Have you ever wondered, “Why is gold valuable?” From being a symbol of wealth and power, to being used as currency and a store of value, gold has a rich history that spans from ancient civilization to modern times. Gold has been used to showcase status among neighbors, to display strength among rulers, and to facilitate trade among nations for millennia.

Yet, despite its brilliant exterior, it is intrinsically worthless. Outside of its limited uses in electronics and dentistry, gold only has value in human society because it is gold and not something else. This explains why over 90% of annual global gold demand is for jewelry and investment purposes and not for industrial use. We spend most of our time using gold as gold and not to conduct electricity or replace our pearly whites.

But why gold? And why not aluminum? Or iron? Or something else entirely?

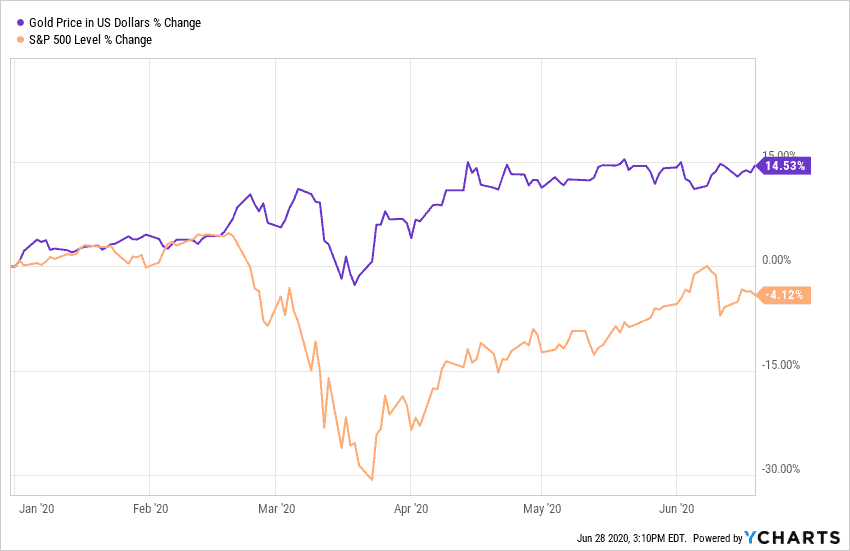

And, more importantly, what about gold as an investment? Given that the price of gold has increased by 10% over the last six months (while the S&P 500 has been flat), is it something that you should consider for your portfolio? Why or why not?

This article will address all of these questions and more. Let’s begin by examining why gold became the most sought after metal in human history.

Why Gold and Not Something Else?

Unlike the many other metals found around the globe, gold has held and retained a high status because of three specific properties: scarcity, durability, and malleability, which I will discuss each in turn.

Scarcity

Gold wouldn’t be what it is if it were as readily available as aluminum, the most abundant metal in Earth’s crust. However, it also wouldn’t be gold if it was as uncommon as rhodium, a rare Earth metal with one-tenth of gold’s annual production. As Warren Buffett stated in his 2011 letter to shareholders:

Today the world’s gold stock is about 170,000 metric tons. If all of this gold were melded together, it would form a cube of about 68 feet per side. (Picture it fitting comfortably within a baseball infield.)

And that gold pile only grows a few thousand metric tons per year, or by 2% of the current global gold stock.

This relationship between gold’s stock and its flow makes it the metaphoric “goldilocks” of Earthly metals— rare enough to be prized, but common enough to be found and utilized throughout the world. Without this relative scarcity, gold might have been just another glittering rock.

Durability

However, scarcity alone isn’t enough to give gold its high status. Gold also has the unique property of being one of the most durable metals on the planet. It doesn’t rust. It doesn’t tarnish. And it can only be corroded under very specific circumstances.

You can bury your gold and come back in 50 years (or 50,000 years) and it would be basically unchanged. This is why Peter Bernstein wrote in The Power of Gold:

In Cairo, you will find a tooth bridge made of gold for an Egyptian 4,500 years ago, its condition good enough to go into your mouth today.

The immense durability of gold makes it one of the few things in nature that can act as a true store of value. This is why gold has been used as a currency throughout history—it doesn’t break down through daily use.

In a world where everything we know degrades, this is why gold is literally able to stand the test of time.

Malleability

Even with its scarcity and durability, gold would have had a much harder time becoming a global phenomenon if not for its unsurpassed malleability. In fact, gold is the most malleable of all metals. It’s so flexible that one ounce can be made into a thin continuous sheet measuring roughly 100 square feet or stretched into a wire over 50 miles long. Pure gold is incredibly soft (for a metal), which allows it to be reshaped with relative ease.

Think about how useful of a quality this is for a store of value. You can divide it, hide it, or transport it from place to place with very little effort. What more could you ask for in a material?

When combined with gold’s scarcity and virtual indestructibility, it’s no wonder that people chased it the world over for centuries. Outside of nailing the trifecta of scarcity, durability, and malleability, gold’s true value comes from embodying the concept of proof of work.

Why Gold is Valuable (Proof of Work)

Despite the beneficial chemical properties of gold highlighted above, its real value comes from the difficulty of its acquisition. As Joe Weisenthal stated in a speech from May 2018:

One of the striking things about gold is just how incredibly hard it is to attain (and hold onto once

you have it) and the different things you have to master to get gold.To get gold you

— Have to be good at warfare

— Be able to marshall an extensive human workforce to mine it

— Mastery of global supply and logistics routes

— Be able to command guards who will watch your gold, and not steal it

— Have the technical know-how to get gold out of the ground, which is expensive and

cumbersome. And so on…In other words, when you have gold you’re communicating all the different things you’re capable

of (mastering supply routes, commanding an army, scientific endeavor, marshalling labor, etc.)Gold, then, is a very specific proof of work. If you can get gold, you’ve proven that you have the

ability to run a state or some state-like entity.

While you don’t need the ability to “run a state-like entity” today to acquire gold, the idea still holds. What made gold valuable historically (and what makes it valuable today) is not its explicit ownership (i.e. I have a rare, shiny piece of metal), but the implicit message of that ownership (i.e. I have the skills/ability/resources to acquire a rare, shiny piece of metal).

The best example I can provide to illustrate this is the history of aluminum. When aluminum was first discovered in the late 1700s, it was initially more valuable than gold because of how difficult it was to obtain. In fact, aluminum was used to cap the Washington Monument, when it was first completed in 1880.

However, as the refining process improved and aluminum extraction became easier, the once rare metal became much less rare. The increased availability of aluminum decreased its proof of work and, thus, reduced its value relative to gold. What started as the capstone to one of America’s most treasured landmarks eventually became the go-to container for sugar water.

This is the undeniable strength of proof of work. With it, you are admired and, without it, you are ignored. So goes the story of gold.

Now that we have discussed why gold is valuable to society, let’s examine how gold might be valuable to you.

When Gold Became an Investment

For most of modern history gold was used as a currency in some form or fashion. This is why William Bernstein remarked that:

…an ounce of gold bought a fine men’s suit in the time of Shakespeare, and so it does today.

Because gold literally was money, there was no inherent gains to be made from owning it.

However, this all changed after the United States abandoned the gold standard in 1973 and allowed American citizens to, once again, privately own gold in August 1974.

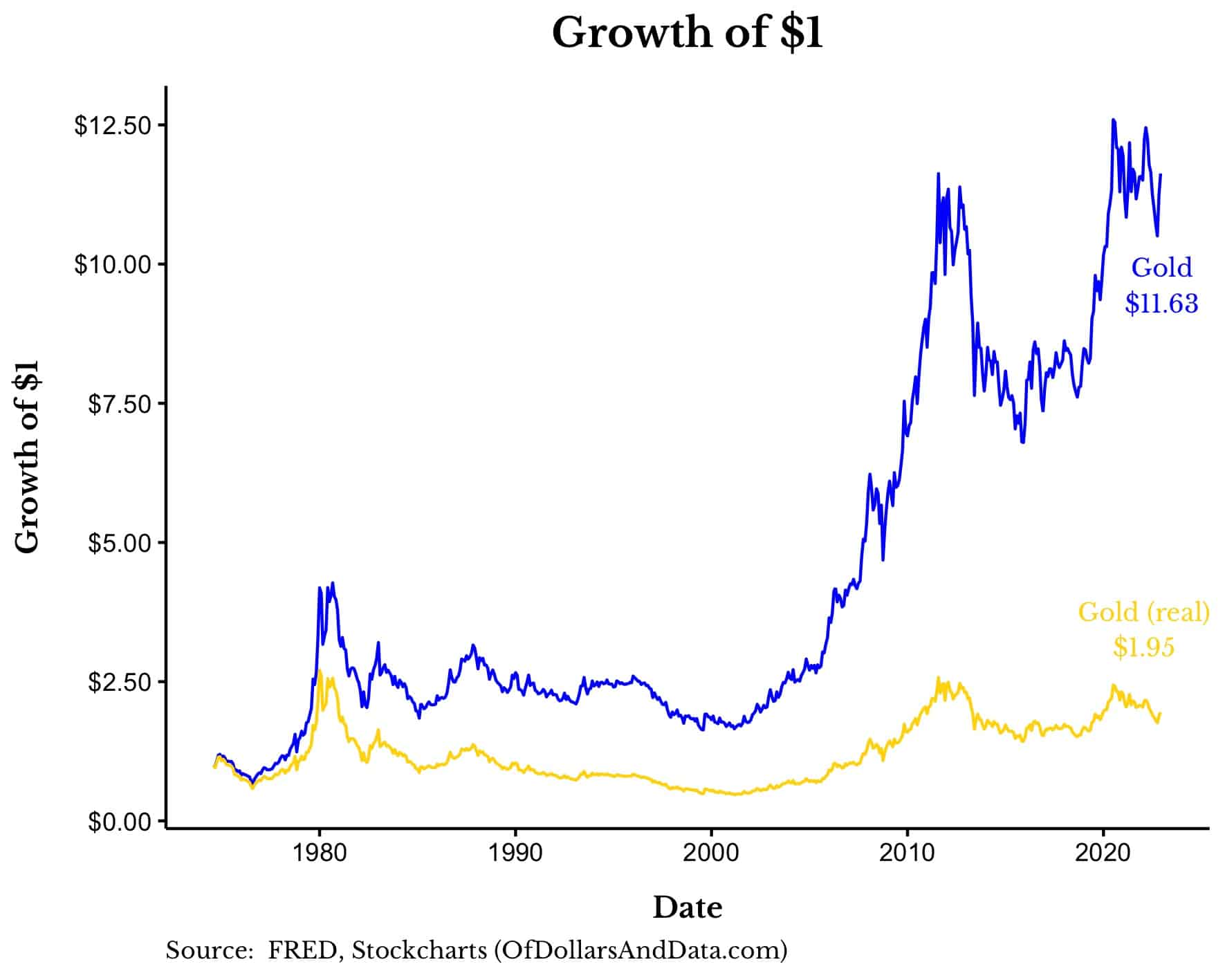

Since then, gold has increased in value from $156 an ounce to around $1,930 today (January 2023). Adjusting for inflation, gold has doubled its purchasing power since it was decoupled from the U.S. dollar:

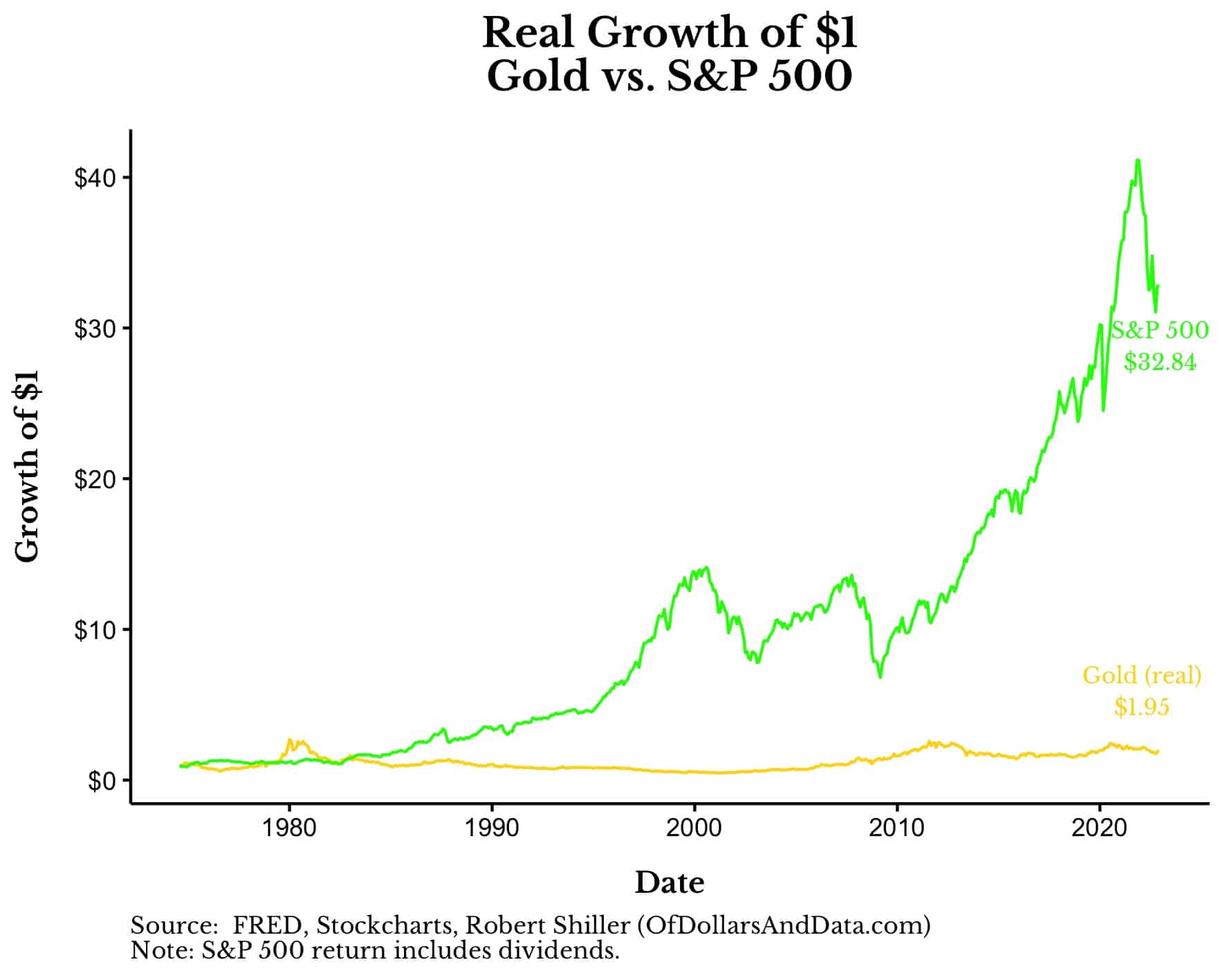

However, gold’s growth has been no match for the inflation-adjusted growth of the S&P 500 (with dividends) from August 1974 to December 2022:

Over this time period the S&P 500 beat gold by 16x in real terms. You might see a chart like this and ask why someone would ever invest in gold for the long term. However, this misses a bigger point about the value of gold within a portfolio. It’s within the context of other assets that gold really shines ( pun intended).

But before we look at how gold can benefit a portfolio, let’s examine the type of investor who shouldn’t own gold in their portfolio at all.

Who Should Not Invest in Gold?

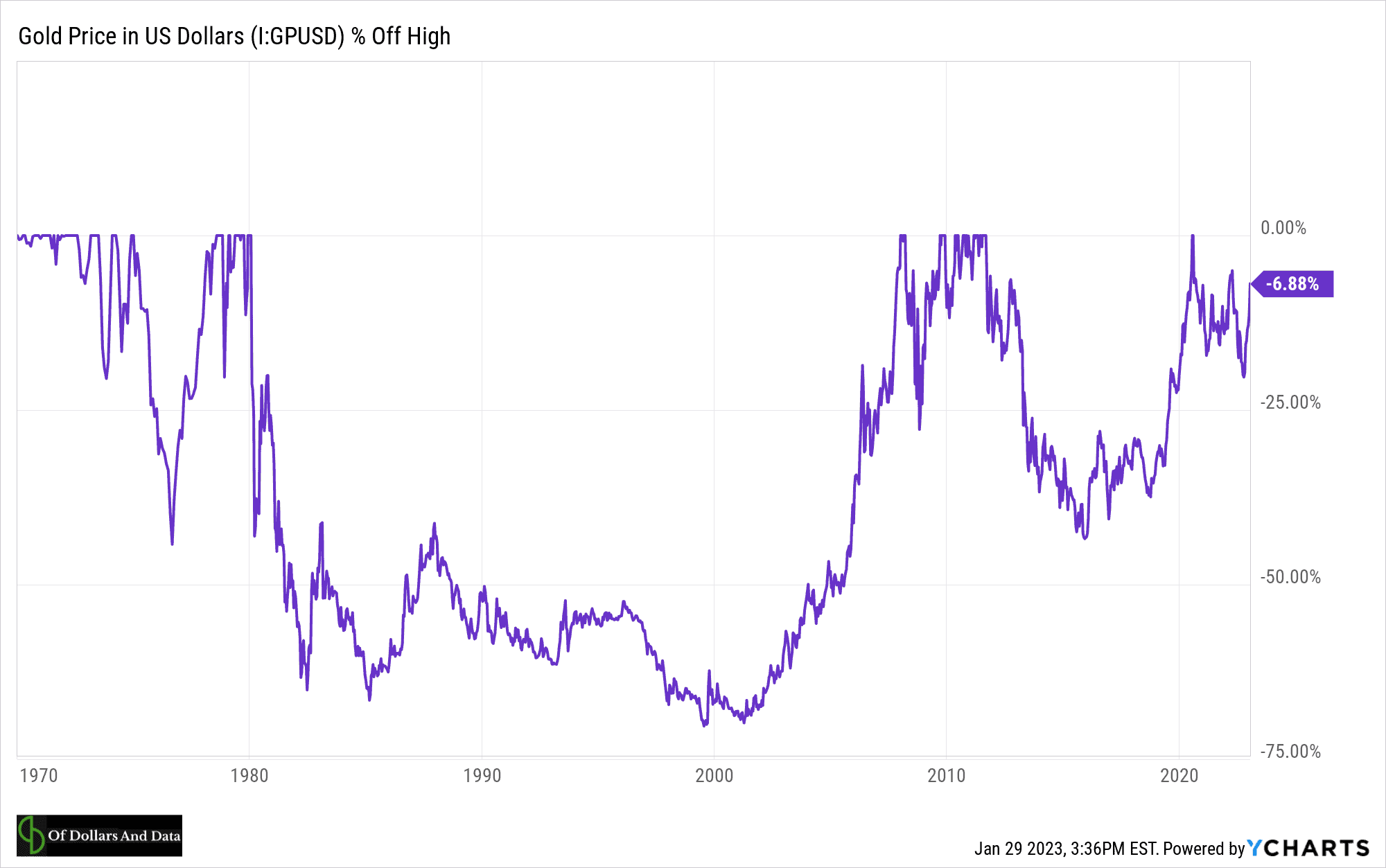

So, you want to own gold for the long run? If so, you better be comfortable with multi-decade drawdowns:

If you aren’t, then welcome to the club. I used to be a gold investor myself, but sold out of it after I realized how difficult it would be to hold an asset over such long periods of time. Even with its price run in recent months, gold is still around 7% off of its 2020 highs.

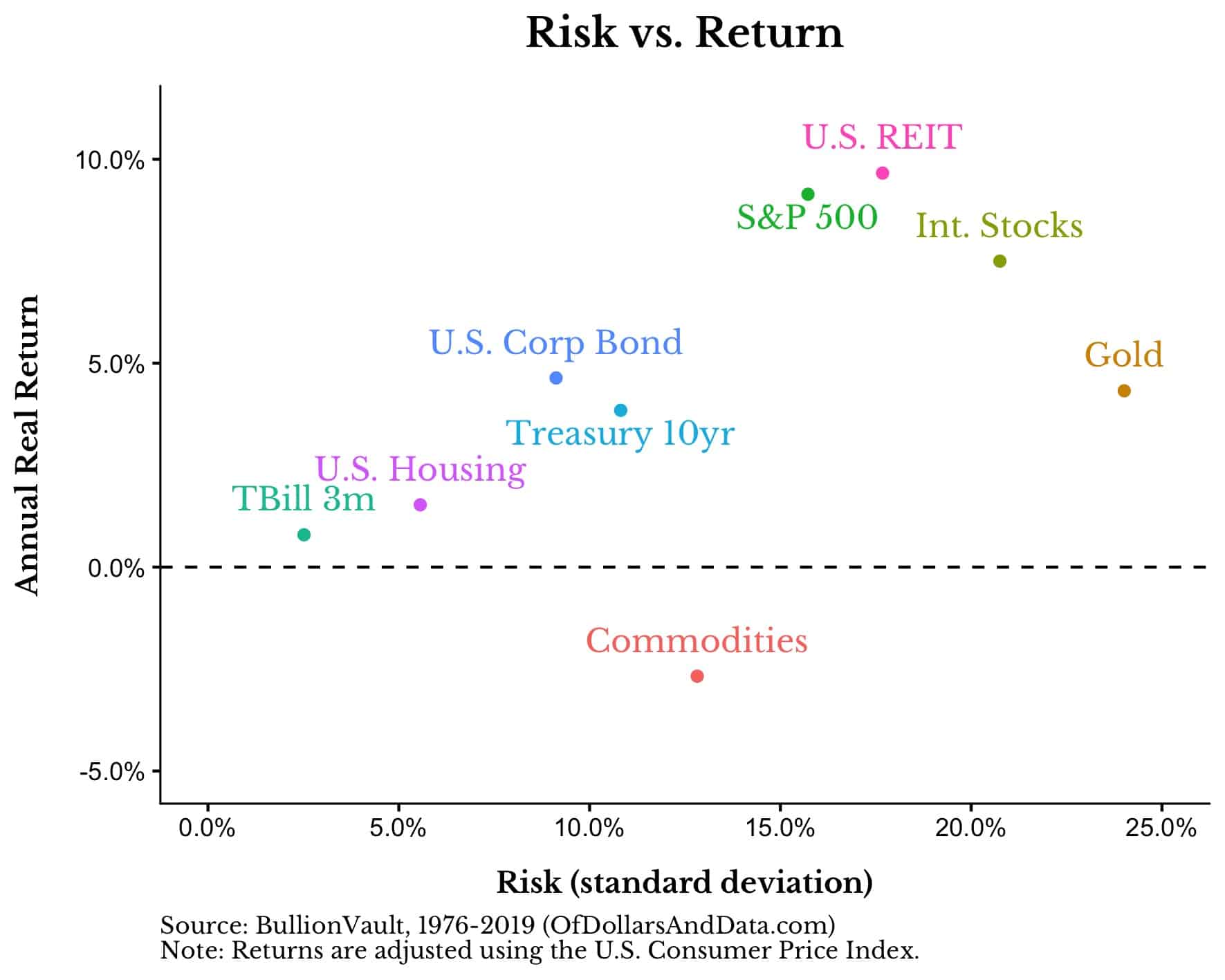

Additionally, gold has much more volatility with much lower returns than many other similarly-risky asset classes (i.e. equities, REITs, etc.). For example, if we look at a plot of risk versus return for various asset classes historically, you can see this distinction more clearly:

As you can see, gold seems to break the pattern of “more risk => more reward.”

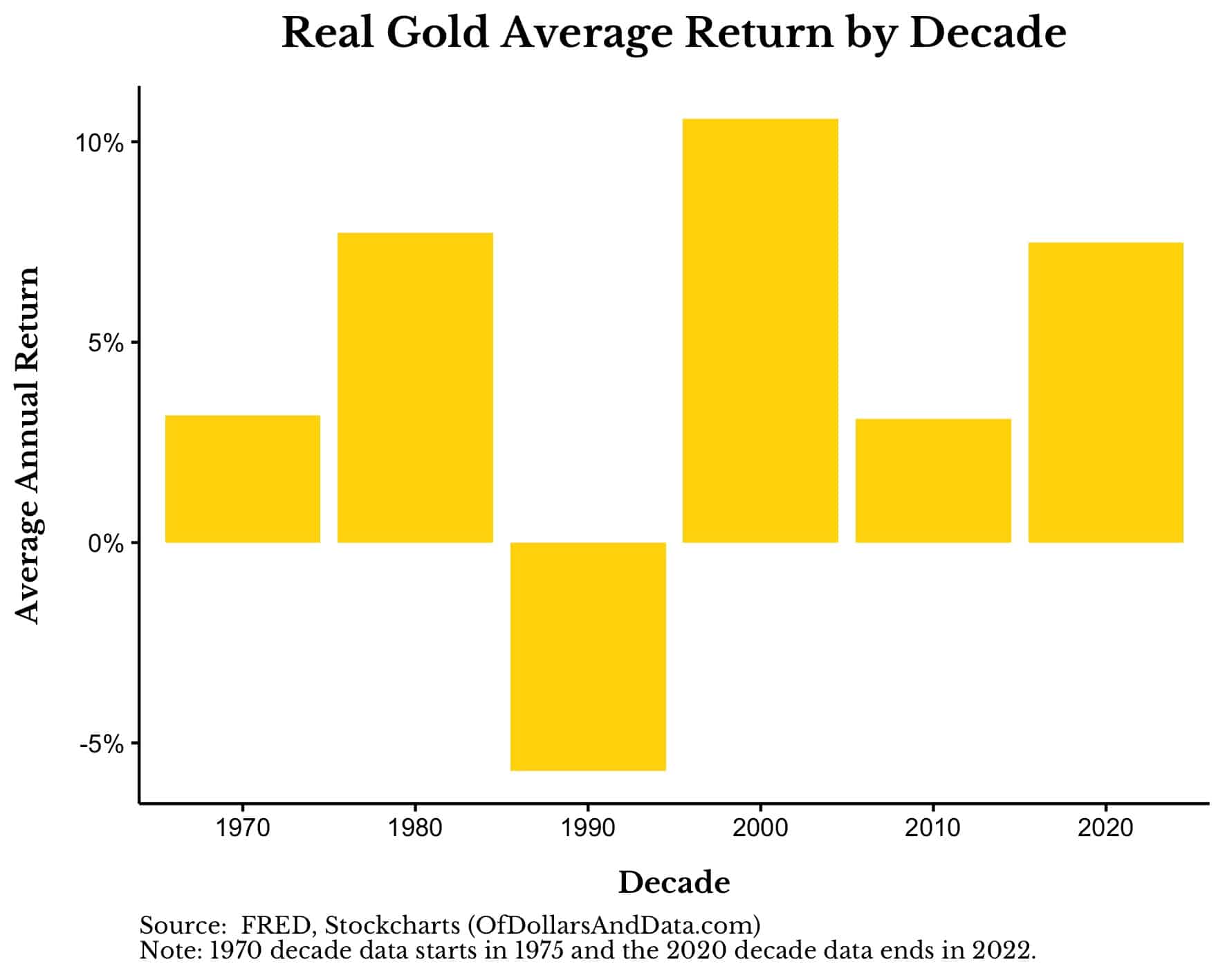

Lastly, gold can go through periods of terrible returns, which can be hard for many investors to stomach. For example, if you look at the returns by decade from 1975 to 2022, you can see that though gold has mostly generated real returns, there are periods where it loses a lot of money:

Because of this, many investors may decide that, when it comes to this asset class, not all that glitters is gold.

In all seriousness, the downsides stated above are based on gold’s individual asset performance, not its performance within a portfolio. Therefore, if you are someone that focuses on individual positions (over portfolio returns) then gold is not likely to be for you.

But, if you can ignore the individual pieces of your portfolio and look at the bigger picture, gold might just be able to add some value for you. Let’s see why.

Who Should Invest in Gold?

While most investors, myself included, have been scared away from gold because of its high risk-low reward track record, there are arguments to be made for owning gold due to its ability to add value at the portfolio level.

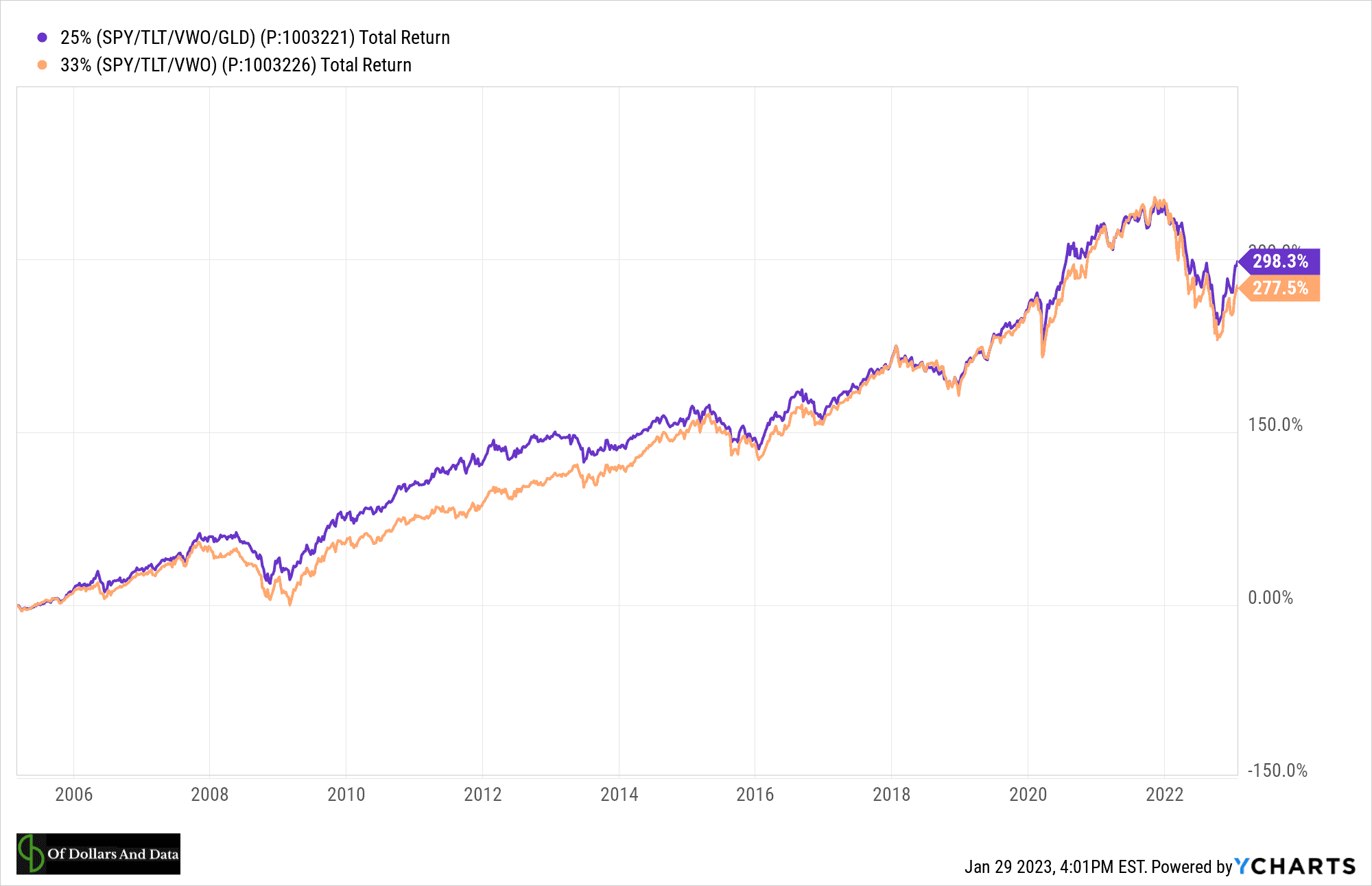

For example, imagine a portfolio with an equal split into three asset classes: the S&P 500 (33.3%), long-term U.S. bonds (33.3%), and emerging market stocks (33.3%). Now imagine taking that portfolio and adding in gold so that the split went to 25% each, such as: S&P 500 (25%), long-term U.S. bonds (25%), emerging market stocks (25%), and gold (25%).

If you were to compare the growth of these two portfolios from 2005 to today (January 2023), the one with gold would have outperformed:

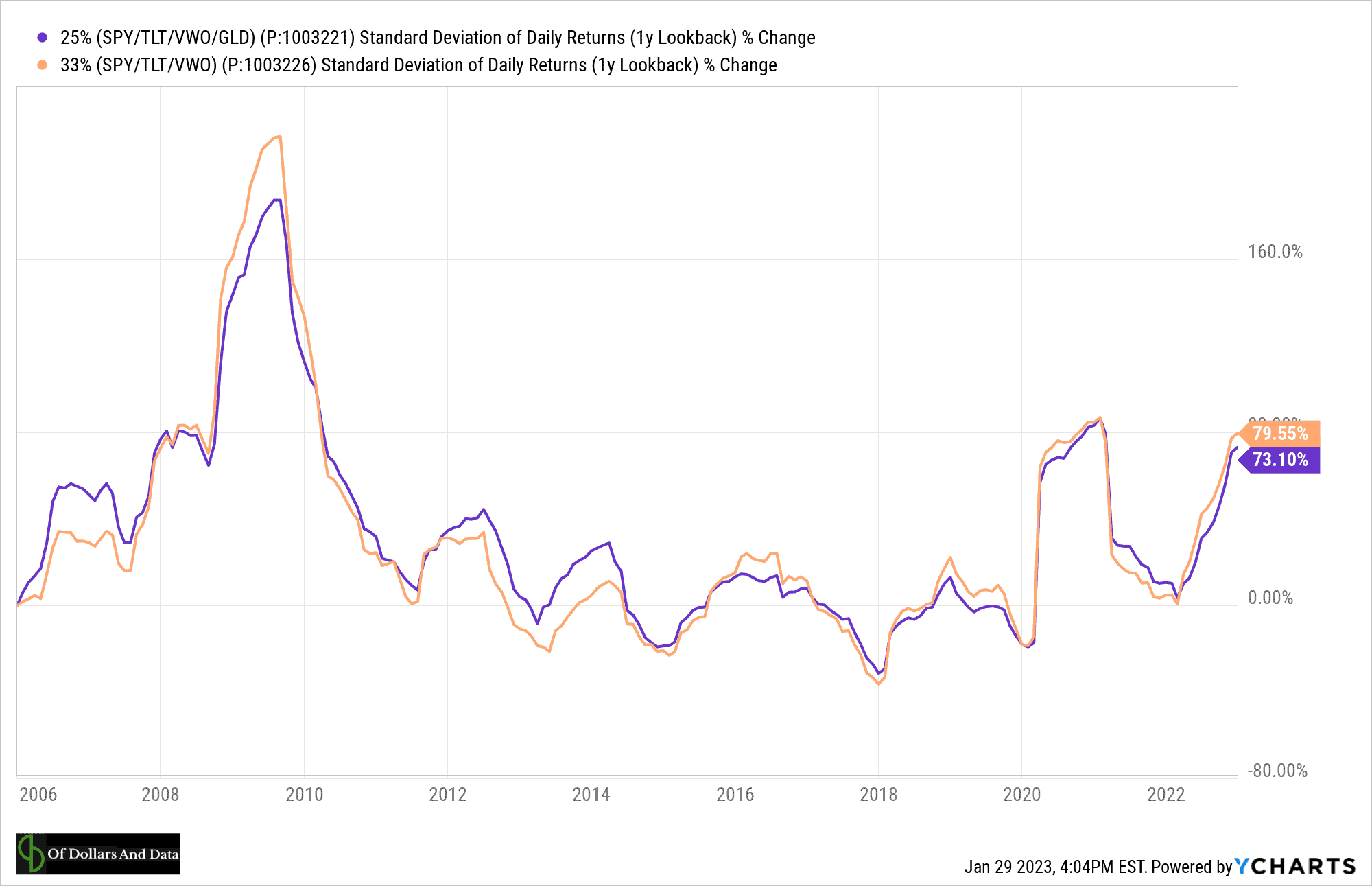

And it would have done so while, generally, having less overall portfolio risk (standard deviation):

This provides evidence that gold can be a useful component of a portfolio even if it is a scary asset class to hold on its own.

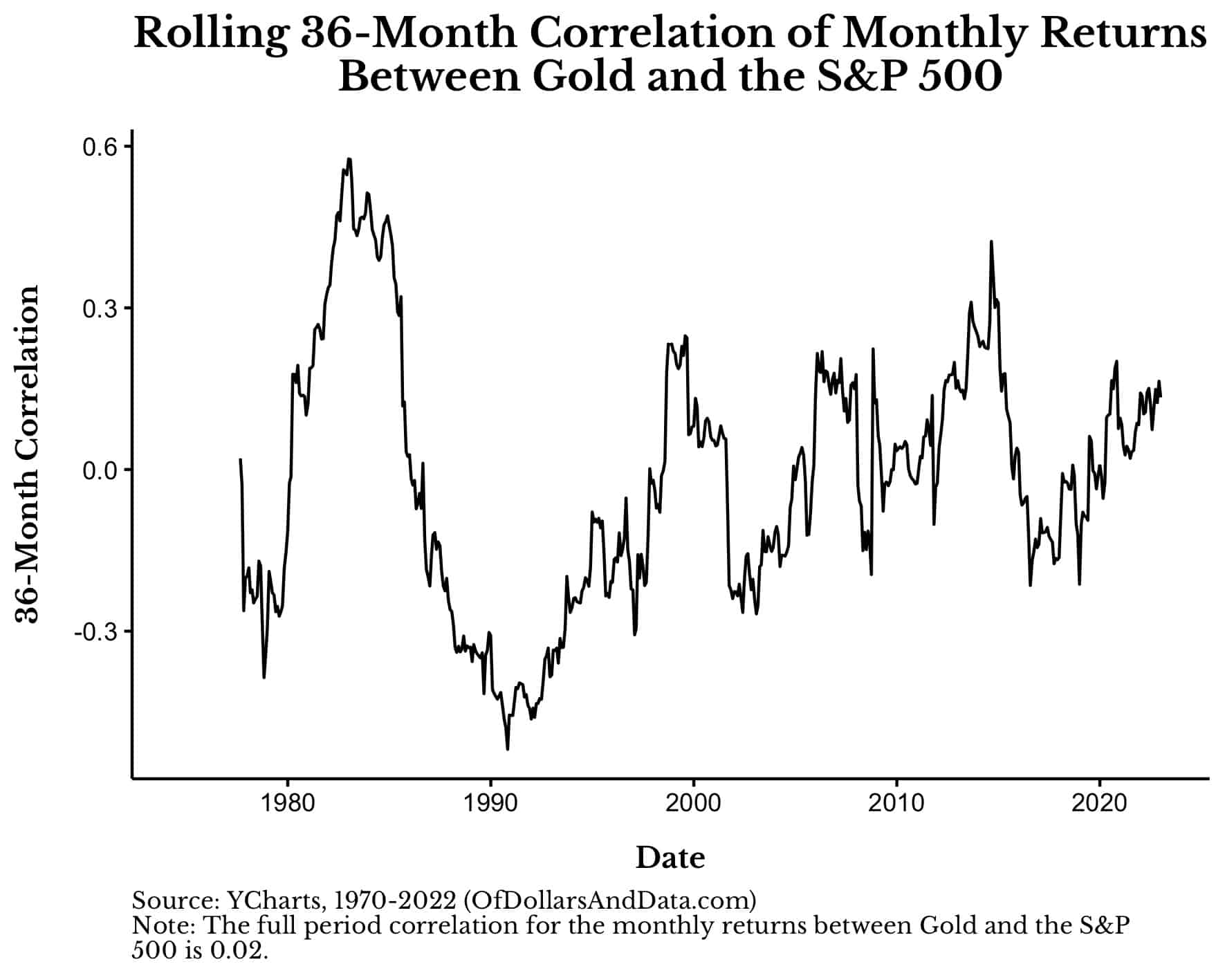

The reasoning for gold’s ability to add value at the portfolio level is its low correlation to other traditional risky asset classes (i.e. stocks). For example, the average correlation of monthly returns between gold and the S&P 500 is basically zero though it has varied historically:

In addition, gold seems to have the ability to de-risk the portfolio when other risky asset classes are getting crushed. For example, compare how gold performed relative to the S&P 500 through the COVID-19 crash in March 2020:

For some of that time gold seemed to be going down with the ship, but then it righted itself and resurfaced as equities continued sinking. Unlike our prior example where focusing on gold can be a detriment to the typical investor, this is an example when focusing on gold could be the mental life raft that keeps someone sane.

Of course, this is always easier said than done. Remember that the outperformance over the S&P 500 in March 2020 came at a time when gold was still in a drawdown from its 2011 highs. However, if you are able to look past this such periods of lackluster performance (pun intended), then you might want to consider adding some gold into the mix.

The Bottom Line: Why Value is in the Eye of the Beholder

So why is gold valuable? Is it its historical demonstration of proof of work? Or its chemical properties that allowed it to rise to such prominence in the first place? Or maybe it’s its modern usage as a portfolio diversifier for global investors?

Maybe it is none of them or maybe it is all of them. The main thing that I learned while researching gold is that value is in the eye of the beholder.

Some of you will see gold as an outdated tool of crazies and conspiracy theorists who own lots of guns and canned goods. Some of you will see gold as the last bastion of hope in a world where the U.S. dollar is certain to implode.

If I had to guess, I would say that the truth is somewhere in the middle. As we digitize our world and find other ways of storing value, gold has more competition than ever before. However, if you think that one of the longest-lived signals demonstrating proof of work in human society is going to be discarded anytime soon, think again.

Invest accordingly and thank you for reading!

If you liked this post, consider signing up for my newsletter or checking out my prior work in e-book form.

This is post 192. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data