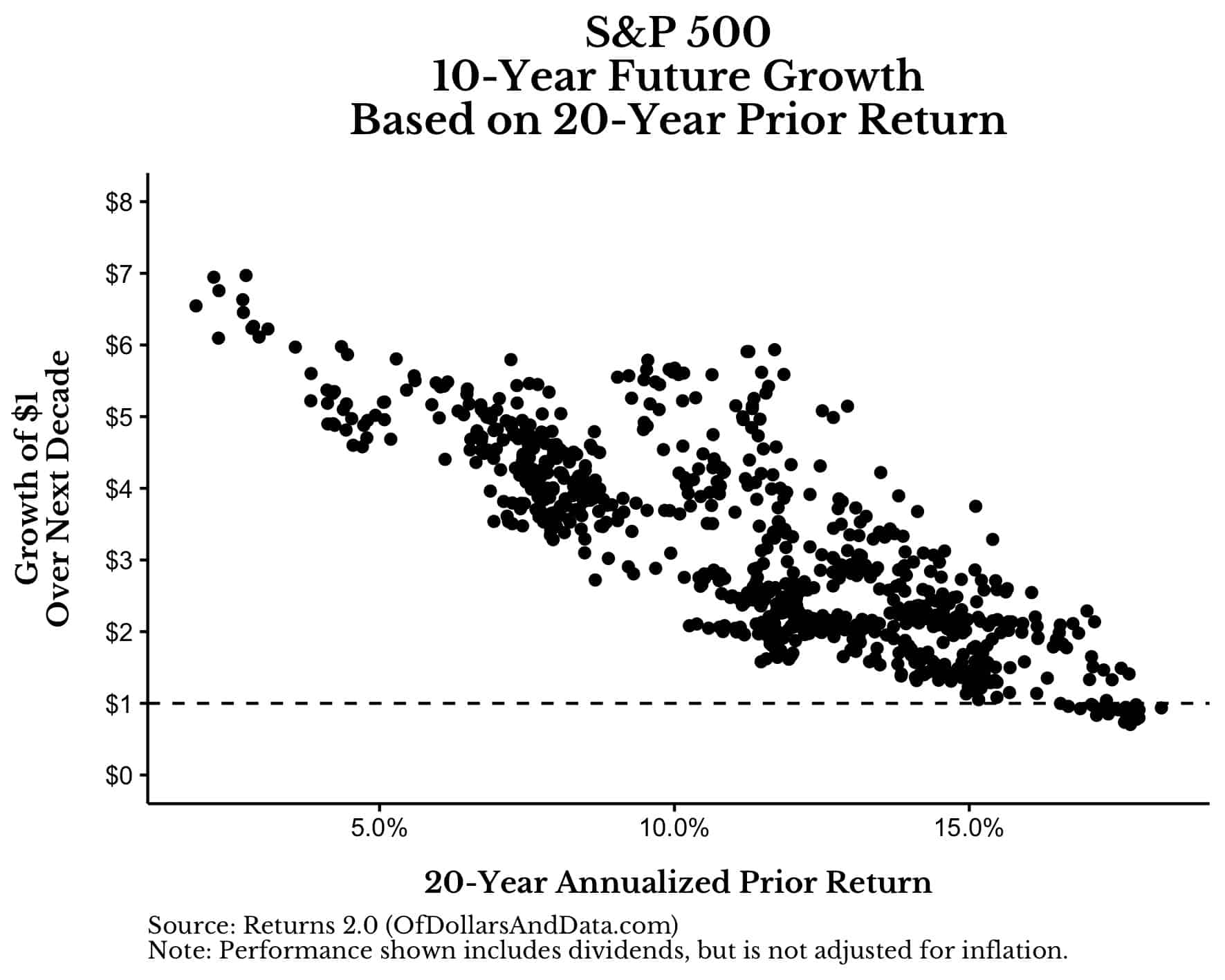

Well, because history suggests that this isn’t far-fetched. To demonstrate this I looked at the annualized returns of the U.S. stock market (including dividends) over the prior 20 years and compared them to the returns over the next 10 years.

Was there a pattern? Did 20-year prior growth have any correlation with growth for the next decade? Yes, somewhat.

Looking at the chart below you will see a clear negative correlation between prior 20-year growth and future 10-year growth. In others words, if U.S. stocks had a great 20-year period (on average), then the next decade was likely to be horrible, but if they had rough 20-year period, then the next decade was likely to be great:

While there aren’t a lot of overlapping periods in this data (though it goes back to 1926), this provides some evidence that U.S. stocks boom and bust with some regularity.

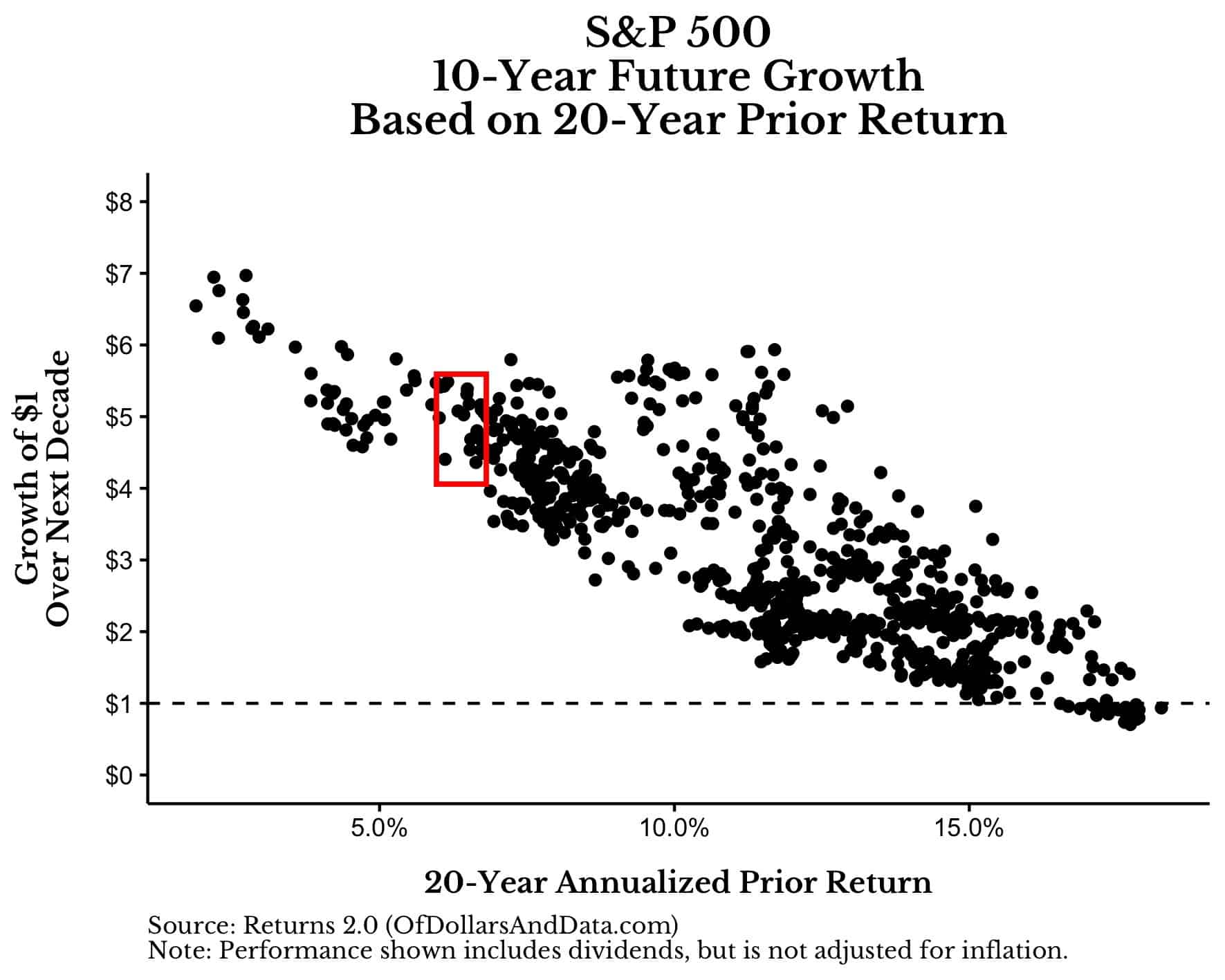

Well guess, what? The 20-year period from 2000-2019 had an annualized return of 6.3% (including dividends). So if we were to highlight that range in the plot above (you can see this below), we would expect U.S. stocks to grow between 4x-5.5x over the next 10 years (i.e. from 2020-2029):

And have U.S. stocks been keeping up with my prediction? Yes and then some.

Since I published this data in early 2020, the S&P 500 has increased by 52% (including dividends). This is roughly a 23% annualized return, which is far above the 15% annualized return that was required to get the S&P 500 to 4x by 2030.

So how far does the S&P 500 need to go to reach the 4x prediction I made at the beginning of 2020? 167% over the next 8 years. And how often do U.S. stocks return 167% (or more) over an 8-year period? Going back to 1926 it’s about 38% of the time. So there is a roughly 2 in 5 chance that my prediction will come true. I like my odds.

And with the S&P 500 currently at 4,670 and the Dow currently at 36,068, this means that we should see the S&P 500 hit 10,000 and the Dow hit 100,000 before 2030.

I know it might seem crazy to make this prediction after all the madness we have seen in markets over the past year, but, on the other hand, it also makes me wonder: Are we bullish enough?

I don’t think we are. If anything the bulls are starting to get a little bearish, myself included. A few weeks ago I wrote a piece about how valuations in the U.S. stock market could not last. I stand by my research, but I now believe that my interpretation of the results (i.e. “don’t buy more U.S. stocks”) was misguided.

How did I get it wrong? I didn’t care to consider the size of these overvalued stocks relative to the rest of the market. The total market capitalization of all the stocks in the Russell 3000 with a P/S ratio > 20 was only $4.5 trillion at the time. That represents just 8.5% of the total market capitalization of the Russell 3000.

So while I believe that the valuations on those U.S. stocks are definitely inflated, how can I then argue to avoid all U.S. stocks as a result? I can’t. My bearish sentiment creeped in and I made a mistake.

As a result of this I am starting to believe the opposite—we aren’t bullish enough. I know how extreme this sounds after the last decade or so of U.S. stock returns, but what if it’s not a market crash we need to worry about but a melt-up? What if the world recovers from Covid in a way that takes markets to a whole new level?

I’m not saying that markets have reached “a permanently high plateau” or that they won’t crash ever again. Of course the market will crash again, possibly right after I publish this article. But what if the opposite happens? What if we have exceptional growth over the next decade instead of a long bear market? What if our future is dominated more by abundance than scarcity?

We are already starting to see this today as basic goods and services have become more common throughout the world. The majority of people on Earth now have access to electricity, running water, the internet and much more. This is why I believe we have entered a new age of prosperity. An age of too much rather than not enough.

This transition hasn’t just happened with physical goods, but with information as well. As David Perell recently highlighted:

In a world of information scarcity, you censor people by blocking the flow of information. But in our world of information abundance, you censor people by flooding them with irrelevant ideas and meaningless data.

Today our problem isn’t having enough information, but having the right information. Something similar can be said about markets and economic growth too. This is why I’m less worried about our ability to create wealth and more worried about how we will divide that wealth once it has been created. It’s about resource selection and division, not resource creation.

If this is indeed our future, then we should be more concerned with political and social instability rather than a market crash. It’s pitchforks we need to care about, not drawdowns.

If you are skeptical, I get it. It’s seems unfathomable that we could see another big year in the market after experiencing a 28.7% total return in the S&P 500 in 2021. But you could have made the same argument at the start of last year after seeing an 18.4% total return in 2020 (during a global pandemic!) and a 31.5% total return in 2019.

But that’s why markets are so intriguing. They can surprise us both on the downside and on the upside. So, I ask again, are we bullish enough?

Happy investing and thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 276 (see also code 158). Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data