Last week, Bloomberg published an article on how the rich avoid paying New York income taxes while still owning a home in the city/state. The key to their tax avoidance strategy is spending less than 184 days in New York within a given calendar year. The 184 day limit is what determines whether an individual is considered a New York residence, and, thus, must pay New York income taxes.

But what counts as “spending a day” in New York? Basically any time you are in the state and not traveling to go somewhere else. So, if you drive from New Jersey to the JFK airport and fly out of state, this does not count as spending a day in NY. But if you stop to grab lunch in NYC on the way, it does.

These details might seem trivial until you realize that many of New York’s richest non-residents want to spend as much time in the city/state as possible without hitting the 184 day limit. And the tactics they follow to comply with the 184 day rule are extreme, to say the least. From Bloomberg:

At New Jersey’s Teterboro and Long Island’s Islip airports, dozens of private jets destined for Florida take off at times such as 11:42 p.m. or 11:54 p.m. Over at JFK, a regular flight from San Juan, Puerto Rico, arrives at a seemingly purposeful time: about 15 minutes after midnight.

Meanwhile, tax attorneys tell stories of clients idling in their luxury SUVs near the New Jersey entrance to the George Washington Bridge shortly before 12 a.m., waiting for the clock to turn before crossing the state line to New York.

In both of these cases, the rich are trying to minimize the days they are in the state. After all, why land at 10 PM and “waste” a day in New York when you can land a few hours later and not?

At first glance this behavior seems absurd. Why would someone so wealthy go to such lengths to save a few percentage points on their taxes? After all, owing a lot in taxes is generally a sign of success. It means you are making lots of money. So why not just pay the tax and get on with your life? Going to these extremes makes it seem like you don’t control your money, but that your money controls you.

This was my thinking on this issue for a long time. But, if you run the numbers on what actually paying these taxes looks like, it feels very different. Let’s see why.

How Bad are Taxes in NY Really?

Imagine you earn $1M per year and are considering moving out of New York and to Florida (a state with no income tax) to save on taxes. How much would this end up netting you per year?

On NY state income taxes alone, you would save around $65,500. The marginal tax rate in this bracket is 6.85% for NY state, but the effective tax rate ends up being 6.55%. When it comes to NYC income tax, you end up saving an additional $38,325 (for an effective rate of 3.8%). In total, that’s over $100,000 in state and local tax savings (>10%) on your $1M income.

But this is the minimum on how much you would save. Because if your income is generated by a business located in NYC, then you would have to pay even more in taxes. One such tax is the unincorporated business tax (UBT). The UBT is a 4% flat tax that you cannot deduct any business expenses against. So if you had $1 million in business income, you’d have to pay an additional $40,000 in tax on top of the $100,000 you are already paying to the state and city. I don’t know about you but $140,000 after taxes (14% of your income) is a lot of money. That’s far more than I spend in an entire year.

And this example is “only” for someone with $1M in annual income. If your income was any higher, the tax hit of living in NY would be even worse. At some point the numbers get big enough that you have to ask yourself, “Why am I paying this?”

If you are so rich that it doesn’t impact you, then you can pay it and get on with your life. But, if you are still in the process of building your wealth, it can raise questions like, “Is my tax money being spent responsibly?” If you believe the answer is no, then you may feel like you have a moral reason to avoid such high taxation.

Some may respond that these high income individuals are simply trying to avoid paying their “fair share” of taxes. But, if you look at the numbers, those NY residents with high incomes are paying a bit more than what any reasonable person might consider fair. Once again, from Bloomberg:

People earning over $1 million each year made up just 1.6% of tax filers, but paid 44.5% of the state’s total personal income taxes in 2021, New York Comptroller Tom DiNapoli said in a recent report. In California, nearly half of the state’s income taxes come from the top 1% of earners.

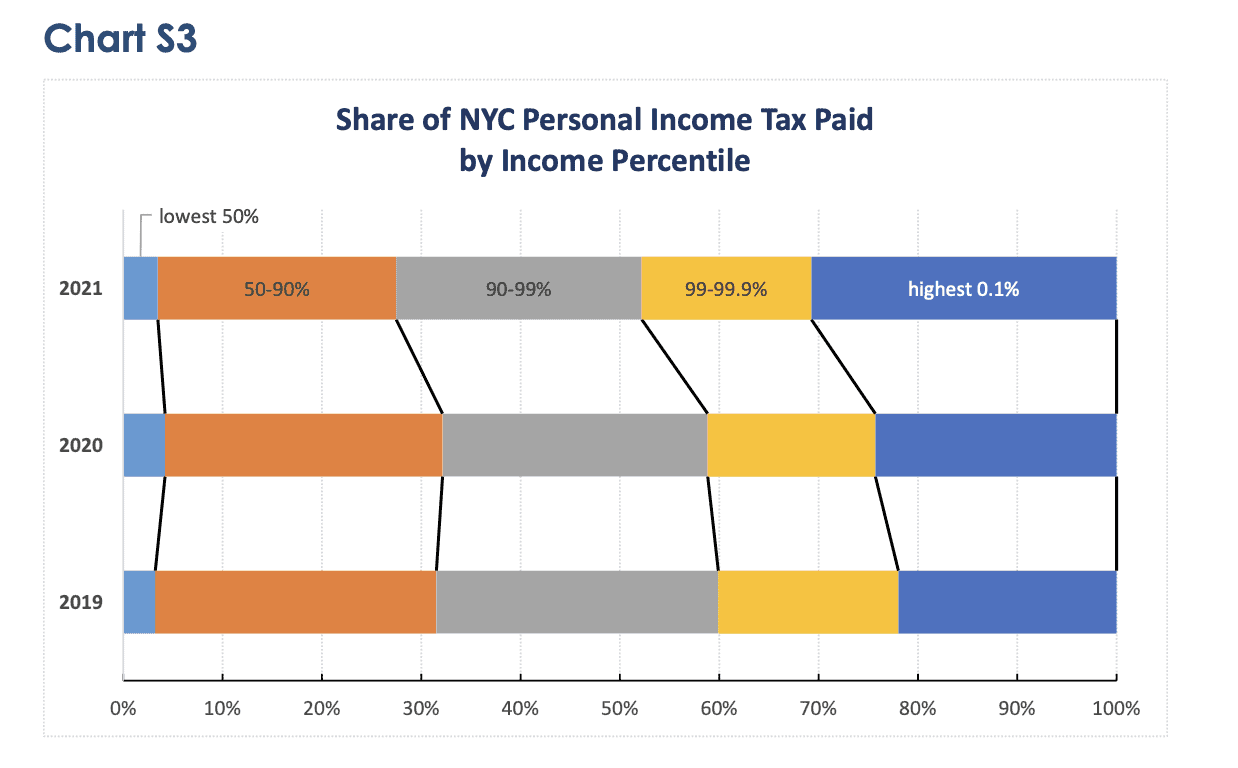

If we look at the distribution of tax liability in NYC in particular, we would see that the top 1% of filers pay 48% of the total tax, the next 9% pay 25% of the tax, the next 40% pay 25% of the tax, and the bottom half pay only about 2% of the tax:

In other words, imagine New York City only had 100 residents and they all went to dinner. When the bill came due, the person with the most income would cover nearly half of it, the next 9 people (ordered by income) would pay a fourth of it, the next 40 would pay a fourth, and the remaining half of the table would cover the 2% left on the bill. Is this fair? Decide for yourself.

This simplified example isn’t illustrative of all the taxes that people pay in NY (i.e. sales, property, etc.), but it does give you an idea of how progressive the system is in general. Whether or not this system is fair is up for debate. Some of the higher income ex-residents of NY have decided it isn’t and will utilize their cars and private jets accordingly.

As for what I believe, I think it’s easy to judge the rich and their tax avoidance strategies from the outside looking in, but much harder once you are in their shoes.

It’s Not You Until It’s You

Of all the human behaviors, tax avoidance seems to be one of the most consistent and most predictable. It’s one of those things that you don’t care about until you really do. And, as someone who has seen their income in the lowest federal tax bracket (10%) and in one of the higher ones (35%), I am starting to get it now.

This is one of the reasons why I recently moved out of NYC to Jersey City. Not only did I want a quieter lifestyle with my girlfriend, but saving 8% on local taxes (NYC + UBT) isn’t bad either. I lived in the city for 6 years to the day. I didn’t leave during COVID.

But my life changed and so did my priorities. I’m trying to buy a house. I want to have kids. I might have to help my Mom financially when she retires. All of these things are more important than the enjoyment I was getting from NYC. So it was time to go.

Without this context, it’s much harder to understand why people make the decisions that they do. Unfortunately, we almost never have the full context, so we end up judging others more harshly than they deserve.

Last week I wrote about how some of the poorest households buy lottery tickets despite not having much money. This week was about how some of the richest avoid taxes despite having plenty of money. I don’t think either of them is wrong. People simply respond to the situation they find themselves in. As Morgan Housel said long ago—no one is crazy.

Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 396. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data