When it comes to figuring out how to invest your money, there is no shortage of advice on the matter. Many financial experts recommend choosing your portfolio based on factors such as your age or your risk tolerance. For example, the popular “110 minus your age” rule recommends allocating (110 – your age)% of your portfolio to stocks and the rest to bonds.

While these approaches are sensible, there’s another, often overlooked, variable that may be an even better guide for your asset allocation—your job. Not only does your chosen occupation have its own set of individual risk factors, but your industry is also correlated with the performance behavior of specific asset classes. For these reasons, adjusting your portfolio based on your career might be the right move for you.

In this blog post I will analyze what the data says on this issue, share how I’ve changed my portfolio as a result, and help you determine whether you should adjust your allocation as well. Let’s start by looking at the connection between asset class returns and how they could impact different industries.

Are Certain Asset Classes Better for Certain Industries?

Before we can figure out whether you should adjust your asset allocation based on your job, we have to know which assets are most (and least) correlated with the industry you work in. Thankfully, the 2015 paper “No Portfolio is an Island” by David M. Blanchett, CFA, and Philip U. Straehl does just that. [Author’s Note: I’ve found their presentation on the same topic to be somewhat easier to understand than the paper.]

Blanchett and Straehl’s work challenges the notion that how you invest should be based solely on your financial wealth by taking into account other forms of wealth that you have access to (e.g. human capital/skills, housing wealth, and pension wealth).

To do this in the context of human capital, their paper examined the correlation between asset class returns and changes in human capital (i.e. wages, growth, etc.) across different industries from 1993-2013. Their goal was to determine which certain asset classes were more or less correlated with certain industries in order to find the optimal portfolio for those working in each industry. The asset classes they analyzed included:

- Cash

- Intermediate U.S. Bonds (“IntBd”)

- Long-Term U.S. Bonds (“LgBd”)

- U.S. Treasury Inflation-Protected Securities (“TIPS”)

- High-Yield U.S. Bonds (“HiYld”)

- Non-U.S. Bonds (“nUSBd”)

- Large U.S. Growth Stocks (“LarGro”)

- Large U.S. Value Stocks (“LarVal”)

- Small U.S. Growth Stocks (“SmGro”)

- Small U.S. Value Stocks (“SmVal”)

- Non-U.S. Equities (“nUSEq”)

- Commodities (“Comm”)

- U.S. Real Estate Investment Trusts (“REITs”)

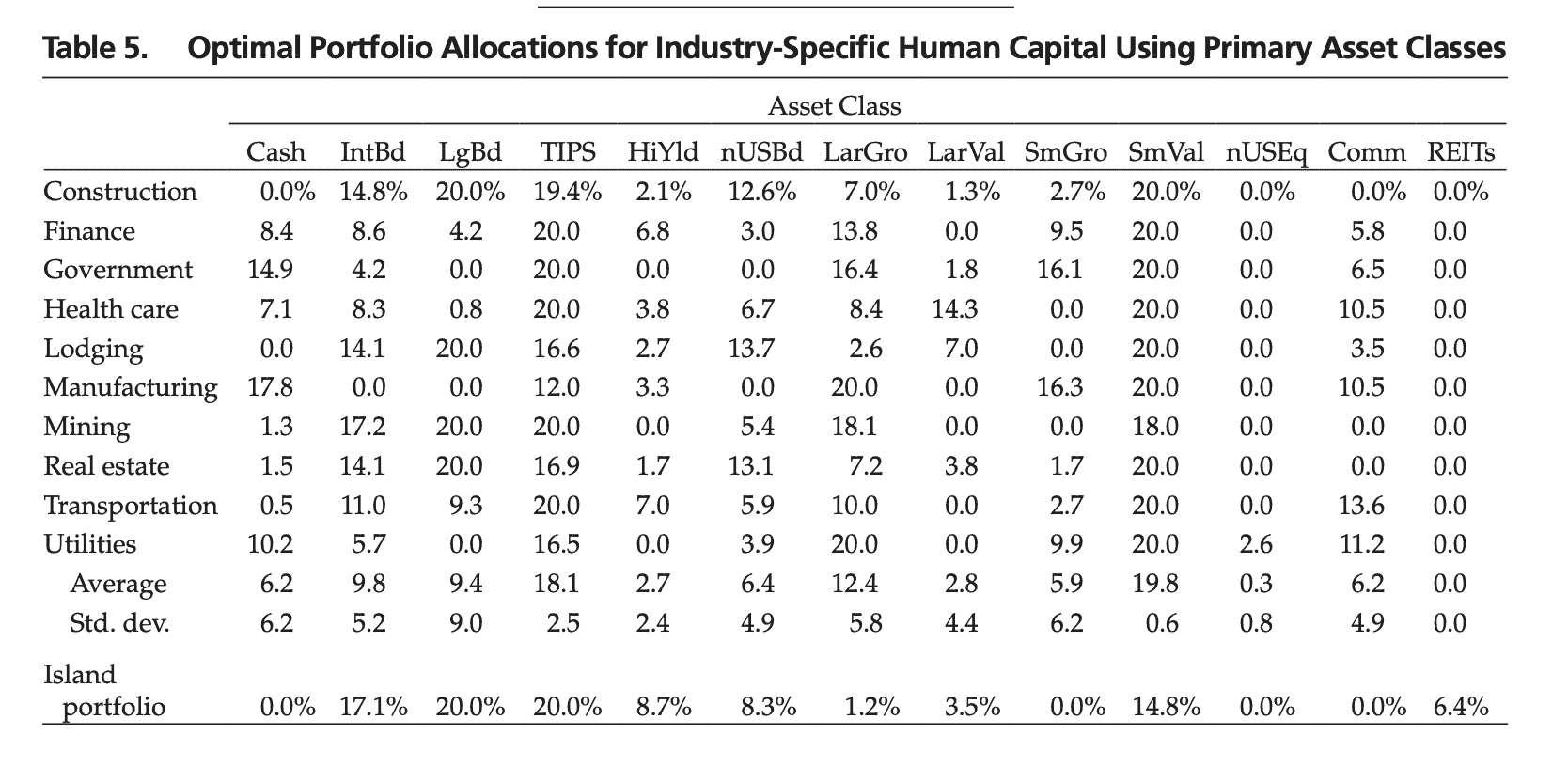

Using this set of asset classes, the authors found that some were more correlated with industry changes in human capital than others. As they stated:

The four asset classes with the highest absolute correlations, along with the highest degree of statistical significance, are intermediate-term bonds (0.45 average), long-term bonds (0.48 average), high-yield bonds (0.39 average), and REITs (0.41 average).

This result makes sense as these asset classes are most closely linked with interest rates, which can have a large impact across all industries and the economy in general when they change.

You can see the full set of correlations between asset class returns and changes to industry-specific human capital (for the industries they studied) in the table below:

While these industry-asset class correlations are useful in certain contexts, they don’t tell us much about how we should adjust our asset allocations based on which industry we are in.

While these industry-asset class correlations are useful in certain contexts, they don’t tell us much about how we should adjust our asset allocations based on which industry we are in.

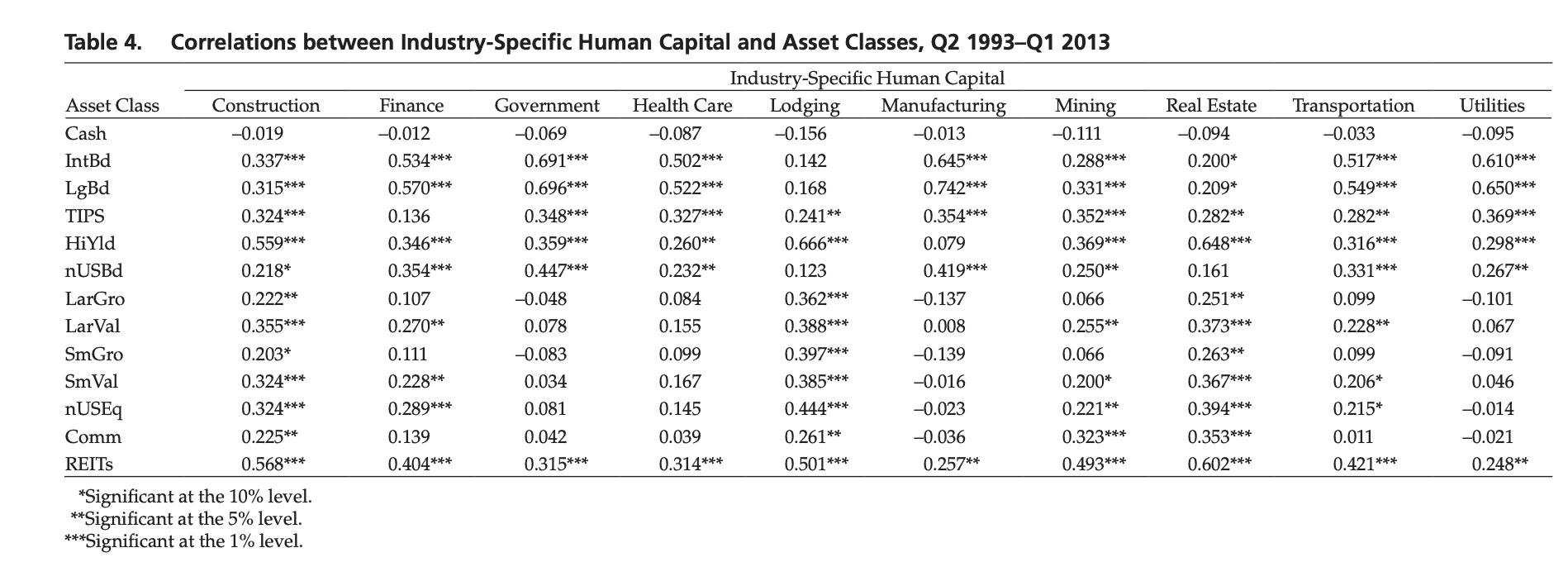

As a result, the authors followed this up by running these asset classes through a portfolio optimizer (with the industry-specific human capital changes included) to find the optimal portfolio within each industry from 1993-2013. The table below presents these results by industry and overall (“Island portfolio”):

As you can see, depending on which industry you are in, the optimal portfolio can vary wildly.

For example, the optimal portfolio for those in Mining allocates nearly 40% to intermediate and long-term U.S. bonds, while the optimal portfolio for those working in the Utility sector would only allocate 6% to these asset classes. In addition, for these specific industries, no portfolio has an allocation to REITs (though the overall “Island portfolio” does) and some have allocations to commodities (though the “Island portfolio” doesn’t).

While these results do suggest that your portfolio should change based on which industry you work in, I wouldn’t take the allocation results above too literally. Firstly, this analysis only contains 30 years of historical data which doesn’t seem like enough to me. And, second, the overall “Island portfolio” is a bit too conservative with nearly 75% of its assets in bonds or TIPS.

Despite these flaws, this table is useful for understanding the relative differences in optimal allocations across industries. For example, as someone who works in the financial industry, this table suggests that I should have some of my wealth invested in commodities (despite their poor track record) and that I shouldn’t have any allocation to REITs.

While I won’t necessarily follow this recommendation exactly, the core idea has made me re-evaluate how I invest my own money.

Why I Am Changing How I Invest…For Now

My investment journey has been anything but a straight path. I’ve bought and sold gold. I’ve gone back and forth on individual stocks. I even put 0.5% of my net worth into altcoin cryptocurrencies about a year ago. And now, in 2024, I’m re-thinking my asset allocation once again. But, it’s not the markets that have got me spooked or some macro trend I am seeing that makes me want to change, it’s my life itself. For context, in September 2023 I tweeted:

97% of my net worth is in financial assets (mostly equities). 3% is in cash for emergencies and operating capital. My apartment is rented and I own very few physical objects. Just Keep Buying isn’t a catchphrase, it’s my financial life.

As proud as I am for having skin in the financial game, I am now realizing how risky this approach is in the broader context of my life. I work at a wealth management firm. I have equity in that firm. I also have a book related to investing in financial markets.

This means that my compensation, my firm equity, and my book royalties are all tied to the performance of the stock market in some way or another. So why should 75%+ of my net worth be tied to the stock market as well? It shouldn’t. It makes no sense. I might as well buy a 2x-3x levered S&P 500 ETF while I’m at it.

The additional exposure to the stock market through my career has made me realize that I need to de-lever a bit. Does this mean that I am selling all of my stocks? Of course not. The allocation in my retirement accounts will remain unchanged as I continue to buy stocks (U.S. and international) as I always have.

However, my taxable brokerage account is another story. The whole reason I started accumulating assets outside of my retirement accounts (and why I recommend not maxing out your 401k) is for the flexibility to use that money for different financial goals. And one of those goals is to eventually buy a house.

With rates where they are today, this seems unlikely in the next year or two. However, buying a house does not seem unlikely in the next five years. So why should I continue to take stock risk with my portfolio when my life is are already taking it? I shouldn’t. Instead, I should de-risk a little and shift some of this money into U.S. Treasury bills, which is exactly what’ve I’ve done.

Since Treasury bills (like U.S. stocks) are also an income-producing asset, this leaves my allocation to income-producing assets unchanged at 95% of my overall portfolio. I’m still buying, but what I’m buying has changed.

Unfortunately, this decision will cost me a decent amount of money over the next 30 years, but I don’t mind. After all, what’s the point of accumulating all this money if I am never going to use it? What’s the purpose of investing if you never make it real?

I’m not telling you this because I think you should reduce your stock exposure or sell down some of your risk assets. I am telling you this so that you question whether your current allocation is right for you. This naturally brings us to our final section.

The Bottom Line

Determining the right asset allocation is never easy. However, you don’t do yourself any favors when you ignore how your allocation fits within your overall life. This is why your career and the industry you work in should be taken into account when selecting a portfolio.

Unfortunately, this is easier said than done. Though there are some products that can remove specific sectors out of your overall stock allocation (e.g. ProShares has some), these solutions aren’t fully customizable. But one day they will be. One day the typical retail investor will have access to a cheap portfolio that can be tailored to their life circumstances.

For example, if you work in the Oil & Gas industry, there will be a way to down weight Oil & Gas stocks across your portfolio. If you work for a public technology company and receive lots of stock-based compensation, there will be a way to eliminate that stock from your holdings and reduce your exposure to similar technology companies as well. Though some direct indexing providers do offer this service now, within the next decade I’m hoping that these capabilities will be available for all retail investors.

Ultimately, whether you decide to shift your asset allocation to offset the other risks in your life is up to you. While this idea can be tempting, it is definitely not required for you to reach your financial goals. Nevertheless, if you feel like you are taking additional risks in your career that you need to hedge against, reducing your exposure to certain financial assets may be the solution. That’s what I did and I’m not looking back.

Happy investing and thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 381. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data