Recently a friend asked me:

What keeps you up at night financially? What is your version of an investing nightmare?

Fortunately, I don’t have anything that keeps me up at night (I tend to be an optimist), but if I had to describe my investing nightmare, it wouldn’t be something we haven’t seen in recent decades. In fact, I’d argue we haven’t seen it within the last 100 years of U.S. market history.

Yes, the Great Depression is about as bad as it gets, but even that would have been over in the span of three years. A hellish three years for sure, but three years can go by quicker than you think.

My investment nightmare doesn’t involve a 50% decline or a lost decade like the one we had in the U.S. from 2000-2009 either. It’s far worse than that. Because even the Lost Decade for U.S. stocks wasn’t that bad when you consider the path markets took over that time period. Let’s review.

Some Bad Decades

The chart below shows the change in U.S. stock prices over the decade from March 1999 to February 2009 (aka The Lost Decade):

Yes, prices declined by nearly 50% from 2000-2003, but that was after one of the biggest price runs in U.S. market history (the DotCom bubble). So was anyone actually shocked when this happened? I would hope not, because it was obvious that a bubble had emerged, but no one knew when it would pop.

Some would say that the same thing is happening today. And they may be right. So if we experience a 30-40% decline in the next few years, will I be shocked? Of course not. Similarly, if the market ripped upward for the next few years would I be shocked? Not at all. This is the nature of markets.

Anyways, back to the chart. After the decline into 2003, what happened next? A massive rally that sent prices above their 1999 highs. So yes, the 50% decline from the bubble sucked, but then you got a rally that got you back to new all time highs within a few years. Think about the level of hope and optimism that this inspired among U.S. investors.

Following that optimism came the Great Financial Crisis and another 50% crash. This wasn’t easy to experience under any circumstance, but considering the rally before, the cumulative pain for investors during this decade was limited to 4 of the 10 years. That’s bad, but I’ve seen worse.

Compare this to the Italian stock market after the Great Financial Crisis. If you look at what happened there, you will see a big decline over a year then basically flat (just oscillations) for the next seven years:

I would argue that an investor would feel objectively worse investing through this decade than through the Lost Decade in the U.S. Having seven years of a flat market would start to weigh on you by the end.

Don’t get me wrong though, being an investor in either of these markets would have been a struggle, but my investment nightmare is a bit worse than both of these.

Going Up the Downstair (My Investing Nightmare)

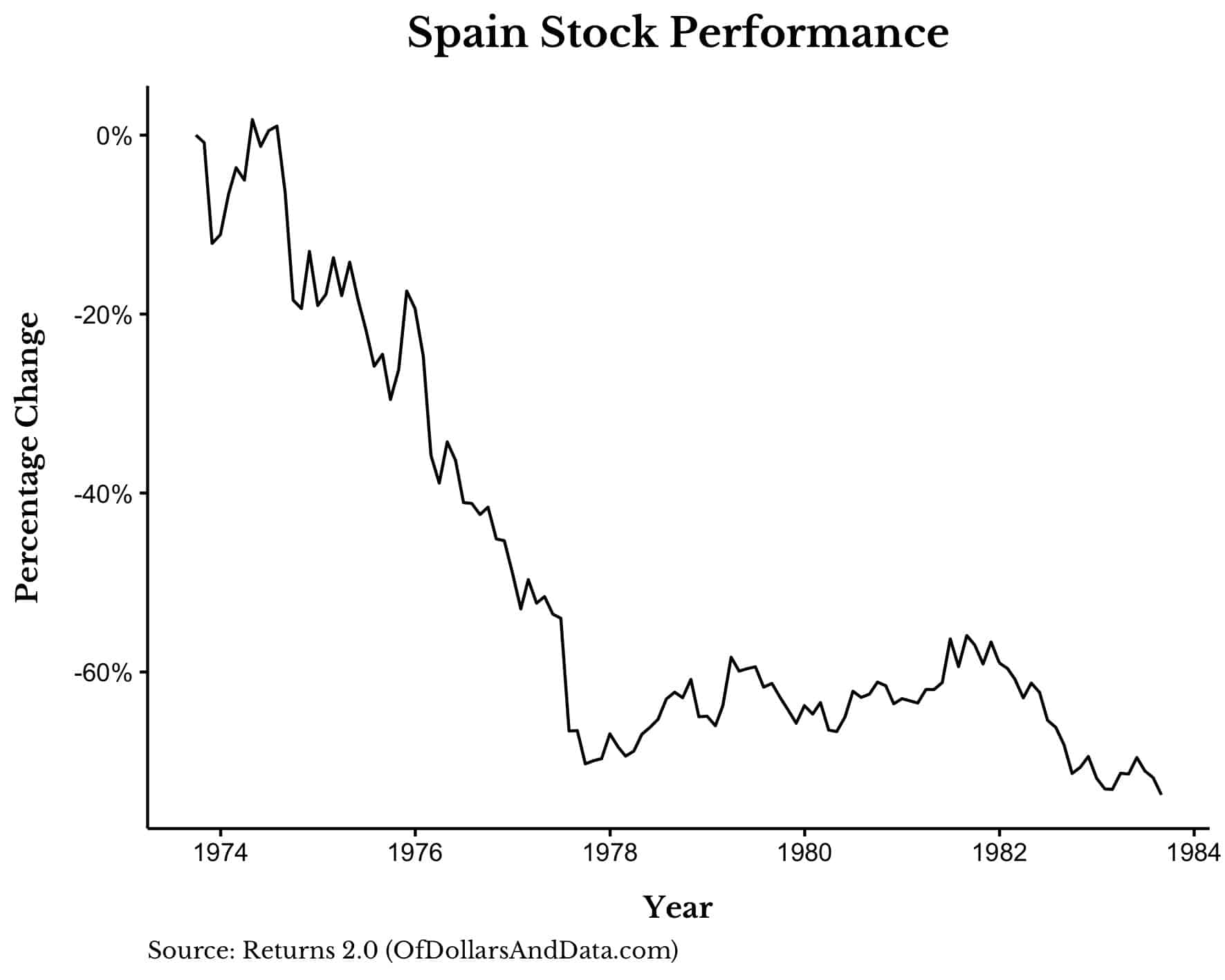

If I had to pick a market to represent my investment nightmare, I would pick Spain from 1973-1983. For the uninitiated, from the mid 1970s to early 1980s Spain experienced high inflation, high unemployment, and sluggish growth that destroyed their capital markets over the course of a decade. And, as the chart below shows, it was a slow ride down for those 10 years:

In my opinion, this is worse than anything that U.S. investors have ever experienced. While the Great Depression was objectively more damaging to capital markets, it happened over a much shorter time period. I cannot imagine seeing stocks decline consistently for four years only to be followed by a weak four year rally, then two more years of declines.

The cumulative pain experienced by investors in this market is unheard of in U.S. market history. This is why it’s my investing nightmare. The slow grind downward. The loss of hope. The questioning of my profession. I can’t even imagine it.

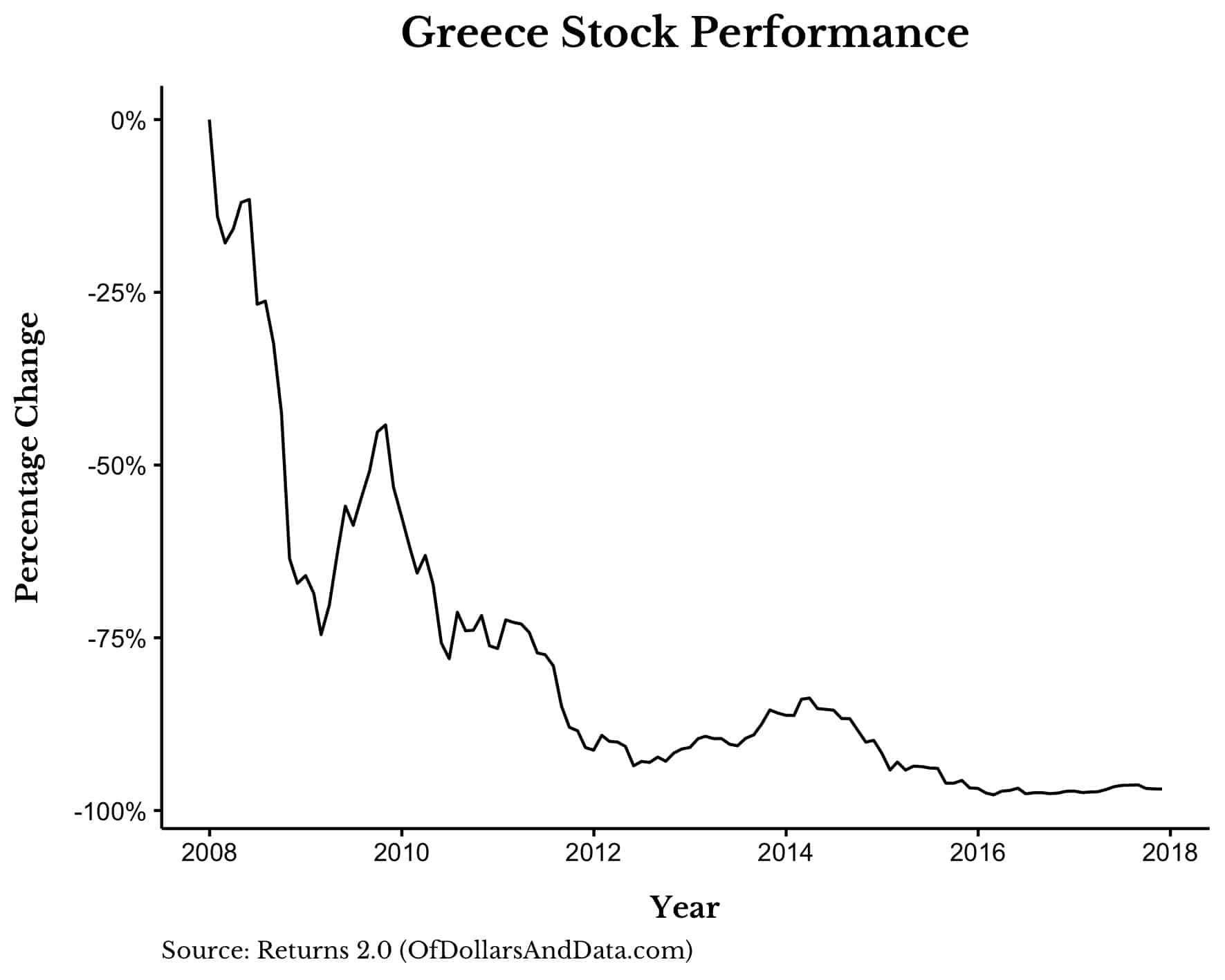

But as bad as that is, there is one market that is much, much worse. It’s so bad that I can’t even consider it as an actual possibility for the future of U.S. or global equities. I’m talking about Greek stocks after 2008, which saw a decline greater than 95% in less than a decade. This chart should be titled “Abandon all hope ye who enter here”:

After seeing this, Spain from 1973-1983 seems like a cakewalk. This is why I can’t even consider this a real possibility for U.S. (or global) markets. Why? Because a 97% decline in U.S. (or global) stocks would imply some sort of end of civilization like event.

If we end up in such a scenario, the only investments that you will actually need are guns and canned goods. As grim as this sounds, fortunately, there are ways to avoid even the worst investment nightmares.

How to Avoid an Investing Nightmare

Though bad markets (and bad decades) will always be out of your control, the one way you can counteract these investing nightmares is to limit your exposure to each of these markets. As bad as Spain was in 1973-1983 or Greece was from 2008-2018, any rational investor should have been diversified across multiple equity markets.

More importantly, they should have been diversified beyond equities as well. The only way to avoid an investing nightmare is to prevent yourself from falling into one in the first place. Limit your exposure to individual markets just like you would limit your exposure to individual stocks. Of course, when markets crash they tend to crash together, but worldwide crashes in equities are exceedingly rare.

Yes, these events will occur now and again (and they will suck when they do). However, you can prepare for these eventual crises by owning income-producing assets that are less correlated with traditional financial markets along with some non-income producing assets as well.

This is how I sleep at night despite the investing horrors that the future surely holds.

Until then…thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 253. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data