Net worth. It’s the be-all-end-all for benchmarking your financial progress. Or is it?

In the world of personal finance, we often hear about the importance of net worth, or the sum of all of your assets minus all of your liabilities (i.e. what you own minus what you owe). However, there is another measure which might be even more important for your financial well-being—liquid net worth.

Liquid net worth is the amount of cash you would have on hand after selling all of your liquid assets and paying off all of your debts. Therefore, liquid net worth is defined as:

Liquid net worth = Liquid assets – debts

In this case, liquid assets are all those assets that can be quickly and easily converted into cash (e.g. money in checking/savings accounts, financial assets in brokerage accounts, etc.) and debt includes any loans that you have (e.g. mortgage, student loans, credit cards, etc.). Note that I’ve excluded your home, your car, and your retirement accounts from your liquid assets because they cannot easily be turned into cash.

To provide an example, if you had $100,000 of stocks/bonds in a brokerage account, $20,000 in a checking account, a $45,000 mortgage, and $15,000 in student loans, your liquid net worth would be: ($100,000 + $20,000) – ($45,000 + $15,000) = $60,000.

Why should you care about liquid net worth? Because it is a proxy for how well you can handle financial risk. In a world that seems increasingly unpredictable, having ample liquid net worth can mean the difference between peace of mind and financial ruin when things get tough.

For this reason, today I am going to go into detail on what liquid net worth is, why it’s important for your financial health, and how you can grow it to ensure that you’re more than just rich on paper.

To start, let’s look at what net worth and liquid net worth are typically comprised of.

What Comprises Net Worth and Liquid Net Worth?

Net Worth

Net worth is the total value of your financial and non-financial assets minus any liabilities, or, as I stated above, it’s what you own minus what you owe. This can be broken down as:

- Assets include:

- Cash and Cash Equivalents: This is money that you have in hand or in accounts that can be accessed immediately, like checking and savings accounts.

- Investments: These can be stocks, bonds, ETFs, index funds, mutual funds, and other investment vehicles.

- Retirement Accounts: Such as 401(k)s, IRAs, and other retirement plans.

- Real Estate: The market value of any property you own.

- Personal Property: This can be anything from your car to jewelry to art.

- Liabilities include:

- Mortgages: What you owe on your properties.

- Loans: These can be personal loans, student loans, auto loans, etc.

- Credit Card Debt: Any outstanding credit card balances.

- Other Debts: Any other debts you may have (e.g. medical bills, business loans, etc.)

While the composition of each household’s net worth will vary, for many U.S. households, a significant portion of their net worth is the equity in their home. This is especially true among older households.

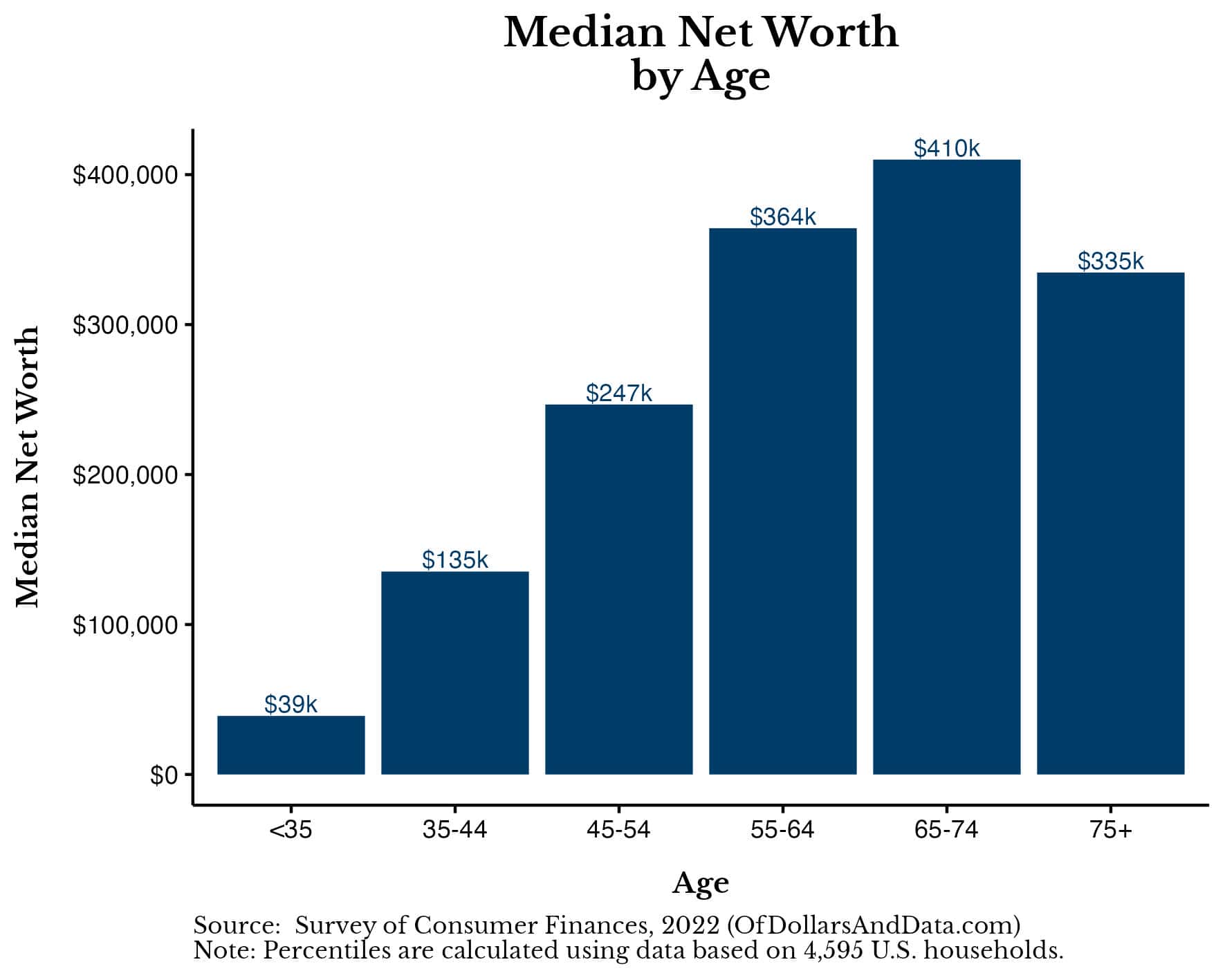

According to the 2022 Survey of Consumer Finances, the median home equity balance across all U.S. households was $88,000, which is about 45% of the median household net worth ($192,700). To get a better idea of this, consider the median net worth of U.S. households by age in 2022:

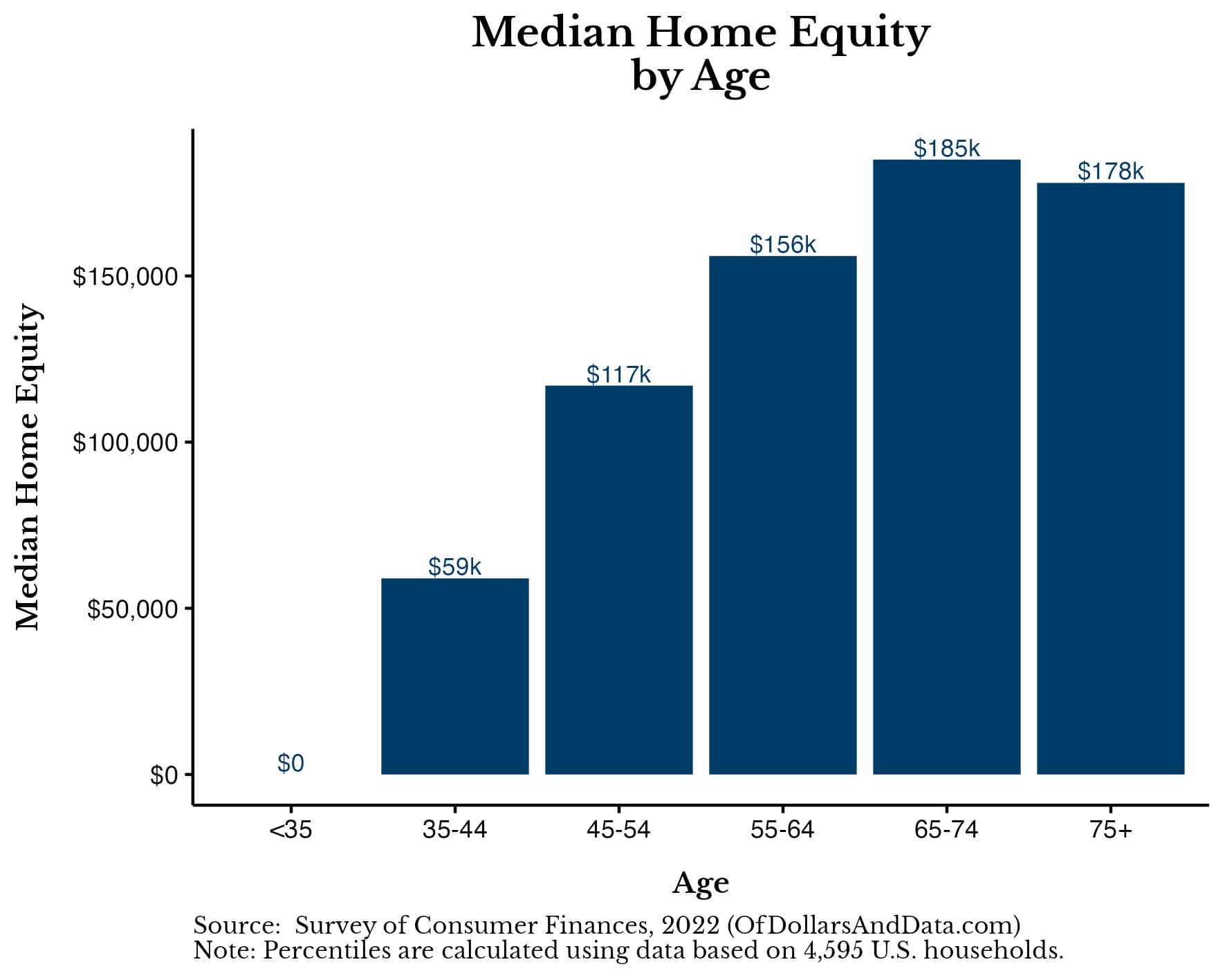

Now compare this with the median home equity of U.S. households by age in 2022:

Outside of households under 35, the median home equity values end comprising over 40% of the median net worths of U.S. households.

There is nothing wrong with having so much of your net worth tied up in your primary residence, but you have to remember that you can’t withdraw your home equity so easily. While home equity lines of credit (HELOCs) exist to make this possible, HELOCs aren’t accessible for everyone and they can take time to process. The same is true for retirement accounts (e.g. IRAs, 401(k)s, etc.) where working adults cannot typically take withdrawals without paying taxes or penalties.

For this reason, we must exclude these kinds of assets when calculating liquid net worth.

Liquid Net Worth

After making such exclusions, liquid net worth can be broken down into:

- Liquid Assets:

- Cash and Cash Equivalents: This is money that you have in hand or in accounts that can be accessed immediately, like checking and savings accounts.

- Liquid Investments: These can be stocks, bonds, ETFs, index funds, mutual funds, and other investment vehicles that can be sold in a short period of time.

- Liabilities:

- Mortgages: What you owe on any properties.

- Loans: These can be personal loans, student loans, auto loans, etc.

- Credit Card Debt: Any outstanding credit card balances.

- Other Debts: Any other debts you may have (e.g. medical bills, business loans, etc.)

Liquid net worth has the same liabilities as net worth, but fewer assets to rely upon. This makes liquid net worth a subset of overall net worth. It’s the subset that draws on assets that can be quickly converted to cash without a significant loss in value. In other words, liquid net worth is the wealth that you can access immediately.

Now that we have a better idea of what liquid net worth is, let’s examine why it’s so important.

Why is Liquid Net Worth Important?

While your overall net worth is a measure of your financial success over your lifetime, your liquid net worth is a snapshot of your financial preparedness in a moment’s notice. When the proverbial shit hits the fan, your net worth won’t save you, but your liquid net worth will.

I find this measure to be far more important than net worth because you can’t eat your net worth. You can’t live off your home equity or your 401(k) contributions…yet. But, you can rely upon your liquid net worth.

This one idea explains why people who are rich on paper can still panic during a crisis. Their issue is that they don’t have liquidity. They don’t have a way to access their wealth. And if you don’t have liquidity, what do you really have?

But, it’s not just the emergency preparedness that makes liquid net worth so important. Having liquid net worth also allows you to take advantage of rare investment opportunities and can provide you additional financial flexibility. When the bulk of your wealth is in an illiquid asset like a home or a business, you can do far less with it than when it’s in a brokerage account.

Now that we have a better understanding of why liquid net worth is so important, let’s examine what the typical liquid net worth is for various U.S. households.

What’s the Typical Liquid Net Worth?

Understanding the typical liquid net worth among U.S. households can provide you with valuable context for your own financial life. Therefore, let’s look at the 50th (median), 75th, and 90th percentile figures for liquid net worth, broken down by age.

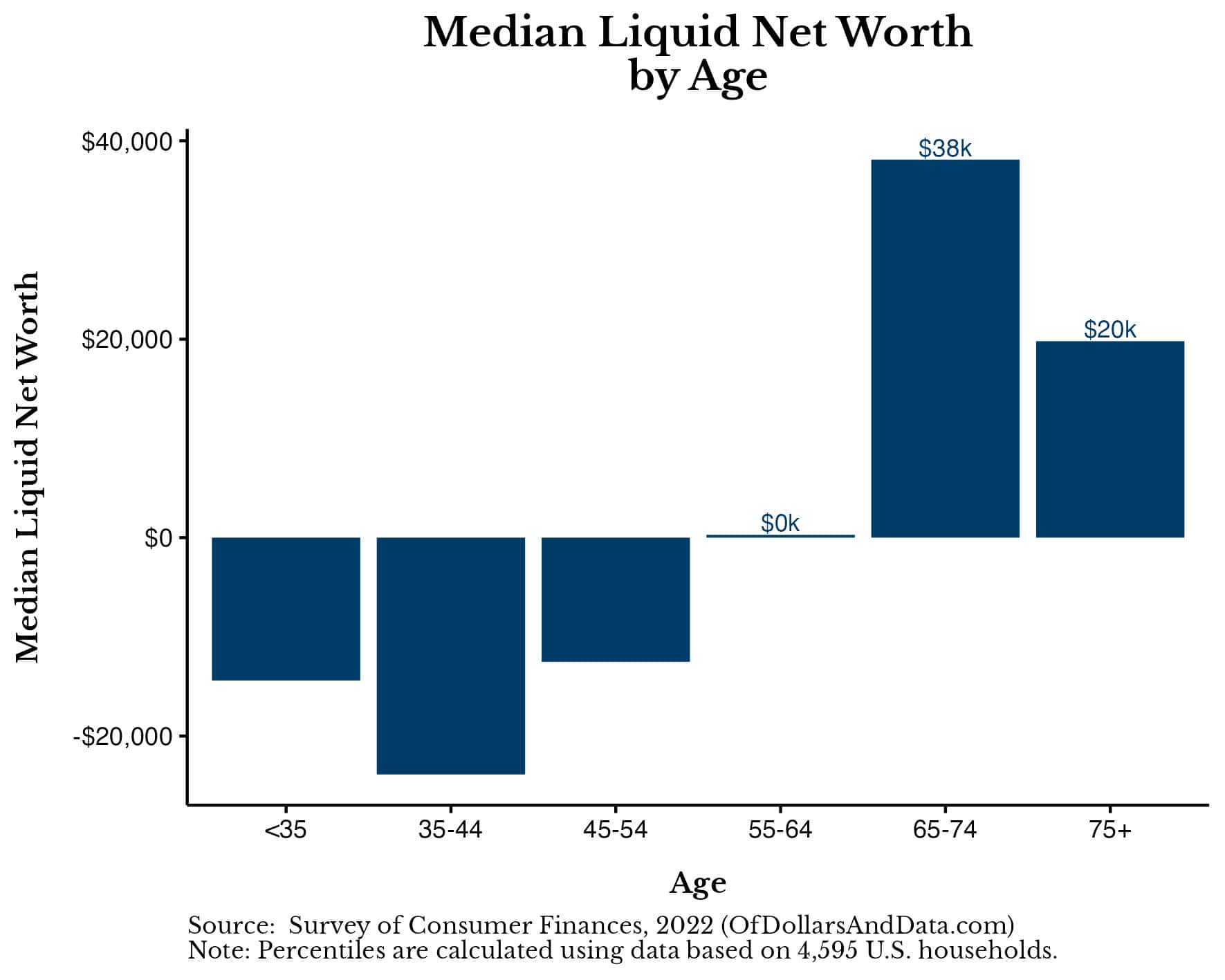

Starting with the median (i.e. 50th percentile) liquid net worth (i.e. the point where half the households have more and half have less), you can see that this measure is negative for younger households, but positive for older households:

This occurs because liquid net worth counts all of your liabilities but none of your illiquid assets. So while younger households are building up their home equity and retirement accounts, their net worth can be positive (and increasing) even as their liquid net worth remains negative.

[Author’s Note: for purposes of this blog post I excluded retirement assets from all age groups, including those of retirement age. While this technically is inaccurate (as older households now have liquid access to their retirement accounts), it allows us to better compare liquid net worth (as defined above) across age groups].

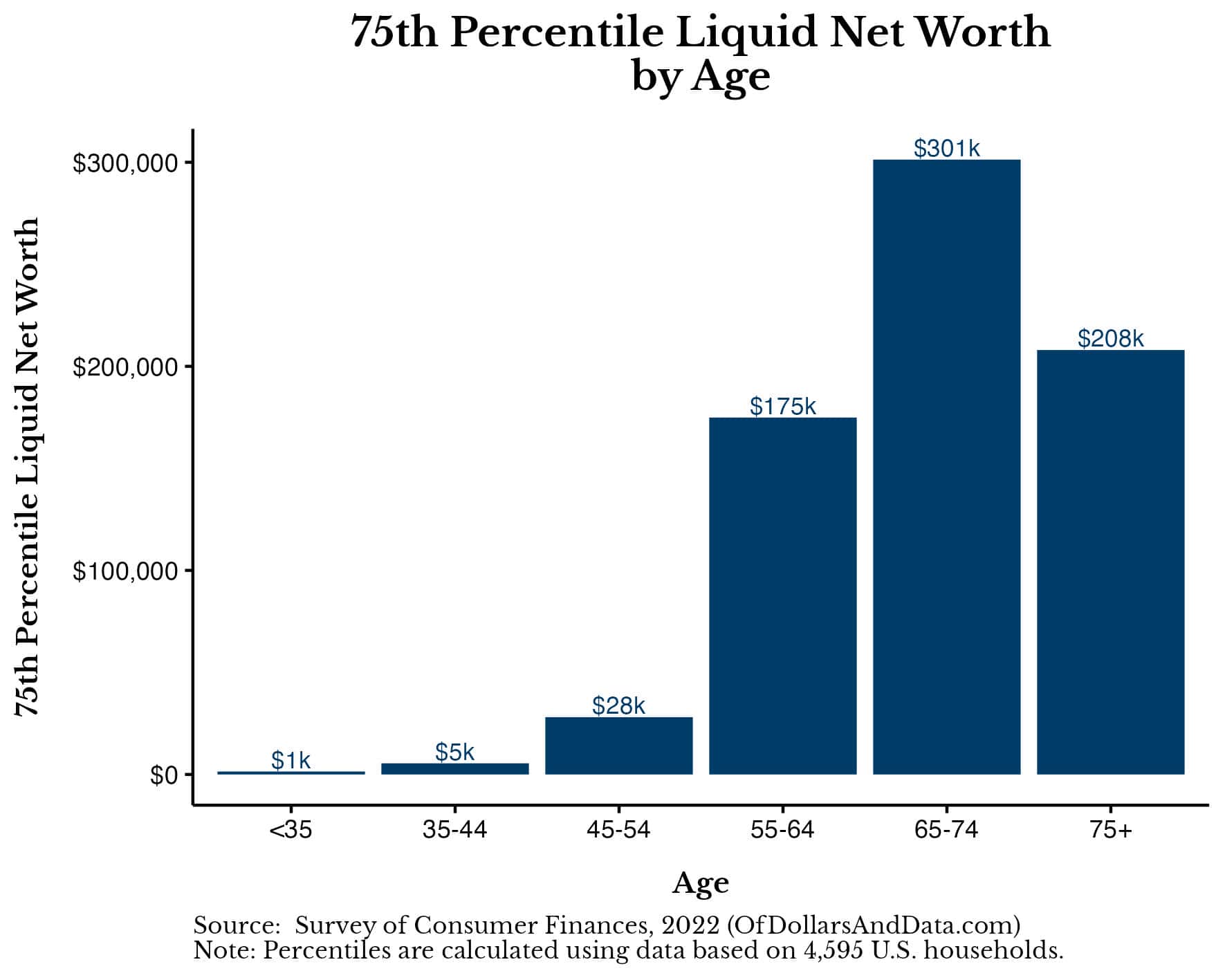

For households at the 75th percentile of liquid net worth, we don’t see the negative liquid net worths at an early age, but we still see increasing liquid net worth over time:

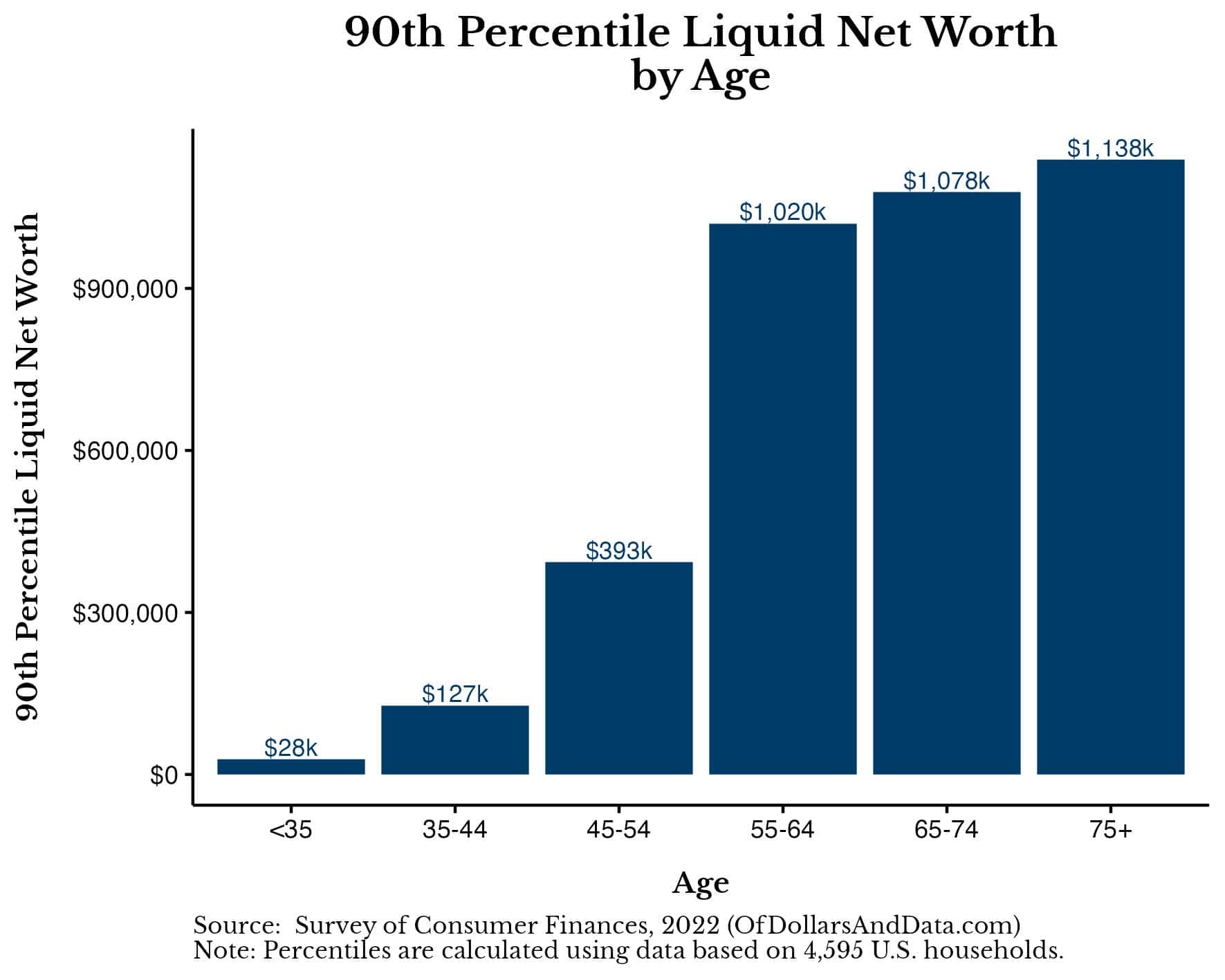

And finally, for households at the 90th percentile we see a large surge in liquid net worth across all age groups:

How did these households get higher liquid net worths than those households nearer the median? They either had less debt, more liquid financial assets, or a bit of both.

But, how did they get less debt or more liquid financial assets? That’s the topic of the next section which discusses how to increase your liquid net worth.

How to Increase Your Liquid Net Worth

While I wish there was a secret to increasing your liquid net worth, unfortunately, there isn’t. The only way to increase your liquid net worth over time is to increase your liquid assets or decrease your liabilities. Outside of turning your illiquid assets into liquid ones, you only have one other option—save more money. That’s it. There’s no shortcut.

By saving more money, you will be able to increase your liquid assets or pay off your debts. How you decide to save that money is up to you. You can either cut your spending or raise your income. While cutting spending works well in the short-term, I find that raising income seems to be the easier long-term solution. After all, you can only cut your spending so much, but your income has no limits.

So, if you want to increase your liquid net worth you need to follow the same general strategy that you would use to increase your net worth—save more money and use that money to increase your assets (liquid assets in this case) or pay off your debts.

How do you know which area you should focus on first (assets or debt)? I recommend paying off high interest debt first, then working on increasing liquid assets. What is the cutoff for high interest debt? There is no exact definition, but here is how I’d look at it:

- If the interest rate is over 8%, pay off that debt as soon as possible.

- If the interest rate is under 4%, make the minimum required payment and use your excess money to buy liquid assets.

- If the interest rate is between 4%-8%, pay off your debt and buy more liquid assets at the same time.

As you can see, when interest rates are high, paying off debt makes sense and when they are low, buying income-producing assets makes sense. For anything in between, it’s a judgement call. This is why investing can be an art as much as a science.

Now that we’ve examined how to increase your liquid net worth, let’s wrap things by discussing where liquid net worth falls short.

The Bottom Line

While liquid net worth can be a decent proxy for your financial preparedness, it also is grounded in some unrealistic assumptions. For example, have you ever heard of someone having to pay off all of their debts at once? I haven’t. No one is ever going to call you up one day and ask you to pay off your mortgage and student loans immediately. This just doesn’t happen.

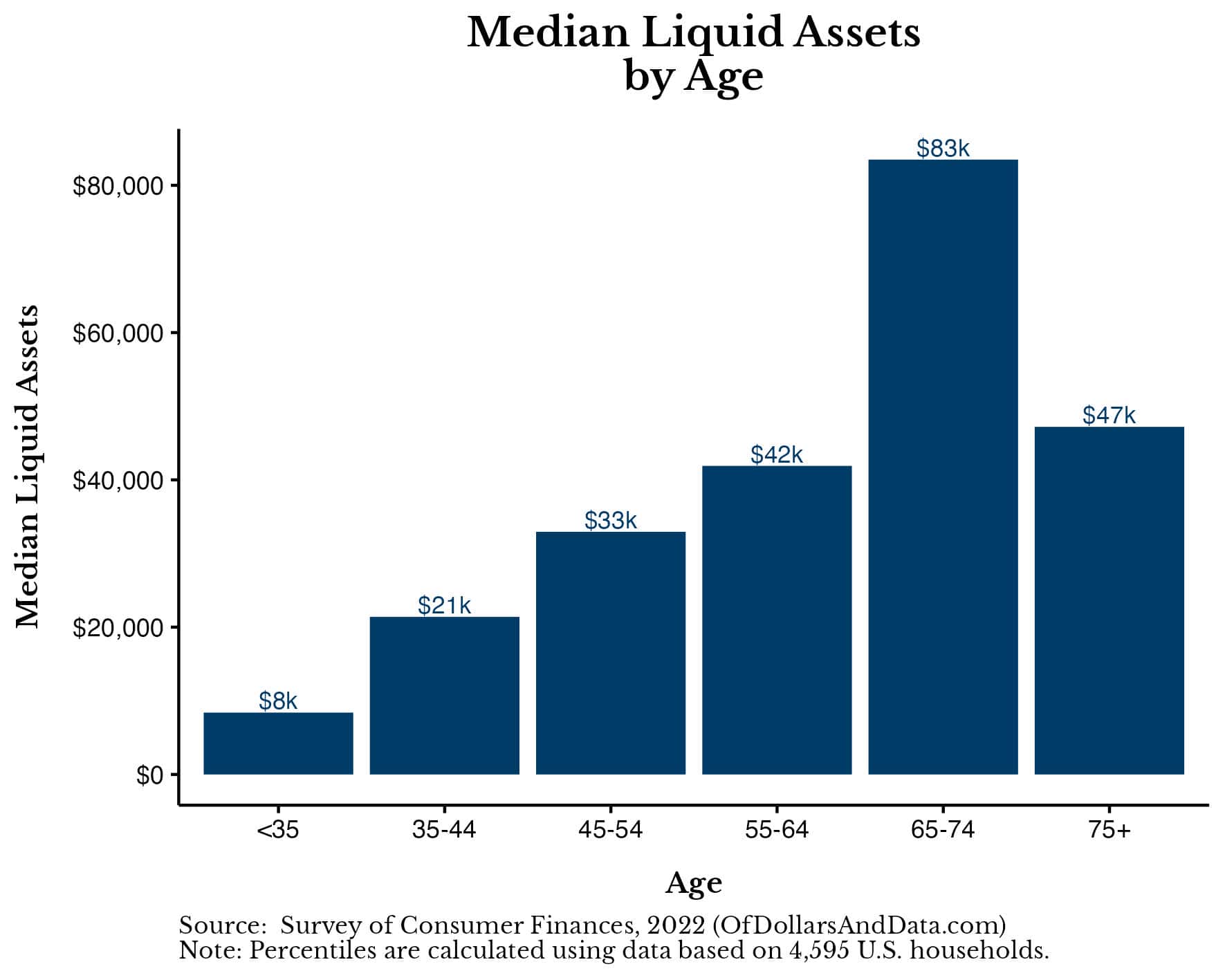

Therefore, during a real financial emergency, you won’t have to pay off all of your debts right away. This means that your liquid assets will be more important than your liquid net worth. And, by this measure, the typical U.S. household seems to be doing okay. Below is a chart showing the median liquid assets of U.S. households by age in 2022:

As you can see, the median household in every age bracket has positive liquid assets even if they have a negative liquid net worth. These liquid assets are what will actually matter during a financial crisis.

Therefore, if you want to have more financial peace of mind, I’d spend more time focusing on your liquid assets and less time worrying about your liquid net worth.

Happy investing and thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 185. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data