Want to get rich?

Then you should just keep buying a diverse set of income producing assets.

While this advice sounds easy enough, the hard part comes when deciding what kind of income-producing assets to own.

Most investors rarely venture past stocks and bonds when creating an investment portfolio. And I don’t blame them. These two asset classes are quite popular and are great candidates for building wealth. However, stocks and bonds are just the tip of the investment iceberg. If you are really serious about growing your wealth, you should consider everything that the investing world has to offer.

To this end, I have compiled a list of the 9 best income-producing assets that you can use to grow your wealth. Note that this list isn’t a recommendation, but a starting point for further research. Because I don’t know your current circumstances, I can’t say which, if any, of the following assets would be a good fit for you.

Personally, I only own 4 of the 9 asset classes listed below because some of them don’t make sense for me (at least at this point in time). I advise that you evaluate each asset class fully before adding/removing anything from your portfolio.

With that being said, let’s begin with the grandaddy of them all…

1. Stocks/Equities

If I had to pick one asset class to rule them all, stocks would definitely be it. Stocks, which represent the equity (i.e. ownership) in a business, are great because they are one of the most reliable ways to create wealth over the long run. Just read Triumph of the Optimists: 101 Years of Global Investment Returns or Stocks for the Long Run or Wealth, War, & Wisdom and you will get the same message—equities are an incredible investment.

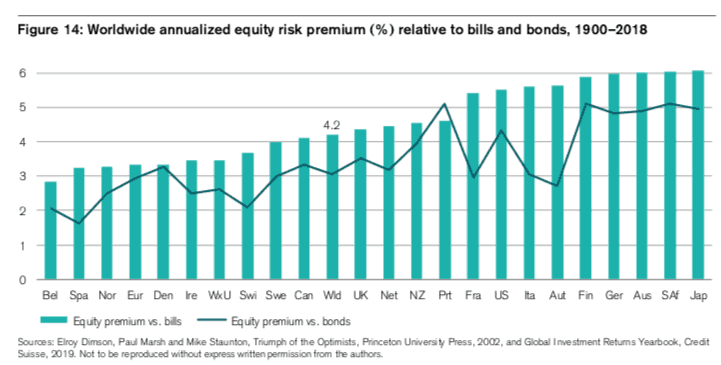

And I don’t just mean equities in the U.S. either. As I have highlighted before, the record of history shows that stocks all over the world have been able to deliver consistent long-term returns (3%-6% above bills):

Of course, is it possible that the 20th century was a fluke and future equity returns are doomed? Yes, but I wouldn’t bet on it.

More importantly, stocks are an amazing investment because they require no ongoing maintenance on your part. You own the business and reap the rewards while someone else (i.e. the management) runs the business for you.

So, how do you buy stocks? Well, you can purchase individual stocks (which I generally don’t recommend) or you can buy a fund that get you broader stock exposure. For example, an S&P 500 index fund will get you U.S. equity exposure while a “Total World Stock Index Fund” will get you worldwide equity exposure.

Of course, opinions differ on which kinds of stocks you should own. Some argue that you should focus on size (i.e. smaller stocks), some argue that you should focus on valuations (i.e. value stocks), and some argue that you should focus on price trends (i.e. momentum stocks). There are even others that suggest that owning stocks that pay frequent dividends is the surefire way to wealth. As a reminder, dividends are just profits from a business that are paid out to its shareholders (i.e. you). So if you own 5% of a business that pays out a total of $1M in dividends, you would receive $50,000. Pretty nice, huh?

Regardless of what stock strategy you choose, having some exposure to this asset class is the most important part. Personally, I own U.S. stocks, developed market stocks, and emerging market stocks from three different equity ETFs along with a handful of positions tilted toward smaller, value stocks. Is this the optimal way to invest in stocks? Probably not. But it works for me and should do well over the long run.

However, despite all the praise that I have just given to stocks, they are not for the faint of heart. As I once stated:

For equities, you should expect to see a 50%+ price decline a couple times a century, a 30% decline once every 4-5 years, and a 10% price decline at least every other year.

It is this highly volatile nature of stocks that makes them difficult to hold during turbulent times. Seeing a decade’s worth of growth disappear in a matter of days can be gut-wrenching even for the most seasoned investors. But what makes these declines especially troubling is when they are based on shifting sentiment rather than changes in underlying fundamentals.

The best way to combat such emotional volatility is to focus on the long-term. While this does not guarantee returns (i.e. see Japan), the evidence of history suggests that time is a stock investor’s friend, not foe.

Stocks/Equities Summary

- Average compounded annual return: 6%-10%

- Pros: High historic returns. Easy to own and trade. Low maintenance (i.e. someone else runs the business).

- Cons: High volatility. Valuations can change quickly based on sentiment rather than fundamentals.

2. Bonds

Now that we have discussed the high-flying world of stocks, let’s discuss the much calmer world of bonds.

Bonds are merely loans made from an investor to a borrower to be paid back over a certain period of time (i.e. the term/tenor/maturity). Many bonds require periodic payments (i.e. coupons) paid to the investor over the term of the loan before the full principal balance is paid back at end of the term.

The borrower can either be an individual, a business, or a government. Most of the time when investors discuss bonds they are referring to U.S. Treasury bonds, or bonds where the U.S. government is the borrower. U.S. Treasury bonds come in various maturities/terms and have different names based on the length of those terms:

- Treasury bills mature in 1-12 months

- Treasury notes mature in 2-10 years

- Treasury bonds mature in 10-30 years

You can find the interest rates paid on U.S. Treasury bonds for each of these terms online here. Additionally, if you need help deciding whether to own short-term, medium-term, or long-term Treasury bonds, I wrote this guide here.

Besides U.S. Treasury bonds, you can also purchase foreign government bonds, corporate bonds (loans to businesses), and municipal bonds (loans to local/state governments). Though these kinds of bonds generally pay more interest than U.S. Treasury bonds, they also tend to be riskier.

Why are they riskier than U.S. Treasury bonds? Because the U.S. Treasury is the most creditworthy borrower on the planet. Since the U.S. government can just print any dollars they owe at will, anyone who lends to them is virtually guaranteed to get their money back. This is not necessarily true when it comes to foreign governments, local governments, or corporations.

This is why I tend to only invest in U.S. Treasury bonds. If I wanted to take more risk in my portfolio, I wouldn’t take it with my bonds. In fact, I recommend bonds as an income-producing asset because of the other properties that they exhibit. In particular, bonds:

1. Tend to rise when stocks (and other risky assets) fall.

2. Can provide “dry powder” when rebalancing your portfolio.

3. Have a more consistent income stream than other assets.

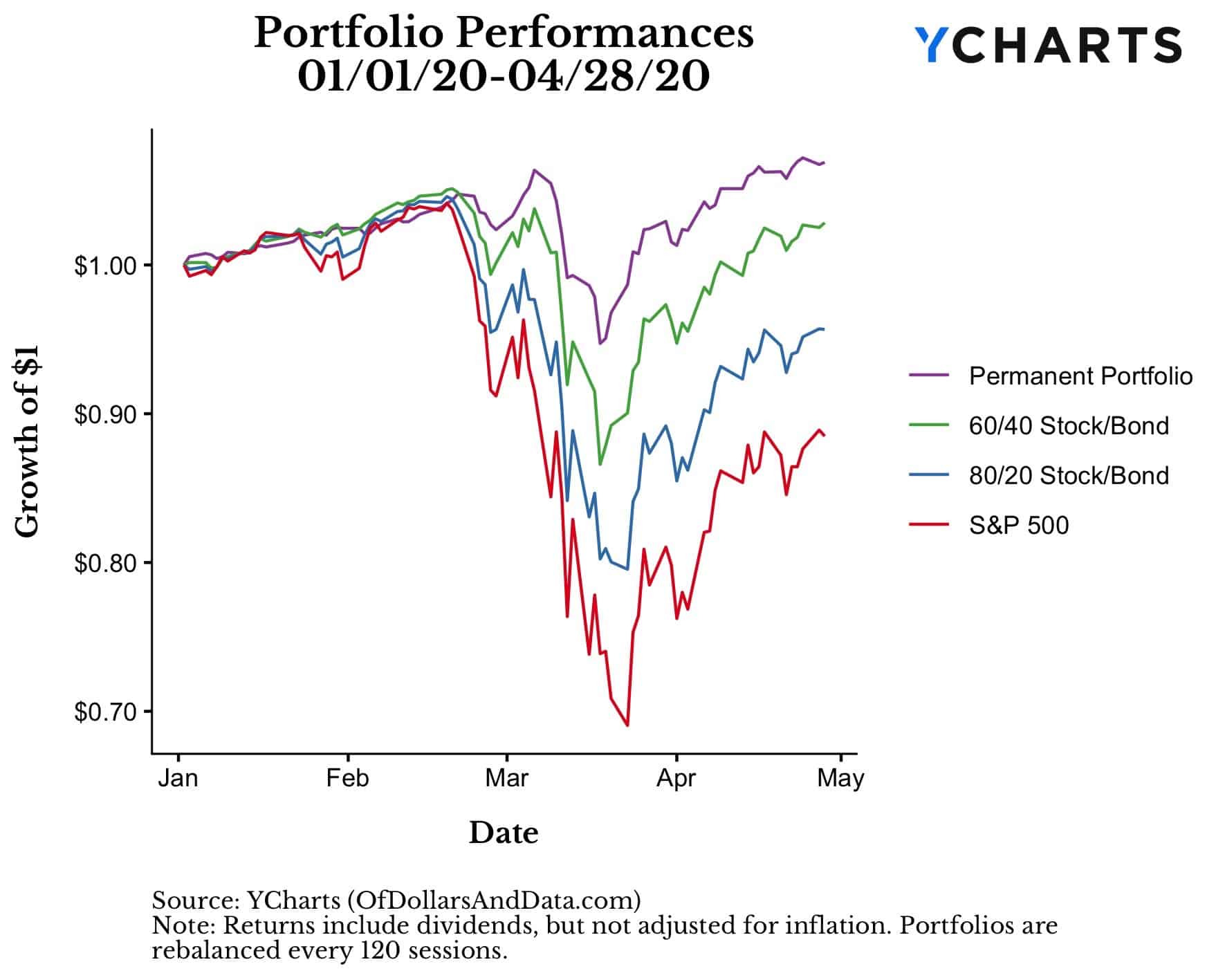

Unlike stocks and other risky assets, bonds have lower volatility which makes them more consistent and dependable even during the toughest of times. As I illustrated, those portfolios with more bonds (i.e. Treasuries) performed better during the 2020 coronavirus crash:

More importantly, those that had bonds and were able to rebalance during the crash saw an even bigger benefit during the recovery that followed. Because of my Treasury bonds I was lucky enough to rebalance on the day of the 2020 market bottom. Yes, this timing was luck, but owning bonds in the first place was not.

So how can you buy bonds? You can choose to buy individual bonds directly, but I recommend buying them through bond funds because it’s much easier. If you think that owning individual bonds is somehow different from owning bonds in a fund, please read this and this to convince yourself otherwise.

Regardless of the kinds of bonds you consider buying, they can play an important role in your portfolio beyond providing growth. As the old saying goes:

We buy stocks so we can eat well, but we buy bonds so we can sleep well.

Bonds Summary

- Average compounded annual return: 2%-4%

- Pros: Lower volatility. Good for rebalancing. Safety in principal.

- Cons: Low returns, especially after inflation. Not great for income in a low-rate environment.

3. Investment/Vacation Properties

Outside of the realm of stocks and bonds, one of the next most popular income-producing assets is an investment/vacation property.

Owning an investment property can be great because not only does it provide you with a place to relax, but it can also earn you extra income. If you manage the property correctly, you will have other people (i.e. renters) helping you to pay off the mortgage while you enjoy the long-term price appreciation on the property. Additionally, if you were able to borrow money when acquiring the property, your return will be a bit higher due to the added leverage.

If this sounds too good to be true, it’s because it is. While there are many upsides to owning a vacation rental, it also requires far more work than many other assets that you can “set and forget.” Owning an investment/vacation property requires the ability to deal with people (i.e. renters), list the property, provide ongoing maintenance, and much more. While doing all of this, you also have to deal with the added stress of having another liability on your balance sheet.

When this goes right, owning an investment property can be wonderful, especially when you have borrowed most of the money to finance the purchase. However, when things go wrong, like they did in 2020, they can go really wrong. As many AirBnb entrepreneurs learned this year, vacation rentals aren’t always so easy.

While the returns on investment properties can be much higher than stocks/bonds, these returns also require far more work to earn them. If you are someone that wants to have more control over their investments and like the tangibility of real estate, then you should consider an investment/vacation property as a part of your portfolio.

Investment/Vacation Property Summary

- Average compounded annual return: 12%-15% (can be much higher/lower depending on specific circumstances)

- Pros: Bigger returns than other more traditional asset classes, especially when using leverage.

- Cons: Managing the property and tenants can be a headache. Less diversified.

4. Real Estate Investment Trusts (REITs)

If you like the idea of owning real estate, but hate the idea of managing it yourself, then the real estate investment trust (REIT) might be right for you. A REIT is a business that owns and manages real estate properties and pays out the income from those properties to its owners. In fact, REITs are legally required to pay out a minimum of 90% of their taxable income as dividends to their shareholders. This requirement makes REITs one of the most reliable income-producing assets on the market.

However, not all REITs are the same. There are residential REITs that can own apartment buildings, student housing, manufactured homes, and single-family homes, and commercial REITs that can own office buildings, warehouses, retail spaces, and other commercial properties. In addition, REITs can be offered as publicly-traded, private, or publicly non-traded:

- Publicly-traded REITs: Trade on a stock exchange like any other public company and available to all investors.

- Anyone who owns a broad stock index fund already has some exposure to publicly-traded REITs, so buying additional REITs is only necessary if you want to increase your exposure to real estate.

- Instead of buying many individual publicly-traded REITs, there are publicly-traded REIT index funds you can buy instead.

- Private REITs: Not traded on a stock exchange and only available to accredited investors (i.e. people with a net worth >$1M or annual income >$200,000 for the last 3 years).

- Requires a broker, which may result in high fees.

- Has less regulatory oversight.

- Less liquid due to longer required holding period.

- May generate higher returns than public market offerings.

- Publicly non-traded REITs: Not traded on a stock exchange, but available to all public investors.

- More regulatory oversight than private REITs.

- Minimum investment requirements.

- Less liquid due to longer required holding period.

- May generate higher returns than public market offerings.

Though I have only ever invested in publicly-traded REIT index funds, real estate crowdsourcing firms like Fundrise are a non-traded alternative that could offer higher long-term returns. If you want to dig deeper into the publicly-traded vs. non-traded REIT discussion, I recommend reading this article from Fundrise, Investopedia, and Millionacres, a Motley Fool service for more information.

No matter how you decide to invest in REITs, they generally have stock-like returns (or better) with a slightly lower correlation (0.5-0.7) during good times. Like most other risky assets, public-traded REITs tend to sell off during stock market crashes. Therefore, don’t expect many diversification benefits on the downside when owning them.

REITs Summary

- Average compounded annual return: 10%-12%

- Pros: Real estate exposure that you don’t have to manage.

- Cons: Higher volatility. Less liquidity for non-traded REITs. Highly correlated with stocks and other risk assets during stock market crashes.

5. Farmland

Outside of real estate, farmland is another great income-producing asset that has been a major source of wealth throughout history. Today, one of the best reasons to invest in farmland is its low correlation with stocks and bonds since farm income tends to be uncorrelated with what is happening in financial markets.

In addition, farmland has lower volatility than stocks while also providing inflation protection. Because of this asymmetric risk profile, farmland is also unlikely to “go to zero” unlike an individual stock/bond. Of course, the effects of climate change may alter this in the future.

What kind of returns can you expect from farmland? According to Jay Girotto on the Capital Allocators Podcast with Ted Seides, farmland is modeled to return in the “high single digits” with roughly half of the return coming from farm yields and half coming from land appreciation.

How do you invest in farmland? While buying individual farmland is no small undertaking, the most common way for investors to own farmland is through a publicly-traded REIT or a crowdsourced solution like FarmTogether or FarmFundr. The crowdsourced solution can be nice because you have more control over which farmland properties you specifically invest in.

The downside of crowdsourced solutions like FarmTogether and FarmFundr is that they are only available to accredited investors (i.e. people with a net worth >$1M or annual income >$200,000 for the last 3 years). In addition, the fees for these crowdsourced platforms can be a bit higher than with other public investments. For example, FarmTogether charges a 1% fee on all initial investments along with an ongoing 1% management fee, while FarmFundr structures deals to either own 15% of the equity or impose a 0.75%-1% management fee along with a 3% sponsor fee. I don’t think these fees are predatory given the amount of work that goes into structuring these deals, but if you hate the idea of fees, this is something to keep in mind.

Farmland Summary

- Average compounded annual return: 7%-9%

- Pros: Not as correlated with stocks. Good inflation hedge. Lower downside potential (land less likely to “go to zero” than other assets)

- Cons: Less liquidity (harder to buy/sell). Higher fees. Requires “accredited investor” status to participate.

6. Small Businesses/Franchise/Angel Investing

If farmland isn’t for you, maybe you should consider owning a small business or part of a small business. This is where angel investing and small business investing come in. However, before you embark on this journey you have to decide whether you will operate the business or just provide investment capital and expertise.

Owner + Operator

If you want to be an owner + operator of a small business/franchise, just remember that as much work as you think it will take, it will likely take more. As Brent Beshore, an expert on small business investing, once tweeted:

Here’s what it takes to run a Subway restaurant.

[links to 800 page operator’s manual]

Now imagine trying to run a $50M manufacturer.

I don’t mention Brent’s comments to discourage you from starting a small business, only to provide a realistic expectation for how much work they require. Owning and operating a small business can generate much higher returns than many of the other income-producing assets on this list, but you have to work for them.

Owner Only

Assuming you don’t want to go down the operator route, being an angel investor or passive owner of a small business can earn you very outsized returns. In fact, according to multiple studies (see here and here), the internal rate of return on angel investments is in the 20%-25% range.

However, these returns aren’t without a very large skew. An Angel Capital Association study found that just 1 in 9 angel investments (11%) yielded a positive return. This goes to show that though some small businesses may become the next Apple, most never make it far past the garage. As Sam Altman, famed investor and President of YCombinator, once wrote:

It’s common to make more money from your single best angel investment than all the rest put together. The consequence of this is that the real risk is missing out on that outstanding investment, and not failing to get your money back (or, as some people ask for, a guaranteed 2x) on all of your other companies.

This is why small business investing can be so tough, yet also so rewarding.

However, before you decide to go all-in, you should know that small business investing can be a huge time commitment. This is why Tucker Max gave up on angel investing and why he thinks most people shouldn’t even start. Max’s argument is quite clear—if you want access to the best angel investments (i.e. big, outsized returns) then you have to be deeply embedded in that community. Therefore, you can’t do angel/small business investing as a side thing and expect big results.

While firms like Microventures allow retail investors to invest in small businesses (with other opportunities for accredited investors), it is highly unlikely Microventures is going to have early access to the next big thing. I don’t say this to discourage you, but to reiterate that the most successful small business investors commit more than just capital to this pursuit.

So if you want to be a small business investor, keep in mind that a larger lifestyle change may be warranted in order to see significant results.

Small Business Summary

- Average compounded annual return: 20%-25%, but expect lots of losers.

- Pros: Can have extremely out-sized returns. The more involved you are, the more future opportunities you will see.

- Cons: Huge time commitment. Lots of failures can be discouraging.

7. CDs/Money Market Funds

Certificates of Deposit (CDs) and money market funds are both low-risk investment options that can provide a steady income stream for investors.

CDs are time-deposit accounts offered by banks and credit unions. When you purchase a CD, you agree to leave your money with the financial institution for a set period of time, such as 6 months, 1 year, or 5 years. In return, you receive a fixed interest rate that is typically higher than what you would earn on a savings account. At the end of the CD’s term, you receive your initial investment plus any accrued interest.

Money market funds, on the other hand, are mutual funds that invest in short-term debt securities, such as government bonds and commercial paper. These funds aim to provide investors with a stable value of $1 per share, which makes them an attractive option for those looking for a low-risk, short-term investment.

With money market funds, you typically have easier access to your money than with CDs or other fixed income products. As a result, money market funds typically offer lower yields than CDs, but higher yields than traditional savings accounts.

Lastly, while CDs (and money market accounts) are FDIC-insured, meaning the U.S. government will guarantee up to $250,000 in deposits per account holder if the financial institution goes bankrupt, money market funds have no such protections. Because they are investment products, money market funds are not insured against loss like CDs or money market accounts.

In summary, CDs and money market funds can be a good option for investors who want to earn a steady income stream while minimizing their risk. However, it’s important to note that these investments typically offer lower returns than many of the other income-producing assets on this list.

CDs/Money Market Summary

- Average compounded annual return: 1%-3%

- Pros: Less risk than bonds for similar levels of return. Safety in principal.

- Cons: Lower returns. Low income in low rate environment.

8. Royalties

If you aren’t a fan of lending, maybe you need to invest in something with a bit more…culture. This is where royalties come in. On sites like RoyaltyExchange you can buy and sell the royalties to music, film, and trademarks. Royalties can be a good investment because they generate steady income that is uncorrelated with financial markets.

For example, over the last 12 months Jay-Z and Alicia Keys’ “Empire State of Mind” earned $32,733 in royalties. On RoyaltyExchange, this song’s royalties for the next 10 years were recently sold for $190,500. Therefore, if we assume that the annual royalties ($32,733) remain unchanged going forward, then the owner of those royalties will earn 11.2% per year on their $190,500 purchase over the next decade.

Of course, no one knows whether the royalties for this song will increase, stay the same, or decrease over the next 10 years. That is a matter of musical tastes and whether they change. This is one of the risks (and benefits) of royalty investing. Culture changes and things that were once in fashion can go out of fashion and vice versa.

However, RoyaltyExchange has a metric called Dollar Age that they used to try and quantify how long something might stay “in fashion.” For example, if two different songs both earned $10,000 in royalties last year, but one of the songs was released in 1950 and the other was released in 2019, then the song released in 1950 has the higher (older) Dollar Age and will probably be a better long-term investment. Why? The song from 1950 has 70 years of demonstrated earnings compared to only 1 year of demonstrated earnings for the song from 2019. Though the song from 2019 may be a passing fad, the song from 1950 is an undeniable classic.

This concept, more formally known as the Lindy Effect, states that something’s popularity in the future is proportional to how long it has been around in the past. The Lindy Effect explains why people in the year 2220 are more likely to listen to Mozart than to Metallica. Though Metallica probably has more worldwide listeners today than Mozart, I am not sure this will be true in two centuries.

Lastly, the only other downsides to investing in royalties (at least on RoyaltyExchange) are the high fees charged to sellers. Though RoyaltyExchange only charges a $500 flat fee to buyers for each royalty purchased, sellers have to pay 15% of the final sale price after an auction closes. So, unless you plan on only buying royalties (and doing it at scale), then royalty investing might not be right for you.

If you are interested in looking at other royalties and what prices they sold for on Royalty Exchange go here.

Royalties Summary

- Average compounded annual return: 5%-20% (according to WSJ), 12% (according to Royalty Exchange)

- Pros: Uncorrelated to traditional financial assets. Generally steady income.

- Cons: High seller fees. Tastes can change unexpected and impact income.

9. Your Own Product(s)

Last, but not least, one of the best income-producing assets you can invest in is your own products. Unlike all of the other assets on this list, creating products (digital or otherwise) allows for far more control then most other asset classes. Since you are the 100% owner of your products, you can set the price, and, thus, determine their returns (at least in theory).

Products include things like books/ebooks, information guides, online courses, and many others. I know quite a few people who have managed to earn five to six-figures from selling their products online. More importantly, if you already have an audience via social media, an email list, or website, selling products is one way to monetize that audience. And even if you don’t have one of these distribution channels, it’s never been easier to sell products online thanks to platforms like Shopify and Gumroad and online payment processors.

The hard part about products as investments is that they require lots of work upfront with no guarantee of a payout. As I have discussed previously, there is a long road to monetization with many side hustles and that also includes with products. However, once you get one successful product under your belt, it is much easier to expand your branding and sell other things as well.

For example, I have seen my income on this blog grow beyond small affiliate partnerships to include ad sales along with more freelancing opportunities. It took years of blogging before I even started earning real money, but now new opportunities are always popping up. If you have more questions about this, feel free to DM me on Twitter.

Your Own Product(s) Summary

- Average compounded annual return: Highly variable. Distribution is fat-tailed (i.e. most products return little, but some go big).

- Pros: Full ownership. Personal satisfaction. Can create a valuable brand and a lot of personal leverage.

- Cons: Very labor intensive. No guarantee of payoff.

What About Gold/Crypto/Commodities/Art/Wine?

A handful of asset classes did not make the above list for the simple reason that they don’t produce income. For example, gold, cryptocurrency, commodities, art, and wine have no reliable income stream associated with their ownership, so they can’t be included above.

Of course, this does not mean that you can’t make money with them or that they shouldn’t be in your portfolio, only that they don’t produce income. Generally, I limit these non-income producing assets to 10%-15% of my portfolio.

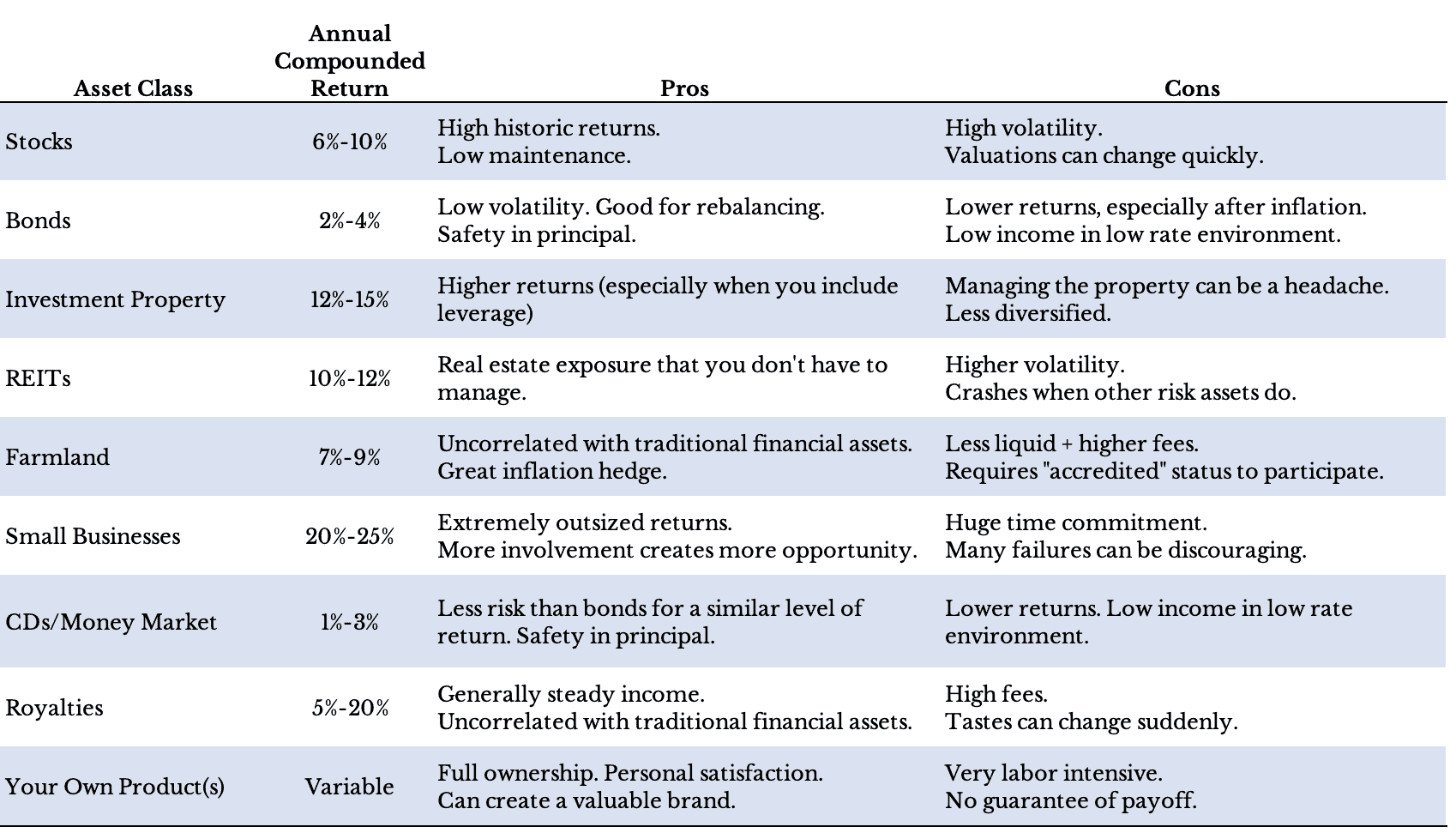

Final Summary

Given all of the information covered above, I thought it would be helpful to produce a summary table for better comparison purposes:

The Bottom Line

No matter what mix of income-producing assets you end up choosing, remember that there are many ways to win when it comes to investing. In this game, it’s not about picking the “optimal” assets, but the ones that will work best for you and your situation.

If I have learned anything since I started blogging a few years ago, it is that two reasonable people can have very different investment strategies and, yet, both of them can be right. With that being said, I wish you the best of luck on your investment journey and thank you for reading!

If you liked this post, consider signing up for my newsletter.

[Full Disclosure: Of Dollars And Data has no ongoing relationship with any of the companies mentioned in this article and no compensation was exchanged for mentioning them.]

This is post 204. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data