The biggest story in finance over the past few weeks concerns Bill Hwang, the founder of Archegos Capital, who lost a record $20 billion in the span of two days. How did he do it? Leverage and lots of it.

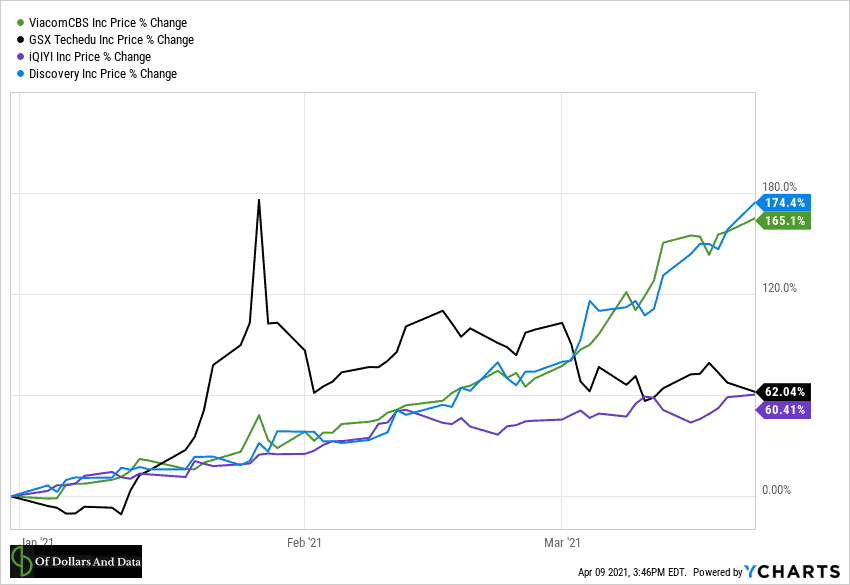

Hwang had levered up about 5x through an assortment of swaps contracts on a handful of individual stocks. The payoffs on these swaps were relatively simple: If Hwang’s stocks were up on the day, his banking partners paid him cash, and if they were down on the day, he paid them cash. From the beginning of 2021 through mid March, this strategy worked wonders for Hwang. Below is a chart illustrating the performance of some of his major holdings over this time period:

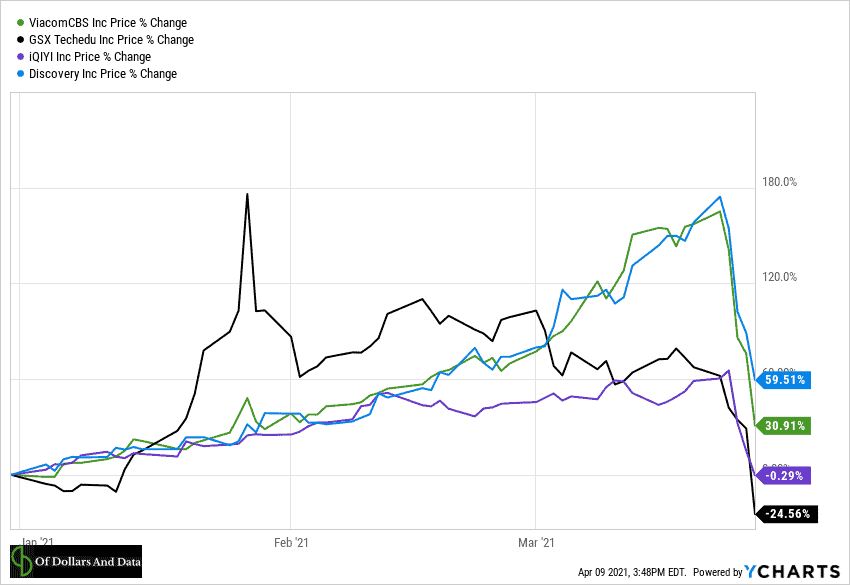

But, then this happened over the course of the next few days:

After experiencing such a severe decline across his portfolio, Hwang had to come up with significant amounts of cash to pay his banking partners. Unfortunately, he didn’t have it. As a result, some of his banks took swift action and began liquidating his positions, causing further losses. As the liquidations mounted, Archegos entered a death spiral. Within two days, Hwang’s fund had lost $20 billion.

While it would be easy for me to write a post criticizing Hwang for using too much leverage, that idea isn’t particularly interesting to me nor particularly helpful to you. Not only have I written about this topic before, but individual investors like you and I aren’t allowed to borrow at these levels anyways. Warning against the use of 5x leverage would be like warning against the dangers of getting injured while playing in the NFL. It is a risk, but not one that 99.9% of people have to worry about.

But what is intriguing about this story is what it illustrates about how we think about wealth. Based on what I’ve read, Hwang now holds the record for the fastest loss of wealth in history. Mark Zuckerberg once lost $16 billion in a single day after Facebook shares plunged by 19% in July 2018, but that was an unrealized loss (on paper only). Since Zuckerberg didn’t sell his shares and Facebook’s share price is now 50% higher than it was before the decline, the loss doesn’t really count.

But I don’t think Hwang’s loss of $20 billion counts either. Because if Hwang had tried to get out of his positions in the days before they crashed, I doubt he would have been left with $20 billion (or anywhere near that) anyways. You can say the same thing about ultra-billionaires who have most of their wealth in one (or a few) assets.

For example, Elon Musk currently owns over $100 billion worth of Tesla stock. If he decided to liquidate all of it, how much of that $100 billion do you think he could actually realize? I have no clue, but I doubt he gets away with more than $50 billion of it. In the process of selling his shares, Tesla’s stock price would go into free fall. Not only would there not be enough buyers to support the price, but once investors found out that Musk was selling, many of them would lose confidence in the stock as well. Of course, Musk would never do such a ridiculous thing, but it illustrates how large sums of wealth are illusionary in the first place.

So when we talk about Bill Hwang’s $20 billion loss, we aren’t really talking about the destruction of 20 billion in realized dollars. It’s not like Hwang took $20 billion in cash and built a position up over time that eventually went up in flames. In fact, it’s the opposite. He took a small amount of money and grew it very quickly by using increasing amounts of leverage. This wealth never really existed anywhere besides on paper.

“But isn’t most wealth on paper though?” Well, yes, but most people can realize that wealth. For example, if I decided to sell every asset I own tomorrow, I would be able to realize all of it at the market price without taking any significant haircut. Since I own small amounts of highly liquid assets, my choice to sell would have no material impact on the market price. This is probably true for 99.9% of people.

However, for those that have larger amounts of wealth, especially in illiquid assets, that’s when things become distorted. Yes their wealth can be measured on paper, but they don’t really know how much they have until they sell. History is filled with examples of ultra-rich individuals who learned this lesson the hard way.

This doesn’t mean that Hwang’s loss at Archegos is unimportant, but that it’s probably less extraordinary that it initially appeared. Because, in Hwang’s case, very little of substance was actually lost. It’s not like $20 billion of physical capital was destroyed or economic activity was reduced by $20 billion. No, his inflated assets were deflated and his true loss was much smaller.

It would be like if you owned an aircraft leasing company with 10 Boeing 747s listed on your balance sheet at $400 million a piece ($4 billion in total). However, after COVID-19 hit, you discovered two things: (1) your airplanes are now worth only $300 million a piece, and (2) you had miscounted and actually only own nine Boeing 747s after all. Now your listed assets are worth $2.7 billion ($300 million * 9 planes) down from $4 billion.

Did you just experience a $1.3 billion loss? No, you experienced a $900 million loss. Since one of your planes never existed in the first place, that additional $400 million was never really lost. This is kind of like what happened to Hwang and Archegos where the value of their individual positions were the equivalent of that extra, non-existent airplane.

Yes this analogy isn’t exactly correct, but it gets at the underlying idea. In some cases, wealth isn’t what it seems. We can see it. We can count it. We can write it down on a piece of paper. But as soon as we go to touch it, it disappears. Like a financial hologram. Like something that never truly existed.

While you may never experience any such thing during your lifetime, there will be people who you know who will. They will overvalue their assets. They will believe their home or business or other asset are worth more than they really are. They will make financial decisions based on this information too. But, one day, they may realize the uncomfortable truth—not all wealth is real.

Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 237. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data